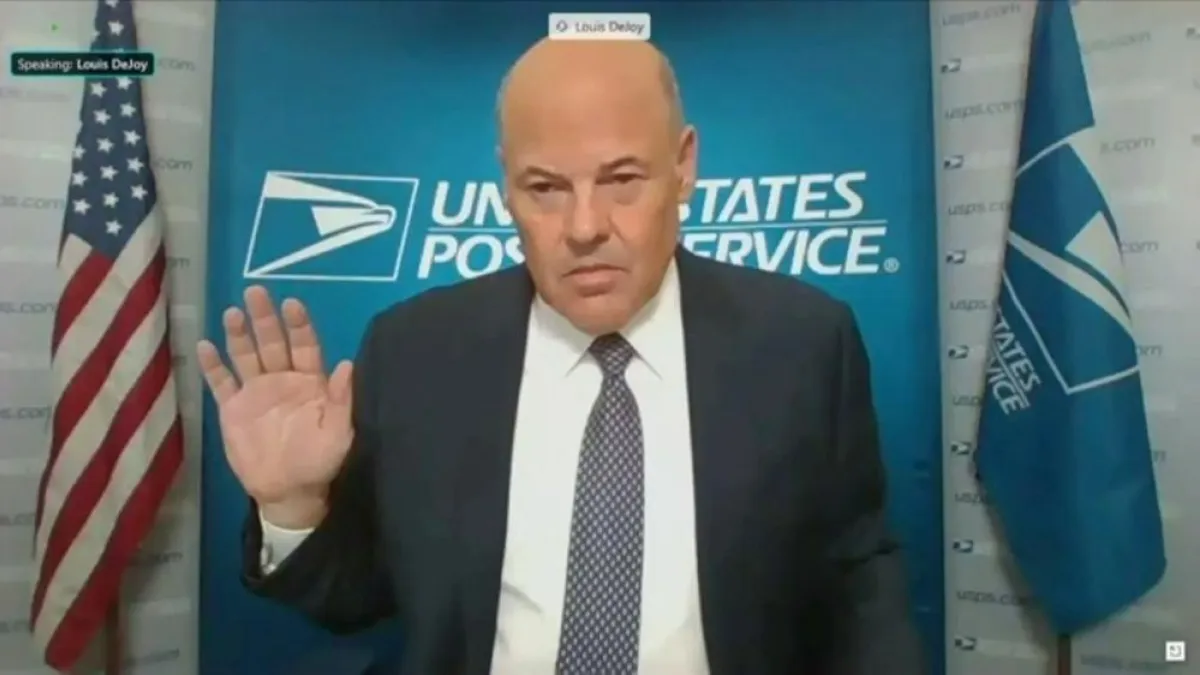

Postmaster General: We Don’t Need More Money for Election

Postmaster General Louis DeJoy told a Senate panel Friday that

he’s "extremely highly confident" that the U.S. Postal Service will

be able to handle the mail-in ballots it receives for this

November’s elections, despite letters reportedly sent by his agency

recently to 46 states warning that it cannot guarantee timely

delivery of all votes sent by mail.

"As we head into the election season, I want to assure this

committee and the American public that the Postal Service is fully

capable and committed to delivering the nation’s election mail

securely and on time," DeJoy testified at a hearing of the Senate

Committee on Homeland Security and Governmental Affairs. "This

sacred duty is my No. 1 priority between now and Election Day."

DeJoy, a former logistics executive and a major donor to

President Trump, has come under fire for changes he implemented at

the Postal Service since taking office in June. DeJoy defended his

moves Friday — and confirmed that, while he has suspended

additional changes until after the election in response to a public

outcry, he still plans

sweeping changes and cost-cutting measures after

the election.

“We are not self-sustaining,” DeJoy

said Friday. “We have a $10 billion shortfall, and

over the next 10 years we’ll have a $245 billion shortfall.”

Democrats want to provide $25 billion in emergency funding for

the Postal Service, in part to help handle an expected surge of

mail-in ballots, and House Speaker Nancy Pelosi has emphasized that

the dollar figure is what the Postal Service Board of Governors

earlier this year said it needed.

Asked by Sen. Rick Scott (R-FL) if the Postal Service needs a

“massive federal bailout” to be able to deliver election mail,

DeJoy said no, but suggested that the Postal Service should be

reimbursed by the federal government for the costs of continuing to

provide its services during the pandemic.

"I don't need anything to deliver mail on election night, but we

do need legislative reform,” he said, adding, "We continued to do

what we're supposed to do and at a significant cost impact, you

know, and I'm one to try to get to a sustainable model, but in this

case we — I believe we deserve some compensation for it.”

DeJoy also said the Postal Service needs to be freed from the

requirement imposed by Congress in 2006 that it

pre-fund its employee retirement benefit programs,

a controversial move that created huge financial challenges.

“If we just throw $25 billion at us this year and we don’t do

anything, we’ll be back in two years,” he said.

Why it matters: “With DeJoy’s comments that he doesn’t

need election-related funding, it could get harder for Democrats to

persuade Republicans to fund the Postal Service in any coming

coronavirus relief package,” The Washington Post’s Amber Phillips

writes.

What’s next: The House is set to vote Saturday on

the Democratic bill to provide $25 billion for the Postal Service.

The White House

said Friday that it “strongly opposes” the

legislation and threatened to veto it. President Trump and White

House officials have said that they would consider additional

Postal Service funding as part of a coronavirus relief package as

long as their other priorities were included.

DeJoy and Robert M. Duncan, chair of the Postal Service’s board,

are scheduled to testify Monday before the House Oversight

Committee.

Biden Bashes Trump on Social Security, Taxes and Health Care:

What You Need to Know

Joe Biden’s well-received acceptance speech for the

Democratic presidential nomination Thursday night may have

emphasized his differences with President Donald Trump —with a

heavy focus on personal traits such as compassion, trust and moral

character — but Biden also touched on some of his proposals on key

policy issues, including Social Security, health care and

taxes.

Here’s what Biden said and what you should know about

it.

Social Security

What Biden said: “For our seniors, Social Security

is a sacred obligation, a sacred promise made,” Biden

said. “The current president is threatening

to break that promise. He's proposing to eliminate the tax that

pays for almost half of Social Security without any way of making

up for that lost revenue. I will not let it happen. If I'm your

president, we're going to protect Social Security and Medicare. You

have my word.”

What you should know: Earlier this month, as part

of his effort to unilaterally provide economic relief

from the coronavirus pandemic, Trump ordered the deferral of

employee’s share of payroll taxes dedicated to Social Security for

the remainder of the year. The payroll tax, which is split between

employer and employee, covers nearly 90% of the cost of Social

Security, according to government data

reported by FactCheck.org. Last year, the

tax produced about $945 billion; the deferral ordered by Trump

would reduce the total this year by about $100 billion over the

next four months, according to an

analysis by the Committee for a Responsible

Federal Budget.

While the White House has claimed that deferral would in

no way harm Social Security, with the lost revenues through

December made up for from general funds, Trump has repeatedly said

that he wants to eliminate the payroll tax altogether: “If I’m

victorious on November 3rd, I plan to forgive these taxes and make

permanent cuts to the payroll tax. So I’m going to make them all

permanent,” he said on August 8.

William Hoagland of the Bipartisan Policy Center says that

a temporary cut to the payroll tax wouldn’t destroy Social

Security, although it could move up the depletion date for the

Social Security trust funds by a year or two. But if Trump were to

“make permanent cuts to the payroll tax,” as he has promised to do,

it would indeed represent an existential threat to the Social

Security system.

For his part, Biden is proposing to boost revenues for the

Social Security system and increase benefits for some

beneficiaries. Workers would have to start paying payroll taxes on

income over $400,000 (the tax currently applies only to the first

$137,700). And beneficiaries would see higher minimum payment

levels, an increase in survivor benefits and a 5% boost for those

who have received benefits for more than 20 years.

Taxes

What Biden said: Biden took aim at the tax cuts

Republicans passed in 2017, referring to “the president’s $1.3

trillion tax giveaway to the wealthiest 1% and the biggest, most

profitable corporations, some of which do not pay any tax at

all.”

What you should know: Biden has promised to roll

back some of those cuts by raising taxes on households making more

than the $400,000 and hiking the corporate tax rate from 21% to

28%.

Fact checkers note that the majority of households

received a tax cut from the Tax Cuts and Jobs Act, with 65% of

households paying less to the IRS in 2018 than they would have

otherwise. But the cuts were considerably larger at higher income

levels, and when the individual provisions of the legislation

expire in 2026, the majority of the benefits — 82.8%, according to

an analysis by the Tax Policy Center — will flow to the top

1%.

