President Biden turned up the pressure on

Democratic lawmakers Thursday as he rallied them to support his

$3.5 trillion economic package. “This our moment to deal working

people back into the economy,” Biden said in remarks at the

White House. But some Democrats warned that it will take

time to work out all the issues that have cropped up as the party

tries to enact the president’s domestic agenda.

Here’s what else is going on.

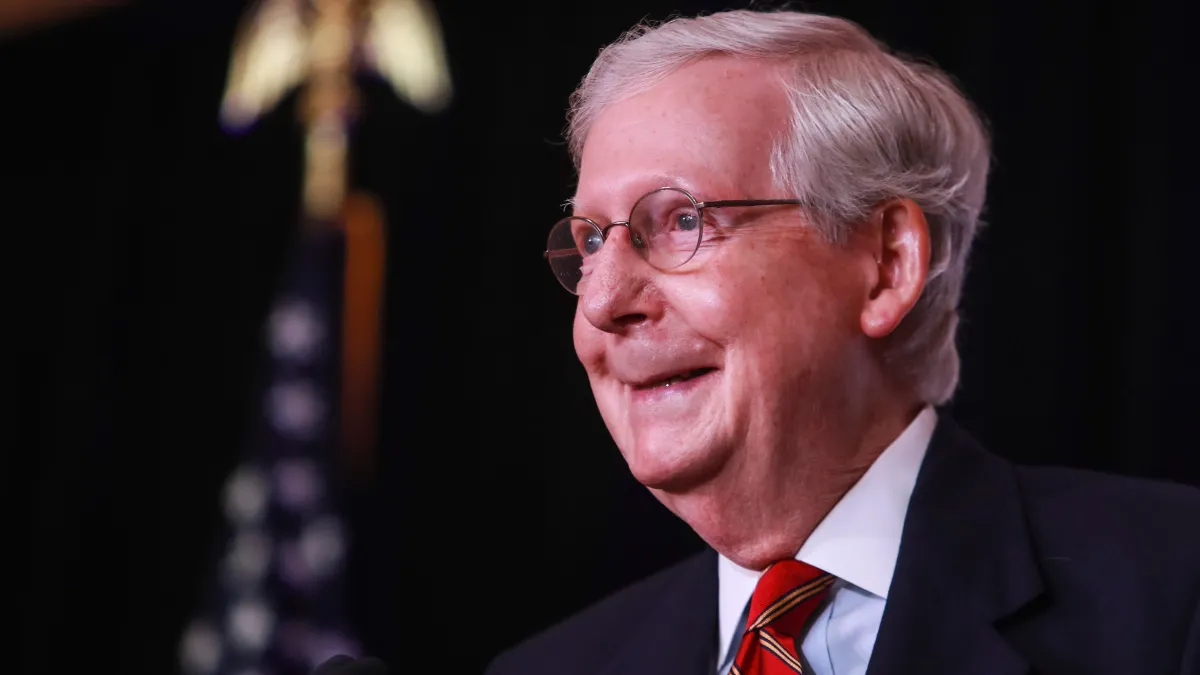

McConnell Warns Yellen That Republicans Won’t

Help Raise the Debt Ceiling

Facing a potential default on U.S. debt payments in a matter of

weeks, Treasury Secretary Janet Yellen called Senate Majority

Leader Mitch McConnell on Wednesday to ask for his bipartisan

cooperation in passing an increase or suspension of the debt

ceiling. But the Kentucky Republican rejected her request,

according to reports Thursday, and stuck to his position that the

GOP will not help Democrats address the debt limit.

“This is a unified Democrat government, engaging in a partisan

reckless tax and spending spree,” a McConnell spokesman said late

Wednesday after the call. “They will have to raise the debt ceiling

on their own and they have the tools to do it.”

In an

interview with Punchbowl News published Thursday,

McConnell explained why he is refusing to support any effort to

raise or suspend the debt limit: “Let me make it perfectly clear.

The country must never default. The debt ceiling will need to be

raised. But who does that depends on who the American people

elect,” McConnell said. “So the only issue is, whose responsibility

is it to do it? A Democratic president, a Democratic House, a

Democratic Senate. ... It's their obligation. They should step up.

It's hard being in the majority. They are the ones who will raise

the debt limit.”

McConnell tipped his hat to earlier bipartisan efforts – “I have

voted a number of times to raise the debt ceiling in divided

government,” he said – but insisted that Democratic control

absolves the Republican Party of any responsibility to help avoid

what could be a global financial calamity, should the U.S.

default.

Democrats push back: Not for the first time, Democrats

rejected McConnell’s argument, pointing out that they voted several

times to raise the debt ceiling during the Trump administration and

that the debt that must be paid now was incurred in the past.

“Senators from both parties overwhelmingly voted in support of

the many laws that contributed to this obligation,” Senate Majority

Leader Chuck Schumer (D-NY) said. “So neither party can wash its

hands of responsibility to pay the bills.”

