Welcome to the weekend! We wish a peaceful Good Friday and a happy Easter to all who observe the holidays. Here’s what we’re watching.

Hiring Cools, but Only Slightly as Labor Market Keeps Chugging Along

U.S. employers added 236,000 workers last month and the unemployment rate dropped a tenth of a percentage point to 3.5%, the Bureau of Labor Statistics announced Friday.

The data provide more evidence that the labor market is cooling off, even as it remains strong by pre-pandemic standards. The March results were below February’s upwardly revised level of 326,000 jobs added and January’s downwardly revised (but still enormous) level of 472,000. Still, the latest number was well above the 2019 average of 178,000 jobs added per month.

“The great labor market machine is finally slowing down some, but it’s still got a lot of strength left,” economist Robert Frick of the Navy Federal Credit Union told The Wall Street Journal.

A remarkable recovery: The economy has now added more than 1 million jobs since the beginning of the year — and 3.2 million since February 2020, just before the pandemic began, more than making up for the millions of jobs lost in the recession. At least as far as employment is concerned, the U.S. has returned to its pre-pandemic growth trajectory.

“If an economist descended from Mars & just had access to labor data through 2019 and then the 2023 data they would find the 2023 data entirely unsurprising--and, if anything, possibly a bit pleasantly surprising,” wrote former Obama administration economist Jason Furman. “They would have no idea anything huge had happened in the interim.”

Not all sectors have recovered equally. Although employment in leisure and hospitality rose by a healthy 72,000 in March, total employment in the sector is still about 368,000 below where it was before the pandemic. Similarly, while employment in government rose by 47,000 last month, there are about 314,000 fewer jobs in the sector compared to early 2020. Over the last three years, the professional and business sector has risen the most, up by more than 1.5 million, and transportation and warehousing (up 918,000) and health care (up 391,000) have been strong, as well.

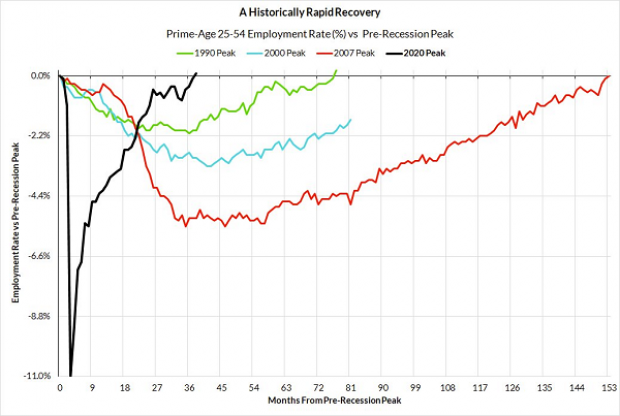

Whatever the details, one thing is clear: The pace of the recovery from the pandemic has been exceptional. As The Wall Street Journal’s Nick Timiraos noted, the share of prime-age workers (ages 25-54) who are currently employed now exceeds the pre-pandemic peak. “It took almost 13 years (Jan '07 to Dec '19) for this ratio to exceed its cyclical peak after the 07-09 recession,” Timiraos said. “It took just 3 years for this current cycle.”

Skanda Amarnath, executive director at Employ America, a research group that advocates for full employment, shared the chart below that compares the recovery time for prime-age employment in the last four recessions. “It's been a historically rapid and complete recovery,” Amarnath wrote. “Took over 12yrs to get back to pre-recession peak following the Great Recession.”

White House celebrates – and warns: President Joe Biden celebrated the strong report, saying it shows the country continues “to face economic challenges from a position of strength.” Biden noted that the economy has added 12.1 million jobs since he took office, and he highlighted the fact that the unemployment rate for African Americans, which now stands at 5%, is at a record low.

Biden said there is more that he wants to do, including boosting economic growth, but warned that Republicans were risking economic catastrophe by refusing to increase the debt ceiling unless federal spending is slashed. “Extreme MAGA Republicans in Congress … are threatening to wreak havoc on our economy with debt limit brinkmanship,” Biden said. “And it’s all to pay for even more giveaways to the wealthiest Americans and largest corporations.”

What comes next: Although the labor market appears to be cooling, the continuing strength demonstrated in the report boosts the odds that the Federal Reserve will move ahead with another interest rate hike at its next meeting in early May. After the report was released, traders on Wall Street pushed the probability of a 25-basis-point increase up from 49% to 67%.

“A slower pace of hiring is clearly a relief to policymakers looking to cool an overheated economy and labor market,” wrote RSM Chief Economist Joseph Brusuelas. “However, neither the slower pace of hiring nor the cooling of inflation is sufficient to cause the Federal Reserve to end its efforts to restore price stability at the current time. We expect the central bank to hike its policy rate by 25 basis points to a range of 5% to 5.25% at the May meeting, and then engage in a strategic pause that will likely last until early 2024 when we see the first possibility of rate cuts being enacted.”

The Fallout From the House GOP’s Blame Game

We told you yesterday about the reported tensions among House Republican leaders as they struggle to coalesce around a budget plan and demands for raising the debt limit. To sum up: House Speaker Kevin McCarthy (R-CA) sees House Majority Leader Steve Scalise (R-LA) as ineffective and Budget Committee Chair Jodey Arrington (R-TX) as incompetent, according to New York Times reporting.

