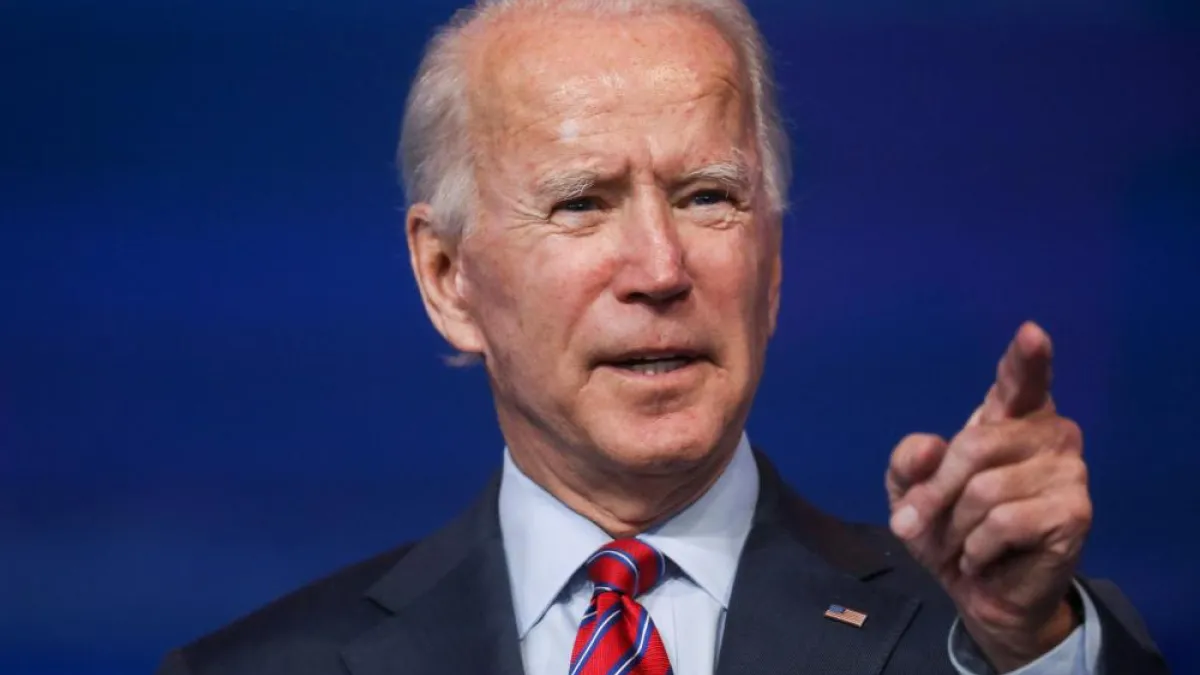

Biden Warns of ‘Very Bleak’ Future Without Stimulus

President-elect Joe Biden on Friday called for “urgent

action” on a coronavirus-relief package, indicating that lawmakers

should pass a bipartisan compromise package as a “down payment”

toward additional coronavirus aid after he takes office.

“Americans need help and they need it now,” the

president-elect said Friday. “And they need more to come early next

year. But I must tell you I am encouraged by the bipartisan efforts

in the Senate around a $900 billion package for relief.”

Biden warned that without quick action to provide relief

as Covid cases surge across the country, “the future will be very

bleak.”

Biden made clear that he would seek to work with

Republicans to provide more economic stimulus next year. “Congress

and President Trump must get a deal done for the American people,

but any package passed in the lame duck session is not enough. It’s

just the start,” he said. “Congress will need to act again in

January.”

Biden said he was confident that he’ll be able to get

Republicans to go along with an additional Covid package next year

because the need will be so dire.

He also touched on the deficit concerns that have been

raised by some Republicans in arguing against additional stimulus.

“By acting now, even with deficit financing, we can add to growth

in the near future,” he said. “In fact, economic research shows

that with conditions like today’s crisis — especially with such low

interest rates — not taking the actions I’m proposing, will hurt

the economy, scar the workforce, reduce growth, and add to the

national debt.”

Pelosi says “there is momentum” toward a

deal: House Speaker Nancy Pelosi on Friday said

that momentum is building on Capitol Hill toward a coronavirus

relief deal and defended her past handling of negotiations,

including her pushback on a White House offer of about $1.8

trillion, larger than the deal now being discussed.

At her weekly press conference, Pelosi (D-CA) said she had

spoken with Senate Majority Leader Mitch McConnell (R-KY) by phone

on Thursday and said talks were making progress after a bipartisan

group of lawmakers earlier this week proposed a $908 billion

compromise deal.

“There is momentum,” Pelosi told reporters. “And so I am

pleased that the tone of our conversations is one that is

indicative of the decision to get the job done.”

Aid to state and local governments, which many Republicans

oppose, and a “liability shield” protecting businesses and

hospitals from coronavirus-related lawsuits, which Democrats have

rejected, remain contentious issues. Negotiators have agreed

that aid to state and local governments should be tied to a

jurisdiction’s loss of revenue, not its population, The Washington

Post

reports.

‘Not a Mistake’: Pelosi said her

handling of earlier talks was

“not a mistake” and explained that she was now

willing to accept a smaller deal — the sort she had long rejected —

because the election of Joe Biden as president and the development

of promising vaccine candidates had changed the dynamic, creating

the promise that an additional Covid-related rescue package could

be done next year.

“With a Democratic president committed to a scientific

solution for this, with the idea that we will have a vaccine, it’s

a complete game-changer from then,” she said.

After months of stalemate, Pelosi said that Congress would

not leave for the upcoming holidays without reaching a deal. “We

must get it done before we leave,” she said. “We cannot leave

without it.”

Sanders comes out against $908 billion

package: As lawmakers scramble to reach a deal,

the latest coronavirus relief plan still faces plenty of hurdles.

Sen Bernie Sanders (I-VT) on Friday said he would vote against the

compromise package and would require significant revisions before

he could support it.

The framework being considered doesn’t include another

round of $1,200 direct payments. “Tens of millions of Americans

living in desperation today would receive absolutely no financial

help from this proposal. That is not acceptable,” Sanders said in a

statement.

Some conservative lawmakers have also come out against the

proposed package. “There’s widespread opposition among

conservatives, particularly among our activists who are sick of

Congress spending money we don’t have,” Jason Pye, vice president

for legislative affairs for FreedomWorks, a conservative advocacy

group, according to The Washington Post.

What’s next: Negotiators hope to reach

a deal and release the legislative text by Monday.

Pelosi and McConnell hope to tie the coronavirus-relief

legislation to a broader, $1.4 trillion omnibus spending package,

but time is running short. “The sheer number of outstanding items

at such a late stage makes it increasingly likely that

congressional negotiators will require a brief stopgap spending

bill to complete their work before leaving for the holidays,”

Politico

reports. “Such a decision could be made early next

week if lawmakers fail to make significant progress over the

weekend.”

Economy Flashing Yellow Lights as Job Growth Slows

The U.S. economy added a disappointing 245,000 jobs in

November, the Labor Department announced

Friday, the weakest job growth since the economy started recovering

in May from the first wave of coronavirus shutdowns.

Job growth has declined for five months in a row, raising

alarms about the waning strength of the recovery and the fate of

millions of workers who have lost their jobs in an economy still

battered by the Covid-19 pandemic. The U.S. remains about 10

million jobs short of its peak in February, and 11 million shy of

the trend line in place in the pre-Covid economy.

The unemployment rate fell by two-tenths of a percentage

point to 6.7% in November, but the decline was driven largely by

more than half a million workers leaving the labor force. According

to an

analysis by Jason Furman, who served as chair of

the Council of Economic Advisers in the Obama administration, a

more realistic unemployment measure that takes into account those

who have dropped out puts the jobless rate at 8.5%.

A worrying trend: The number of people

experiencing long-term unemployment has been rising sharply. “The

jobs report offers clues that what was once temporary unemployment

is becoming more permanent — in ways that, if unchecked, could do

long-term damage to millions of families and to the economic

potential of the United States,” Neil Irwin of The New York Times

wrote.

