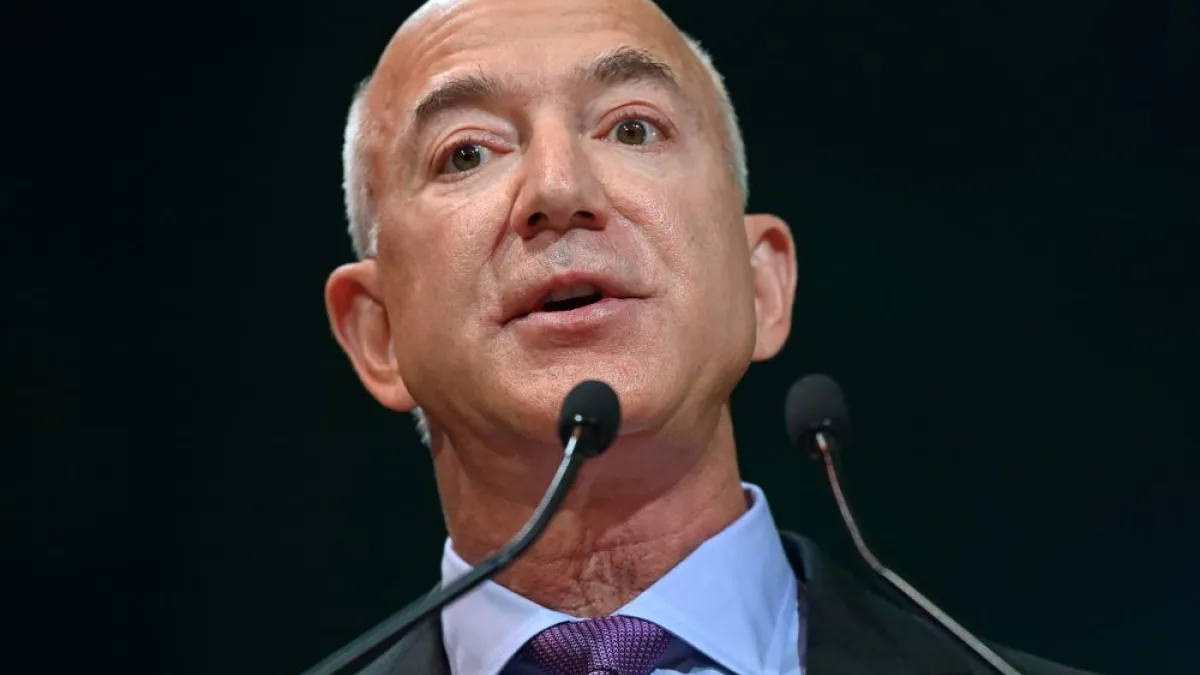

Happy Monday! The Senate will look to pass a $40 billion Ukraine aid package this week and lawmakers are eyeing action to address the baby formula shortage. Meanwhile, the White House clapped back at Jeff Bezos over a critical tweet. Here’s what’s happening.

Bezos vs. Biden on Taxes and Inflation

The White House jumped into an online battle with Jeff Bezos Monday after the Amazon founder criticized President Joe Biden for suggesting that more robust corporate tax payments could help reduce inflation.

Late last week, Biden sent a tweet linking the issues: “You want to bring down inflation? Let’s make sure the wealthiest corporations pay their fair share.”

The world’s second wealthiest man responded over the weekend, denying there was any link between corporate tax levels and inflation. “Raising corp taxes is fine to discuss,” Bezos tweeted. “Taming inflation is critical to discuss. Mushing them together is just misdirection.”

White House spokesperson Andrew Bates fired back at Bezos on Monday: “It doesn’t require a huge leap to figure out why one of the wealthiest individuals on Earth opposes an economic agenda for the middle class that cuts some of the biggest costs families face, fights inflation for the long haul, and adds to the historic deficit reduction the President is achieving by asking the richest taxpayers and corporations to pay their fair share,” Bates said in a statement.

“It’s also unsurprising that this tweet comes after the President met with labor organizers, including Amazon employees,” Bates added, suggesting that Bezos’s criticism may have been motivated by something other than a desire for greater economic precision in presidential communications.

