Hey, it’s almost Friday! With August

days rapidly slipping away, talks are reportedly underway in the

Senate about speeding to a final vote on the bipartisan

infrastructure bill as soon as tonight or Saturday. That would

allow senators to the turn to Democrats’ $3.5 trillion budget

resolution more quickly — and thereby avoid losing more of their

August recess. The move would require the agreement of all

senators, though, and some Republicans are reportedly still

asking for amendments, so we’ll see. In the

meantime, here’s what else you need to know while wondering where

soccer great

Lionel Messi will end up.

Senate Infrastructure Bill Will Add $256 Billion to Deficits:

CBO

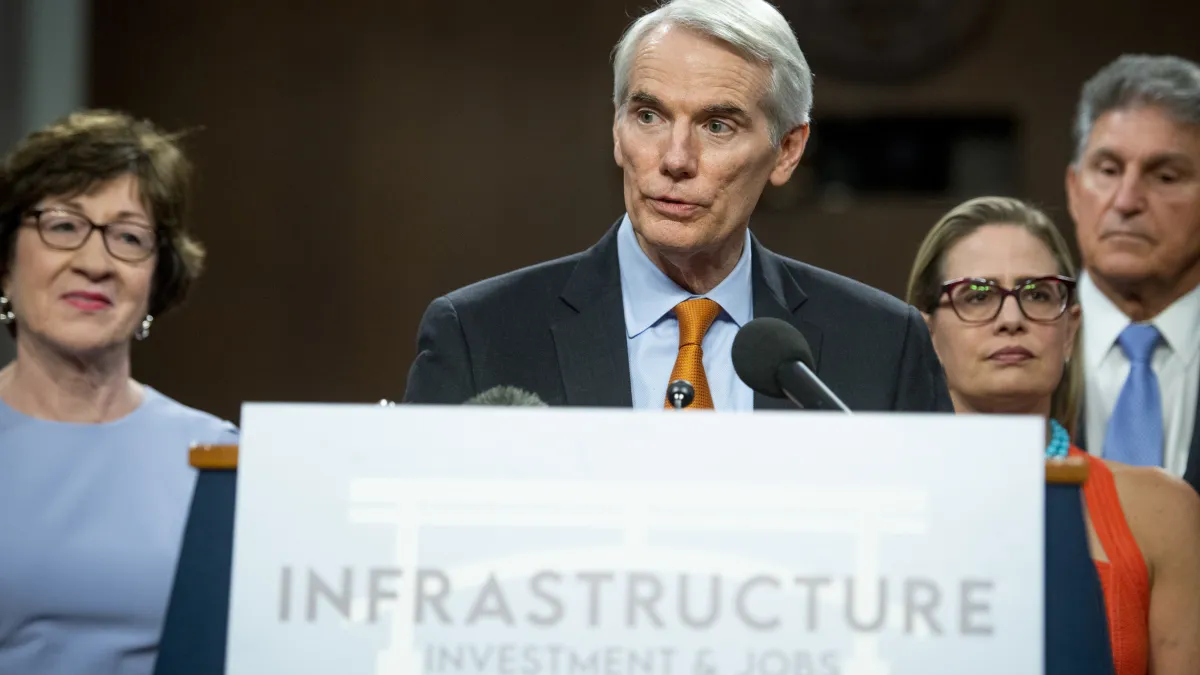

The bipartisan infrastructure bill currently under debate in the

Senate would add $256 billion to deficits over 10 years, the

Congressional Budget Office said Thursday. Negotiators had claimed

that the $550 billion spending package would be fully offset, but

it's been clear that their financing proposals wouldn't cover all

the costs in the official score.

Since the result was largely anticipated, the CBO report

may not swing many votes — or at least not enough to affect passage

of the bill. One of the main Republican negotiators of the bill,

Sen. Rob Portman of Ohio, has reportedly been persuaded that the

infrastructure package would not add as much to the deficit as the

CBO was expected to report, and other Republican negotiators are

expected to follow his lead.

“The new spending under the bill is offset through a combination

of new revenue and savings, some of which is reflected in the

formal CBO score and some of which is reflected in other savings

and additional revenue identified in estimates, as CBO is limited

in what it can include in its formal score,” Portman said in a

joint statement released with fellow negotiator Sen. Kyrsten Sinema

(D-AZ).

Still, budget watchers are bound to be disappointed after

calling for any new spending to be paid for in full. “It’s easy to

get so wrapped up in it and so wrapped up with the things that you

see in the bill that are good … sometimes when you get so wrapped

up in that, it’s easy to lose sight of the fact that the pay-fors

are fake,” said Sen. Mike Lee (R-UT).

