Democrats Dismiss Republican Infrastructure

Offer, Before It’s Even Introduced

Republicans are still working on their scaled-back

counterproposal to President Joe Biden’s $2.3 trillion

infrastructure plan, but Democrats say they’ve already heard enough

to know the GOP offer is a non-starter.

The GOP plan, being spearheaded by Sen. Shelley Moore Capito

(R-WV), the ranking Republican on the Environment and Public Works

Committee, is likely to total $550 billion to $880 billion, with

the costs paid for with user fees and unspent Covid relief

funds.

Capito told reporters Tuesday that she hoped to have a

“conceptual” infrastructure proposal by the end of the week and

that the Republican offer would present a contrast to Biden’s

sweeping blueprint. Republicans have criticized the scope of

Biden’s plan and the corporate tax increases the president has

proposed. The GOP offer is expected to focus on roads, bridges,

ports and airports, as well as water infrastructure, broadband

access and updating the electric grid. Senate Minority Leader Mitch

McConnell said Tuesday that Republicans were “open to a more modest

and targeted” package. Sen. Roger Wicker (R-MS)

said he thought the GOP’s initial offer "might be

somewhere south of $600 billion.”

That’s enough for Democrats to say the GOP plan will fall far

short. “Six hundred billion dollars is not what the country needs —

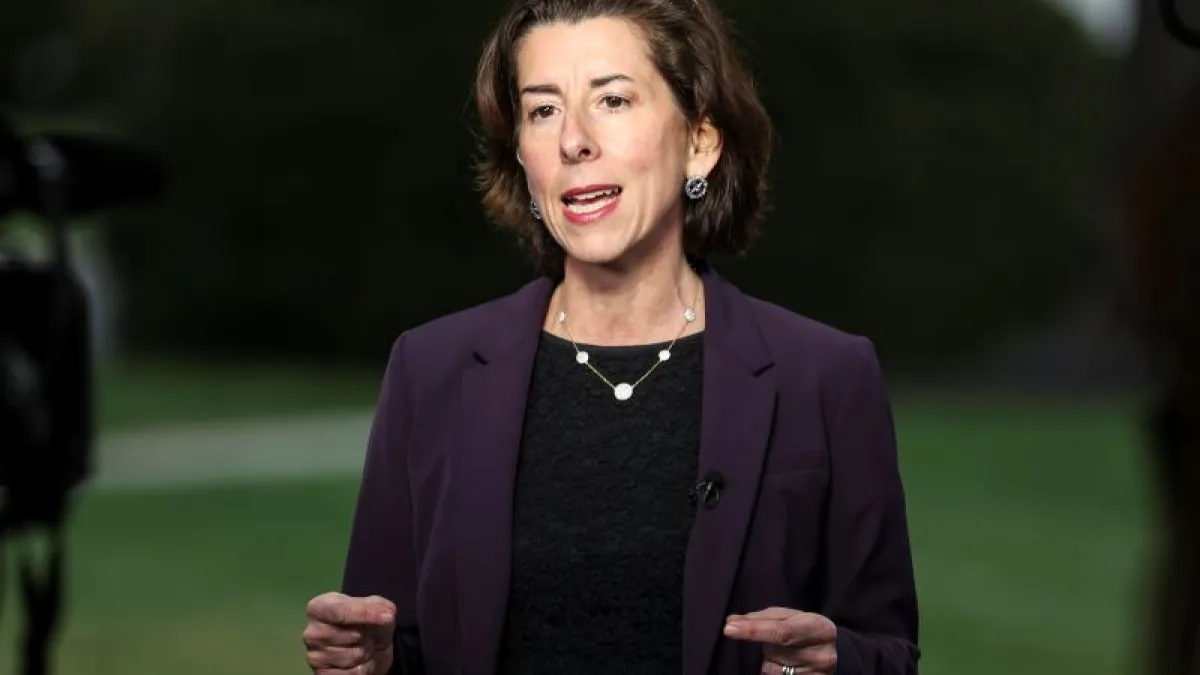

the country needs $2 trillion,” Commerce Secretary Gina Raimondo

told

Politico. “It’s not nearly enough.”

Politico’s Burgess Everett and Marianne LeVine

report that Senate Democrats are also dismissing

the nascent GOP plan, suggesting that it’s too small to be useful

as the basis for bipartisan talks:

“Sen. Richard Blumenthal (D-Conn.) called the proposal

‘totally anemic’ and an ‘insult’ to Biden’s offer. Sen. Elizabeth

Warren (D-Mass.) summarized Democrats’ feelings by observing that

‘the Republican proposal does not meet the moment.’

“’A far cry from $2.5 trillion,” added Sen. Mazie Hirono

(D-Hawaii). ‘Until the Republicans realize the needs are far, far

greater from what they’re proposing, I don’t know that we’re going

to get much further. I hope so … but we’re not going to wait

forever.’”

