Good evening. The Pentagon today provided lawmakers with a cost estimate for President Donald Trump's deployment of troops to Los Angeles. We've got details on that, an updated analysis of the GOP tax plan and more.

Trump's LA Troop Deployment Will Cost $134 Million, Pentagon Says

President Donald Trump has touched off a furious backlash and partisan debate by ordering the deployment of more than 4,000 National Guard troops and 700 Marines to Los Angeles in response to protests that began Friday against federal immigration raids and stepped-up deportations.

That response is estimated to cost $134 million and last for 60 days, a Pentagon official told lawmakers on Tuesday.

Raising serious concerns: In moments of crisis, financial and fiscal concerns obviously are secondary. In this case they trail far behind fears and concerns raised by the idea of a federal military response in the streets of a major American city - one that runs counter to the wishes of state and local officials who said they were well-equipped to handle the protests. Democrats have blasted Trump's move as escalatory, and California sued Trump on Monday, saying that the president had unlawfully bypassed Gov. Gavin Newsom in an "unprecedented power grab." It marks the first time in 60 years that a president has bypassed a state governor to deploy National Guard troops - and when President Lyndon B. Johnson did it in 1965, it was to protect civil rights demonstrators marching in Alabama.

Trump's orders have prompted widespread warnings about executive overreach, with critics charging that the president created a crisis to enable an authoritarian show of force, or that his move was a political stunt meant take advantage of a favorable issue, immigration, and use it to rally supporters, attack opponents and distract from other topics. The Washington Post notes that Trump has declared eight separate emergencies since taking office, far more than other recent presidents, with some of his declarations pertaining to matters where "emergencies were hard to discern."

"I can't get into the head of the president, but this is something a dictator would do," Rep. Zoe Lofgren told the Post. "If people aren't concerned about it, they could watch our country's liberties drip away." (The White House argues that Trump is properly using his executive authority and taking necessary action where Democrats have failed to do so.)

Hegseth faces lawmakers: Questions of cost pale in comparison to such fundamental issues - and yet, they aren't entirely irrelevant. At a combative Tuesday hearing of the House Appropriations Subcommittee on Defense, Democrats pressed Defense Secretary Pete Hegseth and acting Pentagon Comptroller Bryn Woollacott MacDonnell on why the troop deployments were necessary and where the money will come from.

"We have the funding to cover down on contingencies, especially ones as important as maintaining law and order in a major American city," Hegseth said. He also defended the deployment, arguing that it was needed to protect immigration agents in their operations - and he opened the door to other domestic deployments. "I think we're entering another phase, especially under President Trump with his focus on the homeland, where the National Guard and Reserves become a critical component of how we secure that homeland," Hegseth said at one point.

MacDonnell said that the funding will come from the Defense Department's operations and maintenance accounts and the estimate includes food, transportation, housing and other costs.

**Democrats complain about lack of Trump budget details: **Democratic appropriators also expressed frustration that the administration has yet to deliver a complete defense budget request for fiscal year 2026 and complained that the administration is relying on a "risky" reconciliation process and not just on regular appropriations.

"We are in mid-June, Mr. Secretary. We are marking up a defense funding bill in a few hours, and yet we have no idea what your department actually needs," said Rep. Rosa DeLauro of Connecticut, the top Democratic appropriator in the House. She later asked specifically about investments in submarine programs and pressed for information about broader plans for the future. "We don't have anything today. We have zip, nada in knowing where you're going," she said. "Give us the details."

Hegseth said the details would be provided. He still faces two other congressional hearings this week.

Record funding levels: The House Appropriations Defense Subcommittee later advanced the Republican Defense appropriations bill that would provide $831.5 billion in funding for next year, the same base level enacted for fiscal 2025. Combined with defense funding Republicans hope to provide through the reconciliation process, total defense spending for fiscal year 2026 would top $1 trillion.

NIH Director Grilled by Lawmakers on Budget Cuts

Testifying before an Appropriations subcommittee hearing Tuesday, National Institutes of Health Director Dr. Jay Bhattacharya defended the Trump administration's proposed $18 billion reduction in the agency's budget for fiscal year 2026.

The roughly 40% reduction in funding relative to 2025 levels could translate to the loss of about 1,800 grants for medical research next year, according to some experts. And even before a lower budget is put in place, the NIH has cancelled thousands of existing research grants and slowed the approval of new grants since President Trump took office.

Wisconsin Democratic Sen. Tammy Baldwin asked who made the decision to cancel existing grants. "There [have been] changes in priorities for the NIH, to move away from politicized science," Bhattacharya said. "I've made those decisions. Decisions regarding, for instance, Harvard and some other institutions, that's joint with the administration."

Sen. Dick Durbin, Democrat from Illinois, told Bhattacharya that Northwestern University has seen its NIH funding frozen for the past 11 weeks, including $9 million for clinical trials in colon, brain, breast and childhood cancers.

"For God's sake, we lead the world in medical research. Why would we give up on it?" Durbin asked, noting that the White House budget request sought a 38% cut in funding for cancer research. "How are you able to reconcile these budget decisions with the reality of research and what it means to alleviate suffering and, more importantly, to give people hope?"

Republicans on the committee also raised questions about the proposed budget, with Maine Sen. Susan Collins calling the cuts "disturbing."

"It would undo years of congressional investment in NIH, and it would delay or stop effective treatments and cures from being developed for diseases like Alzheimer's, cancer, Type I diabetes, I could go on," Collins said. "We also risk falling behind China and other countries that are increasing their investment in biomedical research."

