It's Thankgiving Eve Eve! Is it wrong not to have

turkey on Thursday? Asking for a friend...

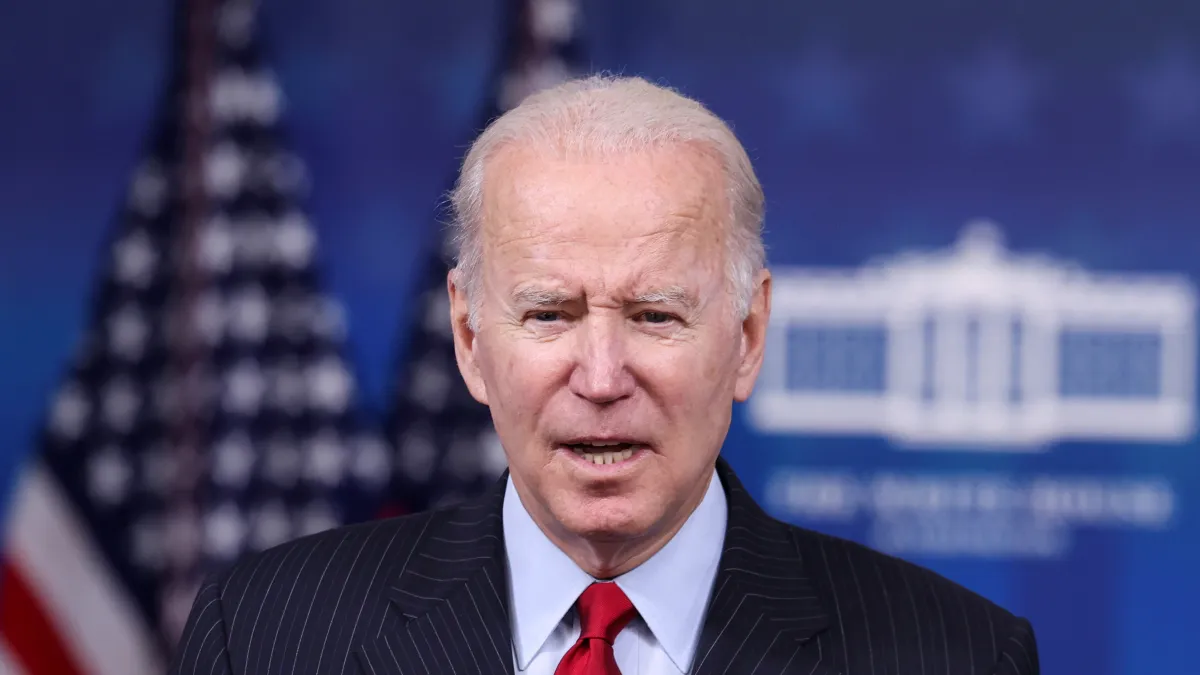

Biden Takes Aim at High Gas Prices

With energy prices hitting multiyear highs ahead of the holiday

season, President Joe Biden on Tuesday ordered the release of a

record 50 million barrels of oil from the nation’s Strategic

Petroleum Reserve.

The release is being coordinated with China, India, Japan, South

Korea and the United Kingdom as part of an effort to put downward

pressure on oil prices globally. Experts expect a total of roughly

100 million additional barrels to be brought to market worldwide in

the coming weeks, the largest single release from reserves in

history.

Gasoline prices are at $3.40 a gallon on average in the U.S., an

increase of more than 50% from a year ago. The release from the

U.S. strategic reserve, which currently holds about 605 million

barrels, should have a noticeable effect on gasoline prices within

a few weeks, GasBuddy.com analyst Patrick DeHaan told

Bloomberg News, resulting in a decrease of 5 cents

to 15 cents per gallon.

But the effect of the release, which will cover about

two-and-a-half days of use in the U.S., could be short-lived. “The

problem is that everybody knows that this measure is temporary,”

Claudio Galimberti of Rystad Energy

told the Associated Press. “So once it is stopped,

then if demand continues to be above supply like it is right now,

then you’re back to square one.”

