Good evening! The conservative majority on the Supreme Court handed President Donald Trump a victory on Friday, scaling back the ability of federal judges to issue nationwide injunctions limiting his actions. The 6-3 ruling involves lower court decisions on a Trump executive order seeking to revoke the automatic granting of citizenship to babies born in the United States. The court did not address the constitutionality of Trump's effort to block such birthright citizenship. Among the five decisions announced today, the final day of the high court's term, the justices also maintained the Affordable Care Act's requirement that health plans provide freepreventive care.

Also, it's shaping up to be a busy weekend in the Senate as Republicans look to pass their megabill. We've got details.

Senate Republicans Eye High-Stakes Saturday Vote on Megabill

It's high noon for the Republican megabill.

Senate Republican leaders are pushing ahead with plans to take an initial procedural vote on their package of tax and spending cuts at noon on Saturday, even as it's not yet clear that they have the votes they'll need.

Senate Majority Leader John Thune of South Dakota reportedly told his members Friday that they can expect the text of the massive bill this evening ahead of a vote tomorrow to kick off debate on the legislation.

Asked if he has 50 votes, Thune told reporters: "We'll find out tomorrow."

Some senators still have concerns over the Medicaid cuts in the package or the costs of the overall plan. But the White House reportedly hashed out a tentative deal with House Republicans from New York, New Jersey and California who were pushing to raise the annual limit on state and local tax (SALT) deductions from the current $10,000 to $40,000. Those House Republicans have enough votes to potentially scuttle any bill that comes back from the Senate.

The House-passed version of the legislation included that SALT increase to $40,000 for households making less than $500,000 a year, but Senate Republicans wanted to dial back the cap and adjust the details of the deal to lower the cost of the tax break. (No Senate Republican hails from a high-tax blue state.) The latest agreement reportedly keeps the $40,000 cap for only five years and reverts to the $10,000 limit after that, cutting the cost to about $192 billion.

House Speaker Mike Johnson and Treasury Secretary Scott Bessent sought to sell Senate Republicans on the deal during a lunch meeting Friday and, according to Politico, Johnson told reporters afterward that he thought the party is "very, very close to closing that issue."

Johnson reportedly also told senators that he wants to do another reconciliation bill after this one, providing an opportunity for more spending cuts or other priorities.

What's next: It's a fiscal cliffhanger! Republicans have plenty of details left to iron out - and votes to wrangle, as several senators have not yet said whether they're ready to move ahead with debate on the bill. Thune acknowledged that the timing of the vote could still slip. President Donald Trump on Friday eased off his July 4 deadline, telling reporters that lawmakers have more time if needed. "It can go longer," he said, "but we'd like to get it done by that time if possible."

Senate Republicans Get Green Light on Revised Proposal to Cut Food Aid

After hitting a wall with the Senate parliamentarian, Republicans have revived their effort to cut spending on food aid for the poor through their massive reconciliation bill.

The parliamentarian ruled last week that the Republican plan to require some states to cover a portion of the cost of benefits in the Supplemental Nutrition Assistance Program did not satisfy the budgetary rules imposed by the reconciliation process. Under the initial plan, states that have payment error rates higher than 6% in their SNAP programs would be required to pay between 5% and 15% of their food aid starting in fiscal year 2028. Most states have error rates exceeding the threshold, and the rule could have forced them to pay hundreds of millions of dollars per year.

A revised plan, approved by the parliamentarian on Friday, allows states to choose the SNAP payment error rates from either fiscal year 2025 or 2026 to determine their funding requirement starting in 2028.

"For Fiscal Year 2029 and following, the state match will be calculated using the payment error rate from three fiscal years prior," the Republicans on the Senate Agriculture, Nutrition and Forestry Committee said in a statement. "A state must contribute a set percentage of the cost of its SNAP benefits if its payment error rate exceeds six percent."

Republicans said the rules will help improve efficiency and reduce waste in SNAP spending. Although the new rules have not yet been evaluated by the Congressional Budget Office, they are expected to help offset the cost of the GOP tax cuts by tens of billions of dollars, depending upon how states react.

Democrats portrayed the move as a classic reverse Robinhood maneuver. "Congressional Republicans have chosen to cut food assistance for millions of Americans to give tax breaks to billionaires," Sen. Amy Klobuchar, the senior Democrat on the Agriculture Committee, said Friday.

Editorials of the Day: Two Warnings About GOP Tax Cuts and Rising Debt

Two standard-bearers of mainstream media opinion-making are out today with editorials warning against President Trump's "One Big Beautiful Bill" and the effects it will have on our national debt.

