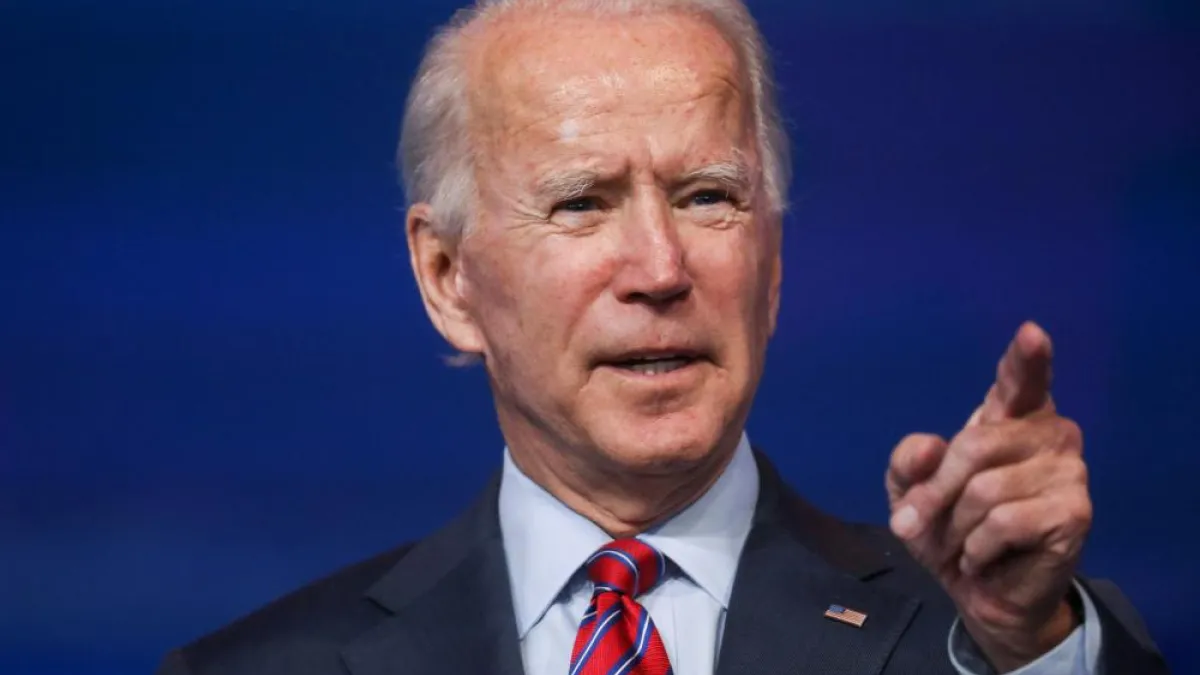

Biden Rolls Back Trump's Medicaid Work Requirements

The Biden administration on Friday afternoon revoked permission

for states to impose work requirements on Medicaid beneficiaries.

The move comes two weeks after President Joe Biden ordered federal

officials to review policies that make it more difficult for

Americans to access federal health care programs.

The Centers for Medicare and Medicaid Services announced that it

is rescinding a rule change made by the Trump administration in

2018 that allowed states to apply to develop programs that would

force Medicaid recipients to work at least 20 hours per week,

provide community service, or attend school or training in pursuit

of a job.

A long-running struggle over benefits: Supporters of

Medicaid work requirements say they are intended to conserve public

funds and to help low-income beneficiaries get back into the

workforce, with the goal of leaving the program as quickly as

possible. Critics say the requirements violate both the letter and

spirit of the law that established Medicaid, and serve to unfairly

restrict access to publicly funded health care for the poor.

At least 12 states received permission from the Trump

administration to impose work requirements, though efforts in

Arkansas, Kentucky and New Hampshire were halted following legal

challenges, and other states have waited to see how those legal

issues play out before rolling out their own programs.

The Supreme Court is expected to hear a case next month

related to the legality of the work requirements in Arkansas and

New Hampshire, but the Biden administration’s reversal could render

that case moot.

Growth Looking Up in 2021, Economists Say

Forecasters are raising their projections for economic growth

this year, based in large part on hopes for the passage of a

substantial stimulus package and the rollout of vaccines around the

country.