The bottom line: The dynamics of the infrastructure talks

may be reminiscent of those on President Biden’s $1.9 trillion

Covid relief package. In that case, Republicans’ initial offer,

also less than a third the size of Biden’s proposal, was promptly

rejected and Democrats moved quickly to pass the legislation on

their own. But there may be more interest in reaching a bipartisan

deal on at least part of the infrastructure plan, and less pressure

to act quickly.

There’s still a long, bumpy road ahead before lawmakers settle

on an infrastructure plan.

Meanwhile, lawmakers are wasting no time lobbying to receive

federal infrastructure money for their districts. Democrats are

already highlighting specific projects to the Biden administration,

from bridges in Minnesota to rail tunnels in New Jersey, and GOP

lawmakers are getting in on the action, too. “Even Republicans who

have been disinclined to support Biden’s economic agenda have

pushed their pet projects at a moment when Democrats are vying to

spend big,” The Washington Post’s Tony Room

reports.

Number of the Day: 200 Million

President Joe Biden said Wednesday that by the end of the day,

the U.S. will have achieved his stated goal of administering 200

million Covid-19 vaccine doses within the first 100 days of his

administration. “Today, we did it, today we hit 200 million shots

in the 92nd day in office,” Biden said at the White House.

Biden also highlighted new tax credits for small businesses

intended to defray the costs of getting employees vaccinated. The

credits, which were part of the $1.9 trillion Covid relief bill

signed into law in March, will be in effect between April 1 and

September 30 and reimburse companies up to $500 per day per

employee getting vaccinated.

“I'm calling on every employer, large and small, in every state,

to give employees the time off they need, with pay, to get

vaccinated,” Biden said. “Any time they need with pay to recover,

if they're feeling under the weather after the shot. No working

American should lose a single dollar from their paycheck because

they chose to fulfill their patriotic duty of getting

vaccinated.”

Another Battle Brewing Over Lowering

Prescription Drug Prices

The White House is expected to include proposals to lower

prescription drug prices as part of President Biden’s next big

spending plan, focused on caregiving and what the White House calls

“human infrastructure.” In anticipation, House Republicans and

Democrats are going on the offensive, reintroducing their own

drug-pricing plans.

That GOP legislation “contains dozens of provisions with

bipartisan support aimed at lowering the price of prescription

pharmaceuticals,” The Washington Post’s Paige Winfield Cunningham

reported Wednesday. “Most of the provisions are relatively minor,

involving things such as expanding transparency or tweaking

incentives, but the bill would cap what seniors pay out of pocket

for Medicare drugs for the first time ever.”

Democrats, meanwhile, are expected to reintroduce sections of

their own legislation to lower drug prices, known as H.R. 3, as

early as Thursday, The Hill

reports.

The fight ahead: Biden’s plan and the Democratic bill are

expected to call for allowing the Department of Health and Human

Services (HHS) to negotiate prices for drugs in the Medicare

program, a key element of the Democratic health care agenda.

Republicans don’t want to go that far, objecting to what they call

“government price control.” They also argue

that a Democratic health reform passed by the House in late 2019

would have hobbled drug companies’ efforts to develop Covid-19

vaccines and treatments.

“That argument seems dubious,” Winfield Cunningham writes,

“considering the federal government has paid pharmaceutical

companies billions of dollars for developing, manufacturing and

distributing six different coronavirus vaccines.” But a

Congressional Budget Office analysis did estimate that the 2019

Democratic reforms would have led to lower revenue for drugmakers

and lower investment in research and development. As a result, CBO

estimated, eight fewer drugs would be brought to market from 2020

through 2029 and about 30 fewer drugs would be released over the

following decade.

The bottom line: The drug-pricing debate to come is

likely to sound a lot like the one we had in 2019, and the result

could be much the same, too. “Expect to hear Republicans talk about

their bill a lot, but it won't go anywhere,” Winfield Cunningham

writes, adding that it’s far from clear that Democrats will be able

to pass some portions of their legislation. “Even if they use

budget reconciliation, requiring just 50 votes in the Senate,

they're operating on extremely narrow margins. And while allowing

direct negotiations with HHS is likely to pass muster within budget

reconciliation rules, other parts of the bill, including the

international pricing index, might not.”

Read the full story at The Washington Post.

Progressive Lawmakers Introduce Plan for Free

College for Most Families

A group of progressive lawmakers led by Sen. Bernie Sanders

(I-VT) and Rep. Pramila Jayapal (D-WA) released a plan Wednesday to

make college free for most American families, paid for by new taxes

on investors.

The legislation, called the

College for All Act, would eliminate tuition at

community colleges and allow students from households earning less

than $125,000 per year to attend public universities at no cost. It

would also double the Pell Grant maximum to nearly $13,000, up from

the current $6,495, and increase funding for historically Black

colleges and universities, among other things.

The costs of the proposal are to be covered by new taxes on Wall

Street trading. A separate bill released Wednesday, called the Tax

on Wall Street Speculation Act, calls for a tax of 0.5% on stock

trades, a 0.1% tax on bond trades, and a 0.005% tax on derivative

trades. The taxes could raise as much as $2.4 trillion over 10

years, the bill’s backers

say, while also reducing excessive trading.

