Happy Thursday! On this date in 1800, President John Adams ordered the federal government — and its grand total of 125 employees — to move offices from Philadelphia to the new capital, Washington, D.C. We've got more below on what's happening in the capital 225 years later.

House Conservatives Revolt Against GOP Budget Bill

House Republicans have managed to get their massive budget reconciliation bill over a series of hurdles. It cleared an 11th committee last night, when the Agriculture panel voted 29-25 along party lines to advance its piece of the legislation, including some $300 billion in cuts to food aid. Yet as the broader plan nears the finish line in the House, Republicans might still trip over themselves as they fight over key details in the package.

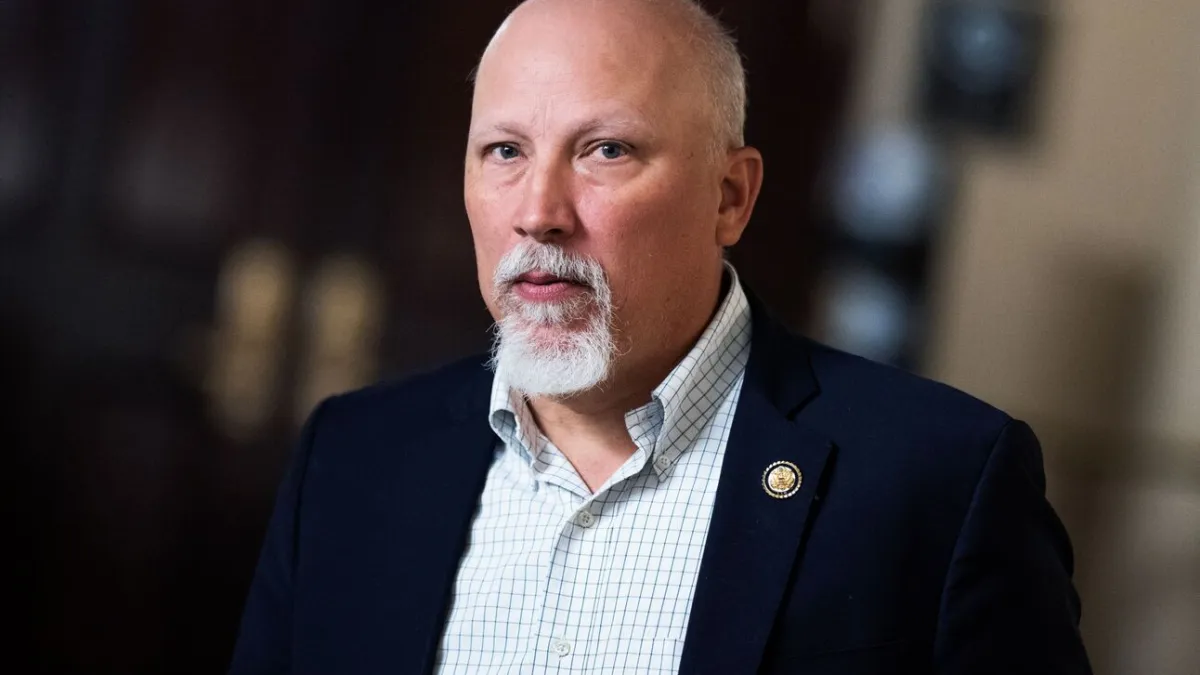

A planned Friday vote on the bill in the House Budget Committee "is increasingly in peril," Politico reports, as at least three conservative hard-liners — Reps. Josh Brecheen of Oklahoma, Ralph Norman of South Carolina and Chip Roy of Texas — have come out against their party's plan and could block it from reaching the floor.

Far-right Republicans are pressing for deeper spending cuts and are upset that the hundreds of billions of dollars in Medicaid cuts approved this week by the Energy and Commerce Committee failed to include some longtime GOP priorities for overhauling the program.

The Budget Committee holdouts were also perturbed to learn that the Congressional Budget Office won't have official cost estimates of the Energy and Commerce sections of the package until early next week - meaning it won't immediately be clear just how much would be saved by the proposed Medicaid changes. They are also concerned that changes in the bill might lead some states to expand their Medicaid offerings. And they complain that the bill's introduction of Medicaid work requirements and rollback of clean energy tax credits aren't set to begin until 2029.

