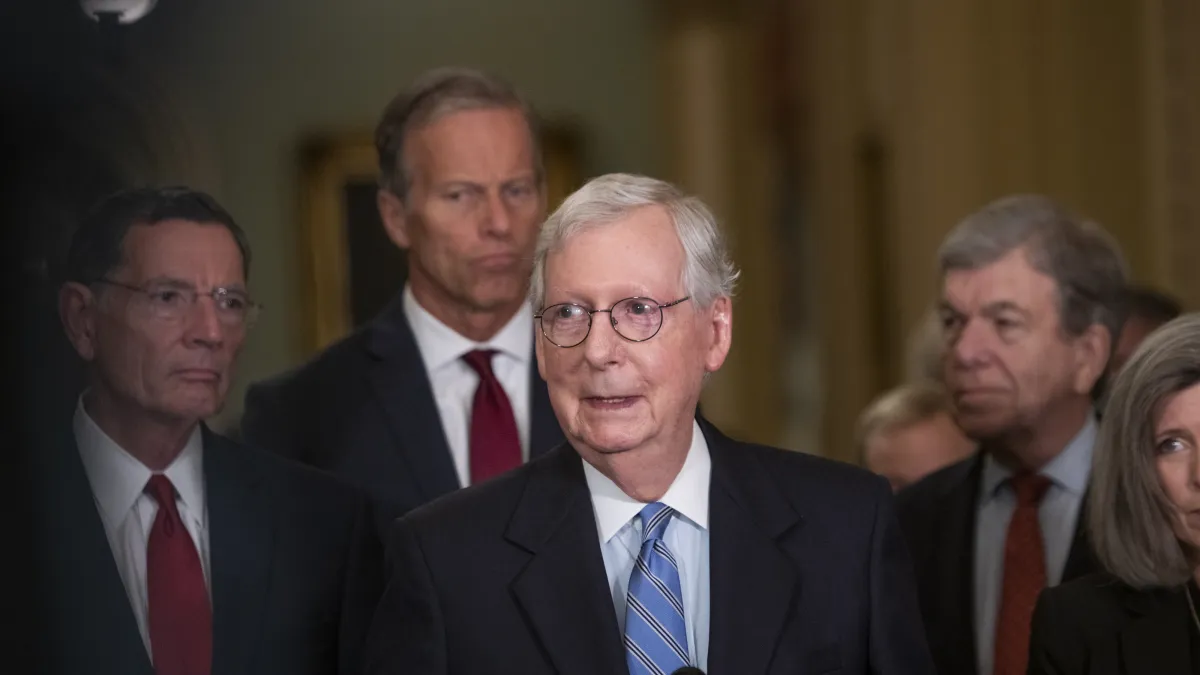

Democrats Say They’ll Take McConnell’s Debt Limit Offer

Senate Democrats on Wednesday said they were prepared to accept

an offer from Republican Leader Mitch McConnell of a short-term

increase in the debt ceiling. The deal would delay — but not

completely defuse — a showdown over nation’s borrowing limit,

pushing the deadline for a longer-term increase from the middle of

this month into December.

Democrats portrayed the agreement as a win, if likely a fleeting

one. “In terms of a temporary lifting of the debt ceiling, we view

that as a victory, a temporary victory with more work to do,” Sen.

Tammy Baldwin (D-WI) told CNN.

“Mitch McConnell blinked and it allows us to spend from here

until November focused on finalizing the Build Back Better plan,”

Sen. Chris Coons (D-DE) told CNN. “So I think that's progress.”

“McConnell caved,” said Sen. Elizabeth Warren (D-MA), according

to

The Hill. “And now we’re going to spend our time

doing child care, health care and fighting climate change.”

Yet even as Democrats said they were prepared to take

McConnell’s offer, they indicated that the debt limit clashes may

be far from over.

In a

statement released Wednesday afternoon, McConnell made

clear that, while he was offering to raise the debt limit by a

fixed amount to cover spending into December, he still expects

Democrats to go it alone from there. “This will moot Democrats’

excuses about the time crunch they created and give the unified

Democratic government more than enough time to pass standalone debt

limit legislation through reconciliation,” he said.

Democrats continued to insist that they won’t take that path,

which they have rejected as too time-consuming and risky.

Setting up another fiscal cliff: By pushing the debt

limit deadline into December, the deal sets up another major fiscal

cliff, given that an extension of government funding just passed by

Congress is set to expire on December 3.

The politics at play: McConnell’s offer may have been

prompted, at least in part, by Democrats’ talk of carving out

an exception to the filibuster rule for raising

the debt ceiling, allowing an increase with a simple majority vote

rather than requiring 60 votes. President Biden late Tuesday called

that

“a real possibility.”

Biden has sought to put pressure on McConnell over his refusal

to raise the debt limit, and the president met with a group of top

business leaders Wednesday to continue that campaign.

McConnell’s offer requires Democrats to put a number on how much

the debt limit is lifted rather than suspending the limit for a

period of time, as Congress has done recently. Democrats have

preferred a suspension since the fixed number could make its way

into political attack ads.

The bottom line: With the clock ticking toward an October

18 deadline to lift the debt ceiling and avoid a potentially

calamitous default, the tentative deal coming together Wednesday

could represent a breakthrough that keeps the Treasury Department

from running out of money. But disagreements about the details of

the deal and whether Democrats will use reconciliation reportedly

could still scuttle the whole thing — and even if lawmakers

finalize a temporary debt limit increase, they could be back to

brinksmanship within weeks.

Sanders to Manchin, Sinema: What Do You Want?

Senate Budget Committee Chairman Bernie Sanders (I-VT) on

Wednesday had some tough words for two colleagues who are

complicating negotiations over the size and scope of President Joe

Biden’s domestic agenda.

