Congress Buys More Time for Covid-Relief Deal, but Talks Are

Going ‘Nowhere’

The House voted 343 to 67 Wednesday to approve a one-week

measure that would keep the government funded until December 18,

providing Congress with a bit more time to hash out a full-year

funding bill and perhaps finalize an elusive Covid-relief

package.

The Senate is expected to vote on the spending bill as soon ass

Thursday.

The path toward a coronavirus package remains far less certain,

clouded by competing proposals and continuing disagreement over key

provisions.

Treasury Secretary Steven Mnuchin jumped back into the

negotiations late Tuesday, with a $916 billion proposal that is

slightly larger than the $908 billion one currently under

discussion by a bipartisan group of centrist lawmakers.

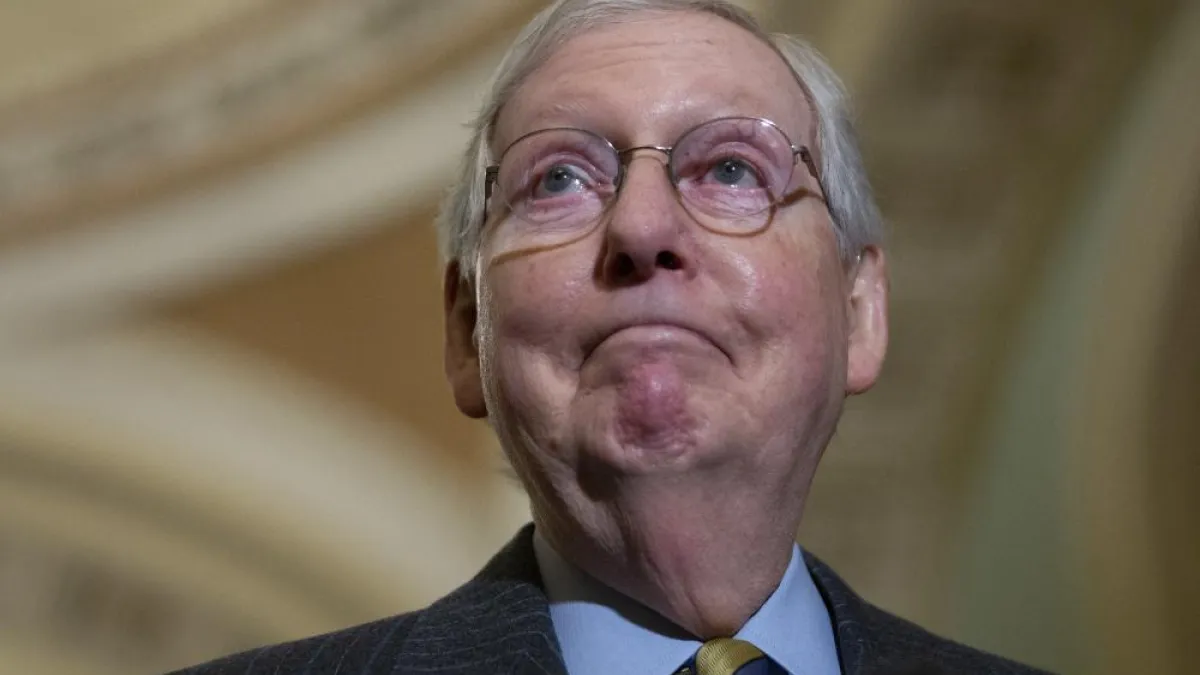

Mnuchin said the proposal has the support of Republican leaders

including Senate Majority Leader Mitch McConnell (R-KY), who had

previously offered a smaller package worth about $500 billion.

Democratic leaders said unified GOP support for a larger

proposal was a sign of progress but were quick to criticize the

details — especially the absence of any money for supplemental

federal unemployment benefits, which in the centrist package are

provided at $300 per week for four months. Instead, the White House

proposes to send one-time payments of up to $600 to most Americans,

at a cost of $164 billion, while spending $140 billion less on

unemployment aid relative to the bipartisan proposal.

House Speaker Nancy Pelosi (D-CA) and Senate Democratic Leader

Chuck Schumer (D-NY) said in a joint

statement that they were concerned that White House

involvement could undermine negotiations.

