George H. W. Bush famously said at the 1988 Republican National Convention, “Read my lips, no new taxes” before he was elected president that fall – and then lost his reelection bid in 1992 after breaking that pledge.

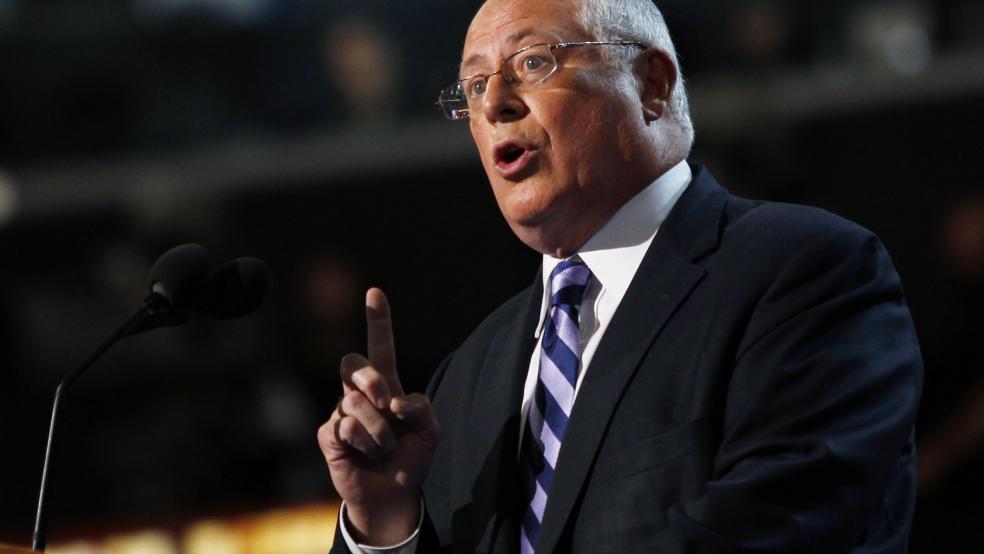

Illinois’s Democratic governor, Pat Quinn, promised that an unpopular 67 percent increase in the state income tax would only be temporary. But on Wednesday, Quinn announced he had no choice but to make the tax increase permanent to fund education and avoid higher deficits.

“The truth is, those that are telling you Illinois can tax less and spend less and still expect to fund education are simply not telling you the truth,” Quinn said while proposing a five-year financial plan in his budget message to the legislature, according to The New York Times.

Related: Gov. Jerry Brown Uses Surplus to Prevent Bankruptcies

While other governors, including Democrat Jerry Brown of California and Republican Rick Snyder of Michigan, have fought with their legislatures over how to spend surpluses, Quinn and the Illinois legislature are saddled with an estimated $5.4 billion backlog of unpaid bills. In his election year budget, Quinn appears to have opted for more tax increases over sharp spending cuts.

Republicans view Quinn as one of the most vulnerable Democratic governors up for reelection this fall, and his populist call for protecting key Democratic constituencies from draconian spending cuts will be put to a test. A February poll by the Paul Simon Public Policy Institute at Southern Illinois University found that 60 percent of Illinois voters opposed making the 2011 income tax permanent – even if it resulted in an increase in the deficit.

Yet large majorities of state voters also dislike the idea of sharp cuts in government spending on a variety of government programs and services – posing a dilemma for Quinn and state lawmakers.

“Illinois is in a financial mess and everybody knows that,” David Yepsen, director of the Simon Institute, said in an interview today. “For a Democrat, it really comes down to keeping that promise to keep that income tax temporary, or you go back on all sorts of Democratic constituency groups and you cut them dramatically. And Quinn is just not willing to do that.”

The income tax increase adopted in 2011 was scheduled to be rolled back in 2015. However, Democrats have warned that the state would face an estimated $3 billion budget shortfall without the extra tax revenue.

Related: Unfunded Pensions Put States and Cities on High Alert

Quinn, a former lieutenant governor in an overwhelmingly Democratic state, first took office in 2009 as an automatic replacement for the disgraced governor Rod Blagojevich and narrowly won election the following year. Quinn is one of the nation’s least popular governors, weighted down by a depressed state economy and a cash-strapped state government and Democratic and union displeasure over his management style.

His attempts to cope with the country’s worst state pension deficit prompted a revolt by public employee unions, normally the allies of a Democratic governor, noted NBC’s Chicago News 5. Public opinion polls indicate that only about a third of voters approve of Quinn’s performance, while sixty percent do not.

Handicappers have targeted the race a tossup – saying that Quinn’s five years in office grant him no clear advantage.

Quinn’s Republican challenger, multimillionaire businessman Bruce Rauner, has no doubt about what direction the governor and state legislature should take. Rauner, who spent $6 million of his own money to win the GOP primary, has vowed to run the state like a business and has emphasized the need for spending cuts and lower taxes.

Related: Illinois GOP Gov. Nominee Would Take on the Unions

Rauner, a private equity specialist, reported $100 million in income over the past three years, $13 million of which he has donated to charitable and civic causes, according to The Wall Street Journal. The highly successful businessman argues that his wealth makes him free from the labor unions and crooked machine politics that have run the state for decades.

Rauner issued a statement after Quinn’s budget speech yesterday, accusing the governor of reneging on an important pledge and “doubling down on his failed policies.” He said that after five years with Quinn as governor, the state still has a record tax hike, high unemployment and education cuts. Rauner vowed to balance the budget without tax increases by creating a “growth economy” and repairing “our broken government.”

Whether Rauner will be able to win election and deliver on those promises remains to be seen.

“I think Quinn is in political difficulty,” said Yepsen, a former political reporter. “He has very poor job approval rating, the right-track, wrong track numbers in this state are awful.”

“Now with that said, I have a hard time betting against an incumbent Democratic governor in a state like Illinois. This is a Democratic state . . . and Pat Quinn is an indefatigable campaigner. He just doesn’t quit. And he is relishing this populist role. So I don’t know any Republicans who think this is going to be a cakewalk.”

Top Reads from The Fiscal Times: