Happy Thursday! House Democrats plan to

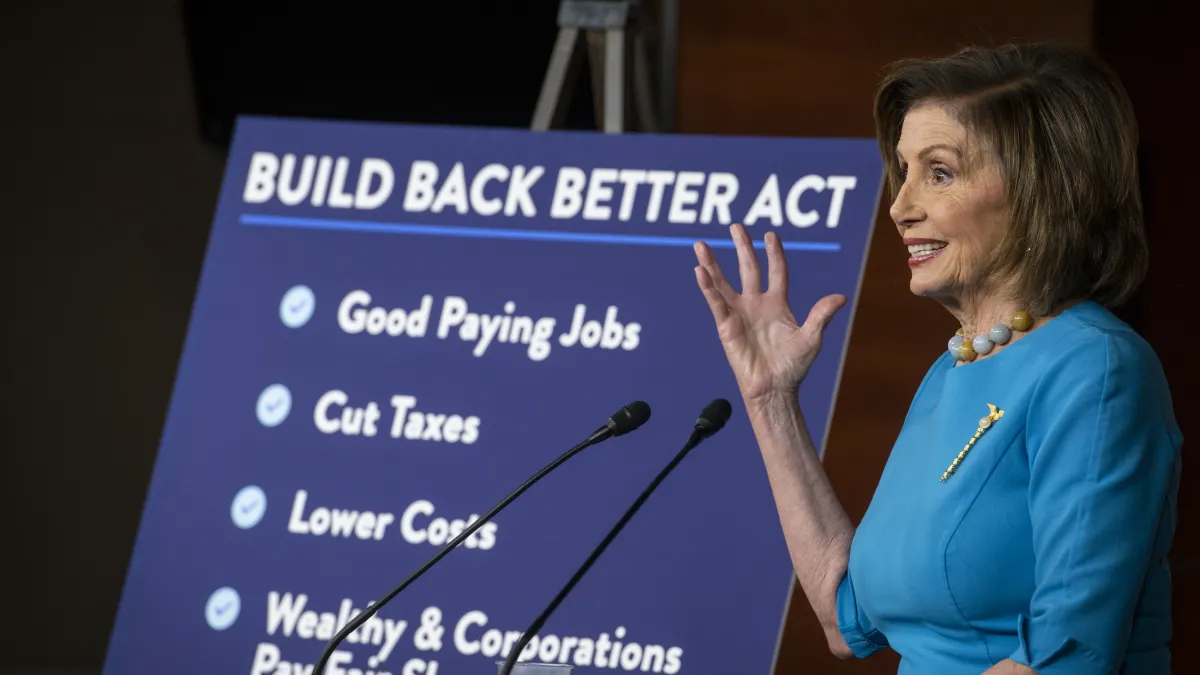

vote on their $1.85 trillion Build Back Better package of social

and environmental programs this evening. Party leaders expressed

optimism throughout the day that they’ll be able to pass what would

be the largest expansion of the nation’s safety net in decades —

even as they still waited for a final cost estimate for the

legislation from the Congressional Budget Office. That estimate

landed a short time ago.

Here’s the latest:

House Dems’ Build Back Better Bill Would Add

$160 Billion to Deficit: CBO

The Congressional Budget Office on Thursday estimated

that, despite promises from President Joe Biden and others in his

party that their Build Back Better plan would be fully paid for,

the legislation would add about $160 billion to budget deficits

over the next 10 years — with a $750 billion gap in the first five

years, a result of the front-loaded nature of the spending plans

that Democrats made temporary to keep costs low.

The budget scorekeeper said that the plan would actually

increase deficits by $367 billion through 2031, but that was “not

counting any additional revenue that may be generated by additional

funding for tax enforcement.” CBO projected that those additional

revenues from beefing up the Internal Revenue Service would total

$207 billion over 10 years — far less than the $480 billion the

White House had projected — bringing the overall deficit impact to

$160 billion.

The new numbers appeared unlikely to derail House

Democrats’ plans to approve the bill. “At the close of the debate,

all that remains is to take up the vote – so that we can pass this

legislation and achieve President Biden’s vision to Build Back

Better!” House Speaker Nancy Pelosi (D-CA) said in a letter to

colleagues Thursday afternoon.

And Treasury Secretary Janet Yellen said in a statement

Thursday evening that, when factoring in her department’s analysis

of the proposed IRS investments, the legislation “is fully paid

for, and in fact will reduce our nation’s debt over time by

generating more than $2 trillion through reforms that ask the

wealthiest Americans and large corporations to pay their fair

share.”

