Good Wednesday evening! It looks like it might be another late night for House lawmakers. Here's what's happening.

Trump, GOP Leaders Try to Muscle Through Their Megabill

President Donald Trump and House Speaker Mike Johnson on Wednesday tried to convince conservative holdouts to back their sweeping tax and budget bill ahead of a self-imposed Memorial Day deadline, but a White House meeting reportedly failed to resolve the lingering opposition to the plan.

Trump reportedly summoned hard-right holdouts for an afternoon meeting, ramping up the pressure on members of the House Freedom Caucus who had warned earlier in the day that they still weren't sold on the package containing much of the president's domestic agenda.

GOP leaders reportedly have agreed to move up the introduction of new Medicaid work requirements from 2029 to December 2026. Conservatives still want steeper cuts to Medicaid and a faster unwinding of clean energy tax credits.

Johnson continued to push for a floor vote on the bill as soon as Wednesday night, even as the powerful House Rules Committee continued to debate the package in a marathon session that started at 1 a.m. Wednesday - and even though GOP leaders had yet to unveil a so-called manager's amendment containing final revisions to the plan, a step made impossible because of ongoing negotiations. Johnson told CNN shortly after daybreak that he was still looking to hold a floor vote Wednesday night and House Majority Leader Steve Scalise delivered the same message to reporters later in the day: "We're going to vote tonight," he said.

Members of the Freedom Caucus quickly cast doubt on that timing. Rep. Andy Harris, the chairman of the ultraconservative group, told reporters on Wednesday morning that the White House had offered a proposal Tuesday night that might win their support, but he thought it would take days to finalize the bill. "There is a pathway forward that we can see," Harris said before adding, "I'm not sure this can be done this week. I'm pretty confident can be done in 10 days."

Any change approved by hardliners would likely stir up trouble with more centrist members. Earlier, Johnson had managed to largely placate blue-state moderates with a deal to raise the cap on the deductibility of state and local taxes. The agreement would raise the deduction limit to $40,000, phasing it out for households with incomes above $500,000, with the threshold for the phaseout growing over the 10 years covered by the bill. But given the push-and-pull dynamic in the fractious House Republican Conference, that deal upset conservatives by making a concession to Democratic-run states and raising the cost of the bill.

Rep. John Rose of Tennessee issued a surprising statement Wednesday afternoon saying he would join hardliners in opposing the bill with the SALT deal included. "Raising the SALT deduction is a bailout for Democrat Governors-paid for by red states with low taxes," he wrote. "Tennesseans should not foot the bill for New York and California's mismanagement."

Before Trump's meeting, the White House Office of Management and Budget issued a statement in support of the legislation that called on Congress to pass it "immediately" and contained what might be seen as a threat to Republican holdouts. "President Trump is committed to keeping his promises, and failure to pass this bill would be the ultimate betrayal," said the statement.

Trump had visited Capitol Hill on Tuesday the drum up support for the legislation and urge both conservatives and moderates to back off demands that were impeding progress to a final vote.

Wednesday's follow-up White House meeting had Harris and some other hardliners sounding somewhat more optimistic, indicating that progress had been made. The next few hours may determine whether it was enough to get the bill over the finish line.

The bottom line: House Republican leaders want to pass their bill tonight, or perhaps tomorrow, seemingly confident that they'll win over the right-wing holdouts. It's not yet clear that they'll have the votes.

Republican Megabill Would Add $3.1 Trillion to the Debt: Analysis

The reconciliation bill Republicans are battling to push through the House would increase the national debt by trillions of dollars, according to the preliminary Congressional Budget Office analysis released Tuesday.

In its first in-depth estimate of the budgetary effects of Republicans' "One Big Beautiful Bill Act," CBO estimated that the package would add $2.3 trillion to deficits over 10 years, 2025 to 2034. But that estimate is incomplete, since CBO has yet to include an analysis of the cost of interactions of various elements of the bill, as well as some changes being made to the bill by lawmakers this week.

The deficit hawks at the Committee for a Responsible Federal Budget filled in that gap Wednesday with their own estimate, finding that interactions would cost $150 billion, and adjustments would cost $50 billion. In addition, CRFB added an estimate of the interest costs associated with a larger national debt, which it pegged at $550 billion. Tallying up the costs, CRFB estimated that the Republican reconciliation bill would add $3.1 trillion to the national debt over 10 years.

Markets not pleased: Investors were already on edge following last week's downgrade of the U.S. credit rating by Moody's, and the cost estimates of the Republican reconciliation bill aren't helping any. Interest rates are climbing sharply, and on Wednesday stocks fell, with the Dow Jones Industrial Average dropping 816 points, or 1.9%, and the S&P 500 falling 95 points, or 1.6%.

"Moody's didn't tell us anything we didn't already know, but they did underscore that things aren't going in the right direction," Kathy Jones, chief fixed income strategist at Charles Schwab, told CNBC. "The big, beautiful bill also, when it comes to debt and deficits, is not going in the right direction."