According to an analysis by the Associated Press, nearly 98% of

the country’s $28.4 trillion national debt was created before

President Joe Biden took office. And the total includes more than

$7 trillion that was added during the Trump presidency.

A strategic gamble: While there’s more than one way for

Democrats to attempt to raise the debt limit, including attaching

it to the reconciliation bill they plan to use to pass President

Biden’s $3.5 trillion economic package, their current strategy

appears to be to include an increase in a must-pass bill that will

keep the government open after September 30 and provide assistance

to hurricane victims and Afghanistan war refugees – while waiting

for Republicans to lose their nerve and vote to support the

measure.

However, Sen. Roy Blunt, a Republican from Missouri who voted to

raise the debt limit during the Trump presidency, told reporters

Thursday that bipartisan cooperation isn’t likely, despite Biden’s

oft-spoken desire for lawmakers to work across the aisle. “I don’t

think anything in the last month has increased the likelihood that

he can now create an atmosphere of: Let’s work together,” Blunt

said.

And McConnell doesn’t sound like he’s in any mood to change his

mind. “I’m not voting [for a debt limit increase],” he told

Punchbowl. “How many different ways do I need to say this?”

Forecast of the Day

A forecast by analysts at JPMorgan,

cited by James Pethokoukis of the American Enterprise

Institute Thursday, gives a good sense of just how much is going on

in Washington right now, and how complicated the political and

economic playing field is:

Effective Tax Rates for High-Income Households

Have Fallen Sharply Since WWII: Report

At the end of World War II, the top 0.1% of households in terms

of income were paying an effective tax rate of about 50%, according

to an

analysis by Robert McClelland of The Tax Policy

Center. That rate declined over time, falling to roughly 25% by

1985, about where it stayed through 2015, with some

fluctuations.

The top 1% of households have followed the same pattern, with

their effective tax rate falling from nearly 40% in 1945 to about

25% in 2015.

By contrast, average effective tax rates for all households

showed remarkable stability between 1945 and 2015, ranging between

12% and 15%.

Number of the Day: $279 Billion

Individual Retirement Accounts were introduced in the 1970s to

help workers save for their golden years, but some lawmakers are

concerned that they are being abused by wealthy investors.

According to the nonpartisan Joint Committee on Taxation, there are

now nearly 29,000 IRA accounts worth more than $5 million each,

with a total value of $279 billion. About 500 of the accounts hold

more than $25 million.

Democrats want to introduce limits into the system, and

restrictions on IRS accounts worth more than $10 million are

included in the tax plan approved by the House Ways and Means

Committee this week. “Lawmakers’ concern, shared by some tax

experts, is that a system created to help the middle class retire

now lavishes too many perks on the richest of the rich,”

says Bloomberg’s Ben Steverman.

Connect the dots between financial policy, politics, and

citizen and legislative action, with the latest from The American

Prospect. Read it HERE.

News

At an Economic ‘Inflection Point,’ Biden Leans Into

Expansive, Populist Agenda – Washington

Post

Biden’s Economic Plan at Risk of Delays as Democrats

Squabble – Bloomberg

Budget Bill Reopens Moderate vs. Progressive Divide for

Dems – Associated Press

Manchin Keeps Washington Guessing on What He Wants

– The Hill

Dems Call in Big Gun as They Face Huge Hill Tests

– Politico

His Economic Agenda on the Line, Biden Prepares to Fight for

Tax Increases on the Wealthy – CNBC

As G.O.P. Digs In on Debt Ceiling, Democrats Try Shaming

McConnell – New York Times

U.S. Initial Jobless Claims Rose Last Week, Led by

Louisiana – Bloomberg

Inflation Soared in Some U.S. Cities, Barely Budged in

Others – Bloomberg

To Retake Congress, the GOP Plans to Attack Democrats on the

Economy – NPR

Almost 450 Economists Signed a Letter in Favor of Extending

the Enhanced Child Tax Credit – CNBC

A Paid Family Leave Policy Could Be Coming to the US. Here’s

What It Would Look Like – CNBC

Views and Analysis

Mitch McConnell’s Debt Limit Game-Playing Is Lunacy, and We

Should Say So – Greg Sargent, Washington

Post

Democrats Should Heed Mitch McConnell’s Advice

– Karl W. Smith, Bloomberg

Democrats’ $3.5 Trillion Spending Plan Flunks Its Own

Test – Michael R. Strain,

Bloomberg

Can American Politics Allow for Long-Run

Investment? – Lee Harris, American

Prospect

Joe Manchin Doesn’t Know What He’s Missing –

Bryce Covert, New York Times

No, the Richest One Percent Don’t Pay 40 Percent of the

Taxes – Jonathan Chait, New

York

Infrastructure Summer: A Surprisingly Radical Housing

Bill – Alexander Sammon, American

Prospect

Families Planned to Use Child Tax Credit to Pay Bills but

Some Were Confused About Eligibility – Elaine Maag

et al, Tax Policy Center

Peter Thiel Gamed Silicon Valley, Donald Trump, and Democracy

to Make Billions, Tax-Free – Max Chafkin,

Bloomberg Businessweek