Since September, the number of people jobless for more

than 27 weeks has risen by 1.5 million, and some economists fear

that the job market will get worse before it gets better. “The

recovery is not insulated from the effects of the pandemic,” Daniel

Zhao, an economist at Glassdoor,

told the Associated Press. “This is the calm

before the storm. We face a long and difficult winter

ahead.”

Biden calls for more stimulus:

President-elect Joe Biden said the report underscores the

need for Congress to provide further stimulus. “This is a grim jobs

report. It shows an economy that is stalling. It confirms we remain

in the midst of one of the worst economic and jobs crises in modern

history,” Biden said in a statement.

Senate Democratic leader Chuck Schumer also cited the

latest employment numbers as he pushed for a deal. “This jobs

report is blaring warning that a double-dip recession is looming

and must be a wakeup call for anyone who is standing in the way of

true bipartisan emergency relief,” he said in a

statement.

Rep. Tom Cole, a Republican from Oklahoma, agreed on the

implications of the report: “I think today’s jobs numbers really

help” the effort to pass another round of stimulus. “We may

disagree about the specifics but there is no doubt the economy

needs help.”

The conservative U.S. Chamber of Commerce said the

“slumping economy” makes it clear that lawmakers need to reach a

deal quickly. “The fire alarm is sounding on our economy and the

only question is whether Congress will respond,” a Chamber

representative said in a

statement. “The time for Congress to move a

bipartisan bill is now. The U.S. Chamber strongly urges lawmakers

to support bipartisan efforts to enact pandemic relief

...”

Blue and Red States Face Deep Budget Cuts

The bipartisan relief proposal being discussed on Capitol Hill

calls for providing $160 billion in aid to state, local and tribal

governments. The New York Times’ Patricia Cohen writes that,

contrary to some GOP objections to a “blue-state bailout,” it is

not just Democratic-led states that are in dire need of federal

help in dealing with the coronavirus pandemic and the resulting

budget crises that threaten to force deep cuts:

“Governors, mayors and county executives

have pleaded for federal aid before the end of the

year. Congressional Republicans have scorned such assistance, with

the Senate majority leader, Mitch McConnell of Kentucky, calling it

a ‘blue-state

bailout.’

“But it turns out this budget crisis is colorblind. Six of the

seven states that are expected to suffer the biggest revenue

declines over the next two years are red — states led by Republican

governors and won by President Trump this year, according to a

report from Moody’s Analytics.

“Those on the front lines agree. ‘I don’t think it’s a

red-state, blue-state issue,’ said Brian Sigritz, director of state

fiscal studies at the National Association of State Budget

Officers. …

“In reality, the degree of financial distress turns less on

which party controls a statehouse or a city hall than on the number

of Covid-19 cases, the kinds of businesses undergirding a state’s

economy, and its tax structure.”

Read more at The New York Times.

Time to Stop Worrying About the Deficit?

We told you

earlier this week that the debate about the

national debt and deficits has heated up again and is bound to

color policy discussions for the incoming Biden administration. The

get a preview of the coming clashes, tune into Bloomberg TV tonight

at 7 p.m. ET for an actual debate on the issue produced by

Intelligence Squared U.S. The motion being debated: "Stop Worrying

About National Deficits."

Arguing for the motion are Stephanie Kelton, an economics

professor at Stony Brook University and a leading proponent of

Modern Monetary Theory, which holds that deficit fears needlessly

prevent fiscal policy from responding to economic needs. She’s

joined by James Galbraith, an economist at the University of Texas

at Austin and former executive director of the Joint Economic

Committee in Congress.

Arguing against them are Todd Buchholz, director of

economic policy under President George H. W. Bush, and Otmar

Issing, former chief economist of the European Central

Bank.

Below are selected highlights from their arguments. Video

of the debate will be available Monday at https://intelligencesquaredus.org/.