Critics argue the tax proposal offers something of a contradiction,

since if it reduces trading activity, it will also reduce the

revenues it generates.

Sanders and Jayapal have introduced similar measures before,

Roll Call

notes, but this is the first time Democrats have

controlled the Senate when they’ve done so. President Biden has

endorsed some parts of the proposal in the past, but not the whole

package.

Foxconn’s $10 Billion Wisconsin Project Gets

Scaled Way Back

In 2017, Foxconn, a massive electronics manufacturer based in

Taiwan, committed to spending $10 billion to build an LCD

manufacturing plant in Wisconsin. Fueled by roughly $3 billion in

state tax credits and millions more in state-funded site

improvements, the facility was to generate as many as 13,000 jobs,

turning tiny Mount Pleasant, Wisconsin, into a global high-tech

hub.

At the groundbreaking ceremony in 2018, then-President Donald

Trump and then-Gov. Scott Walker, both Republicans, sang the

praises of Foxconn CEO Terry Gou, with Trump calling him “one of

the great men of the world, one of the great business leaders of

the world,” while referring to the still theoretical plant as “the

eighth wonder of the world.”

“America is open for business more than it has ever been,” Trump

said, neatly patting himself on the back for a job well done.

This week, current Wisconsin Gov. Tony Evers, a Democrat,

announced that the state was drastically reducing the scope of the

deal — confirming critics’ fears that the agreement was something

less than realistic. In the latest iteration, Foxconn has agreed to

spend $672 million to build a factory that will employ 1,454

people. The incentive package has been reduced more than

thirty-fold, with the state offering about $80 million in tax

breaks.

“I made a promise to work with Foxconn to cut a better deal for

our state,” Evers said. “The last deal didn’t work for

Wisconsin.”

The bottom line: From the start, critics of the Foxconn

deal accused the company of promising far more than it could

deliver and charged Walker with putting too much public money into

a sketchy deal. The renegotiation of the agreement will save

Wisconsin residents money, though there’s no way to get back the

hundreds of millions of dollars already spent by state and local

agencies to prepare the site, or to recover the dozens of buildings

torn down, some seized through eminent domain.

“The cleared, prepped site is bigger than Central Park, with

nearly 100 homes and small farms bulldozed to make way for

Foxconn,” The Wall Street Journal

reported. “For now, the site houses a few shell

buildings and a nearly complete glass-and-steel dome that can be

seen from nearby Interstate 94.”

Send your feedback to yrosenberg@thefiscaltimes.com.

Follow us on Twitter:

@yuvalrosenberg,

@mdrainey and

@TheFiscalTimes. And please tell your

friends they can

sign up here for their own copy of this

newsletter.

News

Biden Calls for Businesses to Give Paid Time Off for

Employees to Get Vaccinated as He Touts 200 Million

Shots – CNN

Senate GOP Conference Upholds Earmarks ‘Ban’ –

Roll Call

GOP Senator Says Republicans Will Have Infrastructure

Counteroffer by the End of Week – CBS News

Lawmakers Lobby to Bring Home Big Bucks as Congress Wrangles

Over $2 Trillion Infrastructure Plan – Washington

Post

Janet Yellen Says Spending by Companies Will Be Key to the

U.S. Reaching Climate Goals – New York Times

Shuttered Venues Still Waiting for Government Aid Announced

in December – NPR

Humana Health Plan Overcharged Medicare by Nearly $200

Million, Federal Audit Finds – Kaiser Health

News

Amtrak’s Proposed $80 Billion Windfall: Too Much or Too

Little? – Roll Call

F-35 Overrun Sticks U.S. Taxpayers, Allies With $444 Million

Tab – Bloomberg

Nation Faces ‘Hand-to-Hand Combat’ to Get Reluctant Americans

Vaccinated – New York Times

Biden Is Pushing a Climate Agenda. Gina McCarthy Has to Make

It Stick – New York Times

Biden's Next Stimulus Bill Could Bring Even More Money:

What's in It for You? – CNet

Views and Analysis

How to Raise Trillions Without Hiking Taxes on Working

Americans – Sen. Bernie Sanders (I-VT), CNN

Why Do Some Democrats Want to Give the Wealthy a Tax

Break? – Karl W. Smith, Bloomberg

Walter Mondale Wasn’t Scared of Raising Taxes. Is

Biden? – Timothy Noah, New Republic

The Government Doesn’t Seem to Have a Solution to the

Vaccine’s New Last-Mile Problem – Philip Bump,

Washington Post

The Job Market Is Tighter Than You Think –

Greg Ip, Wall Street Journal

Long-Term Care Needs a Long-Term Solution –

Washington Post Editorial Board

$12.3 Trillion in Stimulus Killed the Debt Default

Cycle – Lisa Abramowicz, Bloomberg

The Tax Code Helps White People Get Richer – Emily

Stewart, Vox

Another Soda Tax Bill Dies. Another Win for Big

Soda – Samantha Young, Kaiser Health News