"Right now, the House proposal fails to meet the moment," Roy said. "It does not meaningfully change spending ... Plus many of the decent provisions and cuts, don't begin until 2029 and beyond. That is swamp accounting to dodge real savings."

In a statement on social media, Brecheen wrote that "after a meeting with the CBO this morning, it's clear we don't know the true cost of this bill or whether it adheres to the Budget blueprint. We have a duty to know the true cost of this legislation before advancing it."

Other Republicans may also be prepared to vote against the bill. That means the legislation's path to the House floor is suddenly unclear.

House Speaker Mike Johnson has been in talks with both conservatives looking for deeper cuts and moderates who warn that cutting Medicaid or shifting costs to the states could cost them their seats - and cost the GOP its congressional majority. Representatives from blue states have also been pushing for a much higher limit on the state and local tax deduction.

"Not everybody's going to be delighted with every provision in a bill this large, but everyone can be satisfied, and we're very, very close to that," Johnson told reporters.

One concession to conservatives reportedly being discussed would see the Medicaid work requirements take effect in 2027, two years earlier than currently scheduled.

What's next: Friday's Budget Committee vote reportedly may get pushed until next week as negotiations continue through the weekend. This is crunch time for House Republicans — or maybe it's Trump time, as in time for the president to step in and save his agenda. With a narrow majority, both conservatives and moderates have the votes needed to scuttle the Republican bill and are looking to use their leverage to advance their priorities. But the changes being demanded by conservatives likely can't pass the House and undoubtedly would derail the bill in the Senate. If Johnson can't convince his members to fall in line, Trump may have to get involved.

The bottom line: The Republican bill is likely to change before it moves ahead — if it moves ahead. Johnson insists that the package is still on a path to pass next week.

House Reconciliation Bill Would Add $3.3 Trillion to the Debt - and Maybe Much More: Analysis

Amid the swirl of budgetary numbers flowing out of Congress this week, one thing seems pretty clear: Republicans' "one, big, beautiful" bill that delivers on many of President Donald Trump's campaign promises is going to be very costly.

According to a new preliminary analysis by the deficit hawks at the Committee for a Responsible Federal Budget, the bill Republicans hope to pass through the House next week will add $3.3 trillion to the national debt through fiscal year 2034. If the provisions in the bill currently set to expire are made permanent - a not-unreasonable assumption, given how lawmakers often rely on "temporary" provisions to help improve the fiscal projections but end up extending hose measures later — the cost balloons to $5.2 trillion.

The bill will drive up annual budget deficits sharply, CRFB says. The deficit is projected to rise from $1.8 trillion in 2024 to $2.9 trillion by 2034. If the temporary provisions in the bill are extended, the deficit in 2034 will come to an estimated $3.3 trillion - or 7.8% of GDP.

Breaking down the costs: The portion of the reconciliation bill written by the Ways and Means Committee, focused largely on tax cuts and other changes to the tax code, contributes the largest cost to the overall package at $3.8 trillion over 10 years. That cost is reduced significantly by the sunsetting provisions in the bill, which include tax breaks for tipped wages and interest on auto loans. If those provisions are made permanent, the cost rises to $5.3 trillion.

Spending increases for the military, homeland defense and federal law enforcement would add another $321 billion to the 10-year cost, rising to $620 billion if made permanent. Interest costs on the growing national debt are projected to rise, as well, increasing by $580 billion over 10 years, or $750 billion if extended. Dynamic effects in the economy related to the bill are estimated to cost $150 billion in lost revenue over a decade.

The bill also adds some revenues that partially cover its costs. The largest offsets come from the Energy and Commerce Committee, which would save $910 billion over 10 years, largely through reductions in Medicaid spending. The Education and Workforce Committee would save $351 billion by slashing student aid programs, and the Agriculture Committee would shave $300 billion from food aid spending. (CRFB estimates those savings to be $230 billion, but the committee voted last night for an even bigger cut.)

