Tuesday was jam-packed with news as Democrats

continued to push their budget reconciliation plan through House

committees — and continued their wrangling over details of the

package. Among the ongoing fights: a trio of centrists are

threatening to vote against their party’s plan to

lower drug prices, potentially derailing that section of the

legislation.

Just a reminder: While that’s going on, the federal government

will shut down in 16 days if Congress doesn’t provide funding, and

the federal debt limit also needs to be raised or suspended, though

lawmakers appear no closer to agreeing on how they might do

that.

Here’s what you need to know.

Democratic Plan Would Cut Taxes for Most, Hit Top Earners

Hardest: JCT

The tax changes proposed by House Democrats this week would

lower taxes for most Americans, at least in the near term, while

hitting top-earning households with sizable increases, according to

estimates

released Tuesday by the bipartisan congressional Joint Committee on

Taxation (JCT).

The Democratic plan, which is being debated again this week by

the House Ways and Means Committee, calls for restoring a top

marginal individual income tax rate of 39.6%, up from the current

37%. It also includes a host of other changes to individual,

capital gains and corporate taxes that, combined, would raise more

than $2 trillion for the U.S. Treasury over the next 10 years,

according to the JCT.

The congressional tax scorekeeper estimated that households

making less than $200,000 a year would see lower tax bills through

at least 2025, largely as the result of the expanded child tax

credit, while those making at least $1 million a year would face a

10.6% increase in federal taxes in 2023 and a 12.1% increase by

2025. The average federal tax rate for those top-earners would

climb from 30.2% now to 37.3% in 2023 and 38.1% by 2027.

The JCT estimates don’t include Democrats’ proposed increase in

the estate tax, meaning that the tax hit on wealthy households

would be even higher.

“We are taking a significant step toward leveling the playing

field,” House Ways and Means Committee Chair Richard Neal (D-MA)

said Tuesday. “No one likes raising taxes, but

thanks to the strength of our economy, we can afford to do

this.”

A problem for President Biden? The JCT estimates show

that households making between $200,000 and $500,000 a year face an

average tax increase of 0.3% in 2023. They also show that if

lawmakers allow temporary changes to the tax code to expire as

scheduled, including the expansion of the child credit, households

making between $30,000 a year and $200,000 a year would see their

taxes go up slightly, on average, by 2027. Households making

$30,000 to $40,000 a year would see their average tax bill rise by

0.1% while those earning between $100,000 and $200,000 would face a

1.5% average increase.

The House budget plan would extend the credit for four years and

many Democrats want to make the new child tax credit permanent, but

others have expressed concerns about doing so. Most notably, Sen.

Joe Manchin (D-WV) is pushing for a new requirement that parents

work in order to be eligible for the credit. “Tax credits are based

around people that have tax liabilities. I’m even willing to go as

long as they have a W-2 and showing they’re working,” he told

Insider.

With the long-term fate of the credit unclear, the JCT estimates

factoring in its expiration after four years opened the door for

Republicans to claim that the plan violates

President Biden’s pledge not to raise taxes on people making less

than $400,000 a year.

“You’ll hear today that President Biden doesn’t

break his pledge on taxing Americans making less than $400,000, but

that’s false as well,” said Rep. Kevin Brady of Texas, the top

Republican on the Ways and Means Committee.

Republicans oppose the tax plan and have warned that it will

hurt the middle class as well as businesses large and small.

Brady on Tuesday argued, as many economists do,

that the corporate tax increase would be felt by individuals, too:

“As you know, businesses don’t pay taxes, they collect them. And

those burdens land on their workers, lands on their customers,

lands on the retirees whose retirement depends on their success,

and it lands on the communities that they live in.”

Quotes of the Day

“Republicans are united in opposition to raising the debt

ceiling.”

– Senate Minority Leader Mitch McConnell (R-KY), after being

asked whether any Republicans would support a stopgap measure that

would raise the debt limit and extend the federal government’s

funding, which will run out at the end of the month.

“We are going to need the White House to be all in. They have

been transitioning to being that and have been extremely involved

in the last couple of weeks."

