Happy Monday — or maybe not, given that tax filing season starts today. FYI, tax day this year will be Tuesday, April 18, because April 15 falls on a Saturday and Emancipation Day, a holiday in the District of Columbia, falls on Sunday but will be celebrated on Monday, April 17.

Here’s what else is going on:

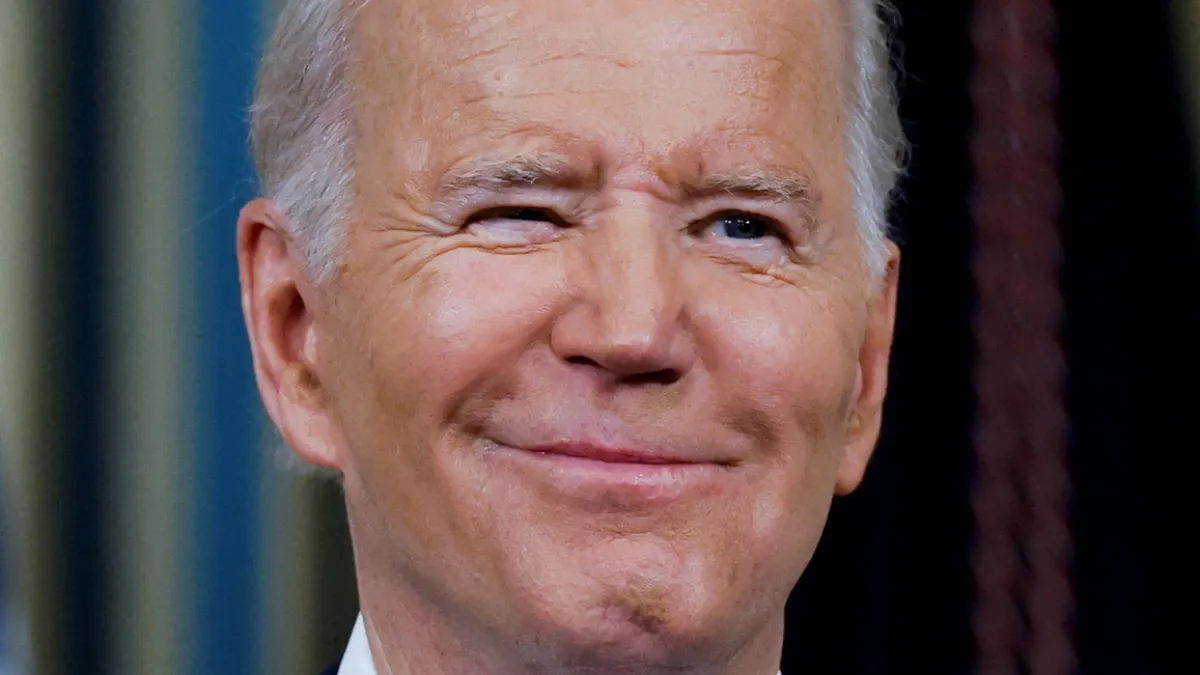

Will the Biden Ultimately Negotiate on the Debt Limit?

Will they or won’t they? The White House insists that raising the debt limit is the responsibility of Congress and that it won’t negotiate with Speaker Kevin McCarthy (R-CA) and House Republicans who are demanding concessions on spending in exchange for any increase in the borrowing limit.

“President Biden looks forward to meeting with Speaker McCarthy to discuss a range of issues, as part of a series of meetings with all new Congressional leaders to start the year,” White House Press Secretary Karine Jean-Pierre reiterated in a statement Friday. “Like the President has said many times, raising the debt ceiling is not a negotiation; it is an obligation of this country and its leaders to avoid economic chaos. Congress has always done it, and the President expects them to do their duty once again. That is not negotiable.”

McCarthy is still pushing for talks, though, and many analysts are skeptical that the White House will be able to hold out, suggesting that Biden’s team will come to the table eventually — though any deal might not be with House Republicans. “Ultimately [Senate Majority Leader Chuck] Schumer, [Senate Minority Leader Mitch] McConnell and Biden will figure something out,” Jim Kessler, executive vice president for policy at centrist Democratic think tank Third Way, told The Hill. “In the end, I think the likelihood is the agreement will come out of the Senate and the House will be forced to take it.”

What might a deal look like? Sen. Joe Manchin, the centrist Democrat from West Virginia, has floated the idea of another bipartisan commission to consider entitlement reforms.

Matthew Yglesias argues in a Bloomberg Opinion piece that the idea just might work this time, noting that the economic environment and interest rate picture are far different than they were in 2011. “Under the circumstances, a call for deficit reduction actually makes sense,” he writes.

And the politics have shifted, too. “House Speaker Kevin McCarthy and his colleagues have painted themselves into a corner on this issue. … In short, nobody in the Republican Party within six feet of a competitive election wants to run on big entitlement cuts. Which is why, for all the drama in the House, Republicans are nowhere near to producing a plan that has anything like 218 votes.”

Biden, meanwhile, is less driven to cut a grand bargain than Obama was, Yglesias argues: “He seems less convinced than Obama was of the merits of entitlement reform, and more willing than Obama was to simply go with the flow rather than trying to persuade Republicans to raise taxes.”

The result could be that the idea of a bipartisan committee could wind up with some momentum.

“My sense here is, and Biden’s been here before — he went through it in 2011 — at the end of the day it’s not ‘My way or the highway.’ He has to give something to Congress and Congress has to give to something to him,” Bill Hoagland, senior vice president at the Bipartisan Policy Center and a former Senate Republican leadership aide, told The Hill, adding that some kind of limit on discretionary spending is likely.

The question then might become what comes out of any committee. “The big question will be if there is an enforcement action tied to the ‘Rescue’ Committee,” writes Cowen analyst Chris Krueger. “Many of the folks in the White House still carry scar tissue from the 2011 fight. We would be surprised if any enforcement mechanism was attached to a Rescue Committee.”

6 Million Jobs Could Be Lost if US Defaults on Debt: Moody’s

If the Republican-led showdown over the debt ceiling goes off the rails and results in a default on the nation’s obligations, the U.S. economy could suffer a severe economic blow, according to a new analysis by Mark Zandi, chief economist at Moody’s Analytics.

Moody’s economic model indicates that the economy could shrink by 4% in the event of a default, putting nearly 6 million people out of work as the unemployment rate soars above 7%. The stock market could lose a third of its value, destroying more than $12 trillion in household wealth. And interest rates would spike, producing an increase in borrowing costs that could linger for years.

Even just flirting with a default can have severe consequences and raise costs for the government, Zandi says.

The bottom line: “A bedrock of the U.S. economy and global financial system is that the U.S. government pays what it owes in a timely way,” Zandi says. “If lawmakers are unable to increase, suspend or eliminate the debt limit before the Treasury fails to make a payment to bondholders or anyone else, the resulting chaos in global financial markets will be unbearable. The U.S. and global economies will quickly descend into recession. In the more than century since the debt limit became law, lawmakers have taken strident warnings like these to heart and acted. Let us hope they do so again. Soon.”

Elizabeth Warren Slams GOP ‘Con Game’ on Debt Limit

Sen. Elizabeth Warren (D-MA) is calling on Democrats to resist the Republican demand for negotiations over raising the $31.4 trillion debt ceiling, saying it’s just another GOP attempt to slash federal spending while protecting the rich from tax increases.

In an op-ed published by The Boston Globe this weekend, Warren accused Republicans of “running a con game” when it comes to the national debt, which she argues has been driven higher not by excessive spending but by repeated tax cuts that have overwhelmingly benefited the wealthiest Americans.

“For generations, Republicans in Washington have relentlessly driven up the national debt by shoveling tax breaks to the rich,” Warren wrote. “The cumulative impact has been staggering. In the 1950s, corporations paid 6 percent of the cost of running our country; today, that number has fallen to 1 percent. The 2017 Republican tax cuts were the latest blow — a $1.9 trillion giveaway to wealthy individuals and multinational corporations.”

Warren questioned Republicans’ professed concern about the national debt, pointing out that the first bill the GOP-led House passed would increase deficits by reducing funding for IRS enforcement, even as GOP lawmakers talk about new tax cuts. “It seems that more debt is fine with Republicans in Congress, so long as it profits the wealthy and well-connected,” Warren wrote.

Republicans have used the debt ceiling playbook before, Warren said, creating a showdown in 2011 that had long-lasting effects, including years of lackluster growth under a Democratic president. “After nearly a decade of reckless Bush tax cuts, they manufactured another debt ceiling crisis, which they then leveraged to push through a massive austerity program,” she wrote. “Those GOP budget cuts cost the US economy more than 7 million jobs, delayed our recovery from the Great Recession by years, and helped set the stage for Donald Trump’s election in 2016.”

Criticizing tax cuts: Warren wants Democrats to flip the script by laying the blame for the increase in the national debt at Republicans’ feet while rejecting their calls for spending cuts in return for raising the debt ceiling. “Here’s the ultimate irony of today’s Republican scam: Without years of Republican handouts to the wealthy, there would be no debt ceiling hostage to take,” she wrote. “If Republicans hadn’t spent nearly $2 trillion on the Trump tax cuts and abetted wealthy tax cheats by starving the IRS for a decade, the United States wouldn’t need to raise the debt ceiling this year. In fact, the current debt ceiling would have sustained federal spending well past the end of President Biden’s first term.”

If Republican tax cuts are responsible for the runup in the debt, then reversing those cuts should be on the table, the senator argued. “Serious conversations about reducing the national debt should start here: Repeal the 2017 Trump tax giveaways to the wealthy,” Warren said. “Let’s close that door before the next $1 trillion slips away.”

Warren also called for closing loopholes in the 15% minimum corporate tax, shutting down tax havens and a tax on billionaire’s wealth — which, taken together, Warren said could raise about $1 trillion in revenue.

“Democrats need to stiffen their spines and say enough is enough,” Warren concludes. “If Republicans actually care about the national debt, they can do what generations of politicians have refused to do — finally agree that billionaires and giant corporations should pitch in just like everyone else.”

Biden to Name a New Chief of Staff: Reports

Just past the two-year mark of his administration, Biden is faced with a Republican-controlled House gung-ho to launch a series of investigations and is suddenly mired in controversy over his handling of classified documents. Now, the president is reportedly set to get a new chief of staff.

Jeff Zients, who oversaw the Biden administration’s coronavirus response until April before returning to the White House in the fall, will reportedly replace Ron Klain, a key member of Biden’s inner circle, who is expected to step down some time after the State of the Union address on February 7. Zients, known for his management skill, will reportedly be tasked with keeping the administration running and implementing Biden’s legislative successes while other Biden advisers focus more on political maneuvering ahead of an expected re-election bid.

Biden is set to meet Tuesday with Democratic congressional leaders and he’ll continue touting his economic agenda over the next eight days in planned trips to Virginia, Baltimore and New York City.

Chart of the Day: Social Security Shortfall

The Social Security trustees estimate that the combined Old-Age and Survivors Insurance (OASI) and Social Security Disability Insurance (SSDI) trust funds will run dry in 2035, resulting in a cut in benefits as the system is forced to rely solely on annual revenues. In its recently updated analysis of the same issue, the Congressional Budget Office came to a more pessimistic conclusion, estimating that the combined trust will run dry in 2033, two years earlier.

“The difference between CBO’s projections and those of the Trustees are likely driven by differences in demographic and economic assumptions,” says the Committee for a Responsible Federal Budget. “For example, the Trustees project that nominal GDP will be over 40% larger in 2096 than CBO predicts.”

Quote of the Day

“There was widespread weakness among leading indicators in December, indicating deteriorating conditions for labor markets, manufacturing, housing construction, and financial markets in the months ahead. … Overall economic activity is likely to turn negative in the coming quarters before picking up again in the final quarter of 2023.”

− Ataman Ozyildirim, senior director for economics at The Conference Board, whose Leading Economic Index fell by 1% in December, marking the 10th straight monthly drop. “On average, the index peaks about a year ahead of a recession, according to the Conference Board,” CNN’s Alicia Wallace notes. “The index appears to have peaked in February 2022, the Conference Board noted.”

News

- House GOP Keeps Up Attacks on IRS With Bill to Abolish the Agency – CNN

- How the U.S. Government Amassed $31 Trillion in Debt – New York Times

- Democrats May Have to Bend on Negotiations With GOP on Debt Ceiling – The Hill

- McConnell Is a Key Player in Approaching Debt Ceiling Fight – The Hill

- Janet Yellen Dismisses Minting $1 Trillion Coin to Avoid Default – Wall Street Journal

- Why the Mainstream Right Wants to Kill the Fair Tax – Politico

- The Fed’s New Challenge: Stay on the Gas or Tap the Brakes? – Washington Post

- Big Winners From Biden's Climate Law: Republicans Who Voted Against It – Politico

- FDA Proposes Simplifying the Covid Vaccine Schedule, Making It Similar to the Flu Shot – NBC News

- How Kevin McCarthy Forged an Ironclad Bond With Marjorie Taylor Greene – New York Times

Views and Analysis

- The Constitution Has a 155-Year-Old Answer to the Debt Ceiling – Eric Foner, New York Times

- Manchin’s Plan to Avert a Debt Crisis Just Might Work – Matthew Yglesias, Bloomberg

- The Smart Bipartisan Plan to Shore Up Social Security – Ryan Cooper, American Prospect

- Go Ahead, Republicans, Pass a National Sales Tax – Timothy Noah, New Republic

- The December Omnibus Bill’s Little Secret: It Was Also a Giant Health Bill – Margot Sanger-Katz, New York Times

- The GOP Tax Plan Is to Let the Rich Pay Less and Make You Pay More – Jennifer Rubin, Washington Post

- Is Kevin McCarthy’s Secret Weapon Joe Biden? – Robert Kuttner, American Prospect

- What to Root for in This Weird Economy – Zachary B. Wolf, CNN

- Drug Companies Could Have Made Naloxone More Accessible. Why Didn’t They? – Leana S. Wen, Washington Post