Welcome to the holiday weekend! The winds of war are

sadly still swirling in Ukraine, but you can distract yourself for

just a moment by taking a peek at this giant,

record-setting strawberry. Here’s what else is

going on.

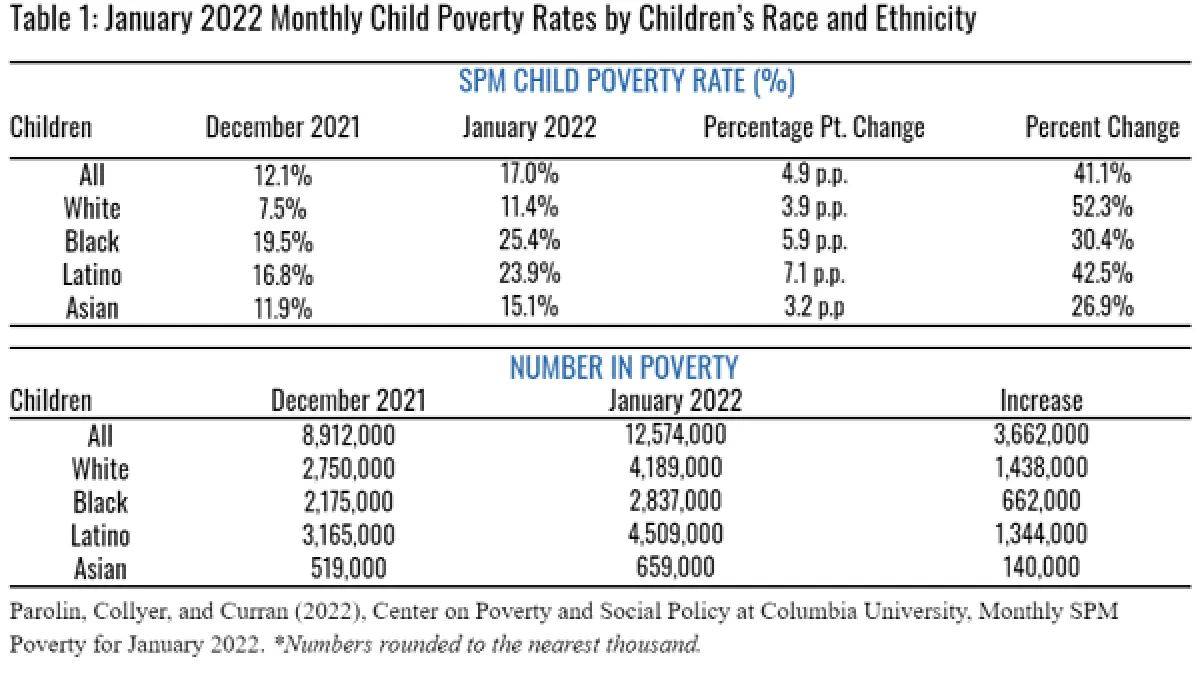

Child Poverty Rate Soars as Expanded Tax Credit Expires

Millions of children in the U.S. fell into poverty in January

after a federal program providing expanded child tax credits

expired, according to a

new analysis by the Center on Poverty and Social

Policy at Columbia University.

About 3.7 million children became impoverished between December

2021 and January 2022, the study found, pushing the child poverty

rate from 12.1% to 17% — a 41% increase. Overall, the number of

children in poverty rose from 8.9 million in December 2021 to 12.6

million last month.

The expanded child tax credit program that ended in December was

part of the $1.9 trillion American Rescue Plan signed into law by

President Joe Biden last March. The temporary program increased the

value of the child tax credit by $250 to $300 per month per child

up to the age of 17, and made the credit payable on a monthly basis

for the final six months of 2021. Roughly 36 million households

with more than 61 million children received payments, cutting the

child poverty rate by about a third.

“While in place, the monthly child tax credit payments buffered

family finances amidst the continuing pandemic, increased families’

abilities to meet their basic needs, reduced child poverty and food

insufficiency, and had no discernable negative effects on parental

employment,” the report’s authors say.

