The Biden administration on Wednesday unveiled its plan to overhaul the corporate tax code, providing a framework for raising trillions of dollars in revenue to help pay for the president’s ambitious economic agenda.

The “Made in America Tax Plan,” outlined in a 17-page document released by the Treasury Department, would raise $2.5 trillion over 15 years, enough to cover the $2.3 trillion cost of President Joe Biden’s recently released infrastructure plan.

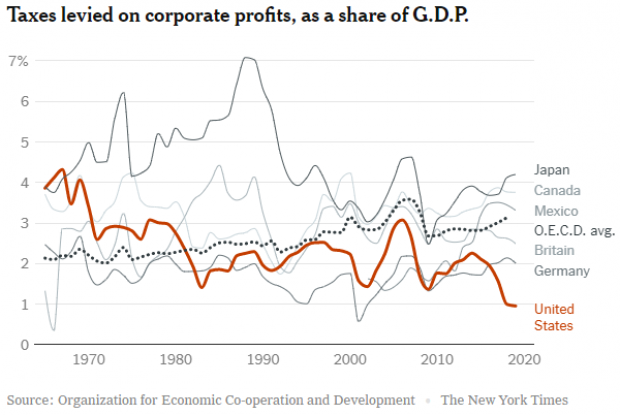

If enacted, the plan would reverse the trend of falling corporate tax collections. In an op-ed published in The Wall Street Journal Wednesday, Treasury Secretary Janet Yellen described the dynamic the administration seeks to overcome: “Over the past three years, corporate tax collections have fallen to their lowest level since World War II: 1% of gross domestic product.”

Reversing course on the Trump tax cuts: The proposal makes it clear that the White House seeks to undo much of the GOP tax overhaul from four years ago. “The 2017 tax law reduced U.S. corporate tax rates, resulting in a significant decrease in corporate tax collection,” the outline of the plan says. “There is little evidence of an increase in economic growth or corporate investment resulting from these dramatic reductions in corporate tax rates.”

One of the plan’s main provisions would raise the corporate tax rate to 28% – halfway between the current 21% rate imposed by the GOP tax overhaul in 2017 and the 35% rate that was in effect before then.

In addition to raising the corporate tax rate, the plan also makes changes to the international provisions of the tax code as part of an effort to eliminate incentives to shift profits to low-tax jurisdictions. The White House wants to apply a minimum tax rate of 21% to foreign earnings, and convince other countries to do the same, thereby ending the “race to the bottom” in tax rates that has starved governments of revenues they need to invest domestically.

“Our tax revenues are already at their lowest levels in generations, and as they continue to drop lower we will have less money to invest in roads, bridges, broadband and R&D,” Yellen told reporters. “By choosing to compete on taxes, we’ve neglected to compete on the skill of our workers and the strength of our infrastructure. It’s a self-defeating competition, which is why we’re proposing this ‘Made in America’ tax plan. It changes the game we play.”

The G-20 could reach an agreement on tax rate harmonization as soon as July, Italian Finance Minister Daniele Franco said Wednesday.

A minimum corporate tax: The Biden plan would also impose a minimum corporate tax of 15%, taking aim at companies that report billions in revenues and yet avoid paying federal income taxes.

Still, the proposed minimum tax is less aggressive than the one Biden campaigned on. The tax would apply only to firms with incomes over $2 billion, considerably higher than the $100 million threshold in Biden’s original plan. Only 180 companies meet that requirement, and the minimum tax would affect just 45 of them, the Treasury said.

Supporters and critics prepare for battle: In her Journal op-ed, Yellen said the plan would also make the tax system fairer and boost incentives for U.S. companies to invest at home. “Tax reform is not a zero-sum game, with corporations on one side and government on the other,” she wrote. “There are policies that are mutually beneficial, true win-wins. Washington has one in front of it right now.”

But business groups, Republicans and some centrist Democrats have signaled that they will not support the plan, at least in its current form. Sen. Joe Manchin (D-WV) has already said that he and several other Democrats are uncomfortable raising the corporate tax rate above 25%, and the U.S. Chamber of Commerce and the Business Roundtable have spoken out against tax hikes, with the latter saying the tax hike plan “threatens to subject the U.S. to a major competitive disadvantage.”