Using the Biden administration’s projection for revenue

from the IRS plan would result in a roughly $113 billion reduction

in deficits over the next decade.

Budget hawks disagree, though, arguing that the CBO

analysis means that Democrats should find $160 billion in cuts or

revenue. “They should also drop the arbitrary sunsets and gimmicky

SALT-related offsets. At an absolute minimum, they should make a

credible commitment not to extend any parts of the bill without

paying for them as well,” said Maya MacGuineas, president of the

Committee for a Responsible Federal Budget, which has found that

making the temporary parts of the bill permanent would about double

its cost, potentially adding $3 trillion to deficits.

The White House's Tax Battle With the CBO

The new CBO analysis projects that the Democrats’ plan to

invest $80 billion over 10 years in beefing up the Internal Revenue

Service and boosting the agency’s tax enforcement would generate

$207 billion in increased revenues, decreasing deficits by a net

$127 billion through 2031.

As expected, that’s far less than the $480 billion in

revenues — and net $400 billion — that the Biden administration has

projected. But the White House has challenged the budget office’s

methodology for estimating the effects of beefed-up IRS

enforcement, arguing that its own projections are more accurate and

pointing to other experts who predict even greater

returns.

The dispute, as Politico’s Brian Faler

writes, “largely boils down to a single question:

How afraid will rich people be of a newly empowered tax collector?

… It’s an inherently tough topic because it means predicting how

wealthy people and corporations will perceive the IRS in the

future.”

The administration has projected that the $400 billion in

additional revenue would include $240 billion expected to flow to

the Treasury from increased audits of corporations and the rich and

another $160 billion that could result from greater compliance as

people adjust their behavior in response to the IRS’s new

muscle.

The Congressional Budget Office projects far less fear, and thus

far less revenue over time, than Treasury officials do. “There’s

other analyses that put a lot of weight on the idea of deterrence —

that if people know that the IRS is doing more and auditing more

that other people then pay more of their taxes,” CBO director

Phillip Swagel said this week. “The research literature on

deterrence, I’d say, is very mixed.”

CBO also says that corporations and the wealthy, in particular —

the very crowd Democrats are targeting — will not be deterred from

trying to avoid taxes.

The White House has gotten support for its position from some

economists and tax experts, including former Treasury secretary

Larry Summers, who has been critical of the Biden administration on

other aspects of economic policy, most notably inflation. In a

Washington Post op-ed Thursday, Summers backs the administration's

view that the IRS plan would generate more revenue than CBO

projects — and he argues that Treasury’s estimates are likely too

conservative as well, pointing to research on the tax gap that he

and others have done.

Summers says that the White House’s $400 billion revenue

estimate represents just 5.7% of the tax gap — the difference

between what is owed and what gets collected — over the next 10

years. “That modest gain is a more-than-reasonable expectation

given the starting point,” he writes. “In general, I believe policy

should be set on the basis of official scorekeeping by nonpartisan

scorekeepers. But, in this case, it would be irresponsible to not

recognize that the CBO estimate for tax-compliance efforts is

conservative to the point of implausibility.” (Read Summers’s full

piece

here.)

The bottom line: House Democrats can only afford to lose

three votes as they try to pass the Build Back Better Act — and

even if they succeed tonight, the legislation still faces an

uncertain fate in the Senate, where Joe Manchin (D-WV) or other

lawmakers may insist on substantial changes.

Estate Tax Revenues Plunge, Even as Wealth Soars

Revenues from the federal estate tax have fallen by 50% in just

two years, according to new data from the IRS reported by

Blomberg News.

In 2018, about 5,500 families paid more than $20 billion in

estate taxes. In 2020, the IRS collected about $9.3 billion from

1,275 families.

“The dramatic decline – to the point where the tax is paid by

0.04% of dying Americans – is largely the result of the tax

overhaul enacted by Republicans in 2017, which doubled the amount

the wealthy can pass to heirs without triggering the levy,”

Bloomberg’s Ben Steverman writes.

Estate tax revenue is expected to continue to decline, despite

the surge in dynastic wealth in the country. Although Democrats

have outlined various changes that would reduce exemptions and

close loopholes in the tax, none of those proposals survived in the

Build Back Better bill following resistance from moderates in the

party.

How a Minimum Tax Would Affect Major US Companies

In the latest version of the Build Back Better bill, Democrats

are proposing a 15% minimum income tax on large businesses, part of

an effort to offset the plan’s $1.85 trillion cost by increasing

tax revenues from the wealthy and corporations. According to a

report released Thursday by Sen. Elizabeth Warren

(D-MA), such a tax would force at least 70 major U.S. companies

that paid less than 15% in income tax in 2020 to pay quite a bit

more, generating an estimated $22 billion in federal revenues in

just one year.