Plans to extend the program: Democrats sought to extend

the expanded tax credit for another year through their Build Back

Better bill, but resistance from Sen. Joe Manchin (D-WV) has all

but scuttled that plan.

Manchin has objected to what he sees as the program’s excessive

generosity, and reportedly has expressed concerns about the

likelihood that the cash payments would be used by parents to

purchase drugs. The conservative Democrat wants the tax credit to

come with more stringent income limits, as well as clear work

requirements — conditions opposed by many Democrats to his left.

And he has insisted that the program be paid for in full on a

realistic schedule, objecting to the short-term extension Democrats

had used to limit the official cost of their $1.75 trillion

spending package. The 10-year cost of the program is estimated to

be $1.6 trillion — nearly as large as the entire social spending

package Democrats were trying to pass late last year.

Child advocates said the increase in poverty shows that Congress

needs to figure out a way to extend the tax credit, even if it’s

smaller than the plan originally put forth by Democrats. “Today’s

report should shake Washington to its core,” Paolo Mastrangelo of

Humanity Forward, a non-profit that seeks to reduce poverty,

told The Washington Post. “This is not a moment

for staking out political positions. Congress needs to compromise

on a targeted, monthly child tax credit that will reverse these

grievous losses. Any extension, even one that is much more targeted

in size and scope, will help reduce the tragic number of families

entering poverty.”

Biden Admin Asks Congress for $5 Billion More in Global

Pandemic Funding: Report

Biden administration officials asked congressional appropriators

Friday for at least $5 billion more in funding the combat the

Covid-19 pandemic internationally, Politico’s Alice Miranda

Ollstein and Erin Banco

report. The new funding request, they write, is

“far less than agencies originally suggested would be needed to

vaccinate the global population and provide funding, staff and

other forms of relief to hard-hit regions.”

The request, reportedly made during a call involving House and

Senate lawmakers and officials from the U.S. Agency for

International Development (USAID) and other federal agencies, is

far below the $19 billion USAID requested earlier this month for

its Covid-19 efforts in 2022, and it’s also well shy of the $17

billion in funding progressives have said is needed for global

pandemic aid efforts.

Health and Human Services Secretary Xavier Becerra earlier this

week told Congress that his department needs at least $30 billion

more for its domestic Covid-19 response, including vaccine

distribution and testing.

How Build Back Better May Rise Again

President Biden earlier this week again pitched his Build Back

Better agenda, telling a gathering of the National Association of

Counties that his plan would help middle-class families “getting

clobbered by the cost of everyday things” by capping child-care

expenses and cutting the cost of prescription drugs. In a tweet

Thursday, the president again touted that 17 Nobel Prize winners in

economics have said the plan will ease inflationary pressures. “We

can get this done,” Biden said.

But as The Washington Post’s Sean Sullivan and Seung Min Kim

report, “it’s not clear such a plan exists anymore, at least in any

recognizable form.” Talks between the White House and key lawmakers

about the plan “have virtually evaporated,” they report, even as

“Biden sometimes makes it sound as though Build Back Better is on

the cusp of passage.”

In reality, the plan is still clouded by questions about what

any new version might look like: “It’s far from evident what, if

any, version of Biden’s once-sweeping proposal could pass this year

and what it would include,” Sullivan and Kim say. “Would it be a

climate plan? A prescription drug initiative? A health-care

bill?”

The plan, and any potential answers to those questions, hardly

came up during a Senate Democratic lunch Thursday attended by White

House Chief of Staff Ron Klain, further evidence that the

legislation remains stalled and has been shifted to the back

burner. Sen. Joe Manchin (D-WV), whose objections to the House

version of the Build Back Better Act effectively iced it, said this

week that “there have been no formal talks for quite a while.”

The Democrats at Thursday’s lunch reportedly focused instead on

broad steps to cut costs in the economy, like a temporary gas tax

holiday. Others in the party have pushed narrower efforts to lower

the price of insulin and other prescription drugs.

The outlook for a new plan: Lawmakers’ attention has

shifted to other priorities, but Democrats haven’t ditched Biden’s

agenda.

