Good evening! On this date 95 years ago, President Herbert Hoover signed the Smoot-Hawley Tariff Act, raising tariffs on thousands of imported goods in a bid to protect domestic jobs and manufacturing. The law backfired as U.S. trading partners enacted retaliatory tariffs, reducing American exports and deepening the Great Depression, which had started in October 1929.

Here's what's happening today.

Trump's Big Bill Would Increase Deficits by $2.8 Trillion on a Dynamic Basis: CBO

The sweeping Republican tax-and-spending bill that would deliver on much of President Donald Trump's agenda would increase deficits by about $2.8 trillion over 10 years, once its economic effects are taken into account, the Congressional Budget Office announced Tuesday.

On a dynamic basis - which takes into account economic growth, inflation and interest rate movements generated by the legislation - the bill would reduce federal revenues by $3.546 trillion over a decade, while cutting outlays by $774 billion, resulting in an increase in deficits of roughly $2.8 trillion.

The bill would cause gross domestic product to grow by 0.5% on average over the 10-year period. Inflation would increase by a small amount, CBO said, while raising interest rates on 10-year Treasury notes by 14 basis points on average.

Additionally, the bill, which passed the House in May and is currently under consideration in the Senate, would require increased borrowing by the federal government. Publicly held debt as a percentage of GDP would rise to 124%, an increase from the 117% level projected in January. As CBO noted, according to "long-standing convention," the cost of this change is not included in the total cost estimate. But if it were, the total overall increase in deficits as a result of the bill is estimated to be roughly $3.4 trillion from 2025 to 2034.

Even higher deficits: The latest CBO analysis finds that the bill would generate more debt when considered on a dynamic basis than it would on a static basis; the CBO concluded that the bill would raise deficits by $2.4 trillion in its static analysis published in May. The increase in interest rates accounts for much of the higher cost in the new analysis.

The results undermine a key argument Republicans are making in favor of the bill: that it will generate so much economic growth that it will pay for itself while lowering debt and deficits in the long run.

"It's not only not paying for all of itself, it's not paying for any of itself," said Marc Goldwein of the fiscally conservative Committee for a Responsible Federal Budget.

Jessica Reidl, a fiscal expert at the conservative Manhattan Institute, said, "First time I've seen a tax cut so poorly designed that the dynamic score RAISES the cost by $356 billion." Reidl added that the small increase in growth generated by the bill would be "dwarfed" by higher interest costs.

Rep. Brendan Boyle, the senior Democrat on the House Budget Committee, said the CBO score demonstrates that the Republican argument is fanciful. "Today's CBO score will disappoint every Republican who hoped tax breaks for billionaires would magically pay for themselves," he said in a statement. "Their handouts to the mega-rich will add trillions to the national debt."

Americans Oppose the GOP's Big Bill by Nearly a 2-1 Margin: Polls

If the budgetary analyses of Republicans' "One Big Beautiful Bill Act" have produced some less-than-beautiful projections, the polling numbers for the package have been pretty ugly, too.

While the Senate continues to work on its version of the legislation, a new Washington Post-Ipsos poll finds that nearly twice as many Americans oppose the GOP plan as support it. The poll, conducted from June 6 to 10, found that 42% of American adults oppose the bill, while 23% support it and 34% say they have no opinion.

Among Republicans, 49% approve of the package, 13% oppose it and 38% have no opinion. Democrats are strongly against the GOP measure, with nearly three-quarters saying they oppose it and just 6% saying they support it. And 40% of independents oppose it, about the same percentage as say they have no opinion. Just 17% of independents support the bill.

A KFF tracking poll released today also finds that the bill is viewed unfavorably by a nearly 2-to-1 margin, with 64% against it compared to 35% for it. That poll finds that 72% of MAGA Republicans view the bill favorably, but 66% of Republicans and Republican-leaning independents who don't identify as MAGA supporters view the bill unfavorably.

Overall, the Post poll finds that about two-thirds of Americans say they have heard little or nothing about the GOP plan. In theory, that could leave Republicans room to sell their tax and spending changes - but the details of the plan appear to be unpopular with people who have heard them. Poll respondents who said they've heard "a good amount" or "a great deal" about the Republican bill oppose it by a margin of 64% to 33%, and 48% say they "strongly oppose" it.

