(Reuters) - U.S. shale oil producer SandRidge Energy Inc rejected demands from activist investor Carl Icahn on Tuesday to replace two of its board members and amend its bylaws, saying any changes should be approved by a majority of shareholders.

The move is likely to exacerbate tensions with Icahn, who has been known to move aggressively against companies he feels are mismanaged and undervalued, and could spark a showdown at the company's annual meeting later this year."The board believes that changes to the composition of the board of directors and other major governance changes, as proposed by Mr. Icahn, should be made with the fully informed approval of a majority of all of the company's shareholders, rather than at the behest of one," SandRidge's four independent directors said in a statement.The rejection comes less than a week after SandRidge met privately with Icahn in New York and tried to quell rising tensions with the billionaire investor, its largest shareholder, who earlier this month accused SandRidge Chief Executive James Bennett of negligence.A representative for Icahn, who owns about 13.5 percent of the company, was not immediately available to comment on Tuesday. Shares of SandRidge were unchanged in after-hours trading at $19.29.Icahn asked the company earlier this month to replace two directors, with one designated by him and the second by other large shareholders. Icahn had also sought bylaw changes that would have required a super-majority of the board to approve large transactions. The push for change came after SandRidge last month terminated a $746 million deal to acquire rival Bonanza Creek Energy Inc that Icahn and other investors said was too expensive and would burden the company with too much debt. SandRidge did acquiesce to part of Icahn's third demand over a shareholder rights plan, known as a poison pill, that bars individual shareholders from accumulating more than 10 percent of shares. The shale producer said it would increase the threshold, though only to 15 percent, not the 25 percent sought by Icahn. The company has not set a date for its 2018 shareholder meeting. The 2017 meeting was held in June. Most companies hold their annual meetings at the same time each year.Icahn has until April 16 to submit any proposal for review by other shareholders at the 2018 meeting. (Reporting by Ernest Scheyder in Houston; Additional reporting by John Benny in Bengaluru; Editing by Savio D'Souza and Lisa Shumaker)SandRidge rebuffs Icahn, boosting ruckus over shale firm's fate

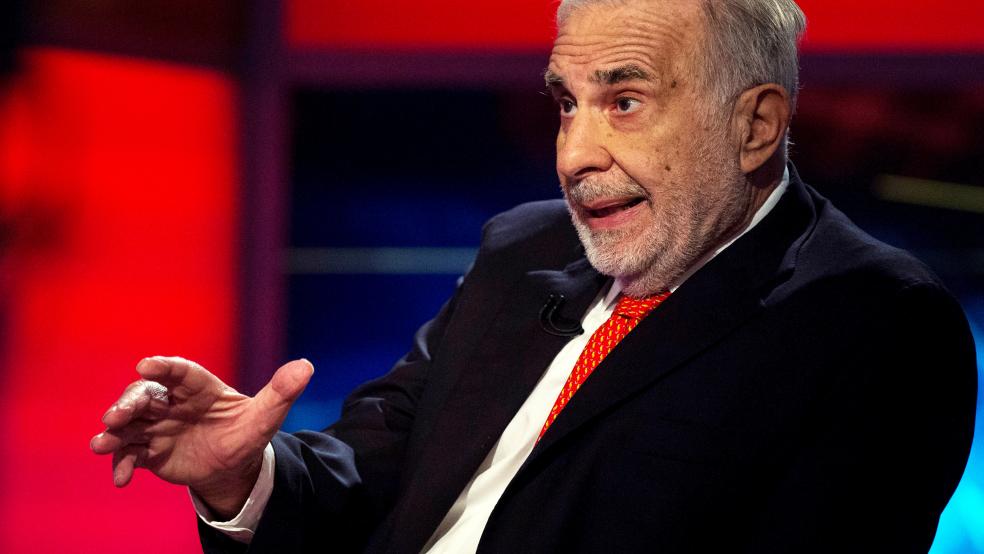

BRENDAN MCDERMID