Economists in a Wall Street Journal survey

bumped up their estimate for annual growth to 4.9% for 2021, up

from the 4.3% projection registered a month ago.

The labor market, however, is looking a bit less robust. While

the economists in the survey project the creation of 4.8 million

jobs this year, that estimate is down from the previous estimate of

5.0 million, and equal to only half of the jobs that have been lost

due to the pandemic.

The unemployment rate is projected to be 5.3% by the end of the

year, falling from the current 6.3%.

How much fiscal aid is needed? Asked

about how much the U.S. economy needs in fiscal stimulus, a

majority of the 62 economists surveyed said the figure was less

than $1 trillion. One respondent said the economy needed more than

$2 trillion, while the rest put the number between $1 trillion and

$2 trillion.

Is the IRS Up to the Challenge of Biden’s Rescue Plan?

President Joe Biden’s coronavirus rescue plan calls for the

Internal Revenue Service to send out another round of relief

payments and would also make the agency responsible for

distributing $109 billion in child benefit payments this year. The

Washington Post’s Jacob Bogage reports that the additional tasks

that may get piled on top of the IRS’s core tax collection mission

threaten to further stretch an arm of government that’s already

been struggling:

“The reliance on the IRS comes at a time when the agency is

already underfunded and scrambling in pandemic working

conditions.

It continues to grapple with a significant backlog from the

2019 tax-filing season, plus snags in earlier rounds of stimulus

payments. Personnel shortages caused by the pandemic have also

caused a major slowdown in agency operations, forcing officials to

platoon staff at IRS campuses to open mail and process a backlog of

paper returns.”

The IRS says it is up to the new jobs it’s being asked to do,

but Erin Collins, the national taxpayer advocate, tells the Post

that she’s concerned that the agency may not have the tools

required already in place.

“It is morphing the IRS into this dual mission of both tax

administration and administering of social programs. The challenge

is the IRS was not set up for that purpose and their IT is not

structured for that,” she says. “I think it’s wonderful the things

that Congress are looking to do going forward, especially with

child care. But I am concerned that the IRS systems were not

created to do monthly checks. I think if you ask the IRS, they say,

‘We will get it done.’ And they will get it done. But my concern

is, at what cost?”

Read the full piece at The Washington

Post.

Article of the Week: The Fed’s Monumental Change on How It

Views Stimulus and Inflation

The hot

economic debate of the moment is over the size of

President Joe Biden’s pandemic relief plan and fears,

raised by economists Larry Summers and Olivier

Blanchard, that it might be so large as to cause the economy to

overheat and result in surging inflation.

Over at New York magazine’s

Intelligencer, Eric Levitz puts that debate into

some important historical context. In doing so, he also lays out

the significance of recent policy shifts by the Federal Reserve and

of Fed Chair Jerome Powell’s speech this week in which he said that

the real unemployment rate is significantly higher than the

official 6.3% and is probably

closer to 10% once the millions of people who have

been driven out of the labor market by the pandemic, as well

as those who have been misclassified as being employed by the

Bureau of Labor Statistics, are factored into the

calculation. “Despite the surprising speed of recovery early on, we

are still very far from a strong labor market whose benefits are

broadly shared,” Powell

said, adding that fully repairing the job market

“will take continued support from both near-term policy and

longer-run investments.”

Powell was effectively intervening in the ongoing economic

debate on Biden’s behalf, Levitz writes, explaining that the Fed

chief’s comments represent a monumental change:

“In the late 1970s, stubbornly high inflation taught the

central bank that the conflict between its dual objectives — to

promote full employment and price stability — was fiercer

than it had previously thought. Specifically, the Fed decided that

it would need to preemptively cool the economy when

unemployment got too low, so as to snuff out inflationary spirals

before they took hold. This was because tight labor markets allowed

workers to hold their employers hostage to unreasonable wage

demands; with no reserve army of the unemployed to draw new hires

from, bosses were forced to placate existing staff. Thus, employers

ended up overpaying their workers and then trying to compensate by

overcharging consumers. ... Therefore, central banks had to

proactively preserve slack in the labor market — both by slowing

economic growth through interest-rate hikes when unemployment got

too low, and by encouraging Congress to rein in deficit spending

lest it spur excessive demand for labor.