“While it is progress that Leader McConnell has signed off on a

$916 billion offer that is based off of the bipartisan framework,

the President’s proposal must not be allowed to obstruct the

bipartisan Congressional talks that are underway,” they said.

“Members of the House and Senate have been engaged in good-faith

negotiations and continue to make progress. The bipartisan talks

are the best hope for a bipartisan solution.”

The Democratic leaders also made clear that they rejected the

White House proposal to spend less on unemployment aid: “The

President’s proposal starts by cutting the unemployment insurance

proposal being discussed by bipartisan Members of the House and

Senate from $180 billion to $40 billion. That is unacceptable.”

Major issues still unresolved: Mnuchin’s proposal

includes provisions on issues that have stymied negotiators so far

— liability protections for businesses, schools and hospitals that

Republicans says are essential and funds for state and local

governments that Democrats insist are needed to avoid layoffs and

help pay for vaccinations. But there’s no sign that either side is

willing to give way on their demands, or their opposition to the

other side’s requirements.

More details on the bipartisan $908 billion plan: The

release Wednesday of more details from the $908 billion centrist

proposal did little to change the picture. Under that

still-developing plan, state and local governments would receive

$160 billion, and businesses would receive liability protections. A

document outlining the details refers to agreements in principle on

the issues, but only insofar as they allow “good faith

negotiations” to continue, according to

The Hill.

McConnell’s offer on Tuesday to drop both issues from the

negotiations — no liability shield and no state and local money —

was quickly rejected and seen by at least one lawmaker as a sign

that the Senate leader isn’t really interested in reaching an

agreement. “Mitch doesn’t want a deal,” Sen. Joe Manchin (D-WV)

told reporters. “You have to have both.”

McConnell blamed Democrats for the lack of progress. “At every

turn they’ve delayed, deflected, moved the goalpost and made the

huge number of places where Congress agrees into a hostage ... for

the few places where we do not agree,” he said on the Senate

floor.

The bottom line: Taking stock of where

negotiations stood Wednesday afternoon, Politico’s Playbook team

said talks were going “nowhere.” Just nine days before Congress is

scheduled to leave town, “there’s no bill, no sense of who is in

charge, no breakthroughs on any long-held policy disputes,” they

said.

Quote of the Day

“We essentially are going to make a choice over the next two

weeks over whether we want to have a double-dip recession or

not.”

– Joe Brusuelas, chief economist at audit and

tax firm RSM, as quoted by

The Hill.

CBO Report Lists 83 Options for Reducing the Deficit

The federal budget deficit in October and November, the first

two months of fiscal year 2021, totaled $430 billion, an increase

of $87 billion, or 25%, over the same period last year, the

Congressional Budget Office estimated

on Tuesday. Spending rose by 9% while revenues fell by 3%.

Individual income tax and payroll tax receipts dropped by 4% while

corporate income taxes decreased 13%.

Deficits have risen dramatically under President Trump, climbing

from $585 billion in fiscal year 2016 to nearly $1 trillion in

2019. Emergency coronavirus relief in fiscal year 2020 lifted a

deficit that was already projected to top $1 trillion to a record

$3.13 trillion.

While deficit reduction has become less of a priority as the

nation grapples with the pandemic and its economic toll, CBO on

Wednesday issued the latest edition of a periodic report laying out

dozens of options — 83 in all

this time — for reducing the deficit over the coming decade.

Some of the options would save relatively little, such as

limiting enrollment in the Department of Agriculture’s conservation

programs, which is projected to save between $3 billion and $8

billion over the decade. Others would save or raise hundreds of

billions of dollars:

- Reducing funding for international affairs programs ($117

billion) - Setting caps on federal spending for Medicaid ($353

billion to $959 billion) - Cutting the Defense Department’s budget ($317 billion to

$607 billion) - Increasing the payroll tax cap for Social Security ($647

billion to $1.024 trillion) - Eliminating itemized deductions ($1.718

trillion) - Imposing a 5% Value-Added Tax ($1.82 trillion to $2.83

trillion)

Most of the options in the report would save $10 billion or more

over 10 years.

In a statement accompanying the report, CBO Direct Phillip

Swagel warns that lawmakers will need to make significant policy

changes to put the federal budget on a sustainable long-term path.

“Beyond the coming decade, the fiscal outlook is daunting,” he

says.

