The White House is giving some uninsured people six more weeks to sign up for coverage in order to avoid Obamacare’s tax penalty for not having health insurance.

The official deadline to sign up for coverage on the state and federal exchanges closed last Sunday, but since this is the first year the Internal Revenue Service is enforcing the individual mandate, the administration is allowing people more time to get covered and avoid a hefty tax penalty.

Related: If SCOTUS Rules Against Obamacare Health Care Costs Will Soar

On Friday, health officials announced they will be creating a special

enrollment period from March 15 to April 30 specifically for uninsured people who weren’t aware of the individual mandate.

“Our intention is that this is one year only for people who have not been in the communication loop,” Andy Slavitt, principal deputy administrator of the Centers for Medicare and Medicaid Services told reporters on a press call Friday.

The Washington Post reported last week that Democrats are “bracing for another Obamacare backlash” when up to 6 million Americans learn they have to pay a penalty when they file their taxes this year unless they qualify for an exemption.

Despite all the media coverage surrounding Obamacare, about 45 percent of uninsured Americans said they were totally or somewhat unaware of Obamacare’s individual mandate requiring everyone to have health coverage or pay a penalty, according to an Urban Institute study.

Adding to the administration’s problem is a tax-form mistake that could delay tax rebates for as many as 800,000 taxpayers. The form is supposed to reconcile 2014 income and subsidies. But HealthCare.gov used the wrong benchmark to make the calculation.

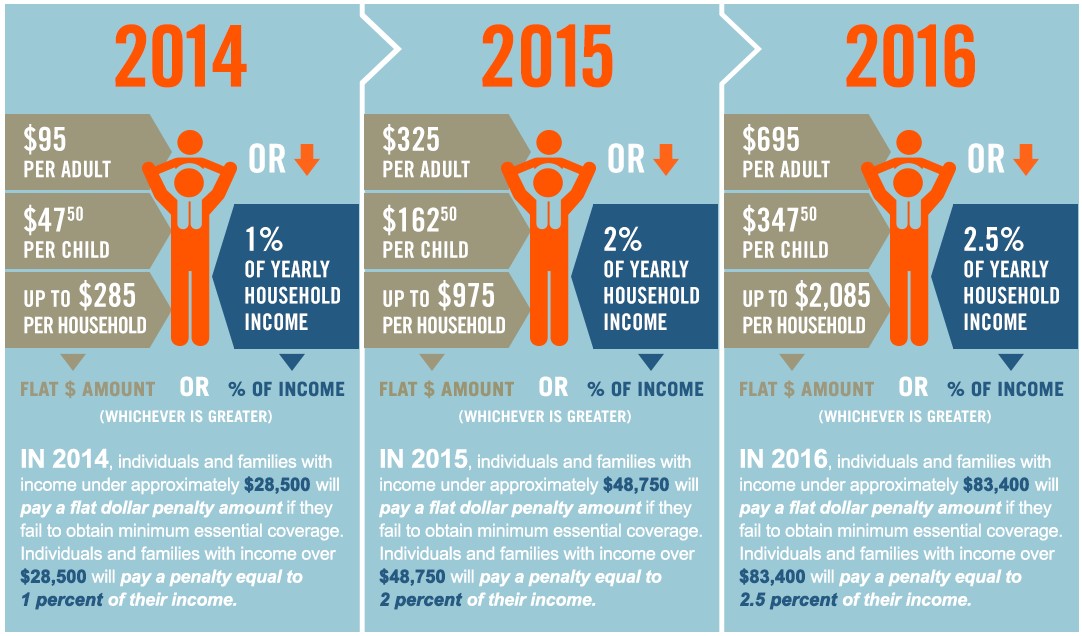

Last year, the penalty was $95 or 1 percent of annual income, whichever is greater. That increases in 2015 to $325 or 2 percent of annual income. Some people first learning of the penalty may end up owing penalties for both years, but the special enrollment period gives them more time to avoid that costly scenario.

Related: How Obamacare Rates with Consumers One Year Later

Some 11.5 million people signed up for coverage during Obamacare’s second official open enrollment period from Nov 15 to Feb 15. Now, officials expect sign-ups to climb even higher after the special enrollment period closes in April. This figure represents people who selected health care plans on the exchanges; it does not account for how many have paid their premiums, nor does it account for people who may not be eligible for Obamacare.

Consumer advocates praised the administration for creating the special enrollment period.

“Even though the second enrollment period was a big success, there remain millions of people who are unaware of the premium subsidies that make insurance affordable and who didn’t know about the tax penalty for failing to buy insurance,” Ron Pollack, Executive Director of Families USA said in a statement. “This special enrollment period will therefore be a helpful, teachable moment and will enable many people to obtain health coverage and avoid future penalties.”

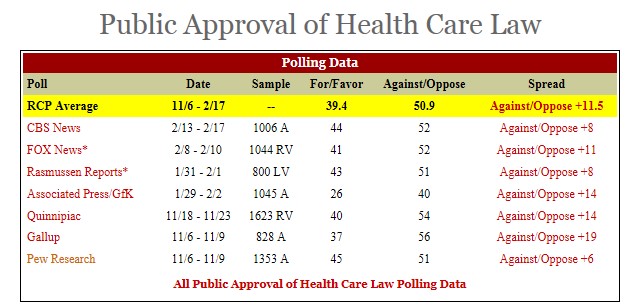

However, not everyone is a fan of the announcement. To Republicans who opposed the mandate from the beginning, it’s a political ploy on the part of the administration to avoid even worse approval ratings of the president’s health care law. Public approval for Obamacare has risen slightly from its all-time low of 36.4 percent to 39.7 percent according to the Real Clear Politics average.

Top Reads from The Fiscal Times:

- The 10 Worst Places for Obamacare in 2015

- Obamacare Tax Traps Are Ready to Grab Your Refund

- Thousands to Get Booted From Obamacare Plans