Inflation looms large: In comments at the White House,

Biden highlighted positive economic news such as strong growth and

a low unemployment rate while portraying the recent surge of

inflation in the U.S. — and higher gas prices — as temporary

problems that his administration is acting to solve. “I will do

what needs to be done to reduce the price you pay at the pump,”

Biden said.

In addition to the release of oil, Biden discussed the “port

action plan” the White House announced earlier this month that is

intended to clear up the supply chain congestion at the nation’s

ports, a key factor in the recent wave of price hikes. Most of the

funds for the effort were provided by the bipartisan infrastructure

package Biden signed into law last week, which set aside $17

billion for port improvements.

The president also said that he had spoken to executives at

retailers and shipping firms, including Walmart, Target, UPS and

FedEx, to make sure that store shelves are fully stocked for the

holidays.

Still, the president’s ability to affect significant changes in

prices is limited, especially when it comes to energy. With

gasoline prices, opening the strategic oil reserve “is the only

thing within policy control at the moment,” Anastasia Amoroso of

iCapital Network told Bloomberg.

More broadly, the White House could have a tough time fighting

inflation, which is hurting Biden politically. Inflation hit a

30-year high in October by one measure, rising 6.2% on an annual

basis — a statistic that will be used to push back against the

Build Back Better bill that contains much of the president’s

domestic agenda.

Will Democrats’ New Insulin Price Cap Survive

in the Senate?

The Build Back Better Act passed by the House last week would

cap out-of-pocket costs for insulin at $35 a month starting in

2023, lowering the cost of the vital diabetes treatment for

millions of people covered by Medicare or private insurance

plans.

As the Senate prepares to take up — and, likely, to revise — the

legislation, Senate Majority Leader Chuck Schumer (D-NY) over the

weekend touted the insulin provision and warned Republicans against

trying to nix the new cap.

“We are here today to tell the GOP to lay off! Do not try to

attempt to kill this provision,” Schumer said at a press conference

in New York. “Ten years ago insulin was cheap and easy and

accessible. But all of a sudden, it’s gone up 12%, 15%, 17% a year,

so now it’s as high as $600. And this is not a drug on patent. This

is not one of those things that’s protected by patent. So there’s

no reason the cost should be so high.”

Schumer said that he would do everything he can to keep the

provision in the bill.

The background: Insulin has been available for nearly a

century, but its price has doubled or tripled over the past decade,

according to a bipartisan Senate report release early this year.

Those surging prices have put insulin front and center in efforts

to tackle high drug prices, with lawmakers in both parties looking

to limit what patients pay for it.

“House Republicans have an alternative to Democrats’ drug

pricing measure, which includes a

monthly $50 cap on insulin and its supplies after

Medicare patients hit their deductibles,” The Washington Post’s

Rachael Roubein

notes. “In the Senate, the

top-ranking Republican lawmakers on the chamber’s health panels

have a bill that includes making permanent a pilot project giving

those on Medicare the option to get a voluntary prescription drug

plan where insulin only costs $35 a month.”

The politics: “Curbing insulin costs is politically

popular – and Democrats seem aware that Republicans could anger

voters by challenging such caps,” Roubein writes, adding

that Republicans have not yet detailed which of the Build

Back Better bill’s health care provisions they may challenge.

The bottom line: While Republicans remain opposed to the

Build Back Better package as a whole, Roubein reports that the key

question now may be whether the Senate parliamentarian nixes the

insulin cap as violating the budget reconciliation rules Democrats

are using to pass the legislation without GOP support. Until that

verdict comes down, Democrats are looking to publicize

their cap and score some political points. “If Republicans want to

defend higher insulin prices going into an election year, that’s a

win for Democrats,” one Democratic aide told Roubein.

Quote of the Day

“It’s sort of a roller-coaster ride when it comes to a net

tax change for folks, both at the bottom and at the top.”

– Garrett Watson, a senior policy analyst at the

Tax Foundation, in a

CNBC article explaining that tax bills may

fluctuate over the next few years if the Build Back Better bill is

enacted, “as tax provisions affecting low and high earners phase in

and out.”