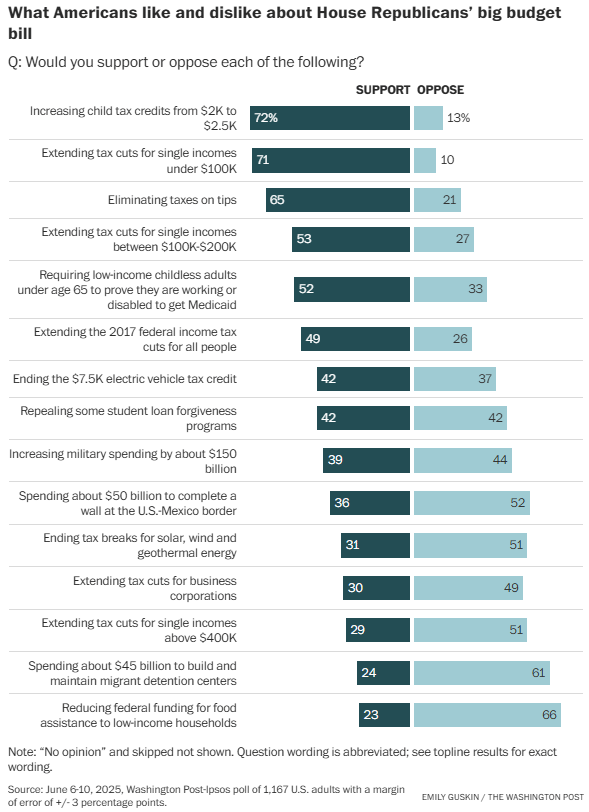

Some elements of the bill are popular: A 72% majority supports increasing the Child Tax Credit from $2,000 to $2,500, as the House-passed plan would do. (The Senate is proposing to dial back the increase to $2,200.) About the same percentage of people approve of extending 2017 tax cuts for people making less than $100,000 a year, and 53% support extending the tax cuts for those making between $100,000 and $250,000. About two-thirds support the elimination of taxes on tips.

Divisions on Medicaid changes: More than half of Americans in the Post poll also support Medicaid work requirements for childless low-income adults under age 65. KFF's poll showed even greater support for work requirements, 68%, including nine in 10 Republicans and half of Democrats.

But in the Post poll, 44% say it's unacceptable that the GOP changes could result in about 8 million people losing Medicaid coverage, compared with 32% who say it is acceptable. (When the GOP bill's new Medicaid eligibility checks, work requirements and other changes are not specified, 63% say it's unacceptable.)

The KFF poll found that support for Medicaid work requirements can swing dramatically when people are given additional information. Backing for the bill among both Republicans and MAGA supporters specifically drops at least 20 percentage points, leaving less than half of each group viewing the law favorably, when the survey respondents hear that the country's uninsured rate would rise and funding for local hospitals would decrease. But support increases when people hear the argument that imposing work requirements could save money and help fund Medicaid for the elderly, people with disabilities and low-income children.

KFF found that Medicaid and the Affordable Care Act are now viewed more favorably than ever, with 83% of adults saying, including 93% of Democrats and 74% of Republicans, they have a positive view of Medicaid and 66% saying they support the Obama health law.

In the Post poll, about two-thirds of Americans also oppose cutting federal funding for food assistance to low-income households and 51% oppose extending tax cuts for individuals making more than $400,000. Just over half of Americans also oppose ending tax breaks for solar, wind and geothermal energy.

Worries about rising debt: Asked about the Congressional Budget Office projection that the legislation would increase the national debt by about $3 trillion over 10 years, 63% of Americans - including 81% of Democrats, 47% of Republicans and 61% of independents - say that's unacceptable. Just 13% call it acceptable, while 24% have no opinion.

The poll, which was conducted among 1,167 adults, has an overall margin of error of plus or minus 3 percentage points.

The bottom line: The GOP bill is broadly unpopular, but many or most Americans still haven't heard much about it, leaving room for both Republicans and Democrats to sway public opinion.