Bezos replied quickly: “Look, a squirrel! … They understandably want to muddy the topic. They know inflation hurts the neediest the most. But unions aren’t causing inflation and neither are wealthy people,” he tweeted. “Remember the Administration tried their best to add another $3.5 TRILLION to federal spending,” he added. “They failed, but if they had succeeded, inflation would be even higher than it is today, and inflation today is at a 40 year high.”

Bezos did have kind words for one Democrat, though: West Virginia Sen. Joe Manchin, whose resistance to the Build Back Better bill assured that much of Biden’s domestic agenda would remain unfunded. “[T]he administration tried hard to inject even more stimulus into an already over-heated, inflationary economy and only Manchin saved them from themselves,” Bezos said.

Summers backs Biden: Former Treasury Secretary Larry Summers, who has been critical of the Biden administration’s $1.9 trillion American Rescue Plan, which he says contributed to inflation, stepped into the squabble Monday, defending the basic premise of Biden’s original tweet.

“I think @JeffBezos is mostly wrong in his recent attack on the @JoeBiden Admin,” Summers tweeted. “It is perfectly reasonable to believe, as I do and @POTUS asserts, that we should raise taxes to reduce demand to contain inflation and that the increases should be as progressive as possible.”

Still, Summers made it clear that he remains opposed to any additional stimulus spending by the administration, and rejects the idea, popular among some Democrats on the left, that corporate price gouging is playing a role in driving inflation higher. “I say this even though I have argued vigorously that excessively expansionary macro policy from the @federalreserve and the government have contributed to inflation,” Summers said. “I have rejected rhetoric about inflation caused by corporate gouging as preposterous.”

House Appropriation Chair Preparing Emergency Funding Bill to Address Baby Formula Shortage

Rep. Rosa DeLauro, the Connecticut Democrat who chairs the powerful House Appropriations Committee, said Monday that she would be putting forth an emergency appropriations bill to address a shortage of baby formula by funding the purchase of formula from facilities approved by the Food and Drug Administration in European countries and Mexico.

“The federal government needs to step in and do something about this and do something about it immediately,” DeLauro said, charging that Abbott Nutrition, which accounts for more than 40% of the baby formula market, has been putting profit ahead of people. Abbott formula was recalled after contaminated batches of formula were potentially linked to the death of two babies.

Abbott said Monday that it has been working on “corrective actions” and taken steps to mitigate the supply issues and has reached an agreement with the FDA on how to restart production at its Sturgis, Michigan, plant and could resume operations within two weeks. “We are confident that we can continue to produce safe, high-quality infant formula at all of our facilities as we have been doing for millions of babies around the world for decades,” the company said.

DeLauro’s committee is set to hold multiple hearings on the baby formula shortage and the federal regulatory response.

Emergency Unemployment Programs May Have Overpaid by $163 Billion: Report

U.S. officials have recovered more than $4 billion worth of improper payments made through the emergency unemployment programs put in place in response to the Covid-19 epidemic. According to one estimate, that may barely scratch the surface of the problem.

The Washington Post’s Tony Romm and Yeganeh Torbati report that an estimate provided to Congress indicates that there may have been more than $163 billion worth of “overpayments” in the unemployment programs, which paid out roughly $1 trillion during the course of the pandemic.

The estimate was provided by Larry D. Turner, an inspector general at the U.S. Department of Labor, who testified before the U.S. Senate Committee on Homeland Security and Governmental Affairs in March, but with little public awareness.

There are still a lot of questions about the size and severity of the erroneous payments, Romm and Torbati say, but there seems to be little doubt that there was significant fraud in the unemployment programs, which were managed by underfunded and poorly equipped state-level offices.

Read the full analysis by Romm and Torbati here.

Numbers of the Day

319,000: Nearly 319,000 COVID-19 deaths in the United States could have been prevented between January 2021 and April 2022 if all adults had gotten vaccinated, according to a new analysis by researchers at Brown School of Public Health, Brigham and Women’s Hospital, Harvard T.H. Chan School of Public Health and Microsoft AI for Health. “This means that at least every second person who died from Covid-19 since vaccines became available might have been saved by getting the shot,” the researchers say in a blog post. They conclude that West Virginia, Wyoming, Tennessee, Kentucky and Oklahoma are the states where the most lives could have been saved by vaccines.