“America’s largest corporations have rigged the tax code in

their favor, employing armies of lobbyists and accountants to write

and abuse the rules so they can avoid paying their fair share of

taxes,” the report charges.

In one example cited in the report, DISH Network reported $2.6

billion in profits in 2020 and paid its chairman almost $95 million

but paid no federal income taxes — and got a $231 million tax

refund to boot. In another example, defense contractor Northrop

Grumman made $3.7 billion, but paid an effective tax rate of just

6.7%, far below the standard tax rate of 21%

“These are not isolated examples,” the report says. “Year after

year, far too many giant corporations report billions in profits to

their shareholders and then tell the U.S. government that they owe

nothing come tax time.”

How the minimum tax would work: The 15% minimum tax would

apply to “book income,” which companies report to their

shareholders and is typically larger than the number they report to

the IRS. Companies often reduce their reported incomes using

various deductions and credits, thereby reducing the taxes they

owe.

According to the Joint Committee on Taxation, such switching to

a minimum corporate tax of 15% would produce $319 billion in

revenue over 10 years.

A problem for corporate investment? Imposing a minimum

tax on book income would raise more federal revenues, but could

have a negative effect on business investment, according to

Thornton Matheson and Thomas Brosy of the

Tax Policy Center.

Under such an approach, companies would lose many of the tax

credits associated with depreciation, which is a key component in

how many firms in the utilities, transportation and manufacturing

sectors evaluate future investments. In their analysis, Matheson

and Brosy found that companies that invest heavily in equipment and

R&D would likely reduce those investments under a minimum book

tax regime.

By comparison, an increase in the corporate tax rate to 25% — a

Democratic proposal that was replaced in the spending bill by the

minimum corporate tax — would raise federal revenues but have no

negative effect on investment decisions.

“Given that the corporate tax base now consists mostly of rents

and that share ownership is skewed toward the wealthy, a rate hike

would have been both efficient and progressive,” Matheson and Brosy

say. “Despite its lower headline tax rate, the book minimum tax may

be more likely to undermine investment.”

Send your feedback to yrosenberg@thefiscaltimes.com.

News

Dems Race to Pass Social Spending Plan With $1.7T Cost

Estimate in Hand – Politico

Budget Office Determines Democrats’ Spending Bill Will Nudge

Deficit Higher – New York Times

Tax Deduction That Benefits the Rich Divides Democrats Ahead

of Vote – New York Times

Dems Agonize Over Tax Cuts for Rich: ‘Bad Policy, Bad

Politics’ – Politico

Democrats Face Moment of Truth: Will They Give Millionaires a

Tax Cut? – HuffPost

Schumer, McConnell Turn Down the Heat on Debt Limit

Fight – Politico

Delauro Pushing for Short Stopgap Funding Bill, No

‘Anomalies’ – Roll Call

SALT Analysis Finds Little Middle-Class Help in Congress’s

Plans – Bloomberg

Democrats Urge Biden to Do More About Inflation

– Axios

Biden Can’t Avoid Blame for Inflation, a Tough Problem to

Fix – Bloomberg Businessweek

Biden’s War on Inflation Is a Battle to Change Human

Behavior – Politico

How Child Care Became the Most Broken Business in

America – Bloomberg

Businessweek

As G.O.P. Fights Mask and Vaccine Mandates, Florida Takes the

Lead – New York Times

Views and Analysis

IRS Reform Will Generate a Lot More Revenue Than the CBO

Thinks – Lawrence H. Summers, Washington

Post

How Democrats Got Trapped in a SALT Box –

Jonathan Bernstein, Bloomberg

Americans Aren’t Feeling Relief From Biden’s

Big Washington Victory – Stephen Collinson,

CNN

Inflation Is Making the SALT Deduction Less Sweet

– Alexis Leondis, Bloomberg

Want More Affordable Housing and Health Care? Here’s a

Fix – Samuel Hammond, Daniel Takash and Steven

Teles, New York Times

The Pandemic Prompted People to Retire Early. Will They

Return to Work? – Peter Coy, New York

Times

The U.S. Supply-Chain Crisis Is Already Easing

– Brooke Sutherland, Bloomberg

I Remember 1970s Inflation. Politicians Should,

Too – James Ellis, Bloomberg

Businessweek

Biden’s Plan to Vaccinate the World Faces an Obstacle:

Vaccine Manufacturers – Adam Taylor, Washington

Post