What comes next: A vote on the bill is expected in the

next few days. Sen. John Cornyn (R-TX), who said he will oppose the

bill, predicted it will advance. “I think the infrastructure bill

will pass,” he said, adding, “It’s got enough support.”

Oh, by the way: Democrats’ budget

resolution will likely also assume that the reconciliation package

will add “somewhere in the ballpark of $500 billion to $1 trillion”

more to deficits over the next 10 years, Roll Call

reports. Democrats have said that the full $3.5

trillion cost of their plan will be offset, and some in the party

have raised concerns about adding to the deficit.

Senate Careens Toward High-Stakes Game of Chicken on Debt

Limit

This right here is exactly what the facepalm emoji was made for:

It’s looking ever more likely that Republicans and Democrats are

headed for a September showdown over raising the debt ceiling.

A two-year suspension of the borrowing limit expired at the end

of July and the Treasury Department has started employing

“extraordinary measures” to enable the government to keep paying

its bills and avoid breaching the ceiling. Those extraordinary

measures may be exhausted shortly after Congress returns from

recess in September, Treasury Secretary Janet Yellen has warned.

Other estimates suggest lawmakers could have several weeks

longer.

Republicans have insisted that they won’t vote to raise the

borrowing limit if Democrats push ahead on a partisan basis with

their $3.5 trillion reconciliation package. They’ve also demanded

that a debt limit hike be accompanied by structural budgeting

reforms along the lines of the spending caps imposed after a

similar showdown in 2011. Some Republicans have also called for a

bipartisan commission on entitlement reform.

“You can’t keep increasing the debt limit over and

over again without some kind of reform that starts to address the

fundamental issue, and that is deficit spending that goes out as

far as we can see,” Sen. Steve Daines (R-MT) told Punchbowl News. “So the

most responsible thing that can be done is to attach some kind of

[budget] reform that we can get agreement as a condition of raising

the debt ceiling.”

Senate Majority Leader Mitch McConnell (R-KY) reiterated the GOP

position on Thursday. “If our colleagues want to ram through yet

another reckless taxing and spending spree without our input, if

they want all this spending and debt to be their signature legacy,

they should leap at the chance to own every bit of it,” he said.

“Let me make something perfectly clear: if they don’t need or want

our input, they won’t get our help. They won’t get our help with

the debt limit increase that these reckless plans will

require.”

McConnell has suggested that Democrats include a provision to

raise or suspend the debt limit in their budget package, which

could pass with only Democratic votes. But some moderate Democrats

are concerned about the political optics of going that route,

preferring to raise the debt ceiling as part of bipartisan

legislation to fund the government. Democrats also point out that

they didn’t play debt ceiling politics when Donald Trump was

president and Republicans added nearly $2 trillion to the debt with

their 2017 tax cuts, so they don’t want to reward GOP brinksmanship

now.

“The rules that existed under Donald Trump, that we

weren’t going to mess with the full faith and credit of the United

States of America, was the appropriate and prudent thing,” Sen.

Mark Warner (D-VA) said, according to Punchbowl. “To create a fake

crisis at this moment, with this much going on in the world, with

this much going on in this country, coming out of Covid and dealing

with the variant, would be the epitome of irresponsibility.”

That sets up a high-stakes game of chicken, with most

Republicans opposed to extending the debt limit as part of a

stop-gap spending bill called a continuing resolution.

The bottom line: Whether we see a debt limit showdown

this fall should become clear within days as Democrats decide if

they’ll include a provision to address the issue in the budget

resolution they expect to take up next week.

US Health Care System Worst Among Wealthy Nations: Report

The U.S. spends more on health care relative to the size of its

economy than any other nation, but its health care system ranks

dead last among a group of its peers, according to a new analysis

from the Commonwealth Fund.

Researchers compared 11 high-income countries: Australia,

Canada, France, Germany, the Netherlands, New Zealand, Norway,

Sweden, Switzerland, the United Kingdom and the United States. They

ranked their health care systems on 71 variables, clustered in five

broad thematic areas: access to care, the care process,

administrative efficiency, equity and health-care outcomes. In four

of the five areas, the U.S. ranked last. In the one exception, the

care process, the U.S. ranked second.

The top performing countries overall were Norway, the

Netherlands and Australia. But the top 10 nations were clustered

together on many measures, leaving the U.S. in a class all its own,

as the chart below indicates.

Where the U.S. falls short: The researchers said

the top-performing systems have four characteristics that

distinguish them from the U.S.:

1. universal coverage with no cost barriers;

2. excellent primary care that is available equally to

all;

3. minimal administrative burdens that distract from

care;

4. investment in social services, especially for children

and working-age adults.

