Lots of action on this Tuesday, as Congress strikes a deal to raise the debt limit and moves toward passing the massive annual defense policy bill. Here's what's happening:

McConnell, Schumer Cut a Deal to Raise the Debt Limit

Congressional leaders have agreed on a novel legislative plan that would allow Democrats to raise the debt ceiling on their own without the threat of a Republican filibuster in the Senate, according to multiple reports Tuesday. If successful, the maneuver would defuse a looming crisis over a possible debt default by the U.S. Treasury, which has warned that it could run low on cash by the middle of next week.

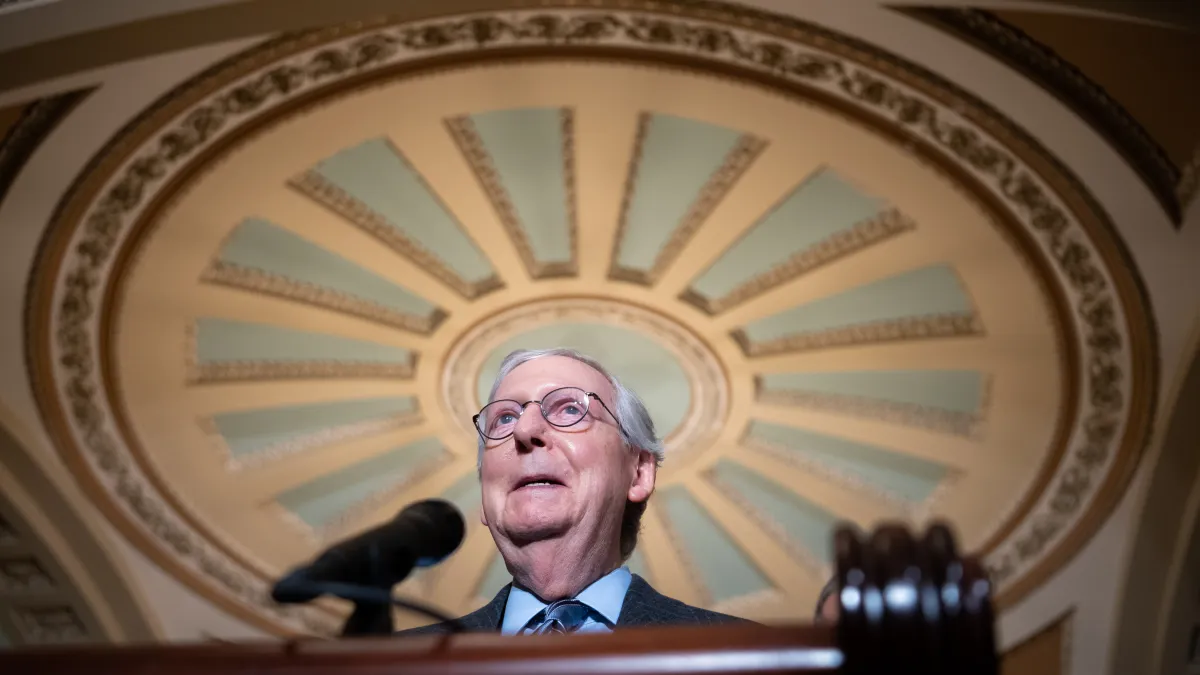

The plan, the product of weeks of talks between Senate Majority Leader Chuck Schumer (D-NY) and Senate Minority Leader Mitch McConnell (R-KY), would establish a one-time procedure to raise the debt limit to a specific number defined in a piece of legislation that requires just a simple majority in the Senate. The authorization for the fast-track procedure would expire after January 15.

At least 10 Republican votes in the Senate would be required to support the bill establishing the one-time procedure, but after that bill passes, the separate piece of legislation raising the debt limit could be approved with just the 51 votes provided by the 50 Democratic senators plus the tie-breaker from Vice President Kamala Harris.

McConnell began selling the plan to his Republican colleagues Tuesday as the House introduced the preliminary legislation. The House package also includes a plan to avoid billions of dollars in cuts to Medicare reimbursements that are scheduled to occur on January 1. If Congress fails to act, spending cuts defined by the Medicare sequestration and PAYGO budget deals 10 years ago will take effect, including a potential 6% reduction in payment levels for some health care providers.

The politics of the deal: The plan — which involves what Bloomberg’s Billy House and Erik Wasson call a bit of “procedural gimmickry” — would allow Republicans to say that they stuck by their vow to not provide any votes that would raise the debt ceiling. Instead, they would simply agree to allow the rule-setting bill to proceed, and Democrats can then raise the borrowing limit on their own.

