Happy Thursday! On this date 54 years ago, Neil Armstrong and Buzz Aldrin became the first people to walk on the moon. Here on Earth, the FIFA Women's World Cup is underway and the host Australia and New Zealand teams have already posted 1-0 wins. The U.S. team’s first match in Friday at 9 p.m. EDT against Vietnam. Will you be watching?

Here’s what else is happening.

A Boost for Biden? Wages Are FInally Rising Faster Than Prices

For the first time since April 2021, wages for American workers have started rising in real dollar terms on a year-over-year basis, thanks in large part to the decline in inflation.

“With inflation finally cooling, workers’ wages are now rising faster than prices,” The Washington Post’s Jeff Stein wrote Thursday. “For most of Biden’s administration, inflation rose faster than earnings, meaning most Americans were getting poorer even as the economy grew and unemployment fell.”

The positive trend, which is only two months old at this point, could have something to do with the recent improvement in consumer sentiment, which showed significant improvement in July in a widely cited University of Michigan survey. Although it’s too soon to say for sure, the better consumer mood could show up in attitudes toward President Joe Biden, whose efforts to sell “Bidenomics” to American voters haven’t yet translated to stronger poll numbers.

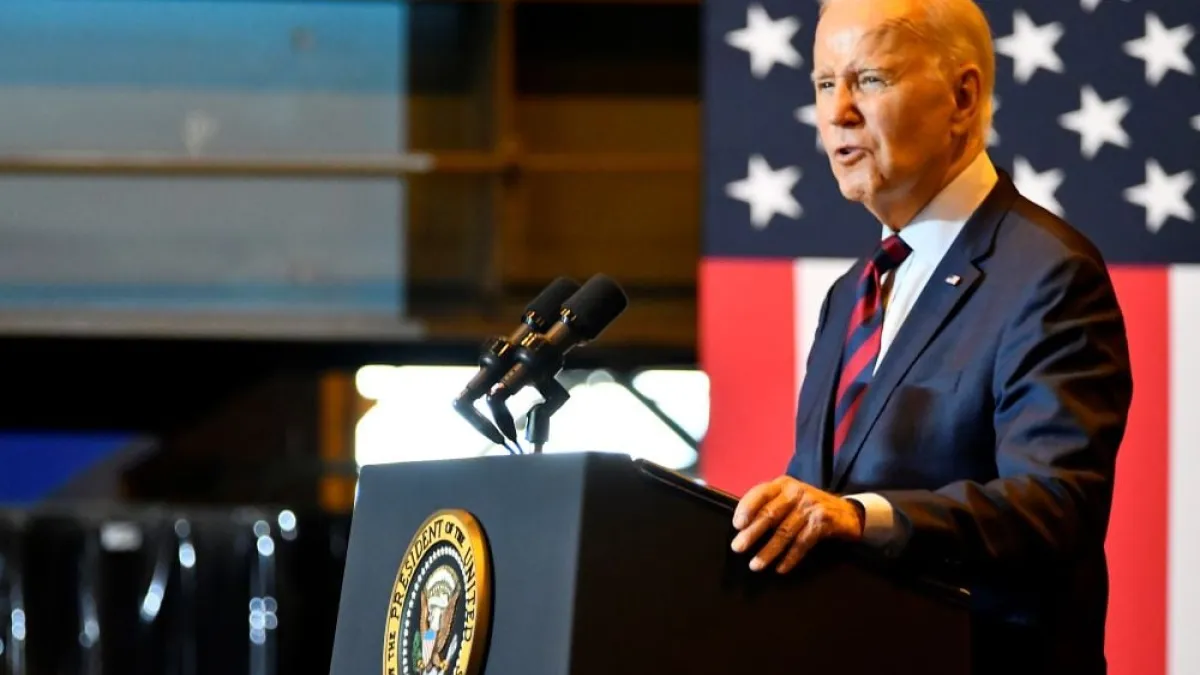

Biden on Thursday again highlighted the economic progress made over the last year. “The U.S. has the lowest inflation rate of any major economy in the world — the so-called G7. It’s less than two thirds of what it was a year ago — down from 9% to 3% — and going to go down lower,” he said in a speech at the Philadelphia Shipyard. “At the same time, pay for low-wage workers has gone up at a faster pace in over two decades. Wages are growing faster than inflation. That means a lot of working folks are beginning to be able to have just a little bit of breathing room.”

As wages “start to make up for the huge amount of ground that was lost, I would expect people to be more optimistic about the economy,” former Obama administration economist Jason Furman told Stein. “If this holds up, it would be helpful to the president politically.”

Number of the Day: $103 Billion

The House approved a bill Thursday that would reauthorize the Federal Aviation Administration for the next five years at a cost of $103 billion. Although the 351-69 vote was bipartisan and not particularly close, lawmakers did have to work their way through some disagreements about specific issues — including pilot training requirements and the availability of long-distance flights from Reagan Washington National Airport — before they could send the bill to the Senate, where it faces a late September deadline.