“Under Jerome Powell, the central bank has brought American

monetary policy into belated alignment with federal law and

empirical economics. Instead of attempting to

preempt high inflation by sustaining a cushion of unemployment,

Powell has waited for inflation to actually show itself before

deliberately cooling the economy, a posture he has justified by

emphasizing the myriad economic and social benefits of maximizing

employment.”

Powell’s speech signaled support for further fiscal stimulus and

a belief that the economy can bear lower levels of unemployment

without a worrisome rise in inflation. “Perhaps most

significantly,” Levitz says, “Powell broke

with past Fed chairman Ben Bernanke by arguing that

fiscal and monetary stimulus doesn’t just accelerate an economy’s

return to full productive capacity, but rather, that stimulus can

actually grow the economy’s long-term growth potential.”

The bottom line: Powell has been making an emphatic case

for more fiscal support for the economy and job market, and that

argument represents a dramatic shift with potentially significant

implications for the politics of federal spending. Unsurprisingly,

the Biden White House is embracing the Fed chair’s view. “Based on

the reporting I've done,” The Washington Post’s Jeff Stein

tweeted this week, “I think it's safe to say Jerome

Powell's comments hold vastly more sway over the White House

economic team than Larry Summer's [SIC].”

Read the full piece at New York.

Have a good three-day weekend! We'll

be back in your inbox on Tuesday. Send your feedback to

yrosenberg@thefiscaltimes.com.

Follow us on Twitter:

@yuvalrosenberg,

@mdrainey and

@TheFiscalTimes. And please tell your

friends they can

sign up here for their own copy of this

newsletter.

News

Trump’s Team Concludes Incendiary Defense, Seeking to Rewrite

the Narrative of His Actions on Jan. 6. – New York

Times

Biden: Governors and Mayors Need $350 Billion to Fight

COVID – Associated Press

Summers and Krugman Debate Stimulus. Here’s a Blow-by-Blow

Account – Bloomberg Businessweek

Study: $1,400 Stimulus Checks Would Help 22.6 Million Pay

Bills Through Mid-July – The Hill

CDC: Strong Evidence in-Person Schooling Can Be Done

Safely – Associated Press

White House Tiptoes Around Governors Relaxing Coronavirus

Rules – Politico

Power-Sharing Rules Spark Big Senate Appropriations

Realignment – Roll Call

U.S. Eyes Flurry of New Taxes on Amazon, Facebook and Google,

Trying to Force Tech to Pay Its ‘Fair Share’ –

Washington Post

Drug Companies Seek Billion-Dollar Tax Deductions From Opioid

Settlement – Washington Post

Moderna in Talks With FDA to Increase Vaccine Doses Per

Vial – Politico

Sign of Inequality: US Salaries Recover Even as Jobs

Haven’t – Associated Press

As Drug Prices Keep Rising, State Lawmakers Propose Tough New

Bills to Curb Them – Kaiser Health News

New Allegations of Cover-Up by Cuomo Over Nursing Home Virus

Toll – New York Times

Maryland Approves Country’s First Tax on Big Tech’s Ad

Revenue – New York Times

The Chamber of Commerce Embraces Biden. And Republicans Are

Livid – Politico

Views and Analysis

Analysis: How Much Will the $1,400 Stimulus Check Help

Financially Vulnerable Americans? – John Leer, Morning

Consult

Bring on Infrastructure Week! – Paul Waldman,

Washington Post

Biden Is the Big Spender America Wants – Paul

Krugman, New York Times

Voices Skeptical of the Size of $1.9 Trillion COVID Relief

Plan – Committee for a Responsible Federal

Budget

The Senate Is Making a Mockery of Itself – Ezra

Klein, New York Times

How We Can Responsibly Address Coronavirus Relief While

Helping to Create a Better Tomorrow – David M. Walker,

The Hill

Why the US Needs a Wealth Tax – Emily DiVito,

Roosevelt Institute

Why a Wealth Tax Is Constitutional – Ari Glogower

et al, Roosevelt Institute

Many Jobless Workers Aren’t Getting Help – New

York Times Editorial Board

What to Tell the Critics of a $15 Minimum Wage –

Gus Wezerek, New York Times