Retail Sales Slide as Consumers Hit the Brakes

American consumers pulled back on spending in May, as retail sales declined by 0.9% from month to month, according to an estimate released by the Commerce Department Tuesday.

Analysts had expected to see a decline in sales at stores and restaurants, but not quite so large, with Dow Jones forecasting a drop of 0.6%. Sales in April were revised lower to -0.1% on a monthly basis.

The pullback in spending appears to be driven by concerns about the direction of an economy threatened by a burgeoning trade war initiated by President Trump - a threat that has pushed consumer confidence down sharply.

"The economy is slowing with consumers nervous about exactly what lies ahead and are choosing to save overall rather than flash some cash at the shops and malls," said Chris Rupkey, Fwdbonds chief economist, per CNN.

Wells Fargo economists said in a note that the May report "is not a terribly encouraging report card in terms of how spending is holding up amid tariffs."

At the same time, the drop in sales was largely driven by a single factor, a sharp decline in auto sales, which had jumped in March as car buyers rushed to purchase vehicles ahead of Trump's April tariffs, pulling demand forward. Excluding autos, the drop in consumer spending would have been a more modest -0.3%.

Economist Tuan Nguyen of RSM US said the report conveys "mixed signals" that suggest that the American consumer is still in pretty good shape, but growing cautious amid uncertainty. He also warned that the threat of tariff-driven inflation is still hanging over the economy, making it highly unlikely that the Federal Reserve will cut interest rates soon.

"In our view," Nguyen wrote, "the economic data over the past two months may be sending a false positive about the overall health of the economy-particularly regarding inflation."

Fiscal News Roundup

- Trump Tax Bill Would Widen Deficits by $2.8T After Factoring in Economic Impacts, CBO Says – Associated Press

- New Megabill Estimate Sees Worsened Deficit Picture – Wall Street Journal

- Interest-Rate Spike Would Push Megabill Cost to $2.8T, CBO Says in 'Dynamic' Score – Politico

- Trump Is Counting on Economic Growth to Offset Tax Cuts. But His 'Big, Beautiful Bill' Likely Wouldn't Deliver, Experts Say – CNN

- GOP Megabill Faces Grim Polling for Republicans – Politico

- Hospitals Stunned by Senate GOP's Medicaid Plan – Politico

- Tax Bill Lacks Votes as Senate Aims for SALT, Medicaid Deals – Bloomberg

- Thune's Biggest Megabill Fires – Politico

- Senate Picks Fight With House GOP on the "Big, Beautiful Bill" – Axios

- Vance on the Megabill: 'We're in a Good Place to Get This Done by the July 4 Recess' – Politico

- 'Set Up for Failure': Trump's Cuts Bring Climate and Energy Agencies to a Standstill, Workers Say – Politico

- KFF Health Tracking Poll: Views of the One Big Beautiful Bill – KFF

- Poll: GOP Budget Bill Faces Nearly 2-to-1 Opposition, With Many Unaware – Washington Post

- G7 Leaders Discuss Ukraine and Try to Salvage Their Summit After Trump's Early Exit – Associated Press

- NYC Mayoral Candidate Is Arrested at Immigration Court After Linking Arms With Man Being Detained – Associated Press

- Trump Increasingly Warm to Using US Military to Strike in Iran, Sources Say – CNN

Views and Analysis

- The US Economy Is in a Good Place, but the Federal Reserve Is Not – Christopher Rugaber, Associated Press

- The Immigration Crackdown Is Full of Economic Contradictions – Jonathan Levin, Bloomberg

- Trump's Tariffs Are Running Up Against the Limits of Nature – Ed Conway, Washington Post

- Republican Spending Bill Throws $156 Billion at Defense Contractors – Emma Janssen, American Prospect

- The Retreat From Aid Is a Costly Mistake – Eduardo Porter, Washington Post

- The Genius Act Will Bring Economic Chaos – Barry Eichengreen, New York Times

- The G-7 Was a Great Idea - Until it Became One Against Six – Andreas Kluth, Bloomberg

- Fannie and Freddie Can Never Be Truly Privatized – Bloomberg Editorial Board