White House spokesman Andrew Bates said in a statement to the

Post that “the president and his team are working hard with a wide

range of lawmakers on cutting costs for American families,

including with regard to prescription drugs and energy.” He also

emphasized that the plan would “reduce the deficit.”

Punchbowl

News notes that, while Senate Majority Leader Chuck

Schumer and others are still working to reach some compromise with

Manchin, the acknowledgment that Build Back Better is stalled

helped Democrats and Republicans reach a deal on topline government

funding levels for the full year and make progress toward an

omnibus spending bill. “Democrats’ push to pass BBB had been the

biggest impediment to such a bipartisan agreement,” Punchbowl says.

“House and Senate appropriators are now rushing to put together an

omnibus spending package by the new government funding deadline of

March 11. That package will include billions of dollars in earmarks

for lawmakers in both chambers, an added bonus heading into

November.”

The bottom line: Talk about elements

of the Build Back Better plan is likely to ramp up again in coming

weeks. The Post notes that a number of Senate committees are

tentatively planning hearings about potential parts of a revised

spending package, taking some steps to appease Manchin, who has

insisted that any new plan go through the regular legislative

process.

Quote of the Day: California’s Step Toward Normalcy

“We are moving past the crisis phase into a phase where we

will work to live with this virus.”

– California Gov. Gavin Newsom (D) at a news conference

Friday announcing a plan for his state to become the first in the

nation to treat the coronavirus as endemic. “The approach for

California’s almost 40 million residents could herald similar

changes throughout the United States,” The Washington Post

notes, “but widely varying vaccination rates mean

some areas may be better prepared than others.”

A programming note:

We’re off Monday for Presidents’ Day. We’ll be back in your

inbox on Tuesday. As always, send feedback to

yrosenberg@thefiscaltimes.com.

News

Biden Signs Stopgap Spending Bill Averting

Shutdown – Associated Press

Biden Shifts Inflation Message to Show He Feels Americans’

Pain – Wall Street Journal

The White House Throws Cold Water on a Restaurant Industry

Bailout – Politico

Fed Officials Push Back on Rapid Interest Rate

Hikes – Associated Press

Summers Blasts Gas-Tax Holiday as ‘Plumbing Depths’ of Bad

Ideas – Bloomberg

The Making of a New Government-Funded Moonshot

Model – Bloomberg

Only 4 States Still Have Indoor Mask Mandates; Fauci Sees

Crisis Stage Exit – Newsweek

U.S. Surgeon General Tests Positive for

Coronavirus – Washington Post

Unproven Covid Drug Use Tracked Along U.S. Party Lines, Study

Says – Bloomberg

State Department Gives Preliminary Approval to $6 Billion

Tanks Sale to Poland – The Hill

Views and Analysis

A Gas-Tax Holiday Is a Terrible Idea –

Bloomberg Editorial Board

This Is the Difference Between a Family Surviving and a

Family Sinking – Bryce Covert, New York

Times

Advocates Seek Other Pathways to Lower Drug Prices

– Rachel Roubein, Washington Post

The 2% Inflation Target Should Be Consigned to

History – Marcus Ashworth,

Bloomberg

Mr. Biden, Your Good Economy Won’t Sell Itself

– Paul Krugman, New York Times

Taxpayers Will Pay an Enormous Price for the IRS Not Using

Facial Recognition – Stewart Baker, Washington

Post

Just What Democrats Need, Another Self-Defeating Round of

Self-Flagellation – Paul Waldman, Washington

Post

Could Wages and Prices Spiral Upward in America?

– Jeanna Smialek, New York Times

The Great Resignation Is Also the Great Retirement of the

Baby Boomers. That’s a Problem – Helaine Olen,

Washington Post

A Critique of Government That Progressives Need to

Hear – Ezra Klein and Alex Tabarrok, New York

Times (podcast)

New Covid Variants Complicate the Question of Vaccine

Mandates – Faye Flam, Bloomberg

America Can Get Back to Normal and Get Better at Fighting

COVID – Eric Levitz, New York