Happy Monday. This will be another big week for Republicans as they try to enact the Trump domestic agenda. Here's the latest.

Can Trump Close the Deal on His 'Big Beautiful Bill'?

House Republicans cleared a big hurdle Sunday night as they work to pass their massive 1,116-page package of tax cuts and other GOP priorities. The House Budget Committee, which had failed to advance the bill on Friday, managed to do so by the slimmest of margins, 17-16, as four conservatives voted "present" to allow the measure to move ahead. But with the fate of the bill still uncertain, President Donald Trump will try to rally support on Capitol Hill Tuesday for what would be a legacy-defining piece of legislation.

Conservatives still unsatisfied: Conservatives made clear that a weekend of additional negotiations had not yet resolved their concerns about the legislation.

"While progress has been made on advancing the 'One Big Beautiful Bill' out of the Budget Committee, it does not yet meet the moment," the House Freedom Caucus said in a statement Sunday night. "As written, the bill continues increased deficits in the near term with possible savings years down the road that may never materialize. Thanks to discussions over the weekend, the bill will be closer to the budget resolution framework we agreed upon in the House in April, but it fails to actually honor our promise to significantly correct the spending trajectory of the federal government and lead our nation towards a balanced budget."

Hardliners are calling for Medicaid work requirements to take effect sooner and for clean energy tax credits to be eliminated faster. They are reportedly also calling for additional Medicaid changes that could lead to benefit cuts, even as more centrist Republicans oppose such moves and worry about their political ramifications.

Meanwhile, Republicans from blue states including New York and California are still pushing for a higher cap on the deductibility of state and local taxes. The current $10,000 cap was set as part of the GOP's 2017 tax law, and a small group of Republicans has rejected an increase to $30,000 as insufficient.

Speaker Mike Johnson acknowledged that negotiators still have to iron out key details. "We're almost there, and I'm very optimistic that we will find the right equilibrium point to get this bill delivered," Johnson told reporters Monday.

House Majority Leader Steve Scalise told CNBC on Monday that the Medicaid work requirements in the bill would take effect in early 2027 instead of 2029. That and other changes to the bill will be included in an amendment that Republicans hope to pass through the Rules Committee, which will begin consideration of the legislation at 1 a.m. - yes, 1 o'clock in the morning - on Wednesday. Republican leaders still hope to hold a vote on the full House floor by the end of the week.

**What's next: **Trump is expected to join a meeting of the House Republican Conference on Tuesday morning and House GOP leaders reportedly want him to press hardliners to ease off their demands and support the bill. Trump reportedly may also look to whip support for the plan via social media.

The bottom line: Republicans remain divided, leaving the outlook for the megabill clouded - especially because Senate lawmakers will likely also want changes and are reportedly already reviving talk of dividing the bill into two or three pieces and passing the easiest portions first.

Quote of the Day

"This bill does not add to the deficit."

− White House Press Secretary Karoline Leavitt, asked at a Monday news conference if President Donald Trump is okay with the GOP's budget reconciliation megabill adding to the deficit. Leavitt went on to claim that, according to the White House Council of Economic Advisers, the bill will save $1.6 trillion. She added that Trump understands the concerns of fiscal conservatives and other Americans. "The goal of this bill is to produce economic growth, to cut taxes and to get our fiscal house in order," she said.

Non-partisan analysts have said that the House bill will worsen the fiscal outlook and "massively increase" deficits in the near term, adding about $3.3 trillion or more to the debt through fiscal year 2034.

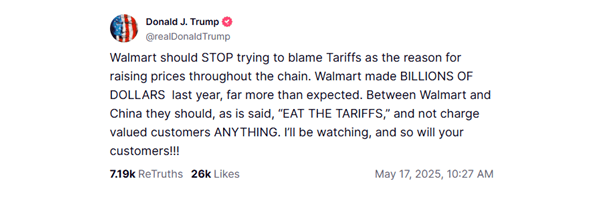

Trump Tells Walmart to 'Eat the Tariffs'

Reacting to statements by Walmart executives last week during an earnings call, President Trump castigated the retailing giant on Saturday for warning that his new tariffs would force the company to raise prices for customers. Pointing out that Walmart is profitable, Trump said the company should "EAT THE TARIFFS" rather than passing some portion of his import tax onto consumers.

At the White House on Monday, Press Secretary Karoline Leavitt was asked if Trump's comments acknowledge that his tariffs are paid by American importers and consumers - the basic story most economists tell, which is denied by members of the Trump administration, including the president himself, who insist that exporters and foreign countries absorb the costs of the tariffs.

Leavitt downplayed the comments from Walmart as reflecting the most severe scenario and doubled down on the administration's view. "The reality is, as the president has always maintained, that Chinese producers will be absorbing the cost of these tariffs," she insisted.

Appearing on CNN this past weekend, Treasury Secretary Scott Bessent was asked about Trump's social media post. "Doesn't that inherently serve as an acknowledgement that tariffs are essentially a tax on consumers?" asked CNN's Jake Tapper. Bessent also downplayed the comments about price hikes, saying executives on earnings calls are required to give "the most draconian case." But he admitted that the tariffs could hurt consumers and importers: "Walmart will be absorbing some of the tariffs, some it may get passed onto consumers," he said.

Writing at Axios Monday, Ben Berkowitz said the comments by Trump and Bessent make it clear the argument about who pays for tariffs is over. "The Trump administration conceded this weekend what economists, CEOs and consumers already knew: Americans pay for tariffs," he wrote.

Bessent added that lower inflation should ease the pain of any price hikes, while blaming the Biden administration for consumers being "skittish" about inflation.

Separately, a report from Bloomberg Economics suggests that the cost of the tariffs is already being borne by American importers and consumers.