Health Insurance

What Biden said: Biden warned that Trump’s “assault

on the Affordable Care Act will continue until its destroyed,

taking insurance away from more than 20 million people -- including

more than 15 million people on Medicaid -- and getting rid of the

protections that President Obama and I passed for people who suffer

from a pre-existing condition.” Biden said that he wants to develop

“a health care system that lowers premiums, deductibles, and drug

prices by building on the Affordable Care Act [Trump is] trying to

rip away.”

What you should know: Most experts agree that the

Trump administration’s effort to have the Affordable Care Act

overturned — arguments will be heard in the Supreme Court shortly

after the election — would, if successful, result in upwards of 20

million people losing their insurance and eliminate the protections

provided for people with pre-existing conditions. While Republicans

have insisted that they are in fact protecting those with

pre-existing conditions, there have taken no concrete steps to do

so, while pursuing repeal efforts that would eliminate those

protections.

Biden also said that as a result of the coronavirus

pandemic, “more than 10 million people are going to lose their

health insurance this year.” While the number is an accurate

estimate, the majority of those people are expected to pick up

coverage from other sources, including family members, Medicaid or

the federal marketplaces established by the Affordable Care Act.

The Urban Institute estimates that about 2.9 million people will be

left without health insurance after those transitions are accounted

for.

Poll of the Day: Protecting Social Security Benefits

Protecting Social Security is a top priority for American

voters, according to a poll conducted by progressive think tank

Data for Progress and released with Social Security Works, an

advocacy group. The online survey of 1,074 potential voters was

conducted on August 7 and has a margin of error of 3 percentage

points.

Chart of the Day: $1 Trillion Yet to Be Spent

“There is $1 trillion stashed away in the U.S., and

it just might save the economy,”

says economist Tim Duy at Bloomberg. That sum is

what’s left in people’s accounts from the $2.2 trillion CARES Act,

which provided $1,200 stimulus checks and $600 per week in extra

unemployment benefits. “It’s enough to either boost consumer

spending by at least $78 billion dollars a month over the next year

or supercharge growth if confidence soon turns higher,” Duy

says.

Send your tips and feedback to yrosenberg@thefiscaltimes.com.

Follow us on Twitter:

@yuvalrosenberg,

@mdrainey and

@TheFiscalTimes. And please tell your

friends they can

sign up here for their own copy of this

newsletter.

News

White House Threatens Veto of Democrats' Postal Service

Bill – The Hill

DeJoy Tells Senators Election Mail Will Be Delivered ‘Fully

and on Time’ – New York Times

Postmaster General Eyes Aggressive Changes at Postal Service

After Election – Washington Post

Researchers, Officials, and Investors Increasingly Confident

About a COVID-19 Vaccine Next January – The

Week

CDC Says U.S. Could Control Coronavirus in 12 Weeks If Most

Americans Wear Masks, Social Distance –

CNBC

This Map Shows Where States Stand on the Extra $300 Weekly

Unemployment Benefits – CNBC

Schumer: Ditching Filibuster Not ‘off the Table’ If Biden,

Democrats Win – Roll Call

Biden’s Immigration Plan: Cancel Trump Orders, Seek Bill in

Congress – Roll Call

Trump Campaign, RNC Have Spent More Than $1 Billion Since

Beginning of 2017, Filings Show – The Hill

Views and Analysis

5 Takeaways From the Postal Service Hearing in the

Senate – Amber Phillips, Washington Post

Unemployment Is Still at Crisis Levels. Why Aren’t We

Treating It as an Emergency? – Helaine Olen, Washington

Post

The U.S. Has Two Economies. How Much Longer Will the Losing

Side Stand for That? – Catherine Rampell, Washington

Post

This Is How Democrats Get Shellacked in 2022

– Ryan Cooper, The Week

Here's How We Beat the Virus and Save the Economy This

Fall – Noah Smith, Bloomberg

Blanket COVID-19 Liability Shield Will Cost

Taxpayers – Steve Ellis, Roll Call

Don’t Rehire a Failed President – Michael

Bloomberg, Bloomberg

Trumpism Is a Racket, and Steve Bannon Knew It –

Michelle Goldberg, New York Times

Another Giveaway to Polluters From the Trump EPA –

Bloomberg Editorial Board

Stocks Are Soaring. So Is Misery – Paul Krugman,

New York Times