Democrats Roll Out Plan for $1,400 Relief

Payments

Democrats are moving ahead with their plans to send $1,400

coronavirus relief payments to millions of Americans. House

Democrats on Monday rolled out their proposal, which calls for

sending the full payments to individuals earning up to $75,000 and

couples making up to $150,000, rejecting calls from Republicans and

some moderates in their own party to scale back eligibility.

Democrats had debated limiting eligibility to individuals making

up to $50,000 and couples earning up to $100,000, a structure

supported by Sen. Joe Manchin (D-WV), who will be a key vote in the

evenly divided Senate as Democrats seek to pass the relief package

with a simple majority.

But as lawmakers in both parties have pushed to keep

high-earning households from receiving the payments, the new

Democratic

proposal would phase out payments to individuals

earning between $75,000 and $100,000 (and couples making twice

those amounts). Individuals making $100,000 a year and couples

making $200,000 would not get relief payments under the plan

unveiled by House Ways and Means Chairman Richard Neal (D-MA).

Unlike earlier relief payments, both children and adult dependents

would qualify.

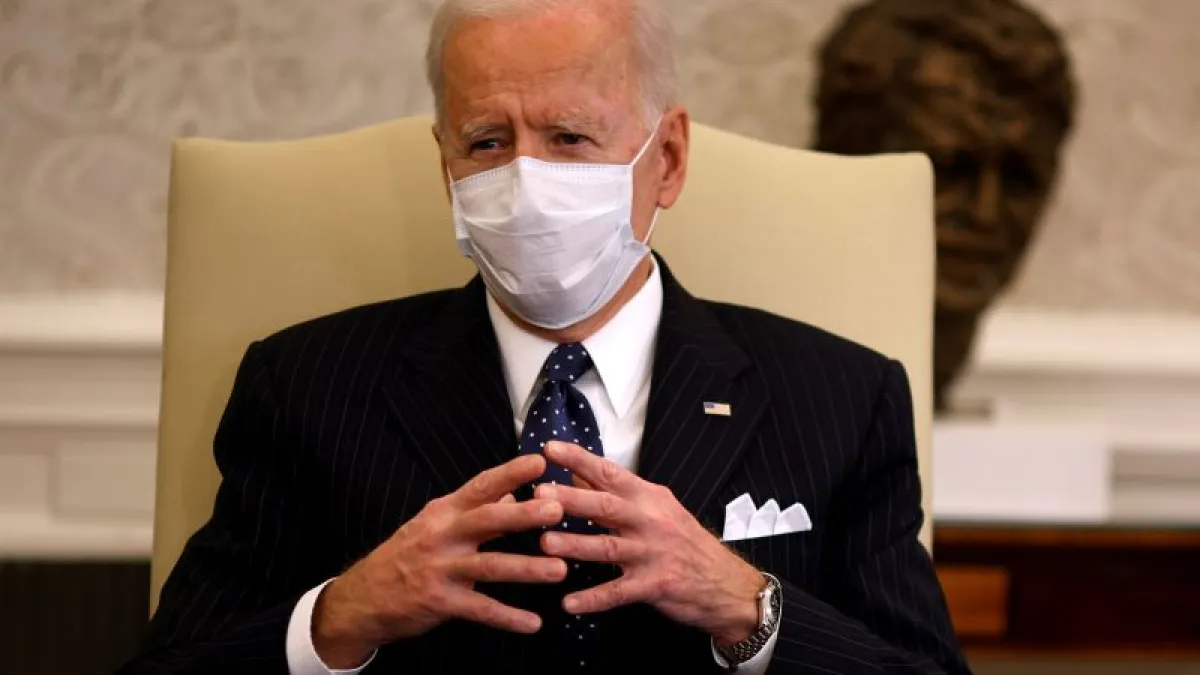

President Joe Biden said Tuesday that he agrees with the $75,000

threshold set by House Democrats.

Why it matters: “The broadening of stimulus payment

eligibility among middle-class households is the latest sign that

Democrats are moving ahead without Republican support,” The

Washington Post’s Jeff Stein and Erica Werner

report.

Some other details from the Democrats’ aid package:

Democrats also unveiled details of an

expanded child tax credit, which we told you about

yesterday, as well as an extension of federal supplemental

unemployment benefits of $400 a week, up from the current $300,

through the end of August (one month less than Biden’s plan

initially proposed). Democrats also included a minimum wage hike to

$15 an hour and a two-year increase in

Affordable Care Act premium subsidies.

Poorest Americans Would Get Major Income Boost

From Covid Relief Bill: Report

Three anti-poverty provisions in the legislation released this

week by the House Ways and Means Committee would provide a 33%

income boost on average for the poorest 20% of Americans, according

to an

analysis by the left-leaning Institute on Taxation

and Economic Policy.

