The strong reception for former Microsoft CEO Steve Ballmer’s new project, USAFacts.org, shows our hunger for reliable, unbiased information from which we can reach our own conclusions.

The public has been losing trust in news media for decades. According to a 2016 Gallup Poll, only 32 percent of Americans had at least a “fair amount” of trust in the media, down from 54 percent in 2003. This year, concerns about media bias have spiked amidst White House talk of “fake news,” “alternative facts” and embarrassing retractions by CNN and The Washington Post.

Related: Why a Microsoft Billionaire Is Building the World’s Largest Plane

In this toxic environment, it is exciting to see Ballmer’s site, a new information source that appears to be politically neutral and, thanks to its wealthy benefactor, will not feel pressure to make partisan compromises to attract eyeballs. Leveraging an array of government data sources, USAFacts provides a useful portrait of the population, government finance and government’s impact on society.

But even as it attempts to give just the facts, Ballmer’s site has to make editorial judgments that could be subject to second-guessing. That second-guessing begins here.

USAFacts.org consolidates federal, state and local government financial statistics and then presents them in a manner that is comparable to a corporate annual report. This is a useful perspective because so many of us are familiar with corporate financial reporting. Financial analyst Mary Meeker did something similar in 2011 with her USA Inc. report, but Ballmer’s project is far more ambitious — including the preparation of a full 10-K report and including all levels of government.

Related: Here’s Why We’re Not Prepared for the Next Recession

While consolidating multiple levels of government into a single report provides an interesting perspective, it has drawbacks. Under U.S. Generally Accepted Accounting Principles, a corporation must include the results of subsidiaries in its financial statements. Subsidiaries are at least half owned by the parent company. But under our constitutional system, state and local governments are more accountable to their voters than to the federal government — and are not analogous to corporate subsidiaries.

As a result, it is usually more important to look at the financial performance of individual state and local governments. This is especially true because the federal government does not normally bail out states and cities that become insolvent, as we saw in Detroit’s case in 2013.

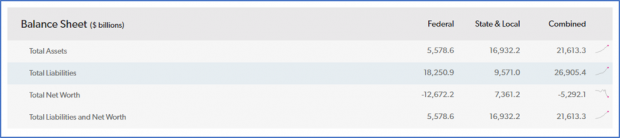

USAFacts accommodates this concern by reporting federal and non-federal results separately. Looking at the balance sheet, we see that the U.S. public sector overall has a negative net worth: Liabilities exceed assets by $5.3 trillion. But that is totally attributable to the federal government. USAFacts shows that state and local governments have $16.9 trillion in assets and $9.6 trillion in liabilities, leaving a positive net worth of $7.4 trillion. On the federal side, USAFacts reports $5.6 trillion in assets, $18.3 trillion in liabilities and a net worth of -$12.7 trillion.

Balance Sheet from USAFacts.org

Although a net debt of $12.7 trillion is bad, it greatly understates the severity of the federal government’s financial position. Audited federal financial statements published by the U.S. Treasury and the Government Accountability Office show a net position of -$19.3 trillion, about half again as bad as the number reported by USAFacts.

Rather than use these audited financials, Ballmer’s site compiles its balance sheet from the Federal Reserve’s Z1 report. It uses the Federal Reserve data because Z1 is the best source of up-to-date consolidated state and local government fiscal data, which it presents in a manner comparable to federal data. But the Z1 report excludes certain liabilities from the audited federal financial statements, including accrued veterans’ benefits.

The Treasury’s $19 trillion negative net position is also an understatement, because it places entitlement programs off balance sheet. However, Treasury also includes supplemental “Statements of Social Insurance” that show $14.1 trillion in unfunded Social Security liabilities and $32.5 trillion in unfunded Medicare liabilities. If these two items were included on the USAFacts balance sheet, the public sector’s negative net worth would balloon from the $5 trillion now shown to over $50 trillion.

Related: How Millions of Aging Baby Boomers Could Bust the Economy

The decision about whether to include or exclude these items is clearly a judgment call. A representative from USAFacts.org told me that since Congress has the power to amend or eliminate these entitlements, they should not be classified as liabilities. But federal employee retiree benefits — which are shown as liabilities — are also subject to legislative cuts. Indeed, the president’s 2018 budget proposal includes reduced cost of living adjustments for federal retirees. Further, given the voting power of senior citizens, significant cuts to Social Security and Medicare are politically inconceivable. Consequently, it seems to me that retirement benefits for the general public should receive the same balance sheet treatment as that accorded to federal employees.

For state and local level governments, USAFacts shows unfunded pension liabilities of $1.9 trillion. This figure, derived from Bureau of Economic Analysis estimates, is somewhat higher than the $1.5 trillion reported by the pension plans themselves. BEA arrives at a higher liability estimate because it discounts expected future pension payments at a lower rate than those used by the plans themselves. This seems appropriate because state and local governments use unusually high discount rates compared to private sector pension plans and those administered by foreign governments. Other observers, using varying discount rates and pension data, derive even higher unfunded liability estimates than those provided on USAFacts. Credit analysts at Moody’s recently reported unfunded liabilities of $4 trillion and Andrew Biggs of the American Enterprise Institute published an estimate of $5.2 trillion.

Related: A New Republican Agenda Is Taking Shape—and It Means Tax Increases

Governmental accounting standards also require state and local governments to calculate and publish something called “Other Post-Employment Benefit” liabilities, or OPEB — essentially, retiree health benefits. Because this OPEB data is not collected by the federal government, it is missing from the USAFacts’ balance sheet. The Boston College Center for Retirement Research estimates that OPEB liabilities total $862 billion across all state and local governments nationally, but my own research suggests that the real number is higher.

Ballmer’s initiative promises to inform the public policy debate with unbiased facts. But when constructing a public sector balance sheet, the site’s creators have had to exercise judgment in sourcing and presenting data. Their choices lead to an estimate of general government negative net worth of $5 trillion. But other analysts could easily produce estimates that are ten or more times higher.

Since government debt is such an important and controversial topic, we need neutral sources like USAFacts to properly inform the discussion about them. I hope Ballmer’s team reconsiders its approach to presenting the government’s balance sheet.