Good evening and goodbye to November! Before we welcome in December, the political world will be drawn tonight to the spectacle of a debate at 9 p.m. ET between California’s Democratic governor, Gavin Newsom, and the Republican governor of Florida, Ron DeSantis, who’s running for the GOP presidential nomination. “One of these guys has managed, with admirable boldness and skill, to establish himself as a viable alternative to his party’s embattled front-runner,” Washington Post Columnist Matt Bai writes. “The other guy is actually a declared candidate for president.”

Here's what else is happening.

Inflation Slows Again: Soft Landing Ahead?

A key measure of inflation was flat in October, raising hopes that the still-healthy economy can avoid a recession even as inflationary pressure continues to dissipate.

The Commerce Department’s personal consumption expenditures price index rose 0.0% on a monthly basis in October, the government reported Thursday. The same index rose 0.4% in both September and August.

On a 12-month basis, the PCE price index rose 3.0%, the lowest level since March 2021. The same index rose 3.4% on a 12-month basis in each of the three previous months.

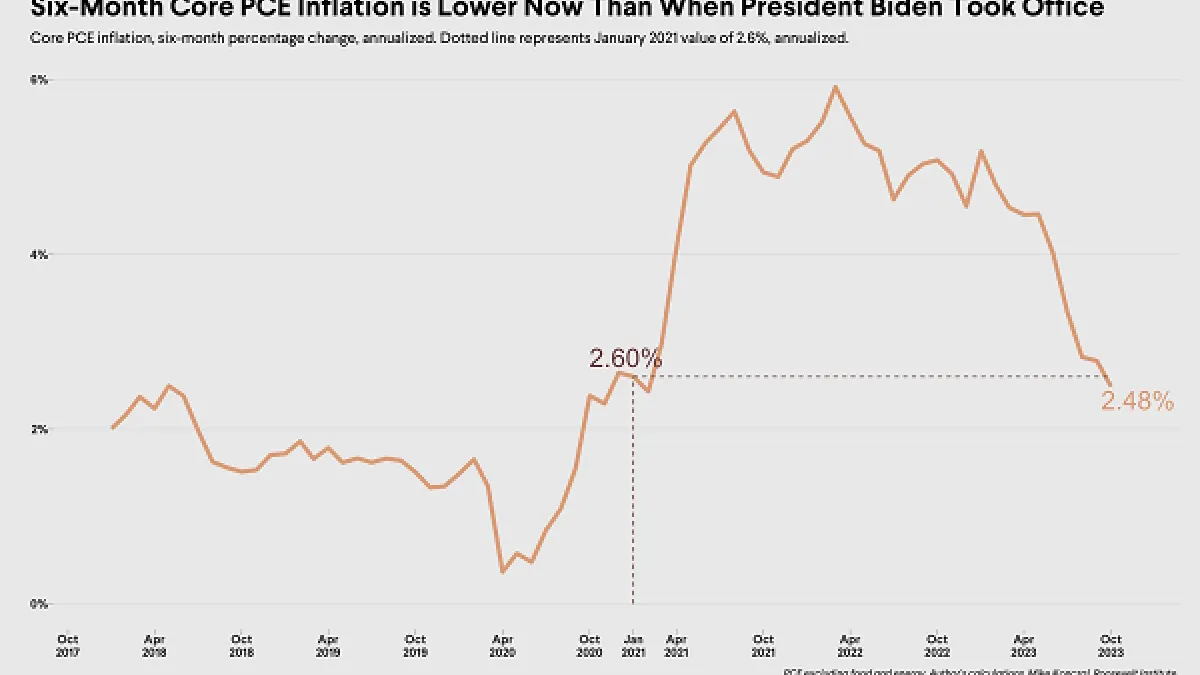

Another key measure closely watched by the Federal Reserve, the core PCE price index — which strips out volatile food and fuel prices — rose 0.2% on a monthly basis, and 3.5% on a 12-month basis. Looking at just the last six months, the core CPE rose at a 2.5% annualized rate, not far from the Fed’s 2% target.

Economist Mike Konczal of the Roosevelt Institute, a left-leaning think tank, noted that on a six-month basis, core inflation is now below where it was when President Joe Biden came into office (see his chart above). “This disinflation is simply unprecedented in the past 60 years,” he wrote. “But the supply shock challenges from reopening were equally unprecedented.”

Former Obama administration economist Jason Furman said the much-discussed “soft landing” scenario, in which inflation falls without a crushing recession or high unemployment, is looking more likely. “I’m later to proclaim it than many others but we're almost at the soft landing,” he said on social media.

Treasury Secretary Janet Yellen cited the same positive scenario. “Signs are very good that we’ll achieve a soft landing, with unemployment stabilizing more or less where it is, or in the general vicinity,” she told reporters.

Yellen also noted that in previous battles against inflation, the Fed had “found it necessary to tighten so much that they flipped the economy into a recession.” Yellen said she hoped that would be avoided this time around. “Perhaps it was necessary in order to reduce inflation and expectations of inflation that became ingrained, but we don’t need that now,” she said.

New York Fed President John Williams said Thursday morning that the central bank will probably hold off on any further interest rate increases. “[B]ased on what I know now, my assessment is that we are at, or near, the peak level of the target range of the federal funds rate,” he said. Williams added that Fed policy is the most restrictive it’s been in 25 years, and it may need to stay that way for “quite some time” to be sure that inflation is defeated.

Williams said he expects the headline inflation rate to end the year at 3%, before falling to 2.25% in 2024.

Op-Ed of the Day: Curing What Ails Nonprofit Hospitals

In a guest essay at The New York Times, Dr. Amol S. Navathe asks why many nonprofit hospitals — exempt from federal, state and local taxes —have been engaged in a series of troubling actions that seem contrary to their mission, including acquisition sprees that are likely to result in costlier care.

Navathe, a senior fellow at the Leonard Davis Institute of Health Economics and a co-director of the Healthcare Transformation Institute at the University of Pennsylvania, writes:

“Hospitals are undergoing a reckoning about their role in the national health system. The United States will require fewer hospital beds in the future if current trends continue. This looming likelihood, plus financial challenges from the pandemic, a severe worker shortage, rising inflation and stock market volatility have put nonprofit hospitals in survival mode.

“Accordingly, they have prioritized protecting their finances, focusing on scale and market power. Unfortunately, these actions too often come at the expense of their mission to serve their communities. This has meant less charity care for patients who cannot afford expensive surgeries or emergency room visits and higher prices for those who can.”

The solution, Navathe suggests, lies with the hospitals’ boards of directors, which can set priorities and determine which metrics matter for executive pay packages: “The key is getting boards to act in service of the mission. They need greater accountability. And that’s where lawmakers and policymakers can help, by finding ways to encourage or require boards to resist the growth interests common to organizations. Hospital systems, like living organisms, tend to put survival and proliferation above all else.”

Read more of Navathe’s recommendations at The New York Times.

Number of the Day: 3:10

As lawmakers scramble to try to reach a deal on border security measures and an aid package for Ukraine, Israel and other national security requests from the Biden administration, the Senate adjourned for the week today at about 3:10 p.m. It is only scheduled to be in session for two more weeks this year.

Send your feedback to yrosenberg@thefiscaltimes.com. And please encourage your friends to sign up here for their own copy of this newsletter.

Fiscal News Roundup

- Defense Bill, Passed 62 Years in a Row, Faces Partisan Minefields in Senate, House – The Hill

- Manchin Makes His Border Pitch: Expand Worker Visas, Don't Get Hung up on Parole – Politico

- Talks of a Border Deal Have Unusual Allies: Democratic Cities and States – Politico

- The 543-Word Editorial That May Have Just Upended the Presidential Campaign – Politico

- Biden Campaign Rips Trump's Health Care Policies in New Ad – CBS News

- US Economy Slowed in Recent Weeks With Inflation, Labor Cooling – Bloomberg

- Federal Reserve’s Preferred Inflation Gauge Shows Price Pressures Continuing to Cool – Associated Press

- Yellen Says Soft Landing Looks Good, Unemployment May Level Off – Bloomberg

- Fed’s Williams Expects Policy to Stay Restrictive for Some Time – Bloomberg

- S&P 500 Has One of Best November Gains in Century – Bloomberg

- Fight Against ‘Price Gouging’ on Military Parts Heats Up – Roll Call

- EPA Unveils Plan to Replace All Lead Water Pipes Within 10 Years – Axios

- Behind the Last-Ditch Effort to Save a Trucking Company That Owes $700M to Taxpayers – Axios

Views and Analysis

- Taylor Swift Brings Jay Powell Some Christmas Cheer – Jonathan Levin, Bloomberg

- Inflation’s Cooldown Gives the Fed Leeway – Justin Lahart, Wall Street Journal

- What’s Fueling Democratic Calls for Limits on Aid to Israel – Olivier Knox, Washington Post

- Why No One Wants to Pay for the Green Transition – Greg Ip, Wall Street Journal

- It’s Not the Economy. It’s the Fascism – Frank Bruni, New York Times

- How Do You Solve a Problem Like Social Security? – Grace Segers, New Republic

- Biden, Trump and ObamaCare – Wall Street Journal Editorial Board

- The Trouble With Bidenomics – James Freeman, Wall Street Journal

- Options to Improve the Child Tax Credit for Low-Income Families: An Update – Elaine Maag, Tax Policy Center