The conventional political wisdom is that Mitt Romney is the strongest Republican in the general election among this cycle’s crop of candidates. The main reason is that he is the most moderate Republican running and therefore has the best chance of capturing the votes of moderates and independents. But at the same time, Romney is the most vulnerable Republican to what I think will be the Democrats’ principal line of attack: the growing maldistribution of income and wealth.

It’s not only Romney’s great wealth that makes him exposed on this issue, it’s also his seeming obliviousness to just how rich he is, his aggressive use of breaks to shelter his wealth from taxation, which has given him an effective tax rate below that paid by many in the middle class.

According to Romney’s latest financial disclosure form, he has a net worth somewhere between $190 million and $250 million. The form provides little in the way of detail and journalists are aggressively searching for it.

On Tuesday, Reuters reported that a substantial amount of Romney’s wealth is parked in offshore tax havens such as Bermuda and the Cayman Islands. According to ABC News, he has as much as $33 million invested in Cayman Islands accounts. As governor of Massachusetts, Romney was critical of corporations that used similar techniques to avoid state taxes. On Thursday, the Wall Street Journal reported that Romney has as much as $102 million in his Individual Retirement Account. To have so much wealth in an IRA is extraordinary. The underlying assets must have been deposited long ago and compounded – tax-free – at a very high rate.

Lastly, it should be noted that Romney’s investments at Bain Capital were often predicated on state and local governments giving special tax breaks to those investments, according to a Jan. 12 report in the Los Angeles Times. For example, Indiana officials were induced to offer $37 million of tax breaks to get a new steel plant built by a company in which Bain had a large investment.

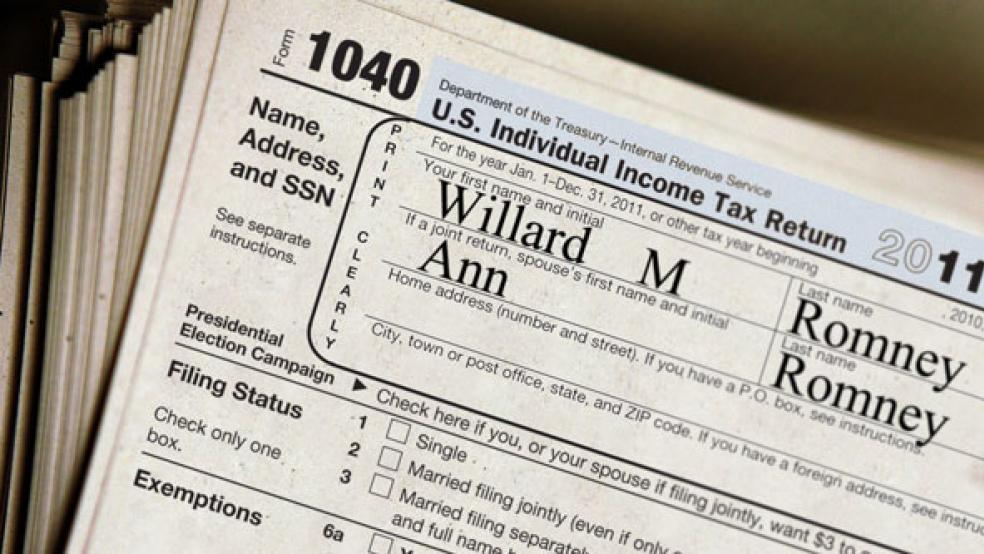

None of this is meant to suggest that Romney has done anything illegal or unethical insofar as his taxes are concerned, based on what we know today. There may be more buried in Romney’s tax returns, but he has not released them. Indeed, he has never released his tax returns in any of his races for public office. Romney has promised to release his 2011 return some time in April, but made no similar promise to release returns from previous years. Political observers are suspicious that he will massage his return to pay more than he usually does in taxes. Even so, Romney has said publicly that his effective tax rate is just 15 percent.

According to the Congressional Budget Office, Romney is only paying as much in federal taxes as the average household in the exact middle of the income distribution. It’s also about half the rate paid by some members of the top 1 percent.

While this is no political liability in the Republican primaries, where every candidate glorifies the wealthy, denounces income redistribution, and has promised huge tax cuts for the rich. But in the general election, tax cuts for the rich and Romney’s aggressive tax avoidance may be a serious problem. Polls consistently show rising concerns about rising income disparity. For example, a January 11 Pew study found that the percentage of people seeing a conflict between rich and poor has risen to 66 percent from 47 percent in 2009.

Furthermore, polls have consistently shown that the American people are comfortable with raising taxes on the rich. Typical are the results of an Economist/YouGov poll last week . It found that 62 percent of people support raising taxes on those making more than $250,000 and only 22 percent are opposed.

It’s worth remembering that Republicans had no trouble making an issue of Sen. John Kerry’s vast wealth, by way of his wife, Teresa Heinz, back in 2004. A Wall Street Journal editorial on October 18, 2004, ridiculed his five houses and criticized his wife for paying just a 12.4 percent effective tax rate on her 2003 income, which resulted mainly from her large investments in tax-exempt municipal bonds. And who can forget that photo of Kerry windsurfing and how often Republicans used it to imply that his wealth made him out of touch with the economic concerns of average Americans?

Some will argue that as long as Romney didn’t cheat on his taxes, it’s not a politically relevant issue. But I think most Americans would agree that no one forced him to run for president and he did so knowing full well that his wealth would be a campaign issue. Moreover, with tax policy being an important policy issue, people should know how a potential president conducts his personal affairs in this area.

Keep in mind that while rich people have a perfect right to exploit every legal tax loophole, they are under no obligation to do so. New York City Mayor Michael Bloomberg, who is many times wealthier than Romney, makes a point of paying more than he could if he were as aggressive about tax avoidance as Romney.

With both Republicans and Democrats agreeing that fundamental tax reform is necessary, an in-depth discussion of Romney’s taxes could illuminate some important questions about the taxation of capital gains, the efficacy of special rules that apply to investment companies like Bain Capital (“carried interest”), and the appropriate tax rate that the ultra-wealthy ought to be paying.

Bruce Bartlett’s new book, The Benefit and The Burden: Tax Reform-Why We Need It and What It Will Take, will be published next week.