GOP Bill Would Slash Taxes for Top Earners, but May Raise Them for Some Low Earners: JCT

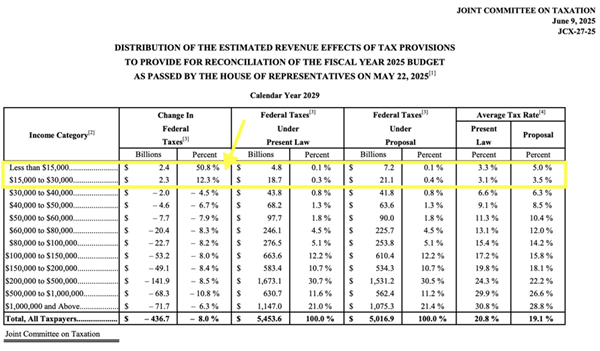

The reconciliation bill containing much of President Trump's agenda would provide a significant tax cut for high-income households, but low-income groups would receive far less of a boost and in some cases actually see their tax burden increase, according to new distributional analyses released by the Joint Committee on Taxation (see here and here).

The distributional effects vary from year to year, but overall, the bill, passed with only Republican support in the House and currently under consideration in the Senate, provides the biggest tax cuts to people at the top of the income ladder. In 2027, for example, 58.8% of all taxpayers would receive a tax cut worth more than $500. But that proportion rises to more than 90% for households earning between $150,000 and $1 million per year, while only 2.2% of those earning $15,000 would see a tax cut that large, and only 17.9% of those earning between $15,000 and $30,000.

In terms of dollar value, the tax bill would provide huge tax cuts at the top and much less at the bottom. According to an analysis by the Urban-Brooking Tax Policy Center, the average tax cut for those earning $35,000 or less would be $160, while those earning between $67,000 and $119,000 would get a tax cut of $1,850. Those making between $460,000 and $1.1 million would get a $21,000 tax cut, and those making $5 million and up (the top 0.1%) would get tax cuts of almost $300,000 in 2026.

As the economist Justin Wolfers points out, the total value of the tax cut for the top 0.1% in 2027 is $48.9 billion. The poorest 40% of the population, on the other hand, will share a tax cut of $29.3 billion.

The numbers reflect both the way the tax cuts are skewed toward the wealthy and the way that income itself is skewed, with those at the bottom earning so little that they pay very little in federal income taxes, leaving little to cut or refund.

In some cases, those at the bottom of the income scale would actually see their tax burden increase as a result of the bill. As noted by economist Heather Long, those earning $30,000 or less will see their tax burdens rise in 2029, with those earning less than $15,000 seeing a 50.8% tax increase (see the chart below).

The Urban-Brooking Tax Policy Center analysis suggests that the reason for the surprising increase in the tax burden is the bill's reduction of federal subsidies that help cover the cost of health insurance, which will reduce incomes in for some poorer households. Without the loss of those subsidies, most people earning $20,000 or less would see a tax cut worth about $40 on average.

Quote of the Day

"I think a lot of us would be surprised if it passed by July 4. I think that's a false deadline. I don't think that we need to put a specific deadline on it. Let's get it right."

− Republican Sen. John Curtis of Utah, questioning the deadline set by Republican leaders for getting the GOP budget reconciliation bill to President Trump's desk. Speaking at a Politico event, Curtis raised concerns about the proposed phaseout of clean energy tax credits. But he also said he believes the bill will eventually pass - though he couldn't say what it would look like or when it would happen.

Fiscal News Roundup

- Hegseth Faces Sharp Questions From Congress on Deploying Troops to LA and Pentagon Spending – Associated Press

- Pentagon Estimates Sending Marines, National Guard to LA Will Cost $134M – The Hill

- Top Republican Breaks With Trump's Marine Deployment to LA – Politico

- California Governor Asks Court to Block Trump Administration From Using Troops in Immigration Raids – Associated Press

- Senate GOP Finalizing Scaled-Down Food Stamp Cuts After Backlash – Politico

- Republicans Back Off Medicare Changes in GOP Megabill – Politico

- 3 Dozen House Republicans Urge Senate GOP Against 'Budget Gimmicks,' Deficit Increases – The Hill

- House GOP Effort to Lock in DOGE Cuts Faces Republican Resistance – The Hill

- RFK Jr.'s Firing of CDC Vaccine Panel Undermines Science, Could Threaten Public Health, Experts Say – CNBC

- Pentagon to Restore Names of 7 More Army Bases That Honored Confederate Generals – The Hill

Views and Analysis

- RFK Jr. Made Some Promises on Vaccines to Get Confirmed. Is He Breaking Them? – Aaron Blake, CNN

- RFK Jr.: HHS Moves to Restore Public Trust in Vaccines – Robert F. Kennedy Jr., Wall Street Journal

- Taking Stock of the Health Coverage Impacts of the House Reconciliation Bill – Matthew Fiedler, Health Affairs

- Don't Expect Much Growth From the One Big, Beautiful Bill – William G. Gale and Kyle Pomerleau, Tax Policy Center

- New US Tariffs Are Working as Intended, Right? Wrong – Bloomberg Editorial Board

- Tariffs Are Finally Starting to Sink In –

- Trump's Tariffs Are Likely to Outlast Him – Clive Crook, Bloomberg

- This Burning Tariff Question Has No Answer... Yet – John Authers, Bloomberg

- National Debt Is a Crisis. Congress Must Take It Seriously – Maya MacGuineas, Dallas Morning News

- DOGE Has Work Left to Do – David Walker, Wall Street Journal

- The White House Wants This Fight With Los Angeles – Ronald Brownstein, Bloomberg