Good evening. President Donald Trump's trade war has already had an effect on the U.S. economy, as we saw in GDP numbers released today. We've got details.

US Economy Shrank in First Quarter of 2025; Trump Blames Biden

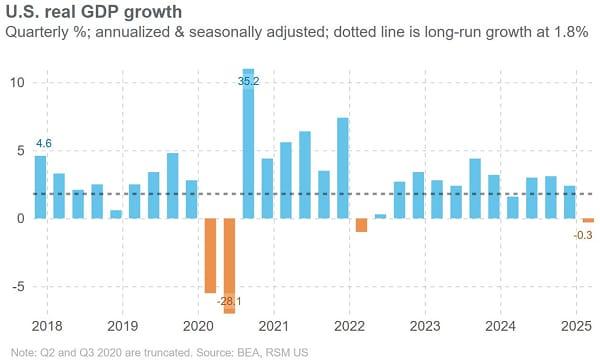

Rattled by a rapid-fire series of changes in government policy under the new Trump administration, including the threat of sharply higher tariffs and major layoffs at federal agencies, the U.S. economy contracted at an annual rate of 0.3% in the first quarter of 2025, the Commerce Department announced Wednesday.

It was the first quarterly shrinking of the economy since the first three months of 2022, when the world was struggling with the Covid pandemic, and it marked a major downshift from the 2.4% annual growth rate over the final months of 2024.

The primary driver of the contraction was a big jump in imports, which are subtracted from GDP, along with a decline in government spending. Imports surged as U.S. firms scrambled to stock up on finished goods and raw materials from overseas before President Donald Trump's tariff increases on trading partners around the world took effect in April.

The jump in imports subtracted nearly 5 percentage points from the topline GDP number, which registered the largest reduction from net imports since at least 1947, The Wall Street Journal reported.

In a separate report released Wednesday morning, the personal consumption expenditures price index rose 2.3% in March on an annual basis, above the consensus estimate of 2.1%. The core PCE index, which ignores volatile food and fuel prices to provide a better sense of the underlying trend, also came in a bit hotter than expected at 2.6%. Economists had expected to see 2.5%. On a monthly basis, though, core PCE was basically flat.

White House pushes back: Speaking at a Cabinet meeting, Trump distanced himself from the news, blaming his predecessor for the negative results. "You probably saw some numbers today, and I have to start off by saying that's Biden - that's not Trump - because we came in in January," Trump said. "We came in and I was very against everything that Biden was doing in terms of the economy. ... We took over his mess in so many different ways."

Soon after the report was released, Trump said on social media that the markets, which tumbled before recovering later in the afternoon, are still under the sway of "the Biden 'Overhang'" and that any decline in stocks has nothing to do with his policies, including tariffs. Stocks this year saw their worst start to a presidential term since 1974.

"This is Biden's Stock Market, not Trump's." (Critics noted that Trump had claimed exactly the opposite before he won reelection, when he took credit for a rising market under President Joe Biden. "THIS IS THE TRUMP STOCK MARKET BECAUSE MY POLLS AGAINST BIDEN ARE SO GOOD THAT INVESTORS ARE PROJECTING THAT I WILL WIN, AND THAT WILL DRIVE THE MARKET UP," Trump wrote in January 2024.)

White House trade advisor Peter Navarro went a step further, saying the GDP report contains all kinds of good news. "I got to say just one thing about today's news, that's the best negative print I have ever seen in my life," he told CNBC.

Navarro cited an increase in domestic investment as a sign that the economy is actually doing well, once you ignore the effects of Trump's policies. The increase in investment "is off the charts when you strip out inventories and the negative effects of the surge in imports because of the tariffs, you had 3% growth," Navarro said. "So, we really like where we're at now."

Democrats weren't buying the spin, though, and had a field day with the negative topline number. "Donald Trump inherited a strong economy - and in just 100 days, he's driving it straight into a ditch," said Democrats on the House Budget Committee. "This is what happens when you let a chaos agent run the economy. Trump's boneheaded trade war is rattling markets and gutting middle-class families in real time."

Stagflation fears rising: Although the White House was no doubt spinning the report fairly hard, economists agreed that the underlying data is not as bad as the topline number. "The headline decline overstates weakness because a lot of that was tariff-induced pull-forward," said Shannon Grein, an economist at Wells Fargo, per the Journal. "Overall, I think that it was a relatively solid underlying report when it comes to demand."

Still, the economic outlook is not as rosy as the Trump administration may like you to believe. Mark Zandi, chief economist at Moody's, told the Journal that the GDP report "probably overstates the economy's weakness, but the economy's weak" nevertheless. Consumer spending is slowing and Americans are growing increasingly worried about higher inflation and potential job losses - the stagflationary combo that dogged the economy in the 1970s.

RSM Chief Economist Joseph Brusuelas said the report indicates that the economy "rests on the knife's edge." The economy is slowing, Brusuelas warned, and the headwinds are only growing stronger thanks to Trump's trade war. "While the economy did not tumble into a recession in the first quarter, unless there is a quick unwinding of the tariffs now hitting the economy, a recession will take place in midyear," Brusuelas wrote in a research note Wednesday.

A record trade deficit: Economist Diane Swonk of KPMG noted that the trade deficit was a historic $322 billion in the first quarter - a "stunning" figure that nearly doubles the previous record set in 2020 as the economy reopened during the pandemic and U.S. consumers rushed to purchase all kinds of products. The trade deficit will likely shrink in the second quarter, but that will reflect weakness and not strength as consumers and firms struggle with rising tariffs, Swonk said, adding that the resulting price hikes could put the Federal Reserve in a difficult spot.

"Unlike the pandemic-induced inflation, we do not have a cushion on savings to buoy spending today," Swonk wrote. "Sadly, the Federal Reserve will be handcuffed by the tariff-induced inflation and unable to offset the blow to demand until that abates."

Republicans Plow Ahead on the Trump Megabill

Republicans continue their race to piece together the sections of their massive budget reconciliation bill. Three House panels approved portions of the "big, beautiful bill" on Tuesday and three more committees - Transportation, Judiciary and Oversight - took up their pieces today. But there may be trouble ahead. Here's an overview.

Republicans drop controversial $20 annual fee on cars: The House Transportation and Infrastructure Committee voted 36-30 on Wednesday afternoon to pass a plan that would provide extra funding for the Coast Guard and the Federal Aviation Administration while rescinding Biden environmental programs. The plan also called for raising about $50 billion from new fees, including annual registration fees of $200 on EVs, $100 on hybrids and, starting in 2031, $20 on all other passenger vehicles. But the annual fee on cars drew significant blowback from lawmakers in both parties, who panned the idea of a "car tax," so Republicans dropped it and instead raised the fee for EVs to $250.

The changes reportedly also reduced the money for the air traffic control system from $15 billion to $12.5 billion and trimmed the new Coast Guard funding from $23 billion to $21.2 billion.

The fees would go to the perpetually underfunded Highway Trust Fund. The plan is aimed at replacing the federal gas tax of 18.4 cents per gallon. In all, the proposal is estimated to cut more than $10 billion from deficits over a decade.

A big boost for the Pentagon: In a 35-21 vote, the House Armed Service Committee approved a plan to increase defense spending by $150 billion, including $34 billion for shipbuilding, $25 billion for a "Golden Dome" missile-defense shield and $9 billion to improve quality of life for servicemembers. Five Democrats crossed party lines to support the package: Reps. Don Davis of North Carolina, Jared Golden of Maine, Gabe Vasquez of New Mexico, Eugene Vindman of Virginia and George Whitesides of California.

Republican Rep. Mike Rogers of Alabama, the chairman of the House Armed Services Committee, touted the added funding as an overdue investment to modernize the military and strengthen an atrophied defense industrial base. "Defense spending is not keeping up with inflation," he said to start the hearing. "In fact, we are currently at the lowest level of defense spending as a percentage of GDP since before World War II. That's unacceptable, and it must change. If we want to restore American deterrence and ensure peace through strength, we must get back to at least 4% of GDP spending."

Big changes to student loan programs: The House Education and Workforce Committee voted 21-14 along party lines to advance a plan that, as we told you yesterday, would overhaul the federal student loan system to save over $330 billion.

"Streamlining loan options as done in this bill will increase affordability for students and families as well as curtail the extent to which schools use taxpayer dollars to line their pocketbooks by loading students up with debt they can't repay," committee Chairman Tim Walberg said.

American Federation of Teachers President Randi Weingarten said the GOP plan would gut Pell grants and hurt borrowers. "This bill takes a hatchet to American opportunity by slashing $330 billion in college affordability to pay for tax cuts for billionaires," Weingarten said in a statement. "This cruel and callous plan would increase individual costs for borrowers, while removing guardrails against predatory colleges hawking worthless degrees."

More money for border barriers: The House Homeland Security Committee also voted along party lines, 18-14, to approve additional border funding, including $46.5 billion to complete 700 miles of border wall, 900 miles of river barriers and more than 600 miles of other barriers. The plan also includes $4.1 billion for new Border Patrol agents and $5 billion for Customs and Border Protection facilities.

New fees on migrants seeking asylum: The Judiciary plan proposed by Republicans includes several elements that are part of a broader crackdown on immigration, such as a minimum $1,000 fee to claim asylum and a $3,500 fee for sponsors of unaccompanied children. It also calls for $45 billion for migrant detention centers, $14.4 billion for migrant removal and $8 billion for new Immigration and Customs Enforcement staff.

Pension cuts for federal workers: The House Oversight Committee voted 22-21 to advance its section of the reconciliation bill, which Republicans say will reduce the deficit by $50.9 billion, in large part by raising the retirement contribution rate for many current federal civilian employees to 4.4% of their salary. The plan also cuts a benefit for federal workers who retire before the age of 62, among other changes. Labor groups slammed the changes, which they said piled on more pain for federal workers already being targeted by the Trump administration. Republican Rep. Mike Turner also objected to the plan. "I do not believe that this bill represents Republican values, and I don't believe that it represents American values," he reportedly said during the markup. "I believe that making changes to pension retirement benefits in the middle of someone's employment is wrong."

Turner reportedly said that the pension changes will not be included in the final reconciliation bill compiled by the Budget Committee.

What's next: Republicans are speeding ahead with their package and are set to have 6 of 11 pieces approved by tonight - but the biggest challenges lie ahead, including contentious provisions on taxes, food stamps and Medicaid as well as differences over the level of spending cuts. "The megabill has mega issues," Politico reported this morning.

The most fraught issue may be Medicaid. The Energy and Commerce Committee has been tasked with finding $880 billion in savings, most of which is expected to come from Medicaid. Republicans are still negotiating over potential changes to the program, but Rep. Don Bacon of Nebraska and reportedly said he'll only support up to $500 billion in Medicaid cuts, and other moderates have also pushed back against deep cuts to the program.

As always, send your feedback to yrosenberg@thefiscaltimes.com.