Top earners would face a higher tax rate but would ultimately

pay less in 2022, according to estimates from the congressional

Joint Committee on Taxation. “That may sound like a

counterintuitive outcome,” CNBC’s Greg Iacurci writes. “But the

rich, especially those subject to the [new Build Back Better]

surtax, would likely change their behavior to avoid a higher tax

rate. Specifically, the surcharge would likely cause a ‘shift of

income’ into this year, according to the Committee.”

Number of the Day: $127.5 Million

The federal government has reportedly reached a tentative $127.5

million settlement with the families of victims of the 2018

shooting at the Marjory Stoneman Douglas High School in Parkland,

Florida. Families of the shooting victims sued the Justice

Department over the FBI’s failure to investigate tips that the

gunman was planning an attack. Seventeen people were killed in the

massacre, one of the deadliest school shootings in U.S.

history.

“The settlement comes a month after the Justice Department

agreed to pay $88 million to the families of those killed at a 2015

shooting at a historic Black church in Charleston, S.C. — which

occurred after the FBI did not conduct a thorough gun-purchase

background check of that gunman,” The Washington Post

reports.

Programming note: We're off the rest

of the week but will be back in your inboxes on Monday. Send your

feedback to yrosenberg@thefiscaltimes.com.

News

Biden Aims to Do What Presidents Often Can’t: Beat

Inflation – Associated Press

Democrats Zero In on Cost of Living to Sell Biden Agenda:

Memo – The Hill

Biden Bill Has Tax Cut for Mere Millionaires, Hike for Mega

Rich – Bloomberg

G.O.P. Donors Back Manchin and Sinema as They Reshape Biden’s

Agenda – New York Times

Brainard Gives Biden a Jobs Ally Alongside Fed’s Inflation

Hawks – Bloomberg

US Bond Bulls Hold Their Ground in Face of Red-Hot

Inflation – Financial Times

Every Step of the Global Supply Chain Is Going Wrong — All at

Once – Bloomberg

For-Profit Colleges Fight Exclusion From Pell Grant Increase

in Biden’s Spending Bill – Washington Post

3 in 4 Americans Say Their Lives Are Back to 'Normal':

Poll – The Hill

America Isn’t Headed Toward Lockdowns, Say White House

Officials – Washington Post

Justice Dept. Asks Court to Reinstate Biden’s Vaccination

Policy for Businesses – Washington Post

CVS, Walgreens and Walmart Fueled Opioid Crisis, Jury

Finds – New York Times

Views and Analysis

President Biden’s Oil-Price Two-Step Won’t Lower Your Gas

Prices – Washington Post Editorial Board

The Non-solution to High Gas Prices Every President Is Drawn

To – Paul Waldman, Washington Post

Spending as if the Future Matters – Paul Krugman,

New York Times

Why the Senate Should Kill the Build Back Better

Bill – Stephen Moore, The Hill

The Democrats’ Last Chance to Make Build Back Better

Better – David Dayen, American Prospect

The Democratic Brand Is Broken. The Infrastructure Bill Isn’t

Fixing It – David Siders, Politico

Joe Biden’s Travails and the Deep Roots of Liberal

Despair – Greg Sargent, Washington Post

Biden: Don’t Repeat Jimmy Carter’s Catastrophic Mistake on

Inflation – Jeff Faux, American Prospect

How Softies Seized the Fed – Paul Krugman, New

York Times

Liberal Economists Got the Memo: Build Back Better Couldn't

Possibly Worsen Inflation – Merrill Matthews, The

Hill

A Better Way to Tax Corporations Than the House’s Book

Minimum Levy – Howard Gleckman, Tax Policy

Center

Why Is It So Hard to Get a Rapid Covid Test in the

US? – Therese Raphael, Bloomberg

Patients Now See Their Records, But Can They Understand

Them? – Eliana Perrin, Bloomberg

As Some Protest Life-Saving Vaccines, the Covid Threat

Marches On – Eugene Robinson, Washington Post