Part of the $1.9 trillion Covid relief bill currently being

drafted by Congress, the provisions would provide another round of

relief payments of $1,400 and expand both the child tax credit and

the earned income tax credit programs. Under the expanded child tax

credit, eligible families would receive $3,000 per child between

the ages of 6 and 17 and $3,600 for children under 6, paid out in

monthly installments. The expanded earned income tax credit would

provide more robust aid, especially for childless adults,

increasing payments by as much as 200%.

For households in the lowest 20% of the income distribution –

with an upper limit of $21,300 and average earnings of $10,900 per

year – the three provisions would provide more than $3,000 in aid

on average, ITEP said. Breaking it down by program, the relief

payments would provide a 20.3% boost to income on average, the

expanded child tax credit would provide 9.7%, and the earned income

tax credit would deliver another 3%.

Households higher in the income distribution would receive

smaller payments on a relative basis, with those in the middle

receiving a boost of about 6.6%.

Overall, all eligible families would receive an average payment

of $3,290 for the year, based on 2020 household data.

Charts of the Day: The US Goes Big

If signed into law, President Biden’s $1.9 trillion Covid relief

package will be “the second-largest injection of federal cash in

U.S. history,” second only to the $2.2 trillion Cares Act last

March, Bloomberg

reported Tuesday. The chart below shows increases

in deficit-financed federal spending going back to the 1930s and up

to last year’s bill, measured as a percentage of the economy.

Mark Zandi, chief economists at Moody's Analytics,

commented last week on the remarkable scale of federal

Covid-related spending, saying that if Biden’s proposal passes,

“the total amount of discretionary deficit-financed fiscal support

provided to the economy during the pandemic will come to well over

$5 trillion, equal to almost 25% of the nation’s pre-pandemic

GDP.”

As the chart below indicates, the U.S. response to the

pandemic would be the largest in the world, with only a handful of

countries spending more than 10% of GDP to address their Covid

health and economic crises. Zandi also notes that the total U.S.

fiscal response to Covid would dwarf the response to the Great

Recession, since the 2009 American Recovery and Reinvestment Act

“amounted to substantially less than 10% of the nation’s pre-crisis

GDP.”

Send your feedback to yrosenberg@thefiscaltimes.com.

Follow us on Twitter:

@yuvalrosenberg,

@mdrainey and

@TheFiscalTimes. And please tell your

friends they can

sign up here for their own copy of this

newsletter.

News

Biden Warms to Fast-Track Stimulus After Liberal Pressure

Mounts – Bloomberg

Jamie Dimon, Other CEOs Meet With President Biden at White

House as Relief Plan Advances – Washington

Post

Senate Votes Trump Impeachment Trial Constitutional; Six

Republicans Vote 'Yes' – The Hill

House Democrats' COVID-19 Relief Bill Includes 2-Year Boost

to Obamacare Subsidies – The Hill

J&J CEO Says People May Need Annual Covid Vaccine Shots

for the Next Several Years – CNBC

How a Sluggish Vaccination Program Could Delay a Return to

Normal and Invite Vaccine-Resistant Variants to Emerge –

Washington Post

Schumer Dodges on Whether Minimum Wage Increase Can Survive

Senate – Politico

US Hiring Plunged in December Even as Job Openings Ticked

Up – Associated Press

Low-Wage Workers Are Losing Jobs Even as Richer Workers Are

Gaining, New Research Shows – New York Times

‘Vampires Have More Heart Than Ted Cruz’: Tanden, Biden’s

Budget Nominee, Atones for Past Tweets –

Politico

About 60% of Nursing Home Staff Declined Covid Vaccines,

Walgreens Exec Says – CNBC

Lost in Antarctica, a Wallet Is Returned 53 Years Later

(Memories Included) – New York Times

Views and Analysis

Advancing Child Tax Credit Payments Makes Good Sense, But the

IRS Will Need Funds to Pull It Off – Elaine Maag and

Howard Gleckman, Tax Policy Center

The Radically Simple New Approach to Helping Families: Send

Parents Money – Claire Cain Miller and Neil Irwin, New

York Times

The Clash of Liberal Wonks That Could Shape the Economy,

Explained – Neil Irwin, New York Times

Three Questions to Ask About Biden’s and Romney’s Child

Allowance Proposals – Catherine Rampell, Washington

Post

The Problem With Using Tax Credits to Fight

Poverty – Matt Bruenig, New York Times

Cash Isn't Going to Solve All the Poor's Problems

– Noah Smith, Bloomberg

How Democrats Learned to Seize the Day – Paul

Krugman, New York Times

History Tells Us to Worry About Inflation –

Ferdinando Giugliano, Blomberg

In Economics, Hawk and Dove Distinctions Are for the

Birds – Daniel Moss, Bloomberg

New-Model Central Banks – Barry Eichengreen,

Project Syndicate

How to End Surprise Medical Bills – Bloomberg

Editorial Board

More Questions Than Answers for US Economy – Phil

Levy, The Hill

What If We Never Reach Herd Immunity? – Sarah

Zhang, The Atlantic