There could be trouble bubbling up in Texas.

Even as most state economies suffered mightily during the Great Recession and its aftermath, the Lone Star State enjoyed a relatively strong and fast recovery, greased by soaring oil prices that supported the regional job market and state tax revenues.

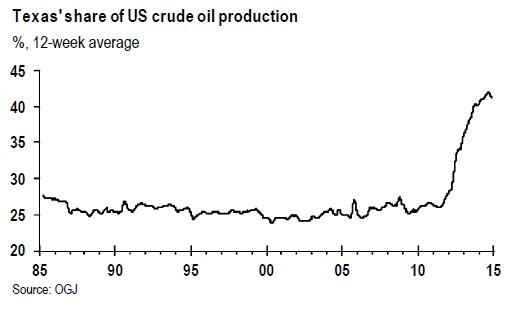

The U.S. oil boom has largely been a story about North Dakota and Texas. Together, as J.P. Morgan economist Michael Feroli noted in a research report on Thursday, the two states have accounted for more than 90 percent of production growth over the past five years. Texas alone is responsible for 67 percent of the nation’s increase in crude production over that time span, and the state’s share of total U.S. output has surged to more than 40 percent.

That oil boom helped spur economic growth that leaders like former Gov. Rick Perry touted as a “Texas miracle.” The state’s economy shrank by an inflation-adjusted 0.5 percent in 2009 but then grew by an annual average of 4.5 percent over the next four years, far outpacing the tepid 2 percent yearly average for country as a whole. While the state’s unemployment rate got as high as 8.3 percent in early 2010, the Texas job market recovered more quickly than the national one did. “The construction crane could easily be declared the state bird,” the Dallas Morning News quipped in one recent editorial.

Related: Early Slowdown Signs Emerge for U.S. Oil States on Crude Slide

The price of crude has plunged some 50 percent since the summer, though, placing the U.S. oil industry in a precarious position — and threatening to turn that Texas boom into a recessionary bust just as other states are finally enjoying stronger recoveries and consumers across the country are starting to benefit from cheaper fuel prices.

“While we expect the country, overall, will be a net beneficiary from falling oil prices, two states look like they will bear the brunt of the pain: North Dakota and Texas,” J.P.Morgan economist Michael Feroli wrote Thursday in a research note titled — what else? — “Houston, you have a problem.”

While the oil sector represents a larger portion of the North Dakota economy than it does in Texas, the Texas economy is more than 25 times bigger. “Given its much larger size,” Feroli wrote, “the prospect of a recession in Texas could have some broader reverberations.”

To get a sense of just how damaging those reverberations might be, Feroli looked back to 1986, when oil prices also collapsed by about 50 percent. In that case, the state’s unemployment rate shot up by 2 percentage points in just a few months, and the regional real estate market fell into a more prolonged skid that left prices 14 percent below their peak by late 1988, even as the national housing market rose 14 percent. “The last act of this tragedy was a banking crisis, as several hundred Texas banks failed, with peak failures occurring in 1988 and 1989,” Feroli wrote.

Related: New U.S. Oil and Gas Well November Permits Tumble Nearly 40 Percent

Yes, much has changed in Texas and the U.S. since the mid-1980s. Feroli notes, for example, that natural gas prices haven’t plunged in sympathy with crude oil this year as they did in 1986. And the sector accounts for a smaller share of total jobs in the state than it did 30 years ago. Even so, the Texas economy is about equally as reliant on the oil and energy sector now as it was then.

“As we weigh the evidence, we think Texas will, at the least, have a rough 2015 ahead, and is at risk of slipping into a regional recession,” Feroli said. That in turn could again cool off the hot Texas housing market, for one thing. Yet there’s little reason right now to fear that it will translate into nationwide weakness: “The national economy performed quite well in 1986, in spite of the Texas recession.”

Top Reads from The Fiscal Times: