Happy Tuesday! Today is National Hug a Newsperson Day. Really. It’s a thing, apparently. Also today, coincidentally, seemingly every newsperson in America was busy covering the arraignment of former President Donald Trump, who pleaded not guilty to 34 criminal counts of falsifying business records in the first degree. The charges — a first for any former president — stem from hush money payments made ahead of the 2016 election.

Here's what else we’re watching.

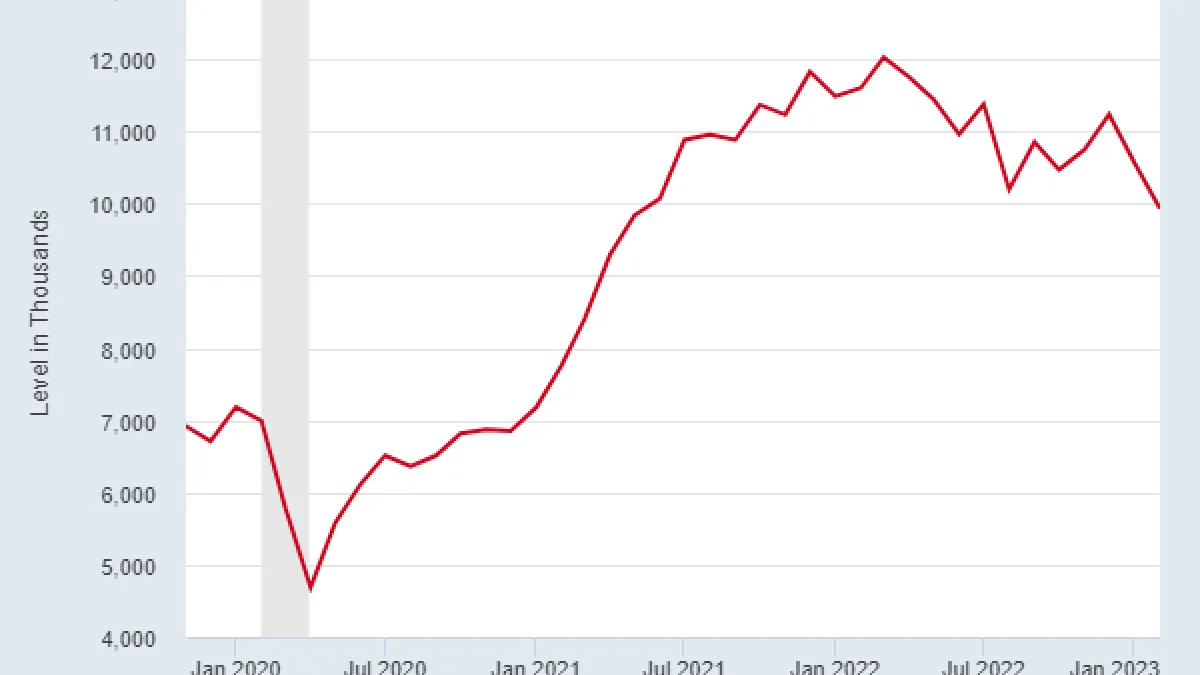

Job Openings Drop Below 10 Million for First Time in Nearly Two Years

The number of available jobs in the U.S. dropped sharply in February, the Bureau of Labor Statistics reported Tuesday, falling to 9.9 million from 10.5 million a month earlier. The results were well below analysts’ expectations and mark the first time job openings have fallen below 10 million since May 2021.

The decrease is a sign that the labor market continues to cool while remaining relatively healthy. Job openings peaked at 12 million in March 2022 and have been bouncing lower ever since, but the number of available jobs is still high relative to pre-pandemic standards; in February 2020, employers posted about 7 million open positions.

The number of jobs available per unemployed worker fell, as well, dropping to 1.67 in February, down from nearly 1.9 in January. Before the pandemic, there were 1.2 jobs per unemployed worker.

Good news for the Fed? The Federal Reserve is trying to slow the economy by raising interest rates, with the goal of reducing inflation by weakening the labor market and easing upward pressure on wages. Tuesday’s report provides more evidence that the Fed’s campaign is having its intended effect.

“We’re finally seeing companies cutting back their openings, which is the first step towards easing the tightness of the labor market,” Lightcast economist Ron Hetrick told The Wall Street Journal. “This could be what a soft landing looks like in today’s economy.”

Bloomberg economist Stuart Paul said the report “shows the labor market is unambiguously cooling, with labor demand moving more in line with supply. Most of the loosening has come via a decline in job openings, which should help alleviate Fed concerns of a potential wage-price spiral.”

Jeffrey Roach, chief economist at LPL Financial, told CNBC that the “labor market is starting to loosen as the number of job openings declined in most sectors. As the economy slows, firms will likely cut openings and workers will be less likely to quit in search of better hours and higher pay.” Roach added that the report could push the Fed toward pausing its interest rate increases, although that would likely require additional signs of softening in employment and inflation ahead of the next Fed meeting in May.

Biden Administration Sending Another $2.6 Billion in Military Aid to Ukraine

The Department of Defense announced Tuesday that is sending another $500 million worth of arms and equipment to Ukraine. In addition, the Defense Department will spend $2.1 billion in Ukraine Security Assistance Initiative funds to purchase a “significant package of air defense capabilities, as well as artillery and tank ammunition, mortar systems, rockets, and anti-armor systems” directly from U.S. defense contractors.

The latest arms package includes “more ammunition for U.S.-provided HIMARS [High Mobility Artillery Rocket System], air defense interceptors, and artillery rounds that Ukraine is using to defend itself, as well as anti-armor systems, small arms, heavy equipment transport vehicles, and maintenance support,” the Pentagon said in a press release.

The Pentagon also updated its tally of total military aid the U.S. has committed to Ukraine so far: $35.8 billion. The list of arms and material flowing to Ukraine — including 1.5 million 155mm artillery rounds, 10,000 Javelin anti-tank missiles, 2,000 Humvees and 1.8 million rounds of 25mm ammunition — now runs to three pages.

Quote of the Day

“House Republicans can’t negotiate the budget with President Biden until they finish negotiating with themselves.”

− White House spokesman Andrew Bates, in a RealClearPolitics article describing the state of negotiations over raising the debt limit as lawmakers are out on a two-week recess. Those talks are essentially non-existent at this point, as the two sides continue to point fingers and Republicans have yet to release a budget plan or official proposals for spending cuts. “Once they get their act together and remove the prospect of a default, and submit a budget,” Bates told RealClear, “we can have a full conversation about spending priorities.”

Opinion of the Day: Don’t Be Fooled by the Social Security Insolvency Date

Budget expert Brian Riedl argues that the new Social Security and Medicare insolvency dates projected last week by the programs’ trustees are a distraction.

In a piece for the National Review and an accompanying Twitter thread, Riedl, a senior fellow at the conservative Manhattan Institute and former GOP congressional staffer, writes that the insolvency dates — 2031 for Medicare’s hospital insurance trust fund and 2033 for Social Security’s Old Age and Survivors Insurance program — understate the financial troubles facing the programs.

The latest projections “feed the faulty assumption that Social Security and Medicare benefits are fully funded for the near future, and thus reform is less urgent,” he writes.

Riedl writes that the Medicare projection is only for Part A of the program, not Parts B and D, which will run a $447 billion shortfall this year. And, he says, the Social Security and Medicare trust funds will ultimately be covered by taxes and borrowing, just the same as if the trust funds did not exist.

“This year, Social Security and Medicare will collect $1.7 trillion in payroll taxes, premiums, etc, and spend $2.3 trillion in benefits. That $649 billion shortfall comprises half the 2023 budget deficit. And these annual shortfalls rise to $2 trillion within a decade,” he writes. “So, no, reform cannot wait a decade until the trust funds go insolvent, because in the meantime SocSec and Medicare will add $13 trillion to the debt and raise the cost of eventual reforms.”

Over the next 30 years, Riedl adds, Social Security and Medicare are projected to spend $156 trillion on benefits but collect only $87 trillion in taxes and premiums.

Riedl argues that paying all promised benefits would involve “crippling tax hikes” that would leave little room to finance any other new spending. So reforms — including higher eligibility ages, benefit trims for top earners and health-care improvements — should be phased in, and soon.

“Delay only locks in higher benefit levels and deeper government debt, which makes the inevitable future reforms deeper and more drastic,” he writes. “Social Security and Medicare can be made sustainable for future generations. But we should not be lured into complacency by barely relevant trust-fund insolvency dates.”

Chart of the Day: Medicaid and Work Requirements

As House Republicans push for spending cuts, one idea they have embraced is ratcheting up work requirements for federal benefit programs, including food stamps and Medicaid. House Speaker Kevin McCarthy called for “strengthening work requirements for those without dependents who can work” in a letter to President Joe Biden last week.

But Drew Altman, president and CEO of the Kaiser Family Foundation, a nonprofit focused on national health issues, wrote in a Twitter thread Monday that increased work requirements “wouldn’t accomplish GOP goals of encouraging work or saving a lot of money.”

The main reason, he explains, is that “most people on Medicaid (63% of nonelderly enrollees not qualifying based on a disability) already work full- or part-time. Most others (all but 7%) aren't working for reasons that likely would exempt them, e.g. caregiving or school.”

Send your feedback to yrosenberg@thefiscaltimes.com.

News

- The Senate’s Social Security Reform Gang Is in Trouble – Semafor

- WH: Biden Can’t Negotiate Until GOP ‘Finish Negotiating With Themselves’ – RealClearPolitics

- IRS to Unveil $80 Billion 10-Year Spending Plan This Week, Yellen Says – Reuters

- House GOP Ratchets Up Focus on Tougher Work Requirements – The Hill

- House GOP Launches Probe Into Use of COVID-19 Education Funds – The Hill

- Inflation Helped Drive ACA Premiums Up 3.4% – Axios

- Treasury Tops Up Tax Credits Where Fossil Fuel Jobs Were Lost – Roll Call

- FDA to Okay Second Omicron-Targeting Booster for Some, Officials Say – Washington Post

Views and Analysis

- Don’t Expect Standoff Over Debt Limit to End Any Time Soon – Stuart Rothenberg, Roll Call

- The GOP Has No Idea What It Wants on the Budget, but It’s Definitely Not That – Catherine Rampell, Washington Post

- How Policymakers Fight a Losing Battle With Models – Sen. Elizabeth Warren (D-MA), American Prospect

- The Job Market Is (Still) Weird – Neil Irwin, Axios

- Understanding the Red State Death Trip – Paul Krugman, New York Times

- Republicans Must Get Over Their Fear of Medicare – Karl W. Smith, Bloomberg

- Why Cheaper Insulin Today Risks Higher Costs Later – Ilena Peng, Bloomberg Businessweek

- Cecilia Rouse Did Her Best to Make Democracy Educational Again – E.J. Dionne Jr., Washington Post

- Just How Dangerous Are India’s Generic Drugs? Very – Ruth Pollard, Bloomberg

- Another COVID Fail: School Budget Cliffs With Gaping Holes – Steve Miller, RealClearInvestigations