Good evening. White House Budget Director Russ Vought today ratcheted up President Donald Trump's battle against Federal Reserve Chair Jerome Powell, accusing the central banker of mismanagement. "The President is extremely troubled by your management of the Federal Reserve System," Vought wrote in a letter he posted on social media. "Instead of attempting to right the Fed's fiscal ship, you have plowed ahead with an ostentatious overhaul of your Washington D.C. headquarters."

Trump has repeatedly criticized Powell and called for the fed to lower interest rates. Analysts suspect that the White House may be laying the groundwork to fire the fed chief for cause. In testimony before Congress last month, Powell disputed claims that the renovation involved lavish features but acknowledged cost overruns.

Here's what else is happening.

Conservatives Are Already Pushing for Another Tax Cut: Report

Although the ink is barely dry on the massive tax and spending package that will add more than $4 trillion to the national debt over the next decade, some Republicans are calling for another major tax cut. As The Washington Post's Jeff Stein reports Thursday, anti-tax activists want the Trump administration to embrace a change in the way capital gains are taxed, a move that would benefit investors.

One of the groups pushing for the change is Americans for Tax Reform, an advocacy group founded in 1985 by the hugely influential anti-tax activist Grover Norquist, who has long called for changing the way capital gains taxes are calculated. Currently, capital gains are measured in nominal dollars, with no adjustment for inflation. The proposed change would allow investors to reduce their gains by the rate of inflation - an adjustment that would reduce taxes owed, especially for investors who held their investments over long time horizons.

Making the change would require an act of Congress, according to an analysis by the Justice Department from the early 1990s. But as Stein reports, conservative groups are pushing for the Treasury Department to make the change on its own, without consulting lawmakers. A Republican senator has reportedly spoken to Treasury Secretary Scott Bessent about the idea.

If the Treasury option fails, Republicans could include the policy change in a second tax bill later this year or early next year.

Norquist told Stein that he has spoken to President Donald Trump about the issue, arguing that he could institute the change via executive order. "I said something like, 'Mr. President, after we do the bill, we will need more economic growth. The Big Beautiful Bill is very pro-growth, but with this, we can have even more growth,'" he said. "The bureaucracy stopped him the first time, but they can't this time."

Regardless of how the policy change might occur, economists say it would be costly for the federal government. Studies done during the first Trump administration found that indexing capital gains to inflation would reduce revenues by between $100 billion and $200 billion over 10 years, Stein says. The benefits would flow overwhelmingly to the already wealthy, with the top 1% claiming about 86% of the proceeds.

Critics say the change would do little to boost the economy, and it would likely face legal challenges if it were implemented via executive fiat. But potential economic benefits may not be the primary concern. Norquist made it clear long ago that tax cuts serve a larger purpose in his battle against big government. "I don't want to abolish government," he famously said in 2011. "I simply want to reduce it to the size where I can drag it into the bathroom and drown it in the bathtub."

Effective Tariff Rate Hits 18%

On Thursday, economists at the Yale Budget Lab updated their analysis of U.S. tariff rates, which continue to change as President Trump unilaterally raises taxes on goods coming into the U.S. from abroad. According to the latest numbers, which include the tariffs announced this week, the average tariff rate being paid by U.S. importers will be 18% as of August 1 - the highest level since 1934.

The Yale analysts say the current tariffs disproportionately affect clothing and textiles. In the short run, consumers can expect to see shoe prices rise by 39% and clothing prices climb by 36%. Over time, as importers find new suppliers, prices for those types of goods are estimated to be 18% higher than before.

Those price increases could take time to show up at your local retailer. As University of Michigan economist Justin Wolfers explains, "New shipments take a month to arrive, then go through customs. So wholesalers don't see higher prices until a couple of months later. (Plus, many had stocked up ahead of time.)"

Trump Would Cut Federal R&D Funding by 22%, New Analysis Says

Scientists have warned that the Trump administration's funding cuts threaten a broad range of research. Now, a new analysis finds that the president's budget request would cut federal funding for research and development by 22%, from $198 billion for fiscal year 2025 to $154 billion for fiscal year 2026. Basic research - the kind that focuses on the advancement of knowledge and seeks answers to big, theoretical questions - would be cut by a third, from $45 billion to $30 billion.

The analysis by the American Association for the Advancement of Science "added up cuts to the budgets of hundreds of federal agencies and programs that do scientific research or provide grants to universities and research bodies," according to The New York Times. "It then compared the funding appropriated for the current fiscal year with the administration's proposals for fiscal year 2026."

The White House budget request outlined in early May called for a roughly 56% cut in funding for the National Science Foundation, from $8.8 billion to $3.9 billion. It also proposed to slash the budget of the Department of Health and Human Services by 26%, or more than $33 billion, including an $18 billion reduction at the National Institutes of Health.

Sudip Parikh, the CEO of the American Association for the Advancement of Science and Executive Publisher of the Science family of journals, warned at the end of May that Trump's 2026 budget request "would end America's global scientific leadership." Other experts have echoed that admonition.

Alessandra Zimmermann, a budget analyst at the science association, told the Times that, accounting for inflation, the proposed $44 billion reduction in federal R&D funding would result in the lowest level of federal spending on science in this century and could allow China to take the global lead in scientific investment.

Read more at The New York Times.

Poll of the Day: The Cost of Child Care Is a 'Major Problem'

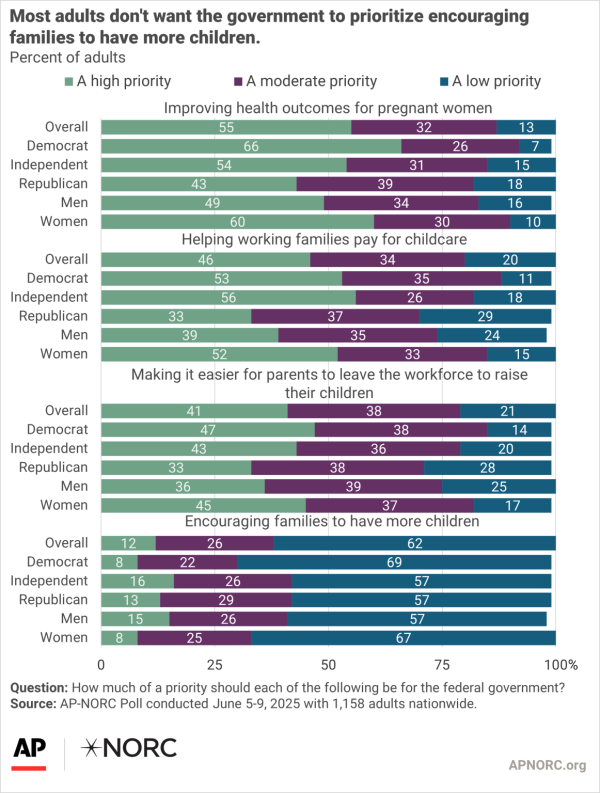

If you have kids or know anyone who does, this won't surprise you: A new poll from the Associated Press and the NORC Center for Public Affairs Research finds that 76% of Americans say the cost of child care is a "major problem" in the United States. But the poll also sheds some light on why addressing the issue is so complicated, as it suggests Americans are divided over the appropriate policy fixes and the role government should play.

Only 46% of adults surveyed say that helping working families pay for child care should be a "high priority" for the federal government, including 53% of Democrats, 56% of independents and 33% of Republicans. Just 41% of Americans say that making it easier for parents to leave the workforce to raise children should be a high priority. But 67%, including 76% of Democrats and 58% of Republicans, favor requiring employers to provide paid family leave for parents of newborns. Almost two-thirds, 64%, support free or low-cost daycare for children too young to attend public school.

The poll of 1,158 adults was conducted June 5 to 9 and has an overall margin of sampling error of plus or minus 4 percentage points.

Fiscal News Roundup

- Funding Bill in Limbo Amid FBI Headquarters Uproar – Politico

- Senators Consider New Security Funding for Lawmakers – Politico

- White House Accuses Powell of Mismanaging Federal Reserve, Citing Headquarters Renovation – CNBC

- A Decade of Missed Opportunities: Texas Couldn't Find $1M for Flood Warning System Near Camps – Associated Press

- Trump's 'Big Beautiful Bill' Cuts Food Stamps for Millions - the Average Family May Lose $146 per Month, Report Finds – CNBC

- State Department Notifies Staff It Will Begin Firing Personnel 'Soon' – CNN

- Federal Judge Issues New Nationwide Block Against Trump's Order Seeking to End Birthright Citizenship – CNN

- With 'Big' Bill in Rearview, Trump Doesn't Have a New To-Do List for Congress – Roll Call

- GOP Cuts Trigger Democratic Warnings on Government Shutdowns – Axios

- Gambling Tax Repeal Bill Blocked in Senate – Roll Call

- FEMA Is Holding Up $2.4 Billion in Grants to Fight Terrorism, States Say – New York Times

- Trump's Cuts Are Making Federal Data Disappear – Bloomberg

- The Surprising Scientists Hit by Trump's D.E.I. Cuts – New York Times

- It Hasn't Been This Hard for Americans to Find Work Since 2021 – CNN

Views and Analysis

- Correcting the Social Security Administration About the Big Budget Bill – Howard Gleckman, Tax Policy Center

- Want Medicaid Coverage? Go Pick Some Vegetables – Philip Bump, Washington Post

- Who Profits Most From Medicaid? Employers Like Walmart and Amazon, Many of Whose Workers Rely on the Program – Michael Hiltzik, Los Angeles Times

- The Economic Drain of Mass Deportation – Wall Street Journal Editorial Board

- Trump Says He's Making America More Competitive. Is He? – Jess Bidgood, New York Times

- When We'll See the Full Damage From Trump's Megabill – Ed Kilgore, New York

- How GOP Megabill Fuels Debt for Future Generations – Miriam Waldvogel, The Hill

- Trump's Tariff Shambles Is a Helpful Warning to the World – Alan Beattie, Financial Times

- Targeting Brazil, Trump Tests Legal Limit of His Tariff Powers – Tony Romm, New York Times

- Too Many Goods Are About to Face Historically High Tariffs – Robert McClelland and John Wong, Tax Policy Center

- A Pizza Oven Tells the Tariff Story So Far – Shawn Donnan, Businessweek

- Should We Politicize the Texas Flood? Absolutely – Paul Krugman, Substack

- The Real Budget Fight Begins – Karl Rove, Wall Street Journal

- Come April, Pope Leo Might Need a Tax Adviser – Daniel A. Witt, Washington Post

- Trump Sneaked Huge Gift for Peter Thiel-Backed Company Into Budget – Edith Olmsted, New Republic

- Right-Wing State Tax 'Revolution' Rolls On – Don Wiener and Arn Pearson, American Prospect