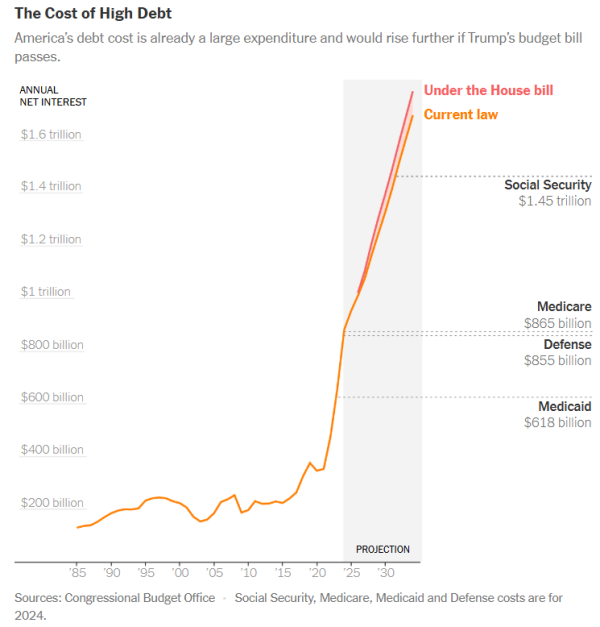

The New York Times editorial board writes that the large national debt and the costly interest payments it now requires are already causing problems. "We, the people, are spending a staggering amount of money each year to borrow money," they write. "The interest payments on the federal debt now exceed the government's spending on the military. They are roughly equal to the annual cost of Medicare. The sum is more than the government spends on anything except Social Security."

And the Times warns that the Republican tax cut plan would only "deepen this profligacy," piling more borrowing costs on top of the more than $1 trillion that the government is already on pace to pay its lenders this year. The Congressional Budget Office has estimated that the House version of the bill would add an average of $55 billion a year in interest costs over the next decade.

"Americans are being asked to bear this burden for a bill that would deliver tax cuts primarily to the wealthiest Americans while slashing health care and other government services for lower-income families," the editorial says, adding that, while both parties share some responsibility for the debt, the Republican policy playbook bears more of the blame. "Three times in the past half-century, Republicans have enacted large tax cuts that necessitated significant increases in federal borrowing. Each time they insisted the cuts would drive economic growth, even claiming that the expansion would be so large that the government would collect more tax revenue. Each time, they've been proved wrong."

The current GOP legislation "would be the fourth iteration of this failed experiment" and the "reverse Robin Hood" of taking from the poor to give to the rich makes no sense: "The expected increase in the debt is particularly absurd because the government would borrow much of the money from the same people who got the biggest tax cuts from the bill. Roughly half of the government's debt typically is sold to American investors, and those investors are disproportionately affluent. When the government borrows from them rather than raising taxes, it is getting the same money from the same people on less favorable terms. Instead of taxing the rich, the government pays them interest."

The Washington Post editorial board similarly warns against the GOP's deficit-financed tax cuts, writing that the bill will eventually come due.

The Post fails to mention the GOP's tax-cutting track record in explaining the rising debt, instead pointing to debt added during the 2007-2008 financial crisis and the Covid-19 pandemic. It also notes that "a significant chunk" of the debt "accrued because the country kept spending at emergency levels even after vaccines enabled the economy to return to normal." Still, it also warns that tax cuts rarely generate enough growth to offset their cost.

"Too much borrowing can also drive up interest rates for everyone," the Post points out. "When the Congressional Budget Office included macroeconomic feedback effects in its model, it found that the price of the GOP bill ballooned by hundreds of billions of dollars, mostly due to higher interest payments."

The bottom line, the Post's editors say, is that Americans should tune out Republican boasts about how much they are cutting taxes. "Recent experience suggests they're just hiding the bill from you, while running up the tally."

Read the full editorials from The New York Times and The Washington Post.

Americans Cut Back on Spending as Inflation Inches Higher

Consumer spending fell 0.1% in May relative to the month before, the Commerce Department announced Friday. It was the first decline in spending since January. Personal income fell, as well, dropping 0.4% on a monthly basis, with disposable income falling an even larger 0.6%. It was the first monthly drop in incomes in nearly four years.

Both sets of numbers were distorted by one-time events. Spending on vehicles dropped sharply in May after rising the month before as Americans scrambled to purchase new cars ahead of new tariffs imposed by President Trump in April. And the drop in income in part reflected a big jump in Social Security payments the month before as new, more generous regulations for some public union retirees took effect.

Still, the declines were potentially a sign of weakness in the economy, arriving as the labor market slows. "It is quite rare for consumer spending to fall in inflation-adjusted terms," noted University of Michigan economist Justin Wolfers. "It happened during covid, and during the financial crisis, and it is happening now."

The signal is far from clear, though. The consumer sentiment index from the University of Michigan moved higher in June, according to data released Friday, even as sentiment remains below 2024 levels. Survey director Joanne Hsu said that "consumer views are still broadly consistent with an economic slowdown and an increase in inflation to come."

Inflation bump: Price data came in slightly hotter than expected, with consumer prices rising 0.1% on a monthly basis and 2.3% on an annual basis. The core price index - which strips out volatile food and fuel prices and is seen by the Federal Reserve as the best measure of the inflation trend - rose 0.2% during the month, faster than expected, bumping the annual core rate up to 2.7%.

The question is whether the modest increase in inflation is just noise in a bumpy data set or an early sign of price hikes driven by Trump's tariffs. Those tariffs have had little effect on prices so far, but most economists believe that pricing pressure is inevitable. CNBC reports that a leading logistics firm says its customers are currently raising inventory prices by 8%-15%, suggesting that an inflationary surge is now in the pipeline.

Ed Al-Hussainy of Columbia Threadneedle Investments told The New York Times that the latest economic data was as good as you could hope for "going into an inflation shock." The real question is what happens next. "Then we'll see how big and persistent it is six months from now," he said.

At the same time, Al-Hussainy added, a slowing labor market could help defuse inflationary pressure, as worried consumers cut back on consumption and weaker demand helps limit the range of upward price movements.

Fiscal News Roundup

- Senate Republicans Near Deal on Trump's Tax Bill, Lawmakers Say – Washington Post

- Senate Republicans Reprise Push to Pay for Tax Cuts by Slashing Food Stamps – New York Times

- Senate Parliamentarian Rejects Religious College Tax Carve-Out, Gun Silencer Deregulation in GOP Megabill – The Hill

- Trump Economic Adviser Warns of Recession if 'Big, Beautiful Bill' Is Delayed – The Hill

- House GOP Advances Bill 'Gutting' Government Watchdog – The Hill

- Supreme Court Preserves Obamacare Coverage of Preventive Health Care – Politico

- Trump Says He's Ending Trade Talks With Canada Over Its 'Egregious Tax' on Technology Firms – Associated Press

- U.S., China Agree on Framework for Trade Deal, Both Nations Say – CBS News

- Trump Signals U.S. Is Nearing Trade Deals but Says Some Countries Will Face Tariffs – New York Times

- US Goods Exports Tumble by Most Since 2020 as Trump's Tariffs Disrupt Trade – Financial Times

- Deep Inside U.S. Economy, More Sticker Prices Start Going up Due to Tariffs, and Inventory Is Headed Down – CNBC

- Big America Hedge Affects Dollar's Global Standing – Axios

- States Fear Critical Funding From FEMA May Be Drying Up – ProPublica

- A Hospital Was in Critical Condition. Could $1.1 Billion Fix It? – New York Times

- Solar Manufacturing Is Booming. Advocates Say It Could Go Bust Without Incentives – NPR

Views and Analysis

- The National Debt Is Already Causing Bigger Problems Than People Realize – New York Times Editorial Board

- Deficit-Financed Tax Cuts Aren't Real Tax Cuts – Washington Post Editorial Board

- Republicans Prepare to Open 'Pandora's Box' of Budget Gimmicks – Andrew Duehren, New York Times

- New Byrd Violations Threaten Trump's Beautiful Bill – David Dayen and Whitney Curry Wimbish, American Prospect

- Tax Bill Highlights the Collapse of GOP Policymaking – Jessica Riedl, The Dispatch

- Capitol Agenda: How Trump Could Get His July 4 Megabill – Lisa Kashinsky, Mia McCarthy and Benjamin Guggenheim, Politico

- Meet the "Moderates" Trying to Make Trump's Tax Bill More Regressive – Timothy Noah, New Republic

- Exploding U.S. Indebtedness Makes a Fiscal Crisis Almost Inevitable – George F. Will, Washington Post

- Thune Says Health Care Often 'Comes With a Job.' The Reality's Not Simple or Straightforward. – Arielle Zionts, KFF Health News

- About Those 'Millions' Losing Medicaid – Wall Street Journal Editorial Board

- This Isn't Really About Defunding Planned Parenthood - Except It Is – Stephen L. Carter, Bloomberg

- How Would the Proposed Additional Senior Deduction Compare to No Tax on Social Security? – Alex Durante, Tax Foundation

- Trump's Budget Bill Is So Bad, Even Fox Is Calling It Out – Edith Olmsted, New Republic

- Missing in the Republican Tax Bill: A Real Answer to the US Medical Debt Crisis – Jeff Smedsrud, The Hill