The number of preventable deaths estimated in the new analysis is higher than the 234,000 total found in a similar analysis released last month by the Kaiser Family Foundation. Cynthia Cox, director of the Peterson-Kaiser Health System Tracker and a co-author of that analysis, told NPR that methodological differences may explain the varying estimates. “Unlike the KFF analysis, the new analysis included data on how many Americans were boosted — so the vaccine-preventable death total includes people who never got vaccinated, along with those whose vaccine protection had waned and who had not received a booster,” NPR reports.

53,200 and $608 billion: Eliminating air pollution from electricity generation, transportation and other energy-related sources in the United States could prevent more than 53,000 premature deaths each year save the economy an estimated $608 billion a year as the result of avoided illnesses and deaths, according to a new study published in the journal GeoHealth and highlighted by The Hill. “My hope is that our research findings might spur decision-makers grappling with the necessary move away from fossil fuels, to shift their thinking from burdens to benefits,” Jonathan Patz, senior author of the study and a professor at the University of Wisconsin–Madison’s Nelson Institute for Environmental Studies, told The Hill.

Quote of the Day

“I think that, yes, in retrospect it was a mistake and I think they agree it was a mistake. There were a number of reasons for it. One of the reasons was they wanted not to shock the market. [Fed Chair] Jay Powell was on my board during the ‘taper tantrum’ in 2013, which was a very unpleasant experience. He wanted to avoid that kind of thing by giving people as much warning as possible. And so that gradualism was one of several reasons why the Fed didn’t respond more quickly to the inflationary pressure in the middle of 2021.”

– Former Federal Reserve Chair Ben Bernanke, in an interview with CNBC, on why the central bank was slow to respond to rising inflation. Bernanke added that in early 2021, after the federal government approved some $2.8 trillion in additional pandemic aid spending, the unemployment rate remained high, the number of people working was still well below pre-pandemic levels and supply shocks were thought to be “transitory.”

“There were a couple of issues I think that are related primarily to the pandemic itself and the way that it scrambled the usual indicators that made it harder for the Fed to read the economy,” Bernanke said.

Send your feedback to yrosenberg@thefiscaltimes.com. And please encourage your friends to sign up here for their own copy of this newsletter.

News

- Biden’s Rescue Money Doled Out to Racehorse Owners, Influencers – Bloomberg

- Yellen Looks to Get Global Tax Deal Back on Track During Europe Trip – New York Times

- Biden Starts Conceding That the Bygone Era of D.C. May, Indeed, Be Gone – Politico

- Ben Bernanke Sees ‘Stagflation’ Ahead – New York Times

- Goldman’s Blankfein Says US Facing ‘Very, Very High Risk’ of Recession – The Hill

- White House Releases Plan to Boost Housing Supply – The Hill

- Sierra Club Presses Senate Democrats for Climate Investments – The Hill

- US Hits 1 Million Deaths From COVID-19 – The Hill

- The F.D.A. Is Expected to Soon Authorize Pfizer-BioNTech’s Booster for 5- to 11-Year-Olds. – New York Times

- "Fashionably Late" Novavax Is Confident Approval Is Coming – Axios

- How Australia Saved Thousands of Lives While Covid Killed a Million Americans – New York Times

Views and Analysis

- Student Debt Is Crushing. Canceling It for Everyone Is Still a Bad Idea – New York Times Editorial Board

- The Economy and Markets Have That Year 2000 Feeling – Neil Irwin, Axios

- What the End of America's Public Health Emergency Could Mean – Adriel Bettelheim and Tina Reed, Axios

- The Disastrous Legacy of the New Democrats – Alex Pareene, New Republic

- GOP to Working Class: Get Mad! But Don’t Expect Much From Us – Paul Waldman, Washington Post

- Biden Is Doing Nothing to Fight Inflation. We Should Be Grateful for That – Megan McArdle, Washington Post

- Can the Fed Pop Bubbles Before They Go Bad? – Sebastian Mallaby, Washington Post

- The Answer to Stopping the Coronavirus May Be Up Your Nose – Akiko Iwasaki, New York Times