Cost and equity are particularly glaring problems for the

U.S., where the wealthy are usually able to purchase excellent

medical services but the non-wealthy face difficulties. “We’ve set

up a system where we spend quite a bit of money on health care but

we have significant financial barriers, which tend to dissuade

people from getting care,” the study’s lead author, Eric Schneider,

told The Washington Post.

The result is the least affordable health care system in the

advanced world, which fails large portions of the population. “We

have almost two health-care systems in America: one for people with

means and insurance, and another one that falls short for people

who are uninsured or don’t have adequate insurance coverage,”

Schneider said.

Read the Commonwealth Fund report here.

Income Inequality Increased Over Past 40 Years: CBO

Household incomes in the U.S. became less equal between 1979 and

2018, both before and after interventions by the government, the

Congressional Budget Office said in a

new analysis released Wednesday.

The top 20% of households saw their pre-tax and pre-transfer

incomes grow by 111% over that time, with an average income of

$321,700 in 2018. By comparison, households in the bottom 20% saw

their pre-tax and pre-transfer incomes grow by 40%, to $22,500,

while the middle quintiles saw growth of 37%. (Transfers refer to

means-tested aid programs, including Medicaid, food assistance,

rental subsidies, and aid to needy families.)

The tax and transfer systems reduced the overall level of

inequality, boosting incomes at the bottom while reducing those at

the top. After taxes and transfers, the poorest 20% of households

saw incomes increase by $15,200 on average, or 68%, to $37,700. At

the other end of the spectrum, the top 20% of households saw

incomes decrease by $77,800 on average, or 24%, to $243,900.

The CBO noted, however, that the averages conceal

considerable variation, especially at the very top, where the 1%

saw much greater income growth. “In 2018, real income after

transfers and taxes for that income group was 268 percent greater

than it was in 1979,” the report says.

Quote of the Day

“The record amount of stimulus in the economy has led

to the most inflation momentum in 30 years, and our economy has not

even fully reopened yet. I am deeply concerned that the continuing

stimulus put forth by the Fed, and proposal for additional fiscal

stimulus, will lead to our economy overheating and to unavoidable

inflation taxes that hard working Americans cannot

afford.”

– Sen. Joe Manchin (D-WV) in a letter urging

Federal Reserve Chair Jerome Powell and the Federal Open Market

Committee to immediately reassess their monetary policy and start

“tapering” stimulus measures including the bank’s purchases of

Treasuries and mortgage backed securities.

Send your feedback to yrosenberg@thefiscaltimes.com.

And please tell your friends they can

sign up here for their own copy of this

newsletter.

News

Bipartisan $550 Billion Infrastructure Bill Nears Critical

Senate Vote – Politico

Senate GOP Poised to Give Biden Huge Political

Victory – The Hill

This Is How Infrastructure Week Might Finally End (in

the Senate, at Least) – The New Republic

Senators Seek to Let States Use Covid Funds for

Infrastructure – Bloomberg

Conservatives Take Aim at Infrastructure Bill in

Senate – Roll Call

How One Republican Is Struggling to Get to Yes on Biden’s Big

Deal – Politico

Budget Reconciliation Instructions Likely to Assume

Deficits – Roll Call

Dems Plot to Squeeze Health Care Promises Into Social

Spending Bill – Politico

Senators Gird for All-Nighter ‘on Steroids’ to Propel $3.5T

Democratic Plan – Politico

Senators Go Beyond Biden to End Private-Equity Tax

Break – Bloomberg

How Should Cities Spend Billions in Aid? Ask People Who Live

There – Bloomberg CityLab

Views and Analysis

I Will Mourn My Daughter Forever. But I Was One of the Lucky

Ones. – Andrew Kaczynski, New York Times

Why McConnell Is Giving Biden an Infrastructure

Win – Jonathan Chait, New York

Stalled Rent Relief Is a Glimpse Into the Flaws of Federal

Aid Distribution – Ed Kilgore, New York

Why We Need the $3.5 Trillion Reconciliation

Package – Sen. Bernie Sanders (I-VT), Wall Street

Journal

Time to Get Serious About the Debt Limit –

Jonathan Bernstein, Bloomberg

America Squandered Decades Living for the Moment –

Noah Smith, Bloomberg

Not Vaccinated? Here’s How You Could Kill Someone’s

Father – Faye Flam, Bloomberg

The Mystery of the Missing Workers, Explained –

Olivia Rockeman, Bloomberg Businessweek