In its present form, the bill would increase the number of air traffic controllers, provide funds for airport modernization projects and clarify the rules governing ticket refunds for passengers, among other things. Several amendments to the bill touching on controversial issues that preoccupy the far right were rejected, including a measure from Illinois Republican Rep. Mary Miller that would have restricted funding for diversity, equity and inclusion initiatives, and another from Tennessee Republican Rep. Andy Ogles that would have required the FAA to consider “weather” but not “climate change” in its analysis of air turbulence.

Transportation and Infrastructure Committee Chairman Sam Graves, a Republican from Missouri, highlighted the importance of passing the bill on time. “It’s vital to our economy, to millions of American jobs, and to the 850 million passengers that depend on our National Airspace System every year,” he said on the House floor. “If Congress fails to act on a new long-term aviation measure by September 30, when the current FAA law expires, key aviation programs will cease to function.”

Just 36% of Hospitals Are Complying With Price Transparency Rule: Report

A federal law that took effect at the start of 2021 requires hospitals to meet new standards for price transparency. Two and a half years later, only 36% of hospitals are complying with the rule, according to a semi-annual report by the nonprofit Patient Right Advocate.

The group analyzed the websites of 2,000 U.S. hospitals from May 9 through July 14 and found that just 721 of them are in full compliance with the rule. While most hospitals have posted the pricing files required by law, “the widescale noncompliance of 64% of hospitals is due to most hospitals’ files being incomplete or not having prices clearly associated with both payer and plan,” the report says. A far smaller number of hospitals — just 69 of those reviewed, or 3.5% — had no usable files posted on their pricing.

The latest review also represents some progress compared to February, when the compliance rate was a reported 25%. “Interestingly, 256 of the hospitals we found to be noncompliant in our February 2023 report are now compliant; however, 40 of the hospitals deemed compliant in the February 2023 report were found to be noncompliant in this report,” the latest document says.

The Centers for Medicare and Medicaid Services is responsible for enforcement of the rule and it imposed its first penalties for noncompliance in June 2022. The report notes that both penalized hospitals immediately came into compliance. “Yet, in April of 2023, only two more hospitals were fined,” the report says. “Both were still found to be noncompliant in this review. As of the time of this report, a total of four hospitals have been penalized, 0.2% of the hospitals that CMS recognized as noncompliant. Clearly, CMS is not strongly enforcing the rule.”

Quote of the Day

"We aren't going to cut expenses in the government. We aren't going to increase taxes that much. We aren't going to go to a bailout with the IMF, that's not realistic. And we're not going to default. The only alternative is to inflate your way out."

— David Rubenstein, co-founder of the Carlyle Group, speaking about solutions to the $32 trillion U.S. national debt on Bloomberg TV, per Insider.

Send your feedback to yrosenberg@thefiscaltimes.com. And please encourage your friends to sign up here for their own copy of this newsletter.

Fiscal News Roundup

- Senate Takes Up Controversial Defense Bill After House Brawl – The Hill

- GOP Lawmaker Says He’s Not Attempting to Block NDAA – Politico

- House GOP Blocks Funds to LGBT Groups, Using Budget in Culture Wars – Washington Post

- Major Aviation Policy Bill Sails Through the House – Politico

- Bid to Add Long-Distance DCA Flights Fails as House Passes FAA Bill – Washington Post

- Bernanke Says Next Fed Interest Rate Hike May Be Its Last – Bloomberg

- Billions of Dollars Are Flowing, But Money Alone Can’t Fix US Infrastructure – Bloomberg

- Tornado Damage to Pfizer Plant Could Worsen Drug Shortages – The Hill

- Covid Changed Newt Gingrich’s Mind About Health Research Funding – Politico

- Vermont Senators Are Laying the Groundwork for a Supplemental Disaster Aid Request – Politico

Views and Analysis

- The Public Has Been Sour on Biden’s Economy. Is That About to Change? – Jeff Stein, Washington Post

- The Economy Is Going Biden’s Way. Now He Has to Get Voters to Give Him Credit – Nancy Cook, Bloomberg Businessweek

- A Cautious Cheer for ‘Bidenomics’? Let’s Look. – Olivier Knox, Washington Post

- The Hidden Way Bidenomics Is Already Weakening Trump’s 2024 Hopes – Greg Sargent, Washington Post

- The Overlooked Reason Our Health Care System Crushes Patients – Chavi Karkowsky, New York Times

- The Strange Unseriousness of No Labels – Katherine Miller, New York Times

- Our Democracy Is Menaced by Two Dragons. Here’s How to Slay Them. – Danielle Allen, Washington Post