"April import prices suggest the US side is continuing to pay most of the cost of tariffs so far," said economists Chris G. Collins and Anna Wong. "While we don't know much about how trade patterns shifted in April, import-price indexes that exclude the cost of tariffs have been little changed since the start of the year. This suggests US importers are paying essentially the same price they would have paid in the absence of tariffs, plus the tariff."

Trump's 'Golden Dome' Could Cost Half a Trillion Dollars

In the massive reconciliation bill still working its way through the House, Republican lawmakers have included $25 billion in funding for a military project known as the "Golden Dome," a cutting-edge defense system intended to protect the U.S. from missile attacks.

The project, which has been talked up by President Trump and appears to be based conceptually on Israel's famous Iron Dome defense system, is still very much in the embryonic stage, and may be little more than a name and a general concept at this point. Harkening back to President Ronald Reagan's "Star Wars" defense initiative of the 1980s, which was eventually abandoned, Trump signed an executive order in January calling for the development of the idea.

The $25 billion provided by Congress would certainly jumpstart the program, but it's not clear how that money would be spent. Defense experts have warned that the project would likely take many years and cost many billions of dollars. The Congressional Budget Office recently sketched out some cost estimates for various proposals, which ranged from $160 billion to $528 billion, stretching over two decades.

Those estimates are likely to be on the low side, many experts believe, given the number of design questions that need to be answered and technical issues that need to be resolved, including the nature of the interceptors that would be deployed and the depth or "layering" of the defensive shield.

Gen. Chance Saltzman, the chief of space operations for U.S. Space Force, told Politico last week that unique defense technologies are always shockingly expensive. "I'm 34 years in this business. I've never seen an early estimate that was too high," Saltzman said. "It's the nature of the business. I think that we don't always understand the full level of complexity until you're actually in execution, doing the detailed planning."

Critics say the cost and complexity would only be made worse if the system is based in space, as expected. John Tierney, the executive director for the Center for Arms Control & Non-Proliferation and who held hearings on missile defense when he served in Congress, said the program is "basically a scam" that is unlikely to work as intended, but will waste hundreds of billions of dollars along the way.

Tierney noted that complex and expensive defense systems run into trouble when the offensive weapons they are targeting are far cheaper and easier to produce - a problem that is greatly amplified in a space-based defense system targeting earth-based weapons.

"Strategically, it doesn't make any sense," Tierney told CNN. "Technically, it doesn't make any sense. Economically, it doesn't make any sense."

The bottom line: Expect Congress to start funding Trump's Golden Dome, but expect to hear a lot of complaints about cost and complexity, too.

Fiscal News Roundup

- House GOP Speeds Toward Showdown – The Hill

- Trump Plans to Rally House Republicans Divided on Tax Cut Bill – Bloomberg

- House GOP Leaders Want Trump to Dissuade Hard-Liners on Deeper Medicaid Cuts – Politico

- Republicans Tweak Megabill's SNAP, Medicaid Provisions – Politico

- Concerns Rise Over Medical Coverage Losses From 'Big, Beautiful Bill' – The Hill

- Senate Republicans Want to Break Up House's Trump Bill Into Bite-Size Pieces – The Hill

- Trump Warns Walmart: Don't Raise Prices Due to My Tariffs but Do Eat the Costs From Those Taxes – Associated Press

- Trump's Tariffs May Mean Walmart Shoppers Pay More, His Treasury Chief Acknowledges – Associated Press

- Scott Bessent Says Tariff Rates Will Return to 'Reciprocal' Levels if Countries Don't Reach Trade Deals With US – CNN

- Trump Economic Adviser on Debt Downgrade: 'Moody's Can Do What It Wants to' – The Hill

- Ray Dalio Says the Risk to U.S. Treasurys Is Even Greater Than What Moody's Is Saying – CNBC

- Trump's DOJ Accuses Medicare Advantage Insurers of Paying 'Kickbacks' for Primo Customers – KFF Health News

- After US Cuts Funding, WHO Chief Defends $2.1B Budget Request by Comparing It With Cost of War – Associated Press

- Libraries Are Cutting Back on Staff and Services After Trump's Order to Dismantle Small Agency – Associated Press

- Trump Administration to Pay $5 Million to Family of Jan. 6 Rioter Ashli Babbitt – CBS News

Views and Analysis

- The Stark Math on the GOP Tax Plan: It Doesn't Cut the Deficit – Richard Rubin, Wall Street Journal

- Trump Press Secretary Flat Out Lies About Effects of Budget Bill – Ellie Quinlan Houghtaling, New Republic

- The Real Message of the Moody's Downgrade – Neil Irwin, Axios

- Moody's Blues Come for US Sentiment – John Authers, Bloomberg

- Moody's Market Jolt Will Leave Its Mark – Jonathan Levin, Bloomberg

- Jim Millstein Says US Risks 'Fiscal Disaster' If Recession Hits – Liz Capo McCormick, Bloomberg

- Trump's Massive Import Taxes Haven't Done Much Economic Damage - Yet – Paul Wiseman, Christopher Rugaber and Ann D'Innocenzio, Associated Press

- The Argument's Over: Americans Pay for Tariffs – Ben Berkowitz, Axios

- Midpoint of Trump Tariff Hiatus to Reveal Increasingly Unsettled World – Craig Stirling, Bloomberg

- Housing, Nutrition in Peril as Trump Pulls Back Medicaid Social Services – Angela Hart, KFF Health New

- Republicans Like Europe - Whether They Know It or Not – Allison Schrager, Bloomberg

- Real State Tax Revenues Decline Amid Growing Fiscal Uncertainty – Lucy Dadayan, Tax Policy Center