Publicly addressing Sen. Joe Manchin (D-WV), who has said he

wants to reduce the plan’s spending total while avoiding any

provisions that would create an "entitlement" society, Sanders told

reporters that it’s time for the West Virginia lawmaker to be more

specific about what he wants.

“Senator Manchin has been extremely critical of the $3.5

trillion proposal that many of us support,” Sanders said. “The time

is long overdue for him to tell us with specificity — not

generalities, but beyond generalities, with specificity — what he

wants and what he does not want, and to explain that to the people

of West Virginia and America.”

Sanders also had words for Sen. Kyrsten Sinema (D-AZ), who

reportedly opposes some tax increases included in the Biden plan,

but who has avoided publicly stating her concerns and

preferences.

“Sen. Sinema’s position is that she does not negotiate

publicly,” Sanders said. “I don’t know what that means … Don’t know

where she’s coming from.”

For both senators, Sanders said he had a simple request: “Tell

us what you want.”

Manchin affirms limit: Although Manchin recently signaled

that he’s willing to go above his previously stated upper limit for

the size of the plan of $1.5 trillion over 10 years, on Wednesday

he sounded more firmly wed to that cap. “My number has been $1.5.

I've been very clear,” he told reporters.

Manchin also repeated his concerns about the government proving

too many goods and services. “I've been very clear when it comes to

who we are as a society, who we are as a nation. ... I don't

believe that we should turn our society into an entitlement

society. I think we should still be a compassionate, rewarding

society," he said, explaining that the government should focus on

taking care of those who can’t take care of themselves.

Sanders addressed Manchin’s concerns at his press conference,

asking, “Is protecting working families and cutting childhood

poverty an entitlement?” Referring to Democrats’ effort to include

dental, vision and hearing benefits in Medicare, Sanders asked,

“Does Sen. Manchin really believe that seniors are not entitled to

digest their food, and they're not entitled to hear and see

properly? Is that really too much to ask?”

Number of the Day: $1 Billion

The Biden administration announced Wednesday that it would spend

$1 billion on at-home rapid coronavirus tests, with the goal of

quadrupling their availability. Jeffrey Zients, the White House’s

Covid-19 coordinator, said 200 million rapid tests would be

available on a monthly basis by the end of the year.

“The changes reflect the administration’s growing emphasis on

at-home testing as a tool for slowing the spread of Covid-19,” The

New York Times’ Noah Weiland

reports.

Chart of the Day: How the U.S. Lags on Toddler Care

The United States provides far less financial support for

toddler care than other developed nations, writes Claire Cain

Miller at The New York Times:

“The U.S. spends

0.2 percent of its G.D.P. on child care for

children 2 and under — which amounts to about $200 a year for most

families, in the form of a once-a-year tax credit for parents who

pay for care.

“The other wealthy countries in the Organization for

Economic Cooperation and Development spend an average of

0.7 percent of G.D.P. on toddlers, mainly through

heavily subsidized child care.”

On the other hand, Cain Miller notes, the United States

spends more than any OECD country except Luxembourg on elementary

school through college. “We as a society, with public funding,

spend so much less on children before kindergarten than once they

reach kindergarten,” Elizabeth Davis, an economist studying child

care at the University of Minnesota, tells Cain Miller. “And yet

the science of child development shows how very important

investment in the youngest ages are, and we get societal benefits

from those investments.”

The pandemic has highlighted the importance — and economic

value — of child care, and Democrats are looking to provide more

support for younger children as part of their bill to expand the

social safety net, but the details of that bill, and options to cut

costs, are still being negotiated.

Read the full article at The New York Times.

Send your feedback to yrosenberg@thefiscaltimes.com.

And please tell your friends they can

sign up here for their own copy of this

newsletter.

News

Dems Take GOP’s Short-Term Debt Fix Offer, Kicking Deadline

to December – Politico

Debt Deal Still Being Drafted Into Legislation, Democratic

Senator Says – CNN

Biden Enlists Big Bank CEOs to Pressure GOP on Debt

Limit – Bloomberg

Finance Executives Say the Risk of a Default Is Already

Damaging the Economy – New York Times

What the Debt Ceiling Means for Social Security and

More – New York Times

Biden Team Seeks to Pare Back Economic Agenda in Strategy

Shift – Bloomberg

Manchin’s Opioids Tax Plan Faces Pushback From Lobbying

Groups – Roll Call

Flush With COVID-19 Aid, Schools Steer Funding to

Sports – Associated Press

Major Insurers Running Billions of Dollars Behind on Payments

to Hospitals and Doctors – Kaiser Health News

Troubled Student Loan Forgiveness Program Gets an

Overhaul – New York Times

A ‘Historic Event’: First Malaria Vaccine Approved by

W.H.O. – New York Times

Secret Trove Illuminates the Lives of Billionaires

– Washington Post

Views and Analysis

How Democrats Can Close the Deal on Build Back

Better – Washington Post Editorial Board

Biden’s Frustration With Manchin and Sinema Captures a Dark

Truth – Greg Sargent, Washington Post

Republicans, Be Careful How You Oppose the Reconciliation

Bill – Henry Olsen, Washington Post

A Carbon Tax Is Not the Solution to Global Climate

Change – Eric Toder, Tax Policy Center

The Budget Wreck Is Congress’ Fault — and Yours –

Kevin R. Kosar, The Hill

Offshore Accounts Aren’t for Evading Taxes. They’re for

Evading Laws Altogether – Brooke Harrington, Washington

Post

How to Make Retirement Saving Easier for Millions of

Americans – Renu Zaretsky, Tax Policy Center

The Federal Reserve Is Fighting the Wrong Inflation

War – Bill Dudley, Bloomberg