National debt rising: With or without the sunsetting tax cuts, the bill would help raise the national debt to levels unseen during peacetime relative to the size of the economy. "By 2027, under the reconciliation bill, debt would exceed the previous record of 106 percent of GDP set just after World War II," CRFB says.

By 2034, the bill would raise the debt to $53 trillion, for a debt-to-GDP ratio of 125%. And if the package were extended, the debt would rise to $55 trillion, or 129% of GDP.

Quote of the Day: Walmart Warns of Price Hikes

"The immediate challenge is obviously navigating the impact of tariffs here in the U.S. ... We will do our best to keep our prices as low as possible, but given the magnitude of the tariffs, even at the reduced levels announced this week, we aren't able to absorb all the pressure, given the reality of narrow retail margins."

− Walmart CEO Doug McMillon, warning in an earnings call with investors on Thursday that the retail giant is soon going to have to raise some of its "everyday low prices" due to President Trump's tariffs.

"I want to thank President Trump and Secretary Bessent for the progress made recently," McMillon said. "We are hopeful that it leads to a longer-term agreement between the U.S. and China that would result in even lower tariffs."

Fiscal News Roundup

- Conservative Republicans Revolt Over Domestic Policy Bill, Threatening Its Path – New York Times

- Megabill Teeters After Hard-Liners Make Their Stand – Politico

- GOP Leaders Poised to Accelerate Medicaid Work Requirements in Trump Agenda Bill – The Hill

- Why a $10,000 Deduction Is Blocking the G.O.P.'s $3.8 Trillion Tax Bill – New York Times

- House Agriculture Committee Approves $300 Billion in Nutrition Spending Cuts – Politico

- GOP Tax Bill on Track to Add More Than $2.5 Trillion to U.S. Deficit – Washington Post

- GOP Tax Chief Hopes for Bipartisan Tax Bill Before Year's End – Politico

- 'First Time We Were Hearing of Them': The GOP Megabill Is Packed With Surprises for Some Republicans – Politico

- D.H.S. Requests 20,000 National Guard Members to Help With Immigration Crackdown – New York Times

- Noem Eyes $50M for New DHS Jet – The Hill

- US Reports Lackluster Retail Sales as Tariffs Start to Dampen Demand – Reuters

- Older People in Crosshairs as Government Restarts Social Security Garnishment on Student Loans – Associated Press

- UnitedHealth Group Is Under Criminal Investigation for Possible Medicare Fraud – Wall Street Journal

- House Democrats Warn Against Trump Cuts to Scientific Agencies – The Hill

- The Firm Running Georgia's Struggling Medicaid Experiment Was Also Paid Millions to Sell It to the Public – ProPublica

Views and Analysis

- Trump's New Tax Cuts Could Shower Americans With Cash, for Now – Andrew Duehren, New York Times

- Republicans Outdo Themselves in Food Stamp Cuts – Emma Janssen, American Prospect

- Republicans' $715 Billion Health Care Cut Won't Work, but It Will Hurt Millions – Rep. Troy A. Carter (D-LA), The Hill

- Replacing the Income Tax With Tariff Revenue Is the New Republican Fantasy – Adam Michel, The Hill

- Trump's Moment of Budget Reform Truth – Kimberley A. Strassel, Wall Street Journal

- Even Democrats Might Like MAGA Accounts – Allison Schrager, Bloomberg

- Consumers Prop Up the Economy. They're Showing Signs of Strain – Colby Smith and Christine Zhang, New York Times

- Is It Too Late to Save the US Economy? – Matthew A. Winkler, Bloomberg

- Tariffs and the Truth Behind Trump's 'Two Dolls' Gaffe – Joseph C. Sternberg, Wall Street Journal

- Musk Adviser May Make as Much as $1 Million a Year While Helping to Dismantle Agency That Regulates Tesla and X – Jake Pearson, ProPublica

- Which States Would Be Affected by a House Proposal to Cut Federal Medicaid Funding for States That Cover Undocumented Immigrants? – Samantha Artiga, KFF

- How Chronic Disease Became the Biggest Scourge in American Health – Brianna Abbott and Josh Ulick, Wall Street Journal