– Rep. Pramila Jayapal (D-WA), chair of the Congressional

Progressive Caucus, in a piece at

The Hill noting that Democrats expect it will be

difficult to get their $3.5 trillion budget plan through the House,

where they can only afford to lose three votes.

Covid Relief Programs Saved Millions From Poverty: Census

By at least one key measure, the percentage of the population

living in poverty fell to a record low in 2020, thanks to the

unprecedented relief effort by the federal government in response

to the Covid crisis, the U.S. Census Bureau announced Tuesday.

According to the Bureau’s

Supplemental Poverty Measure, which takes into

account the effects of a wide range of government aid programs, the

poverty rate fell to 9.1% — more than two percentage points lower

than the 11.8% rate recorded in 2019. That’s the lowest reading for

the supplemental measure since 1967, when modern poverty records

began.

At the same time, the official poverty rate — which accounts for

some government programs, such as unemployment and Social Security,

but not others, including food aid, housing assistance, stimulus

checks and tax credits — increased by 1 percentage point in 2020,

to 11.4%, a remarkably small change given the enormity of the

economic crisis at hand.

“It all points toward the historic income support that was

delivered in response to the pandemic and how successful it was at

blunting what could have been a historic rise in poverty,”

Christopher Wimer of the Columbia University School of Social Work

told The New York Times.

Better than 2009: The Census notes that the Covid relief

programs were far more effective at cutting poverty than the aid

provided after the Great Recession. By all measures, poverty rose

significantly at that time, in large part because the $900 billion

authorized by Congress was much smaller compared to the trillions

of dollars lawmakers spent in 2020 and 2021.

The reductions in poverty were also remarkably widespread, with

virtually every demographic group seeing declines in poverty rates

due to government assistance.

Boosting the Biden agenda: The Census report provides

more fodder for supporters of President Joe Biden’s economic

agenda, which calls for extending some Covid relief programs as

part of a broader effort to strengthen the social safety net.

White House economist Jared Bernstein told the Times that the

data show that these aid programs are extremely effective in

reducing poverty, and worth continuing. “It’s one thing to

temporarily lift people out of poverty — hugely important — but you

can’t stop there,” Bernstein said. “We have to make sure that

people don’t fall back into poverty after these temporary measures

abate.”

Republicans, for the most part, will disagree, regardless

of the data, arguing that while the programs may have made sense

during a severe recession, they would, if made permanent,

constitute a “reckless taxing and spending spree,” as Senate

Minority Leader Mitch McConnell (R-KY) put it Monday.