CBO notes that the options “are intended to reflect a

range of possibilities rather than to rank priorities or present a

comprehensive list” and it says that the inclusion or exclusion of

an idea does not represent an endorsement or rejection. CBO’s

website includes a search tool

that allows users to choose options based on potential savings or

budget category.

Bezos and Musk, World’s Richest Men, Qualify for Anti-Poverty

Tax Break: Report

David Kocieniewski of Bloomberg News reports that the world’s

two richest men, Amazon founder Jeff Bezos and Tesla founder Elon

Musk, are eligible for a tax break intended to help poor

communities. That’s because the sites of their privately owned

space companies, Blue Origin and SpaceX, were designated as

Qualified Opportunity Zones as part of a much-criticized program

that was part of the 2017 tax cuts:

“The billionaires’ qualification for the federal benefit,

which hasn’t been previously reported, enables them to avoid

capital gains taxes on money they steer into opportunity zone

operations. Those investments can then grow tax-free, and if the

billionaires keep their investments in place for a decade, any

appreciation can be shielded from federal capital gains taxes

forever.”

Another billionaire, Richard Branson, also stands to benefit

from the program, Kocieniewski says. Brett Theodos, a community

development expert who has studied the opportunity zone program for

the Urban Institute, tells Bloomberg: “It would be a gross misuse

of scarce resources to be subsidizing billionaires to go out into

space when there are people struggling with real problems here on

earth.”

Read the full story at Bloomberg News.

A terrible year just got even

worse: The Campbell Soup company

warned that it’s facing "supply constraints" in

its cookie division, meaning holiday-season shortages of Pepperidge

Farm cookies.

Send your tips and feedback to yrosenberg@thefiscaltimes.com.

Follow us on Twitter:

@yuvalrosenberg,

@mdrainey and

@TheFiscalTimes. And please tell your

friends they can

sign up here for their own copy of this

newsletter.

News

December Smashes Records for Virus Cases as Deaths Near

300,000 – Bloomberg

Bipartisan Group Aiming to Wrap Up Coronavirus Relief Deal

Wednesday – Roll Call

Momentum Stalls for Covid-19 Relief Bill – The

Hill

Congress’s Relief Negotiations Drag Amid Renewed

Finger-Pointing – Bloomberg

Trump EPA Finalizes Rollback Making It Harder to Enact New

Public Health Rules – Washington Post

White House Task Force: Vaccine May Not Reduce Virus Spread

Until Late Spring – The Hill

For the First Time, the U.S. Will Reward Nursing Homes for

Controlling the Spread of Infectious Disease –

Washington Post

Britain Warns Against Pfizer Vaccine for People With History

of ‘Significant’ Allergic Reactions – Washington

Post

States Face Tough Questions About Who Should Get Covid-19

Vaccines After the Initial Groups – CNN

Azar Says He’s Met With Biden Transition Team, Will Be in

Touch With His Successor – Washington Post

U.S., Covid Vaccine Makers in Talks About Boosting

Acquisition – Bloomberg

Job Openings in U.S. Unexpectedly Rose to a Three-Month

High – Bloomberg

Cannon House Office Building Renovation Expected to Go $137

Million Over Budget – Roll Call

Views and Analysis

Both Parties Should Embrace This Stimulus Bill –

Michael R. Strain, Bloomberg

So Are We Going to Get a Covid-19 Stimulus Deal, or

Not? – Chris Cillizza, CNN

The Coronavirus Aid Package Should Include Stimulus Checks,

Targeted to Those Who Need Them Most – Washington Post

Editorial Board

Why Republicans Are Trying to Stop Xavier Becerra From

Heading HHS – Helaine Olen, Washington Post

Liberal Economists Say Debt Doesn’t Matter. They’re

Wrong. – Brian Riedl, Washington Post

How Much Debt Is Too Much? – Milton Ezrati,

Forbes

Congress’s Bipartisanship Fetish Is Killing the Covid Relief

Effort – Osita Nwanevu, New Republic

The Cabinet Selection Process Is Veering Off

Course – David Dayen, American Prospect

‘Warp Speed’ for the Coronavirus Vaccine Ended When It

Reached U.S. Regulators – Megan McArdle, Washington

Post

The End of the Businessman President – Kyle Edward

Williams, New Republic