Matthew Luzzetti, chief U.S. economist at Deutsche Bank, said in a research note that budget deficits are headed toward 6%-7% of GDP, which is "inconsistent with debt-to-GDP stability over the long run."

"Absent a clearer commitment towards putting deficits on a downward path," Luzzetti added, "investor concerns about U.S. fiscal dynamics are likely to persist."

Republican Reconciliation Bill Would Benefit Wealthiest Households the Most: CBO

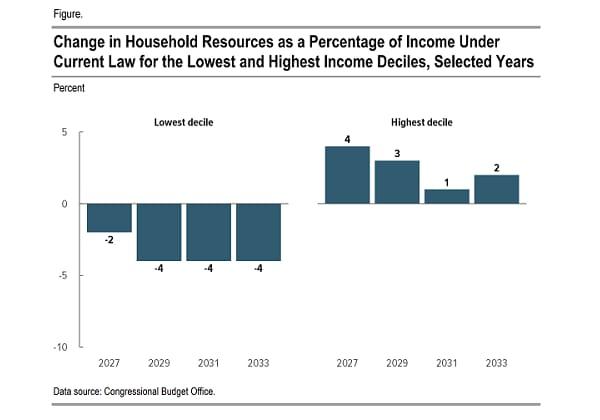

The Congressional Budget Office released a preliminary analysis late on Tuesday of the distributional effects of the Republican reconciliation bill, finding that the plan would help most households on average, but would notably help high-income households more, while actually taking from the poorest.

Coming in response to a request by Democratic leaders in Congress, the analysis said: "CBO estimates that if the legislation was enacted, U.S. households, on average, would see an increase in the resources provided to them by the government over the 2026-2034 period. The changes would not be evenly distributed among households. The agency estimates that in general, resources would decrease for households in the lowest decile (tenth) of the income distribution, whereas resources would increase for households in the highest decile."

CBO says the loss in resources among the lowest 10% in income would be driven mainly by reduced in-kind transfers through Medicaid and food assistance programs. At the top of the income scale, gains for the top 10% would be driven by reductions in taxes paid.

This chart from the CBO analysis comparing the effects of the bill on households in the bottom 10% of income to those in the top 10% makes the uneven distribution clear:

Lawmakers react: Republicans rejected the analysis, saying it fails to capture the positive economic effects of the bill on all income groups while accusing Democrats of wanting people to be "stuck on the welfare rolls."

"First, they're not measuring economic benefits to low-income earners, they're measuring federal resources distributed," House Budget Chairman Jodey Arrington said. "For instance, there are fewer transfer payments to people on welfare if you prohibit illegal immigrants from accessing these programs and enact common sense work requirements to stop trapping people in dependence. Second, when you allow Americans from every walk of life to keep more of their income, you lift millions out of poverty ..."

Democrats, on the other hand, embraced the analysis, saying it confirms what they've been saying about the bill all along. "This is what Republicans are fighting for - lining the pockets of their billionaire donors while children go hungry and families get kicked off their health care," Rep. Brendan Boyle, the senior Democrat on the Budget Committee, said in a statement. "CBO's nonpartisan analysis makes it crystal clear: Donald Trump and House Republicans are selling out the middle class to make the ultra-rich even richer."

Fiscal News Roundup

- GOP Leaders Tee Up High-Stakes Vote on Trump Domestic Policy Bill After President’s Personal Pitch to Holdouts – CNN

- White House Says Failure to Pass Tax Bill Would Be ‘Betrayal’ – Bloomberg

- The Republican Spending Bill Is Sending Yields Soaring and Creating a Major Market Headache – CNBC

- Trump Administration Asks Supreme Court to Shield DOGE From Releasing Records – New York Times

- Republican Bill Sets Stage for a New Global Tax Fight – New York Times

- U.S. Formally Accepts Luxury Jet From Qatar for Trump – New York Times

Views and Analysis

- The GOP Tax Bill Ignores Decades of Economic Research – Kathryn Anne Edwards, Bloomberg

- Congress Is Whistling Past the Downgrade – Washington Post Editorial Board

- The Budget Bill Is Built to Hassle the Poor and Grow the Debt – Justin Fox, Bloomberg

- Here Are the Worst Things in Trump’s Big, Beautiful Bill – Grace Segers, New Republic

- House Republicans Unite Around Sweeping Medicaid Cuts – James Baratta, American Prospect

- Why Donald Trump Is Blocking Conservatives’ Attempts to Get Bigger Medicaid Cuts – Adam Cancryn and Jake Traylor, Politico

- Republicans Have a SALT Tax Deal. Who Will Benefit? – Zach C. Cohen, Bloomberg

- The Bond Market Is Getting Awfully ‘Yippy’ Again – Robert Burgess, Bloomberg

- Why Washington’s Huge Tax Bill Is Worrying Bond Investors – Colby Smith and Joe Rennison, New York Times

- U.S. Debt Is on Pace to Set a Record High, Going All the Way Back to 1790 – Alicia Parlapiano and Margot Sanger-Katz, New York Times

- The Reality of Trump’s Golden Dome – W.J. Hennigan, New York Times