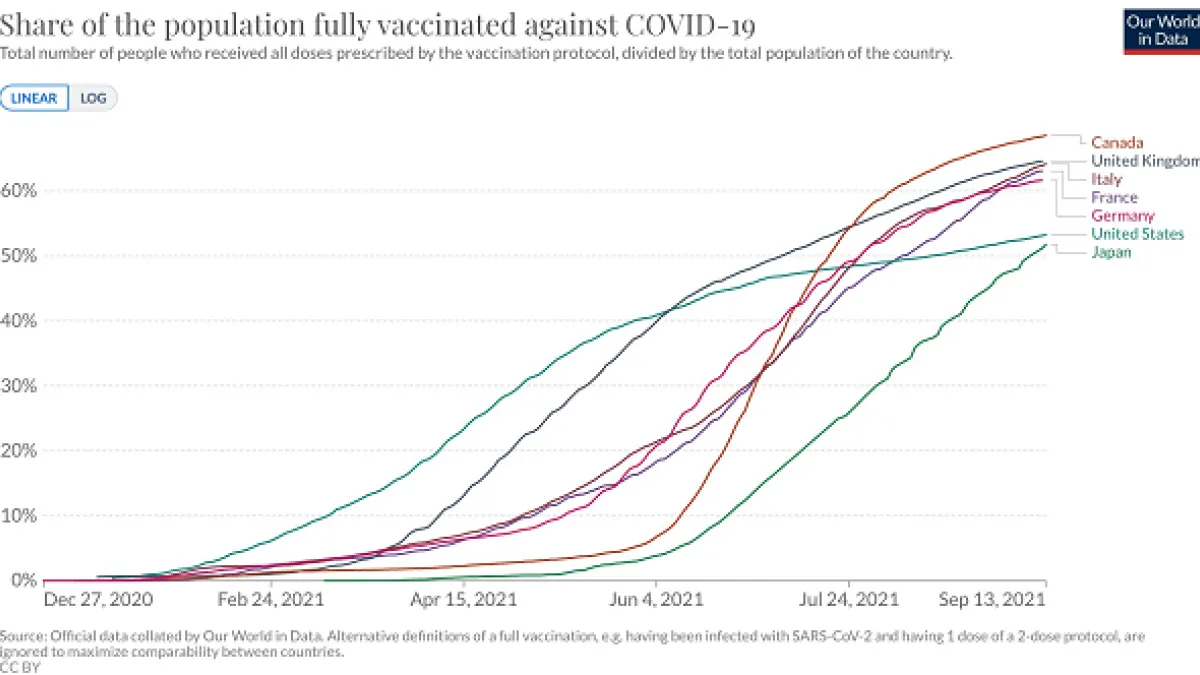

Charts of the Day

With Japan poised to surpass the U.S. in percentage of

population vaccinated, the U.S. will soon be the vaccination

laggard of the G7 nations, The Washington Post’s Ishaan Tharoor

said Tuesday.

Along the same lines, former Biden White House

Covid adviser Andy Slavitt noted

that, “By the end of September, the US will have the lowest

vaccination level of all prosperous democracies, with the largest

supply & the biggest head start.”

A pair of charts from The New York Times gets at the cost of the

slowdown in vaccinations. According to Times analysis, the failure

of states to vaccinate their populations as quickly as the leading

state, which has been Vermont for much of the pandemic, has cost

thousands of lives.

“During the latest coronavirus wave, in July and August, at

least 16,000 deaths could have been prevented if all states had

vaccination rates as high as the state with the highest vaccination

rate,” the

Times says. “The number of lives that could have

been saved will grow unless vaccination rates in lagging states

improve.”

News

Schumer and McConnell Dig In on the Debt Ceiling –

Politico

Cruz Set to Filibuster Any Democratic Attempt to Raise Debt

Limit – Politico

SALT Cap Rollback for Two Years Debated by House

Democrats – Bloomberg

House Democrats’ Plan to Tax the Rich Leaves Vast Fortunes

Unscathed – New York Times

House Democrats Push for Permanent Earned Income Tax Credit

Expansion – CNBC

Business Groups Sense Momentum in Scaling Back Democratic

Priorities – The Hill

Tester Says '100 Percent' of Reconciliation Package Must Be

Paid For – The Hill

Rich Heirs Face Expensive Surprise Tucked in Democrats’ Tax

Plan – Bloomberg Law

Estate Taxes Are Easy to Avoid. House Democrats Want to

Change That. – Wall Street Journal

Democrats Put Tax Hikes on Fast Track — After Knocking GOP’s

Haste on Tax Cuts – Politico

Democrats Are Pouring Cold Water on Joe Manchin's Suggested

Work Requirement for the Biden Child Tax Credit –

Insider

Treasury to Release More Rental Aid to Avert

Evictions – Politico

Prices Climbed More Slowly in August, Welcome News for the

Fed. – New York Times

A Plan to Hasten the Sale of Surplus Federal Property Gets

Bogged Down – New York Times

Biden’s Workplace Vaccine Mandate Faces Headwinds

– Politico

Covid Hospitalizations Hit Crisis Levels in Southern

I.C.U.s – New York Times

Views and Analysis

A Tax Scorecard for Reconciliation, Round 2 –

Marie Sapirie, Forbes

House Dems Have a $2T Tax Plan. Here’s What You Should

Know. – Brian Faler, Politico

What Working-Class Parents Want Biden and Republicans to

Know – Patrick T. Brown, New York Times

Should Biden Reappoint Jerome Powell? It Depends on His

Theory of Change. – Neil Irwin, New York Times

Biden's Wildly Unconstitutional Vaccine Mandate –

Justin Haskins, The Hill

The Lives Lost to Undervaccination, in Charts –

Emma Pierson, Jaline Gerardin and Nathaniel Lash, New York

Times