Kelton: “When the government eliminates deficits,

balances its budget or moves it into surplus, then it's operating

its budget like a vacuum, it's hoovering those dollars away from

the rest of us. And that reduces our wealth. So think about whether

you want the government to be running deficits which produce your

surpluses, or whether you'd prefer them to hoover away some of the

financial assets that you hold. …

“No one is arguing for unbridled deficit spending, out of

control, never-ending larger and larger deficits. Deficits can be

too big. And inflation can be evidence of a deficit that's gotten

too big. But deficits can also be too small, and evidence of a

deficit that is too small is unemployment. That's what we have

today. And that's what Dr. Galbraith and I would like to convince

you of. Let's worry about the unemployment and the death and the

depressed economy, not the government deficit.”

Galbraith: “What we did in 2020 when

we were hit with a pandemic was utterly remarkable. In the United

States, we poured over $2 trillion into the economy, over 10% of

our national income, to support people's income, to replace their

lost wages, to keep them in their homes. We're running out of money

now. We need to put some more in. It's as simple as that. To say we

can't do it for some reason that wasn't apparent seven months ago

is a sad proposition which has no foundation in any reality that

we're currently facing.”

Buchholz: “No one believes during a

pandemic that we should cut spending, or be concerned about the

deficit. That is not today's discussion. Having said that, our

concern is that Modern Monetary Theory says that you should engage

in reckless grand spending even in good times, and it interests

populist politicians with far too much power to do ill.

…

“We are confronting a situation where the next 10 years,

Social Security and Medicare in the U.S. — those trust funds will

go dry. And there will be automatic spending cuts if nothing is

done. Now our colleagues here say, well, we can keep spending until

inflation shows up. I would like to ask why is it our distinguished

colleagues have so much trust in politicians to do what politicians

hate to do, that is, cut spending and raise taxes when inflation

comes?”

Issing: “A renowned German economist

once remarked, expecting public politicians to resist the

temptation of free public spending is like expecting a dog to sit

disciplined before a box of sausages. … The proposal to ignore

public deficits and debt is pure populism, promising a land of milk

and honey, the surest way to undermine and ultimately destroy the

value of currencies.”

News

Pelosi Eyes Combining Covid Aid With Mammoth Spending

Deal – Politico

Sage Grouse, Biomass Riders Trip Up Omnibus Spending

Bill – Roll Call

Bipartisan Governors Call On Congress to Pass Coronavirus

Relief Package – The Hill

CDC Recommends People Wear Masks Indoors When Not at

Home – Washington Post

As the Virus Shatters Records, Pence Says U.S. Is Facing a

‘Season of Hope’ With Likely Vaccine Approval – New York

Times

States Submit Vaccine Orders as Coronavirus Death Toll

Grows – Associated Press

US Mayors Expect 'Dramatic' Cuts to Their Public

Schools – The Hill

Covid Survivors With Long-Term Symptoms Need Urgent

Attention, Experts Say – New York Times

Progressives Shift Focus From Biden's Cabinet to His Policy

Agenda – Axios

How Dozens of Trump’s Political Appointees Will Stay in

Government After Biden Takes Over –

ProPublica

Trump Campaign Committees Spent $1.1 Million at Trump

Properties in the Last Days of His Losing Campaign –

Washington Post

Views and Analysis

Why Are Republicans Moving Toward a Stimulus Compromise?

Here’s a Clue – Greg Sargent, Washington

Post

Strike a Deal on Pandemic Relief Right Now –

Bloomberg Editorial Board

Jobs Data Was ‘Perfect Miss’ for Fed and Fiscal

Stimulus – Brian Chappatta, Bloomberg

A Jobs Report Without Silver Linings – Neil Irwin,

The Upshot

The Winter Mitch McConnell Created – David Brooks,

New York Times

Congress’ Juggling Act – Jake Sherman et al,

Politico

I’m Joining Biden’s Economics Team. Here’s Some of What I’ll

Be Thinking About – Jared Bernstein, Washington

Post

Federal Deficits Don't Work Like Credit Cards –

Noah Smith, Bloomberg

Republicans Are Complaining (Again) About the Budget

Deficit – Michael Hiltzik, Los Angeles Times

Learn to Stop Worrying and Love Debt – Paul

Krugman, New York Times