We all know that the financial crisis that led to the Great Recession was caused by banks and lenders who issued mortgages to anyone who wanted to buy or refinance a home. They gave them away like candy on Halloween.

So naturally, the government decided to right the wrong by tightening the standards for qualifying for a mortgage. Apparently, they went too far by making the pendulum swing too far the other way. How do we know?

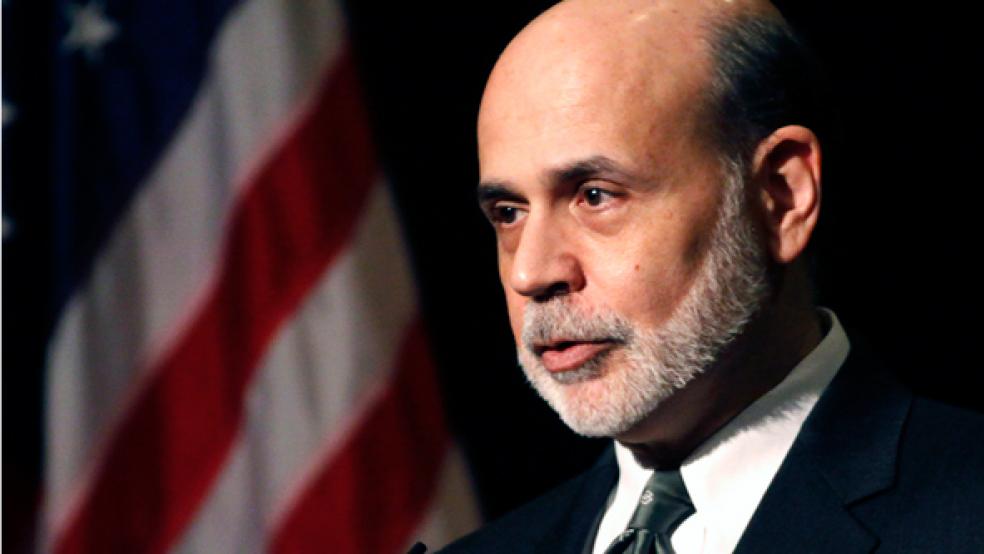

When Ben Bernanke, former chair of the Federal Reserve tried to refinance his mortgage, he was rejected. Bloomberg reported that he told Mark Zandi of Moody’s Analytics at a conference in Chicago yesterday, “I recently tried to refinance my mortgage and I was unsuccessful in doing so.”

When the audience laughed, Bernanke said, “I’m not making that up.” “I think it’s entirely possible” that lenders “may have gone a little bit too far on mortgage credit conditions,” he said.

Bernanke, the father of quantitative easing—the controversial stimulus plan that some say helped pull the economy out of the mud—wants regulators to take it easier on applicants who are likely meet their mortgage obligations. And we agree.

The only thing Bernanke didn’t reveal, however, was his credit rating!

Top Reads from The Fiscal Times: