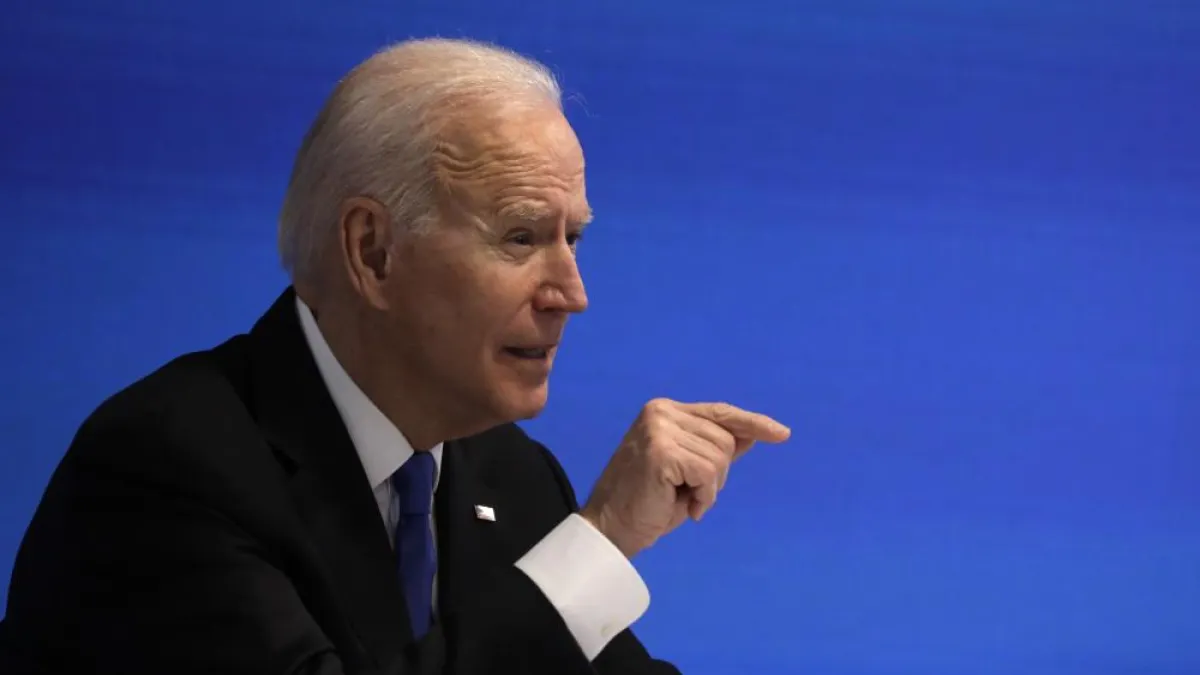

Biden Eyes a Big Tax Hike on Rich

Investors

President Joe Biden will propose raising the capital gains tax

rate to 39.6% for those earning more than $1 million a year,

Bloomberg reported Thursday. That would roughly

double the current capital gains tax rate of 20% for those

high-income households and, when combined with the current 3.8%

surtax on investment income that helps fund Obamacare, produce a

top rate of 43.4%.

The proposal is expected to be released next week, when the

White House unveils its “American Families Plan” to increase

spending on things like education, child care and paid leave, at an

estimated cost of roughly $1.5 trillion. The capital gains tax

increase is projected to raise $370 billion over 10 years,

according to an

analysis by the Tax Policy Center, with the

revenues intended to help cover the costs of Biden’s proposed

investments in what administration officials are calling “human

infrastructure.”

If enacted, the tax increase would mark a significant change in

how investment gains are treated in the tax code relative to labor.

Biden has pledged to equalize tax rates on the two, which for many

years have been unequal, with investment gains being taxed at a

lower rate than labor income. During the campaign, Biden argued

that it was unfair that wealthy investors paid lower tax rates on

the sale of stocks and bonds than workers did on their more modest

incomes derived from their jobs.

Investors react: The news sent shockwaves through Wall

Street, with stocks falling sharply. Andrew Mies, chief investment

officer of 6Meridian, told the

Associated Press that investors were reacting to a

new unknown factor. “The knowns are the economy is good and

improving, earnings are good and vaccinations are going pretty well

in the United States,” Mies said. “The things the market doesn’t

know are tax policy, both at the corporate and individual level,

and what the Fed is going to do in the next 12 to 18 months.”

Jack Ablin of Cresset Capital Management said the selling could

continue, depending on how things play out. “Biden’s proposal

effectively doubles the capital gains tax rate on $1mm income

earners,” he said, according to

CNBC. “That’s a sizable cost increase to long-term

investors. Expect selling this year if investors sense the proposal

has a chance of becoming law next year.”

Some investors expressed doubts about the likelihood of passing

the tax increase, at least at the level being discussed today. “I

think these are also trial balloons and sort of laying the stake

out for future negotiations,” Doug Sandler of RiverFront Investment

Group told CNBC. “If I want to get something done, the first thing

I’m going to do is come with a really extreme request and then I’m

going to negotiate back from that. That’s just the way politics

work. I’m not going to guess we’re going to double the capital

gains tax because that narrow majority in Congress, that seems too

controversial to get passed, but it starts the framework that taxes

are going higher.”

Biden eyeing other tax increases on the rich:

Administration officials continue to debate other possible tax

increases that could be used to pay for Biden’s forthcoming

American Families Plan, according to

The New York Times. Biden is reportedly planning to call

for raising the top individual income tax rate from 37% to 39.6%,

and officials are reportedly considering capping deductions for

rich taxpayers or raising the estate tax.

Other elements of the plan have changed recently, the

Times’s Jim Tankersley reports: “Administration officials had

planned to include a health care expansion of up to $700 billion,

offset by efforts to reduce government spending on prescription

drugs. But they have decided to instead pursue health care as a

separate initiative, a move that sidesteps a fight among liberals

on Capitol Hill but that risks upsetting some progressive groups

that have pushed Mr. Biden to prioritize health issues.”

Republicans Counter Biden With a $568 Billion Infrastructure

Outline

Republican Senators outlined a $568 billion counteroffer to

President Joe Biden’s infrastructure plan on Thursday, proposing to

narrow the scope of any bipartisan package and spend roughly a

quarter of the nearly $2.3 trillion that the president and

Democrats say is needed.

The total for the five-year GOP framework comes in below the

$600 billion to $800 billion range that Sen. Shelley Moore Capito

(R-WV), who is spearheading the Republican planning, had floated

last week, but Capito emphasized that it the proposal is the

largest infrastructure investment her party has ever proposed.

"This is a robust package,” she told reporters, adding that it is

meant to serve as a starting point for bipartisan talks.

The White House said Thursday that it also sees the GOP offer as

a basis for negotiations. "We certainly welcome any good faith

effort and certainly see this as that, but there are a lot of

details to discuss and a lot of exchanges of ideas to happen over

the coming days," White House Press Secretary Jen Psaki said. But

some Democratic lawmakers have already criticized the GOP plan as

too small, and many have suggested it is a non-starter.

What’s in the GOP outline: Republicans have objected to

Biden’s expansive definition of infrastructure, arguing that it

goes far beyond traditional programs by calling for large

investments to speed the transition to electric vehicles and

improve caregiving for the elderly and disabled.

The two-page framework released Thursday seeks to define

infrastructure along narrower, more traditional lines. “It’s

important that any infrastructure legislation have adequate funding

levels and not be so large as to fail to launch, which means

sticking to actual infrastructure. That’s why our framework works.

It serves as a realistic, thoughtful approach that addresses the

core areas of infrastructure that we all agree upon,” Capito

said in a statement.

Other Republicans behind the plan include Roger Wicker (MS), Pat

Toomey (PA), Mike Crapo (ID) and John Barrasso (WY). Their

framework includes:

• $299 billion for roads and bridges;

• $61 billion for public transit systems;

• $61 billion for ports, inland waterways and

airports;

• $20 billion for railroads, including Amtrak;

• $65 billion to expand broadband

infrastructure;

• $49 billion for drinking water and wastewater

infrastructure and water storage;

• $13 billion for highway safety and other safety

programs.

Big differences with Biden: As a reminder, Biden’s

plan calls for $621 billion in funding for

transportation infrastructure, including $174 billion for electric

vehicles and $115 billion for road and bridge repair. So that

section of Biden’s proposal alone would provide $53 billion more

than the entire GOP plan, but the Republican plan would direct more

than twice as much funding toward roads and bridges.

Biden’s plan also calls for spending hundreds of billions more

on water projects, broadband and the electric grid — and he wants

to provide $400 billion the help care for the elderly and disabled

as well as hundreds of billions more for research and development,

manufacturing investments and retrofitting homes and commercial

buildings. You can see a comprehensive breakdown

here.

What’s not in the GOP outline: The document released

Thursday is vague on a key and contentious element of any

infrastructure proposal — how to pay for it.

Republicans have rejected Biden’s call for higher corporate

taxes and their framework does so again, saying that the 2017 Tax

Cuts and Jobs Act, which lowered the corporate tax rate from 35% to

21%, should be preserved and that Republicans are against “any

corporate or international tax increases.” The document also calls

for keeping the cap on the deductibility of state and local taxes,

which some Democrats have sought to repeal.

But the GOP framework does not include specifics on pay-fors,

relying instead on broad statements of principle — federal

infrastructure funding “should be fiscally responsible and based on

needs," should partner with state and local governments as well as

the private sector, and should "flow through existing formula

programs and proven discretionary programs."

Republicans have suggested covering the costs of an

infrastructure plan through fees imposed on those who use the

infrastructure and by repurposing unused federal spending. “We want

it to be paid for. We're not interested in raising taxes. We think

that people that use our infrastructure are a lot of the solution.

There's a lot of private money out there,” Capito said

Wednesday.

Jobless Claims Hit Another Pandemic Low

In another good sign for the recovery, new jobless claims

fell to the lowest level since March 2020, when the pandemic first

began to shut down the U.S. economy.

About 547,000 people filed for unemployment benefits at

the state level last week, the Labor Department announced Thursday,

with another 133,000 applying for aid through the temporary

Pandemic Unemployment Assistance program, bringing the total for

the week to 680,000.

Progress continues: “For now, the

economy is showing steady signs of recovering,”

says Christopher Rugaber of the Associated Press.

“Sales at retail stores and restaurants soared 10% in March — the

biggest increase since last May. Federal stimulus checks of $1,400

have been sent to most adults. And Americans who have kept their

jobs have accumulated additional savings, part of which they will

likely spend now that states and cities have loosened business

restrictions and the virus wanes.”

Ian Shepherdson of Pantheon Macroeconomics says

that the drop in claims “confirms that last week’s unexpected

plunge was no fluke,” adding that he expects to see “further

declines over the next few months as the reopening continues, while

payroll growth will accelerate markedly.”

But the numbers are still huge: About

8 million people are still out of work due to the pandemic, and

17.4 million people are receiving some kind of unemployment

assistance. “Claims are extremely high” by historical standards,

says

Heidi Shierholz of the Economic Policy Institute, and still coming

in at about three times the level seen before the

pandemic.

Send your feedback to yrosenberg@thefiscaltimes.com.

Follow us on Twitter:

@yuvalrosenberg,

@mdrainey and

@TheFiscalTimes. And please tell your

friends they can

sign up here for their own copy of this

newsletter.

News

Biden Will Seek Tax Increase on Rich to Fund Child Care and

Education – New York Times

Biden Unveils Sweeping Climate Goal — and Plans to Meet It

Even if Congress Won't – Politico

Senate GOP Preserves Earmark Ban, Adds Strict Debt Ceiling

Posture – Politico

Under Biden, Senate Republicans Shun Earmarks and Return to

Fiscal Conservatism – New York Times

Republicans’ Opening Bid on Infrastructure Is About a Quarter

of the Size of Biden’s Plan – Vox

'Far Too Small': Democrats Pile on GOP Infrastructure

Plan – Politico

Senators Push to Secure U.S. Drug Supply Chain After

Disruptions During COVID-19 Pandemic – CNBC

D.C. Statehood Bill Passes House, Setting Up Historic

Showdown in Senate – Washington Post

Investigation Suppressed by Trump Administration Reveals

Obstacles to Hurricane Aid for Puerto Rico – Washington

Post

Bidenworld Fears Many Vaccine Skeptics May Be Unreachable.

They're Trying Anyway – Politico

States Have a New Covid Problem: Too Much Vaccine

– Politico

Health Officials Lean Toward Resuming Johnson & Johnson

Coronavirus Vaccine — but With a Warning – Washington

Post

Views and Analysis

Welcome to Joe Biden’s Boom Economy – Alan

Blinder, Wall Street Journal

Tax Hikes Will Stifle the Recovery – Sen. Rob

Portman (R-OH), Wall Street Journal

The Debt Limit Is Back (Kind Of) – Ben White and

Aubree Eliza Weaver, Politico

Get Ready for Another Dumb Debt Limit Fight –

Jonathan Bernstein, Bloomberg

Repealing the SALT Cap Would Be More Regressive Than the

TCJA – Committee for a Responsible Federal

Budget

Weatherizing Homes Could Be One of the Most Vital Legacies of

Biden’s Infrastructure Plan – Joseph W. Kane and Tara

Pelton, Brookings Institution

End Welfare as We Know It — for the Upper Middle

Class – Richard V. Reeves and Christopher Pulliam,

Washington Post

Biden Wants to Slash Emissions. Success Would Mean a Very

Different America – Brad Plumer, New York Times

Shortchanged: Weak Anti-Retaliation Provisions in the

National Labor Relations Act Cost Workers Billions –

Lynn Rhinehart and Celine McNicholas, Economic Policy

Institute

Rising Incomes Render Republican Strategy Obsolete

– Michael R. Strain, Bloomberg

We’re Asking Rich Countries to Keep Their Vaccine

Promises – Tedros Adhanom Ghebreyesus, New York

Times

Here Is How the Filibuster Dies – Jennifer Rubin,

Washington Post

Biden Went Big in His First 100 Days, and Now Comes the Hard

Part – Josh Wingrove and Nancy Cook, Bloomberg

Businessweek