Politico’s Rachael Bade on Friday examined some of the fallout from that report, noting that McCarthy “appears to be looking for a scapegoat” to take the blame for the predicament he got himself into by making a variety of promises to conservatives to win their backing for his bid to be speaker.

“There’s a reason McCarthy is singling out Arrington and Scalise,” Bade writes, “and it’s about more than just disagreements over policy or strategy. People close to McCarthy tell us that he perceives both men as disloyal — and he’s known to hold a grudge.”

Bade adds that Republican sources “found McCarthy’s lack of pushback on the Times story to be quite conspicuous. … His paltry response did not go unnoticed.” But there has been a bit of pushback to the criticisms in the Times piece, with one unnamed Arrington defender telling Politico that the budget chief “has largely been hamstrung by Kevin.”

The bottom line: The media may delight in what Bade describes as “the ‘Mean Girls’ drama playing out in McCarthy’s leadership circle,” but the tensions could portend some major obstacles for House Republicans’ budget plans and their effort to win spending concessions from the White House in exchange for raising the debt limit. It could also mean that any showdown over the debt ceiling may be even more difficult to resolve.

A Win for Medicare Advantage Insurers

The Biden administration this week finalized a rule that it said would strengthen Medicare Advantage and crack down on “misleading marketing schemes” by insurers providing plans under the program. But The Hill’s Joseph Choi and Karl Evers-Hillstrom report that the reforms, meant to curb billions of dollars in overpayments to private insurers, were weaker than expected after an aggressive, multimillion-dollar industry lobbying blitz.

“Reforms to overbilling will phase in over a three-year period instead of immediately, and insurers will enjoy a higher reimbursement rate than expected, both key wins for the industry,” Choi and Evers-Hillstrom write.

The Medicare Advantage program contracts with private insurers to provide health coverage, often including benefits that aren’t included in the traditional Medicare program for seniors. The Advantage plans have grown in popularity in recent years and are on pace to cover more than half of all Medicare beneficiaries. They’re also extremely profitable for insurers, who have been found to exploit the program to boost their profits by adding diagnostic codes to patients, often without additional treatments, in order to get more revenue from the government. “The Medicare Payment Advisory Panel, which advises Congress on Medicare issues, estimates that nearly $124 billion in overpayments will have been made to private insurers since 2007, including $44 billion in 2022 and 2023,” The Hill notes.

Meena Seshamani, deputy administrator for the Centers for Medicare and Medicaid Services, called the decision to gradually phase in policy changes “consistent with prior practice.” Even so, The Hill notes that Raymond James analysts upgraded the outlook for UnitedHealth and Cigna, both major insurers, citing an “improving regulatory backdrop” and calling the phase-in period “a win for the industry.”

Number of the Day: 100%

Some Democratic lawmakers have been pushing to have the Defense Department pay all of troops' Basic Allowances for Housing, covering the cost of housing for U.S. active-duty forces that don’t live on base. Rep. Marilyn Strickland of Washington and Sen. Raphael Warnock of Georgia have proposed legislation that would raise the housing reimbursement rate from its current 95% to 100% — and they now have some Republican support, John M. Donnelly of Roll Call reports.

Donnelly writes that the reimbursement rate was 100% for about a decade until 2015, when the defense authorization bill cut it as a cost-saving measure. The change is reportedly costing troops some $200 or more a month. Raising the reimbursement to 100% would cost the Pentagon $1 billion a year. The Defense Department’s total budget request for 2024 is $842 billion.

News

- Kevin McCarthy’s Blame Game Sweeps Capitol Hill – Politico

- McCarthy Says He's 'Very Concerned' He Won't Reach a Deal to Raise the Debt Ceiling Because Biden 'Never Wants to Meet' – Insider

- Biden Seeks Respite From US Tensions With Upcoming Irish Visit – The Hill

- U.S. Adds a Healthy 236,000 Jobs Despite Fed’s Rate Hikes – Associated Press

- Black Unemployment Rate Hits Record Low – Washington Post

- Summers Says Recession Probabilities Rising, Fed Nearing the End – Bloomberg

- Push Is on to Boost Troops’ Housing Allowance – Roll Call

- In Battle With DOJ Over Classified Docs, Senate Turns to Power of the Purse – The Hill

- IRS Unveils Plan to Crack Down on Tax Cheats, Improve Service – Roll Call

- IRS Releases Plan to Spend $80 Billion Windfall — With Critical Details Missing – Politico

Views and Analysis

- Labor Market Is Cooling Plenty Under the Surface – Jonathan Levin, Bloomberg

- Jerome Powell Will Not Be Stopped – Kevin T. Dugan, New York

- Biden and McCarthy Bump Heads on the Ceiling – Hugo Gurdon, Washington Examiner

- U.S. Economy’s ‘Two Cycles’ Put Fed in a Pickle – Aaron Back, Wall Street Journal

- King Dollar Still Looks Safe From the Yuan – Jacky Wong, Wall Street Journal

- Global Excise Tax Application and Trends – Adam Hoffer, Tax Foundation