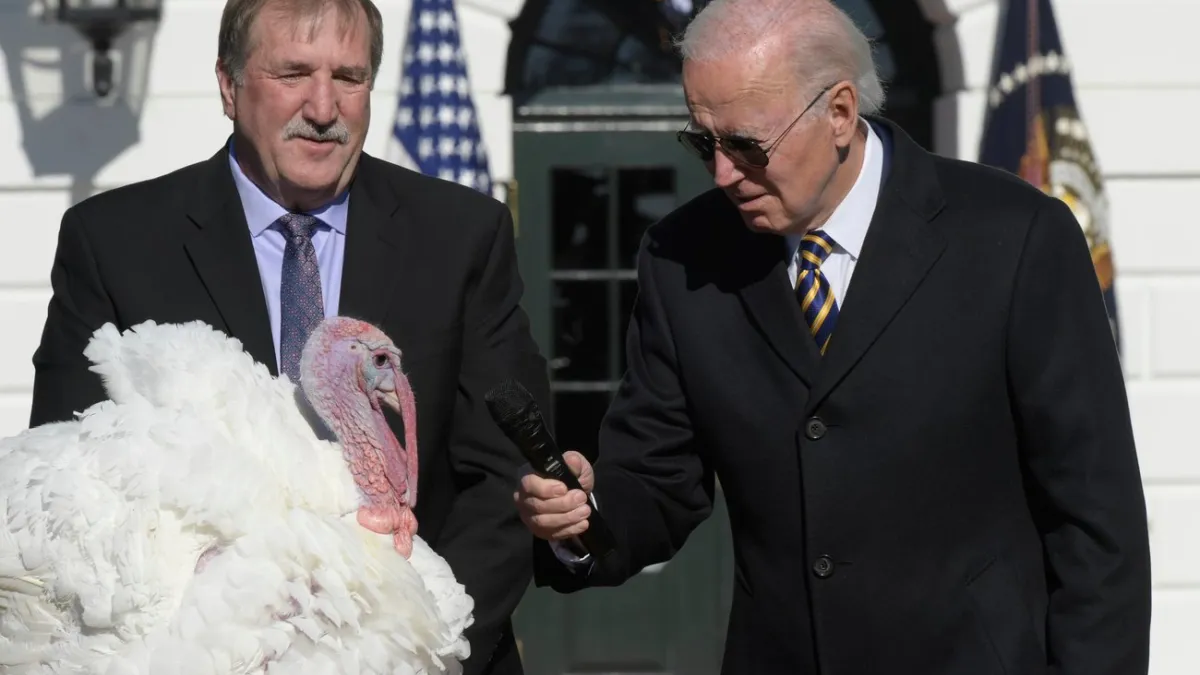

It should be a quiet week on the fiscal front as Congress is out ahead of Thursday’s Thanksgiving holiday. At a brief, joke-filled White House ceremony Monday, President Joe Biden pardoned the annual Thanksgiving turkeys, named Chocolate and Chip, and took the opportunity to work in a few election-related cracks. "The only red wave this season is going to be if [my] German Shepard Commander knocks over the cranberry sauce on our table," he said. He also urged Americans to get their Covid and flu shots. "Two years ago, we couldn’t even have Thanksgiving with large family gatherings," he said. "Now we can. That’s progress, and let’s keep it going."

Overseas, the U.S. men’s soccer team played to a disappointing 1-1 draw against Wales in its opening match of the World Cup. Next up: England on Friday.

Audits Reveal Millions in Medicare Advantage Overcharges

Newly revealed federal audits show that some Medicare Advantage health plans have overcharged the government by millions of dollars.

The audits dating back to 2011 through 2013 were made available thanks to a multi-year Freedom of Information Act lawsuit by Kaiser Health News that was settled in September. Federal auditors reviewed the files of 18,090 patients and found overcharges of about $12 million, with some plans charging more than $1,000 too much per patient on average. Applying that rate to a broader range of Medicare Advantage plans suggests overcharges totaling roughly $650 million.

Officials at the Centers for Medicare & Medicaid Services say they plan to use the analysis to recover funds in the Medicare Advantage system, which is operated by large, private insurance companies. But the agency has failed to do so for nearly 10 years, and recently postponed the announcement of a final adjustment process for overcharges.

KHN’s Fred Schulte and Holly Hacker spoke to Ted Doolittle, a former CMS official who worked on fraud and billing abuse. "I think CMS fell down on the job on this," Doolittle said, adding that the agency may be "carrying water" for the insurance industry, which is "making money hand over fist" from Medicare Advantage.

"From the outside, it seems pretty smelly," Doolittle said.

One expert in expert in medical record documentation told KHN that overcharging, driven by insurance companies claiming that patients are sicker than they really are and thereby earning higher compensation for services, is "absolutely endemic" in the Medicare Advantage system. "I don’t think there is enough oversight," the expert said.

The bottom line: Medicare Advantage has been growing rapidly and now covers more than 28 million people at an annual cost of $427 billion. It will soon cover the majority of the Medicare population. But questions remain about the government’s ability to monitor the system while protecting taxpayers from abuse.

Democrats Should Defuse the Debt-Limit Time Bomb: Orszag

Peter Orszag, the former head of the White House Office of Management and Budget and the Congressional Budget Office, warns in a Washington Post op-ed that the perils of debt-limit brinkmanship are greater than ever before.

Republicans have indicated that they will use the need to raise the debt limit sometime next year as leverage to force Democrats to accept spending cuts. Orszag warns that the danger of this tactic is heightened "because political norms that governed past negotiations — in particular, the idea that avoiding default is paramount — might no longer hold."

In addition, he writes, the market for U.S. Treasurys has seen lower liquidity and greater volatility recently — and "what the Treasury market definitively does not need is heightened uncertainty over the debt ceiling. Jitters over lower liquidity in Treasurys make threats to the debt limit more dangerous than in the past."

Orszag urges lawmakers to defuse the threat during the current lame-duck session of Congress, either in bipartisan fashion or through a Democrat-led reconciliation bill that would need only 50 votes to pass the Senate. The first approach seems far-fetched since Republicans are unlikely to cooperate in the numbers needed. Democrats have rejected the second approach, with some expressing concern that it would be too time-consuming given the many other items they have to address. The Biden administration reportedly anticipated that some Democrats (read: Sen. Joe Manchin of West Virginia) might not cooperate with a party-line plan, either.

Orszag urges congressional Democrats to reconsider: "Any Democrats averse to taking such a painful vote now should consider how much leverage their party will lose once Republicans control the House — and how much higher the risk of default will be then. It’s generally not a good idea to enter a negotiation with a ticking time bomb and a counterparty willing to let it go off."

In a similar vein, Bloomberg columnist Jonathan Bernstein warns that Democrats are making a mistake by not addressing the debt limit before Republicans take control of the House. Republicans may get the blame, but Democrats won’t be able to avoid some blowback. "Whatever voters might claim they feel about who is responsible, if the economy tanks, Biden will take the blame," he writes.

Read Orszag’s full piece at The Washington Post and Bernstein’s at Bloomberg.

Send your feedback to yrosenberg@thefiscaltimes.com. And please encourage your friends to sign up here for their own copy of this newsletter.

News

- Rail Union Rejects Contract as Strike Threatens U.S. Economy Before Holidays – Washington Post

- Divided GOP Tiptoes on Biden Request for More Ukraine Aid – The Hill

- Biden Sending Federal Aid as NY Digs Out From Huge Snowstorm – Associated Press

- Pelosi Had ‘a Career to Be Proud Of,’ Former GOP Speaker Says – Politico

- Rep. Ilhan Omar Criticizes McCarthy for Threatening to Remove Her From Committee – Washington Post

- GOP Centrists Prepare to ‘Flex Our Muscles’ – Politico

- Progressives, Once Skeptical of Biden, Rally Around His Chief of Staff – Politico

- Social Security Left At-Risk Americans Behind in Pandemic, Report Finds – Washington Post

- Defrauded Student Loan Borrowers in Line for Relief Are Still Waiting Months Later – Washington Post

- These Cities Have the Best Public Transit Systems – Bloomberg

- RSV, Covid and Flu Push Hospitals to the Brink — and It May Get Worse – Washington Post

- Coronavirus Variants Are Dodging Antibody Treatments. New Lab-Made Options May Help – Washington Post

- ‘Kind of Scary’: Amoxicillin Shortage Has Some Parents Panicking – The Hill

- NFL Games in 2020-21 Season Associated With Spikes in COVID Cases: Research – The Hill

Views and Analysis

- Threats to Weaponize the Debt Ceiling Are More Dangerous Than Ever – Peter R. Orszag, Washington Post

- Democrats Are Making a Mistake on the Debt Limit – Jonathan Bernstein, Bloomberg

- Democrats Need a Crash Course in Political Jiujitsu – Jennifer Rubin, Washington Post

- A GOP-Led House Can Shape the Agenda for 2024: Here’s How – Peter King, The Hill

- Paul Ryan Invents a New Category of Anti-Trumpism – Chris Cillizza, CNN

- Have We Been Measuring Housing Inflation All Wrong?—Justin Fox, Bloomberg

- Bond Market’s Inverted Yield Curve Has Something for Everyone – Conor Sen, Bloomberg

- COP27 Yielded a Historic Climate Fund. COP28 Must Do More, Experts Say – Maxine Joselow, Washington Post

- How This Climate Change Fund Could Fuel Populism in Richer Nations – Henry Olsen, Washington Post

- Reparations for Black Americans Can Work if They Are Reimagined – Andrew Delbanco, Washington Post