“The red line is intact,” McConnell said. “The red line is that you have a simple majority, party-line vote on the debt ceiling. That's exactly where we will end up.”

Despite resistance from some in his caucus, McConnell appeared to be well on his way to finding the 10 backers he needs. After a briefing from the Kentucky Republican, several key GOP senators indicated that they would support his approach.

One feature of the plan that appeals to Republicans is that it forces Democrats to raise the debt limit on their own while naming a specific new limit, presumably somewhere well north of $30 trillion.

Sen. John Cornyn (R-TX) said the plan would enable Republicans to hold Democrats “politically accountable for racking up more debt.”

A quick vote: House Speaker Nancy Pelosi (D-CA) announced a vote on the legislative package scheduled for Tuesday. Assuming it passes, the bill would then head to the Senate, and McConnell said he could see a vote occurring as soon as Thursday.

House Set to Pass $768 Billion Bill Providing Big Boost to Pentagon Budget

The House is set to pass a $768 billion defense policy bill Tuesday evening, hours after the House and Senate Armed Services committees unveiled a compromise version of the long-delayed legislation. The bill would boost the Pentagon budget by about $24 billion more than President Biden had requested.

“The bill would authorize a $740 billion base budget for the Defense Department, $27.8 billion for nuclear weapons programs under the Department of Energy and $368 million for defense-related activities in other departments,” Roll Call reports. “Appropriators will need to decide whether to provide the budget authority to pay for it all.”

In addition to funding for new aircraft and ships, the bill provides funding boosts for plans to counter China and support Ukraine. It authorizes $7.1 billion for the Pacific Deterrence Initiative, the plan to increase U.S. presence in the region and deter China. That funding is $2 billion more than Biden requested. The bill also includes nearly $118 billion for Pentagon research and development of new technologies, $5.8 billion more than Biden requested. It also would provide a 2.7% raise for troops.

“Notably absent from the measure,” Roll Call reports, “is a provision pushed by top Senate Foreign Relations Committee Republican Jim Risch of Idaho, that would have imposed sanctions on those involved with building or financing Nord Stream 2, the controversial Baltic Sea pipeline that will transport Russian natural gas to Germany and circumvent Ukraine’s pipelines, potentially depriving the country of billions of dollars a year in transit fees.”

The bottom line: After a messy process, the compromise version of the National Defense Authorization Act appears set to pass, and it demonstrates what Catie Edmondson of The New York Times calls “the bipartisan consensus on Capitol Hill for continuing to spend huge amounts of federal money on defense initiatives, even as Republicans lash Democrats for spending freely on social programs.”

Read more about what’s in the NDAA here, here or here.

Dems’ Corporate Minimum Tax Plan Raises Red Flags

President Biden’s social spending and climate plan relies on a new 15% minimum tax on large corporations, which is projected to generate about $320 billion over the next decade, making it the single largest source of revenue in the bill. But senior Treasury Department officials have raised some red flags about the new tax, concerned that it might be difficult to implement, would make the tax code less efficient and could weaken some of the clean energy incentives elsewhere in the legislation, The Washington Post’s Jeff Stein reports.

As Democrats battled in recent months over the details of their Build Back Better plan and sought to ensure that it could get the votes it needs to pass the Senate, they were forced to drop their original plans to raise the corporate tax rate from 21% to 28% because of opposition from Sen. Kyrsten Sinema (D-AZ).

They instead wound up turning to a minimum tax on corporations with more than $1 billion in annual profits. “The new minimum tax is intended to ensure that all big corporations at least face a 15 percent rate,” Stein explains, “but it works by eliminating tax breaks — such as benefits for new capital investments — that Congress has put in place to achieve other policy goals.”

Some Democratic lawmakers and climate advocates have already expressed concern that the new plan would undercut the Build Back Better bill’s new tax incentives to promote investments in clean energy. An analysis by the American Clean Power Association suggested that limiting the ability of companies to deduct large capital investments will lead to an increase of 15% to 20% in the cost of clean energy and result in 820 million more metric tons of carbon dioxide compared to the original plan, Stein says.

