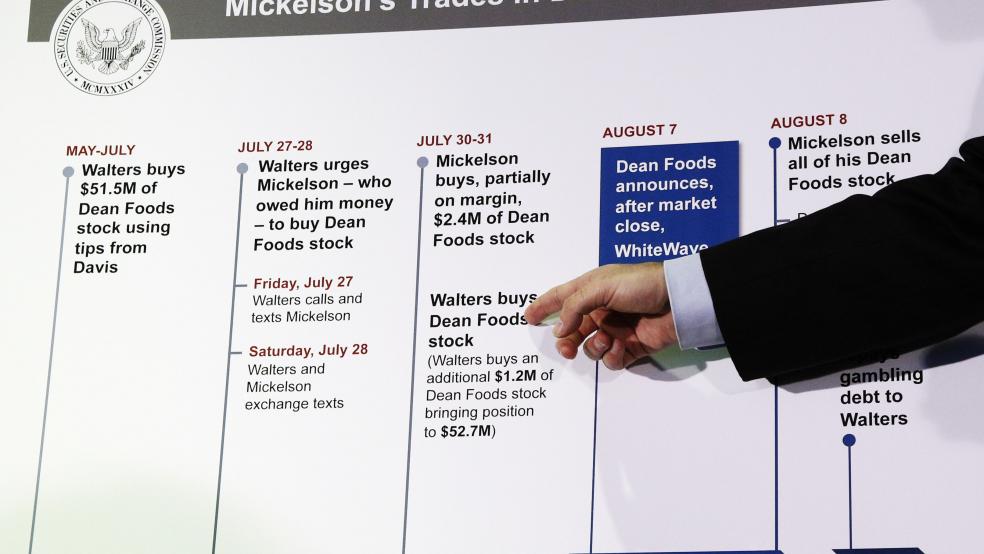

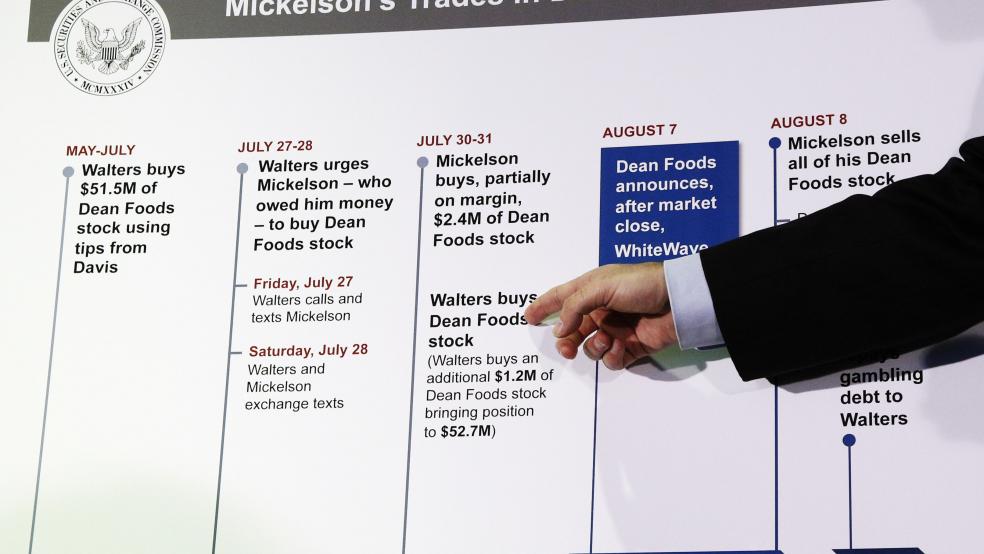

NEW YORK (Reuters) - U.S. authorities on Thursday charged a former chairman of Dean Foods Co and a professional Las Vegas gambler with engaging in a years-long insider trading scheme, which included a tip that benefited professional golfer Phil Mickelson. William "Billy" Walters, who has built a multimillion-dollar fortune as a famed Las Vegas sports bettor, and Thomas Davis, Dean Food's former chairman, were criminally charged in a case brought by federal prosecutors in Manhattan.Mickelson, who has won three Masters golf titles, was not criminally charged, but was named as a relief defendant in a civil lawsuit by the U.S. Securities and Exchange Commission, which said he also traded in Dean Foods stock.A relief defendant is not accused of wrongdoing but has received ill-gotten gains as a result of others' illegal acts. The lawsuit said that at a time when Mickelson owed Walters money after placing bets with him, Walters, aware of a Dean Foods corporate spin-off, urged him to trade in the company's stock, enabling the golfer to earn $931,000.The charges were announced by Manhattan U.S. Attorney Preet Bharara, marking the most significant case his office has pursued since a 2014 appellate ruling limited the scope of insider trading laws.The ruling in particular limited authorities' ability to pursue charges against a defendant who heard a stock tip second- or third-hand that originated with a corporate insider, making prosecuting someone like Mickelson more difficult.Walters, 69, was arrested in Las Vegas on Tuesday on charges of securities fraud, wire fraud and conspiracy. Davis, who resigned from Dean Foods' board in August, pleaded guilty on Monday.Barry Berke, Walters' lawyer, said the allegations were "based on erroneous assumptions, speculative theories and false finger-pointing."Mickelson felt "vindicated" that the SEC concluded he did not engage in any wrongdoing, his lawyer, Gregory Craig, said in a statement. He also said Mickelson had entered an agreement with the SEC to return all the money he made on the investment.Thomas Melsheimer, Davis's lawyer, said his client was "pleased to be cooperating with the government in its investigation."Walters has long faced various state and federal probes in his career as one of the most successful sports betters in the United States. In 1992, he was acquitted by a federal jury of charges related to illegal bookmaking.According to Thursday's indictment, from 2008 to 2014 Walters obtained inside information about Dean Foods from Davis and used it to make $32 million in profits and avoid another $11 million in trading losses.Davis disclosed information to Walters about Dean Foods' financial outlook, earnings and its spin-off of WhiteWaves Food Co. The deal sent the company's shares soaring after it was announced on Aug. 8, 2012, according to the indictment.Walters earned another $1 million trading on insider information about Darden Restaurants Inc from Davis, who was sought by an investment firm in New York as an investor or director, the indictment said.The two men have been friends since the mid-1990s, based on shared interests in sports, golf, gambling and business, according to court papers.In exchange for his tips, the indictment said Davis received significant benefits, including about $1 million in loans that largely were never repaid.The probe conducted by the Federal Bureau of Investigation and U.S. Securities and Exchange Commission became public in 2014 amid news reports also linking the investigation to activist investor Carl Icahn.Investigators had examined whether Icahn passed inside information about Clorox Co to Walters, sources have told Reuters. It was unclear if that aspect of the probe remains active.Icahn acknowledged last year he had a business relationship with Walters but said he never provided inside information to anyone.The cases in the U.S. District Court, Southern District of New York, are U.S. v. Walters, No. 16-cr-338, U.S. v. Davis, No. 16-cr-338, and Securities and Exchange Commission v. Walters, No. 16-cv-03772.