Happy Wednesday! A new quarterly GDP report out today suggests that the U.S. economy is holding up well under the uncertainty created by President Trump's trade policies, but the details indicate underlying weakness. Given that outlook, the Federal Reserve held rates steady, as expected. Trump, meanwhile, said he would stick to an August 1 deadline for new trade deals and announced a 25% tariff on imports from India. Here's the latest.

US Growth Surged in Q2, but Economists Warn of Trouble Ahead

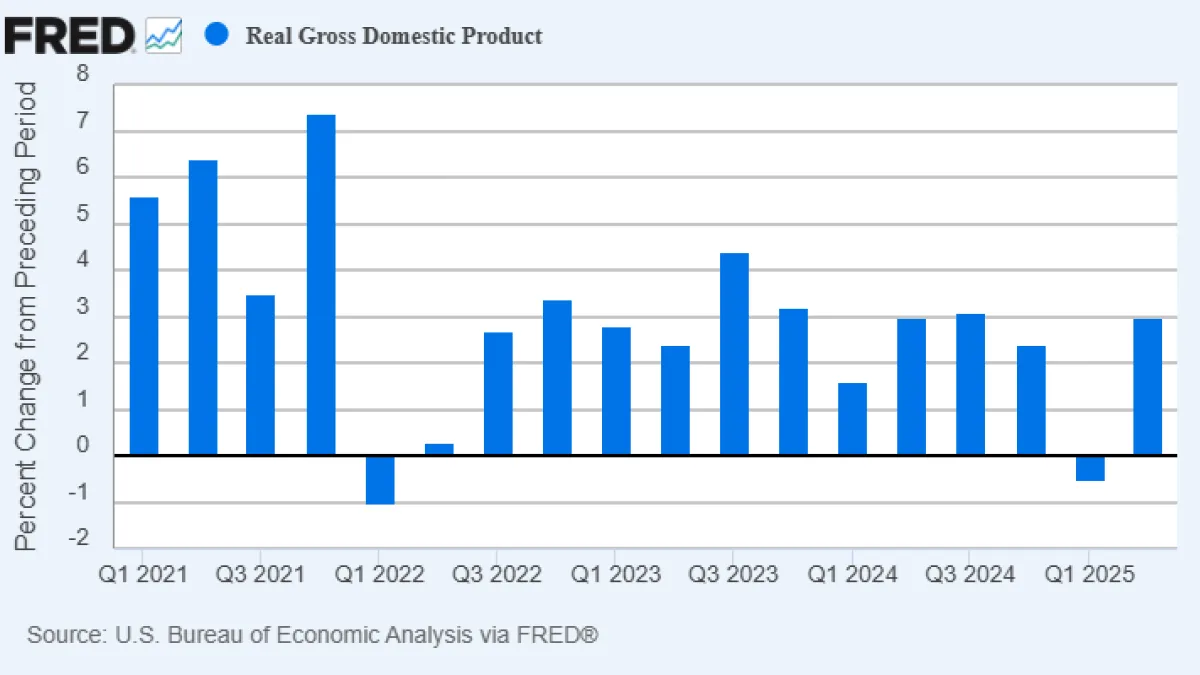

The U.S. economy grew at a faster-than-expected annual rate of 3% from April through June of this year, according to preliminary data released Wednesday by the Commerce Department, but economists warn that healthy headline figure masks weaker underlying trends that may portend a slowdown in the coming months.

On its face, the report suggests a solid economic rebound after gross domestic product shrank at a 0.5% annual rate over the first three months of the year. In a social media post, President Donald Trump hailed the growth as "WAY BETTER THAN EXPECTED!" and used it to again press Federal Reserve Chair Jerome Powell to lower interest rates.

But the gross domestic product growth data for both the first and second quarters were distorted by special factors - most notably Trump's trade war, which caused swings in imports and exports as businesses scrambled to build up inventories ahead of expected tariff increases. Economists said Wednesday's data suggests that growth over the first half of the year has been sluggish as the economy contends with challenges and uncertainty caused by the president's protectionist policies. "Headline numbers are hiding the economy's true performance, which is slowing as tariffs take a bite out of activity," Nationwide chief economist Kathy Bostjancic wrote, per the Associated Press.

Imports subtract from growth in the calculation of GDP - after all, the "D" stands for domestic - and a 30% drop in imports over April, May and June added more than 5 percentage points to growth. At the same time, a drop in inventories after the first quarter build-up sliced 3.2 percentage points from growth. Together, net exports and inventories boosted GDP growth by 1.8 percentage points in the second quarter after acting as a 2-percentage-point drag in the first quarter, according to Goldman Sachs economists.

Consumer spending increased at a modest 1.4% annualized pace in the second quarter, in line with expectations and up from a 0.5% rate in the January-March quarter. But a key measure of economic activity that tallies consumer spending and gross private fixed investment increased 1.2% in the second quarter, the weakest since the end of 2022 and down from 1.9% in the first quarter.

Overall, economic growth averaged 1.25% in the first half of the year, a marked slowdown from the 2.8% GDP growth in 2024. "The picture is not pretty, an own goal by U.S. policymakers," said Freya Beamish, chief economist at TS Lombard, according to Reuters. "An economy that was purring along, defying expectations of a slowdown, has been placed on hold."

Federal outlays fall again: Federal government spending fell for the second straight quarter, dropping at a 3.7% annualized rate after falling at a 4.6% clip in the first quarter. Nondefense spending fell at an 11.2% annual rate in the April-June quarter. The drops likely reflect the Trump administration's DOGE spending cuts.

Inflation remains muted: The Federal Reserve's preferred measure of inflation, the personal consumption expenditures, or PCE, price index, rose at a 2.1% annual rate in the second quarter, down from 3.7% in the first quarter. The core PCE price index, which excludes volatile food and energy prices, rose 2.5%, compared with a 3.5% increase the prior quarter. More detailed data on inflation and spending for June is due out tomorrow.

The bottom line: Trump's economy may be more tepid than the strong GDP report suggests.

Fed Holds Steady on Rates, but Dissent Is Growing

For the fifth meeting in a row, the Federal Reserve Open Market Committee on Wednesday stood pat on interest rates, maintaining the central bank's benchmark lending rate in a range between 4.25% and 4.5%. The decision to hold steady was widely expected but comes amid rising pressure from President Trump and members of his administration for the Fed to cut rates.

In a notable dissent, two Fed governors appointed by Trump, Michelle Bowman and Christopher Waller, said they favor an immediate rate cut of 25 basis points. It was the first time since 2020 that more than one member of the Fed's 12-member rate-setting committee broke with Fed Chair Jerome Powell, and the first time in more than 30 years that more than one of the central bank's seven governors voted in dissent.

Productive meeting: At an afternoon press conference, Powell downplayed the dissenting votes, saying the debate at the meeting was productive and he is not surprised there are different views of how to proceed among Fed officials, given the uncertain environment. The economy is basically in good shape, Powell said, but Trump's tariffs could deliver a supply shock that threatens both sides of the Fed's dual mandate of maintaining stable prices while maximizing employment. Potential price increases call for an increase in rates, while a potentially softening labor market calls for a cut, and you can't do both at the same time.

Powell said that inflation remains a bit too high, even without the tariffs, which appear to be adding more price pressure. The labor market, on the other hand, is basically still in balance, but that could change quickly. "Downside risks to the labor market are certainly apparent," he said.

Given the contradictory forces in play, it makes sense to continue to wait to see how things develop, Powell said. He added that Fed officials have made no decisions about what they will do at the next meeting in September, and will continue to review new data as it rolls in.

Asked by a reporter about the tariffs, Powell said the country is still in "early days" with respect to how the import taxes will affect the economy. The base case, Powell said, is for tariffs to force a one-time upward price-adjustment throughout the economy, with little effect on inflation beyond that, but officials will have to wait and see. Powell added that no matter how the tariffs present themselves in the economy, they ultimately will not be inflationary - because the Fed will act to nip inflation in the bud if it does begin to flare up. "In the end, there should be no doubt that we will do what we need to do to keep inflation under control," he said.

Powell also downplayed the pressure coming from Trump to cut rates, pressure recently delivered in person when the president paid an unusual visit to Powell at the Fed's headquarters building, which is undergoing an expensive - and in Trump's framing, wasteful and potentially fraudulent - renovation. While some think that Trump has played up the renovation issues to gain leverage over Powell as part of his campaign to force rate cuts, the Fed chief painted a more conciliatory picture. "We had a nice visit with the president," he said. "It was an honor to host him."

What the analysts are saying: The Fed's decision came as no surprise, and Powell's comments did little to change the outlook for many analysts. Some analysts, though, said they detected a slightly more hawkish tone from Powell than they expected, dimming hopes for more than one rate cut this year.

Mark Hackett, chief market strategist at Nationwide, said investors are now more pessimistic about what would be the first rate cut of the year occurring in September. "Markets turned lower during the press conference as investors became less convinced that a September rate cut is likely," he said, per Bloomberg. "Chair Powell previously stated that a rate cut would be appropriate if there were no tariffs, but that tone was not expressed this time."

The CME Groups' FedWatch tool showed market expectations of a September rate cut falling from more than 75% as of a month ago and about 63% yesterday to roughly 46% today.

Quote of the Day

"In a way, it is a back door for privatizing Social Security."

– Treasury Secretary Scott Bessent, talking about the new savings accounts for newborns created by Republicans' recent tax legislation. Bessent was speaking at a forum hosted by Breitbart News on Wednesday.

It's not clear what exactly Bessent meant in his reference to privatization, and the White House did not immediately reply to a request for comment from the Associated Press. But Democrats were quick to highlight the remarks, which suggest that Republicans have not abandoned their long-held desire to privatize the popular social welfare program, despite President Trump's vow to leave Social Security alone.

"A stunning admission," Majority Leader Chuck Schumer said in a speech in the Senate. "Bessent actually slipped, told the truth: Donald Trump and government want to privatize Social Security."

The new program creates a $1,000 savings account for every baby born from the beginning of 2025 to the end of 2028 - roughly the four years of Trump's second term. Families can add up to $5,000 per year to the accounts, with the gains going untaxed until they are withdrawn when the child is an adult.

Fiscal News Roundup

- Fed's Powell Sticks With Patient Approach to Rate Cuts, Brushing Off – Associated Press

- The U.S. Economy Rebounds to 3% Growth in Second Quarter - but Tariffs Skew Picture – NPR

- Trump Hits India With 25% Tariff, Threatens More Over Russia – Bloomberg

- Companies From Stanley Black & Decker to Conagra Are Saying Tariffs Will Cost Them Hundreds of Millions – CNBC

- China Promises to Help Companies Slammed by Tariffs, as Talks With the US Left in Limbo – Associated Press

- Government Shutdown Talk Is Starting Early Ahead of a Difficult Funding Fight in Congress This Fall – Associated Press

- There's a Massive Bipartisan Housing Bill Moving Forward in Congress – Axios

- US Treasury to Sell More Short-Term Debt in Continuation of Biden-Era Policy – Financial Times

- Judge Orders Trump Administration to Explain Why Order to Restore Voice of America Wasn't Followed – Associated Press

- White House Backtracks on NIH Funding Hold Amid Hill Uproar – Politico

- Bessent Hails New 'Trump Accounts' as 'Backdoor Way to Privatize Social Security' – Politico

- Brown University Signs Deal With Trump Administration to Restore Funding – The Hill

- Hundreds of Billions in Over-Budget Federal Projects Exposed, as Senate DOGE Tries to Claw Money Back – Fox News

- FDA Vaccine Chief Leaving Agency After Less Than 3 Months – Associated Press

- ICE Entices New Recruits With Patriotism Pitch and Promise of $50,000 Signing Bonuses – Associated Press

Views and Analysis

- Big Rebound in GDP Masks Hidden Weakness in the US Economy – Bryan Mena, CNN

- The Weirdest GDP Report Ever – Wall Street Journal Editorial Board

- The US Will Be the Biggest Loser From Trade 'Wins' – Bloomberg Editorial Board

- The White House Can't Fix Its Deficit Problem With Tariffs – Jessica Riedl, Washington Post

- The EU Has Validated Trump's Bullying Trade Agenda – Financial Times Editorial Board

- Has Donald Trump Ended Free Trade? – Anne Kim, Washington Monthly

- Trump Is Winning Trade Battles. The War? We'll See – Neil Irwin and Courtenay Brown, Axios

- Trump's Tariffs Give CEOs New Ways to Swindle Americans – Ellie Quinlan Houghtaling, New Republic

- The Trump Tax Deduction That Counts – Karl Smith, Washington Post

- Privatizing Veterans' Health Care Will Be a Disaster – Russell Lemle and Jasper Craven, American Prospect

- Do SNAP Food Restrictions Help Health, or Punish Poor People? – Emma Janssen, American Prospect