Officials in the Treasury Office of Tax Policy are also uneasy about the minimum tax, Stein reports, adding that many tax policy experts view the idea as less efficient and effective than the straightforward corporate rate hike Democrats abandoned because of Sinema. “If you just raise the corporate rate, it’s better on efficiency grounds, on equity grounds, on the amount of money that can be raised,” Steve Rosenthal, a senior fellow at the Tax Policy Center, told the Post. “I expect the Biden administration, like the rest of us, thinks a corporate minimum tax is second-best to a corporate rate increase.”

In a statement to the Post, the Treasury Department disputed the idea that it does not fully back the latest plan. “As is the case when developing any tax policy, Treasury broadly surveyed considerations relevant to adopting a corporate minimum tax before advancing it as a major proposal in the Administration’s fiscal year budget,” Alexandra LaManna, a Treasury spokeswoman, said. “The Build Back Better Act’s proposed corporate minimum tax, which is very similar, would prevent the largest 0.00075 percent of U.S. corporations from paying little or no income tax and raise significant revenue so we can invest in our economy.”

The bottom line: The corporate minimum tax may be the second best idea, but it’s the best one Democrats can all get behind. This anonymous quote in Stein’s piece sums up the situation neatly: “The Treasury people whose job it is to say if something is good tax policy know it is not, but the White House people whose job it is to get Kyrsten Sinema’s vote have given no other choice.”

Quote of the Day

“This is probably the most important project that we can undertake. … We have to develop a vaccine before we need it, which means a vaccine that will protect against any coronavirus, including those that have yet to emerge.”

– Dr. Bruce Gellin, the chief of global public health strategy at The Rockefeller Foundation’s pandemic prevention institute, in a Politico piece reporting that some top scientists are urging the Biden administration to “think bigger” in the Covid fight and push for a “super vaccine” that would protect against all coronavirus variants. Another scientist, Eric Topol of the Scripps Research Translational Institute, tells Politico: “We need a universal coronavirus vaccine that’s not affected by variants. We can do this but there hasn't been the will or the prioritizing. Many months ago, before Omicron, we could have had an Operation Warp Speed-like effort to take this on. It was expected that we would have a really tough variant beyond Delta.”

Number of the Day: $400 Million

The U.S. Agency for International Development announced a new initiative Tuesday that will invest $400 million in funds from the American Rescue Plan Act enacted in March to help other countries get Covid vaccines and distribute them more efficiently to their citizens. The funding for the new program comes in addition to $1.3 billion already committed for global “vaccine readiness.”

Send your feedback to yrosenberg@thefiscaltimes.com. And please tell your friends they can sign up here for their own copy of this newsletter.

News

- Democrats, Republicans Say They’ve Reached Deal to Avert Another Debt Ceiling Crisis – Washington Post

- Lawmakers Rush to Avert Looming Medicare Cuts – Politico

- House Prepares to Pass $768 Billion Defense Policy Bill – New York Times

- Dems Weigh Forcing Manchin's Hand on Their $1.7T Megabill – Politico

- Judge Halts Biden Vaccine Mandate for Federal Contractors Nationwide – The Hill

- As Omicron Threat Looms, Inflation Limits Fed’s Room to Maneuver – New York Times

- Americans’ Pandemic-Era ‘Excess Savings’ Are Dwindling for Many – New York Times

- Senior Republican Warns Postal Reform at Risk if DeJoy's Job Is Threatened – Politico

- U.S. Coronavirus Cases Approach 50 Million – Washington Post

- Coronavirus Vaccine Demand Grows in U.S. Amid Omicron Variant Concerns, Booster Eligibility Expansion – Washington Post

- New Covid Pills Offer Hope as Omicron Looms – New York Times

- Amid Push to Vaccinate Children, Other Challenges Deluge Pediatricians – New York Times

Views and Analysis

- Yes, the 2017 Tax Cuts Helped Working-Class Americans. But Conservatives Should Be Honest About How – Henry Olsen, Washington Post

- Every 8 Seconds, An American Turns 65. How Do We Care for Everyone? -- Ai-jen Poo and Ezra Klein, New York Times (podcast)

- Can Democrats Sell Biden’s Agenda? New Ads Test a Different Approach – Greg Sargent, Washington Post

- The GOP’s Disregard for Doctors on the Coronavirus – Aaron Blake, Washington Post

- How Biden Can Enlist Insurance Companies to Get Covid-19 Tests to All Americans – Leana S. Wen, Washington Post

- My Red State Is Already Pretending Covid Is Gone. Now Here Comes Omicron – Teri Carter, Washington Post

- How Is the GOP’s Coronavirus Recklessness Compatible With Being Pro-Life? – Michael Gerson, Washington Post