Good evening. President Donald Trump launched a major salvo in his tariff war today, placing a 50% import tax on good from Brazil - though the move may have had more to do with personal grudges than trade policy. We've got details on that and more.

Trump Hits Brazil With 50% Tariff, Claiming 'Witch Hunt' Against Former Leader

President Trump announced a new batch of tariffs Wednesday, including a 50% levy on goods coming to the U.S. from Brazil.

Trump cited the country's treatment of its Trumpian former president, Jair Bolsonaro, as a major factor in his decision to apply such a high tariff. Unlike many other nations that have been hit with significant tariffs, the U.S. had a trade surplus with Brazil in 2024.

Like Trump, Bolsonaro stands accused of trying to overturn an election loss illegally, and is currently facing trial for the alleged crime. In a letter to President Luiz Inácio Lula da Silva of Brazil posted on his social media platform, Trump called for a halt to the legal proceedings. "This Trial should not be taking place," Trump wrote. "It is a Witch Hunt that should end IMMEDIATELY!"

Trump also accused Brazil of making "insidious attacks on Free Elections, and the fundamental Free Speech Rights of Americans," citing "SECRET and UNLAWFUL Censorship Orders to U.S. Social Media platforms" by the Brazilian high court.

Lula fired back, calling Trump "irresponsible for threatening tariffs on social media." He also called on world leaders to reduce their use of the U.S. dollar in global trade.

In addition to Brazil, Trump also announced tariffs on the Philippines, Brunei, Moldova, Algeria, Iraq, Libya and Sri Lanka.

The Big Bills Congress Must Deal With Next

Republicans' "big, beautiful" bill is done, but Congress still has plenty of important fiscal legislation and related items to deal with before the end of the 2025 fiscal year on September 30. Lawmakers in the Senate and the House are marking up the annual defense policy bill this week and next, for example. And they've got plenty more on their plates.

Funding the government to avoid a shutdown: The GOP's big package of tax and spending cuts was a budget reconciliation bill, meaning that it had to deal with mandatory spending, taxes and/or the debt limit. It could not touch on discretionary spending - that is, annual funding for things like transportation, education or defense. Congress must still deal with those funding decisions or pass yet another stopgap spending measure before the September 30 deadline to avert a shutdown.

Neither the House nor the Senate has gotten very far, leaving little chance of passing all 12 annual appropriations bills in time. The Senate Appropriations Committee will be marking up three bills tomorrow. The House has passed one 2026 spending bill covering military construction and Veterans Affairs and House appropriators have marked up four others. But Republicans and Democrats appear to have little room to strike a bipartisan deal on spending levels or appropriations details, leaving the possibility of one or more stopgap funding bills - potentially another full-year continuing resolution - or an ugly shutdown fight.

Voting on Trump's rescissions package: The White House has requested that Congress claw back $9.4 billion in approved funding for foreign aid and public broadcasting. Lawmakers must act on the request by July 18 or it will expire without the cuts being enacted. The House narrowly approved the package last month. The Senate is expected to take up the rescissions request next week, but Republicans in the chamber are eyeing changes to the package.

Some have expressed concerns about cuts to the global AIDS prevention program known as PEPFAR and about the potential loss of public broadcasters, especially for rural communities. "I have already made clear I don't support the cuts to PEPFAR and child and maternal health," Senate Appropriations Chair Susan Collins told reporters Tuesday night.

Fiscal hawks in the GOP are worried about the signal their party might send by failing to cut the relatively small amount of funding at stake. "If the Republicans in the United States Senate do not pass the rescissions package after all the rhetoric about reducing spending, then they should hide their head in a bag," Sen. John Kennedy of Louisiana told reporters. "And I think the White House will provide the bag."

Mapping out more budget reconciliation bills: Republicans are already talking about two more rounds of budget reconciliation and the cuts they might include. "We've been planning a second reconciliation bill for the fall attached to the next fiscal year, and then potentially one in the spring," House Speaker Mike Johnson told Fox News Sunday. "That's my plan. Three reconciliation bills before this Congress is over. I think we can do that."

Key Republicans support the idea, and party leaders reportedly used the possibility of future reconciliation packages containing additional spending cuts and other Republican priorities to sway holdouts on the last big bill.

Republican Sen. Ron Johnson of Wisconsin told reporters that congressional leaders and the White House promised him another shot at ending the Affordable Care Act's 90% federal cost share for new enrollees in states that expanded Medicaid - a change that would cut an estimated $313 billion in spending but could lead to widespread coverage losses.

"Senior Republicans on Capitol Hill and in the White House, meanwhile, continue to deny they made any side deals as a condition of winning over holdouts," Politico notes.

Quote of the Day

"The growth that's just attributed to the tax cut is way too hot, even compared with what conservatives like me would say. ... It's just way, way, way out of line."

– Glenn Hubbard, who led the White House Council of Economic Advisers under President George W. Bush, questioning projections by Trump White House economists about the economic benefits of the big bill Trump just signed into law.

Hubbard was quoted today in a New York Times article by Tony Romm and Colby Smith that examines the "grand and potentially disruptive economic experiment" that President Trump has launched through his tax cuts, tariffs, deregulation and immigration crackdown.

"His actions in recent weeks have staked the future of the nation's finances - and its centuries-old trading relationships - on a belief that many economists' most dire warnings are wrong," Romm and Smith write, adding that "the president has now achieved broad swaths of what he set out to do, making him responsible for the highs or lows on the horizon."

Government Spending Up $144 Billion So Far This Year: CBO

Federal spending is $144 billion higher in the first six months of 2025 than it was during the same period last year, the Congressional Budget Office estimated Wednesday in its June budget review. The numbers indicate that any talk of reduced spending by the Trump administration, achieved through DOGE or by any other means, has not produced real results.

For the fiscal year, which began in October 2024, outlays are up $320 billion, or 6%, while revenues are up $254 billion, or 7%. Together, they produced a budget deficit of $1.3 trillion for the first nine months of the fiscal year, about $65 billion higher than the same period a year ago.

The timing of payments and receipts influenced the final numbers, CBO said. Without that calendar-influenced shift, the deficit would have been about 1% smaller than it was last year.

The fiscal hawks at the Committee for a Responsible Federal Budget said the latest CBO estimates provide a warning for lawmakers, who just passed enormous tax cuts. "Bottom line-high levels of debt combined with tax cuts and growing spending is a recipe for fiscal disaster, and we should change course immediately," CRFB's Maya MacGuineas said in a statement.

X Post of the Day

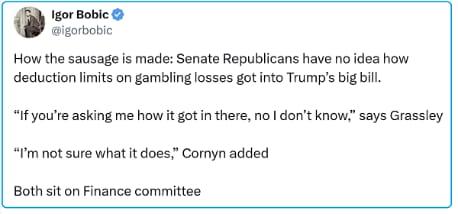

Professional gamblers are loudly complaining about a provision in the Republican tax legislation that President Trump signed into law on July 4 that limits write-offs of gambling losses. As HuffPost's Igor Bobic reports this week, many GOP senators had no idea the provision had been inserted into the bill, including Sens. Chuck Grassley of Iowa and John Cornyn of Texas, who sit on the Senate Finance Committee.

Sen. Thom Tillis of North Carolina, one of the few Republicans who voted against the bill, told Bobic that he does not support the policy. "I was so focused on Medicaid, I wasn't looking for other reasons to be against the bill," he said. "But that would be another one."

Rep. Dina Titus, a Democrat from the gambling mecca of Nevada, has introduced a bill to reverse the policy, which caps the deduction of gambling losses at 90%, down from 100%. Sen. Catherine Cortez Masto, another Democrat from Nevada, will reportedly try to pass a repeal of the provision in the Senate this week via unanimous consent.

Fiscal News Roundup

- FEMA's Response to Texas Flood Slowed by Noem's Cost Controls – CNN

- Most Fed Officials See Rate Cuts Coming, but Opinions Vary Widely on How Many, Minutes Show – CNBC

- The GOP Blew Past Debt Warnings. The Markets Have Noticed – Politico

- The Megabill Provisions You Might Have Missed – Politico

- Senate GOP Plots How to Move Trump's $9.4B Clawbacks Request – Politico

- Senate Finance Chair Endorses a Second Megabill This Fall – Politico

- Arrington Sees Another Chance to Notch Conservative Wins, Spending Cuts in Second Megabill – Politico

- The Fight Between Musk Acolytes and the White House for Control of DOGE – Wall Street Journal

- Confused About Where Things Stand With Trump's Tariffs? Here's a Handy Primer – NPR

- Tariffs Are Already Squeezing Corporate Margins, New Survey Finds – Axios

- Trump Delayed Reciprocal Tariffs After Bessent Wanted More Time on Deals – Wall Street Journal

- Two Kevins Battle to Be Next Fed Chair in Trump's Apprentice-Style Contest – Wall Street Journal

- Bessent Steps Up Criticism of Fed as Auditions for Chair Intensify – New York Times

- 'People Are Going to Die': A Malnutrition Crisis Looms in the Wake of USAID Cuts – Wired

- Senate Panel Advances Trump's Nominee to Lead CDC – Politico

Views and Analysis

- With Taxes and Tariffs in Place, Trump Takes Reins of U.S. Economy – Tony Romm and Colby Smith, New York Times

- Republicans Are Planning Even More Safety-Net Cuts – Ed Kilgore, New York

- The "Undeserving Poor" Deserve Medicaid – Timothy Noah, New Republic

- Pregnancy Is Going to Be Even More Dangerous in America – Jessica Grosse, New York Times

- Why Voters Probably Won't Punish Republicans for Cutting Medicaid – Perry Bacon Jr.

- Trump's "Big, Beautiful Bill" Stops Short of "No Tax on Tips" Promise – Jason Lalljee, Axios

- As the Texas Floodwaters Rose, One Indispensable Voice Was Silent – Zeynep Tufekci, New York Times

- Why the Federal Government Will Shut Down. And Why It Won't – Jake Sherman and John Bresnahan, Punchbowl News

- The Real Reason Trump Wants to Fire the Fed Chair – Lael Brainard, Washington Post

- Trump's Next Fed Chair Pick Already Comes With a Credibility Problem – Jeff Cox, CNBC

- Trump's Previous Tariff Push Terrified the World Economy. He's Betting This Time Is Different – Josh Boak, Associated Press

- Who Is Paying for the Trump Tariffs? – Sheldon H. Jacobson, The Hill

- Trump Treats Tariffs More as a Form of Power Than as a Trade Tool – Maggie Haberman, New York Times

- Extend and Pretend Is a Feature, Not a Bug of Trade Policy – Joseph Brusuelas, RSM