At a time when Americans are shouldering a crippling $1.2 trillion in student debt, it comes as no surprise that paying for higher education is the biggest financial concern for parents with children who are younger than 18 and planning to go to college. It may be more of a surprise that the young adults so often burdened with those loans now feel better about their finances than people in any other age group.

In a new Gallup poll released this week, 73 percent of parents with kids below age 18 ranked paying for college as a financial worry — more than said they were concerned about saving enough for retirement and covering medical expenses.

Related: White House Loses $22 Billion on Student Loans Plans

Parents “face twin challenges of paying for ever-escalating college expenses for one or more children and saving for their own retirement,” Gallup’s Jeffrey Jones wrote in a blog post detailing the survey results. “And parents worry a great deal about both, but slightly more about college (73 percent) than retirement (68 percent).”

The percentage of people worried about college costs was, unsurprisingly, even higher among low-income families: 85 percent of families with an annual household income less than $30,000 said they are concerned about affording college tuition for their kids.

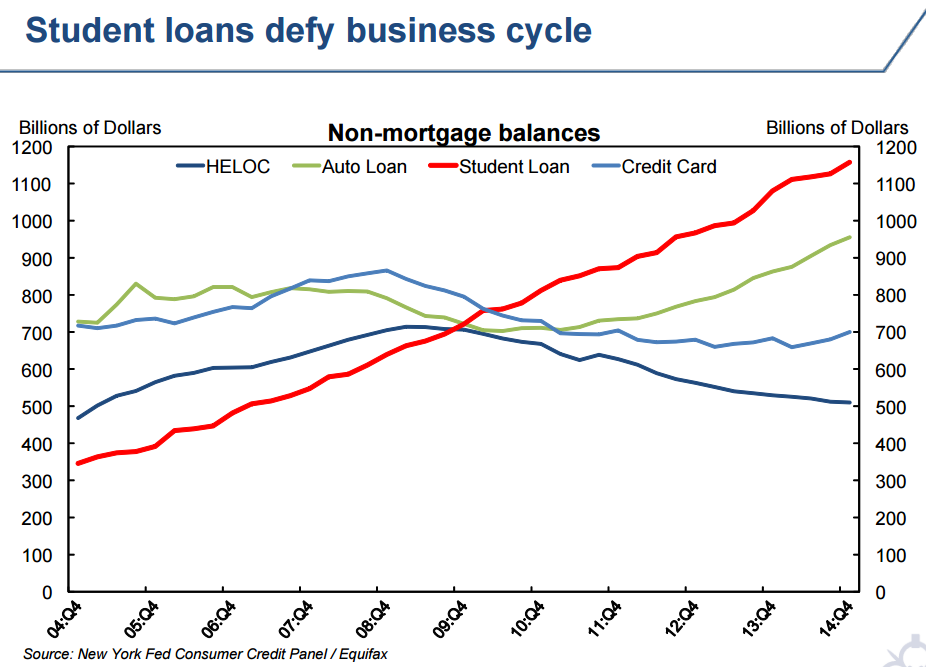

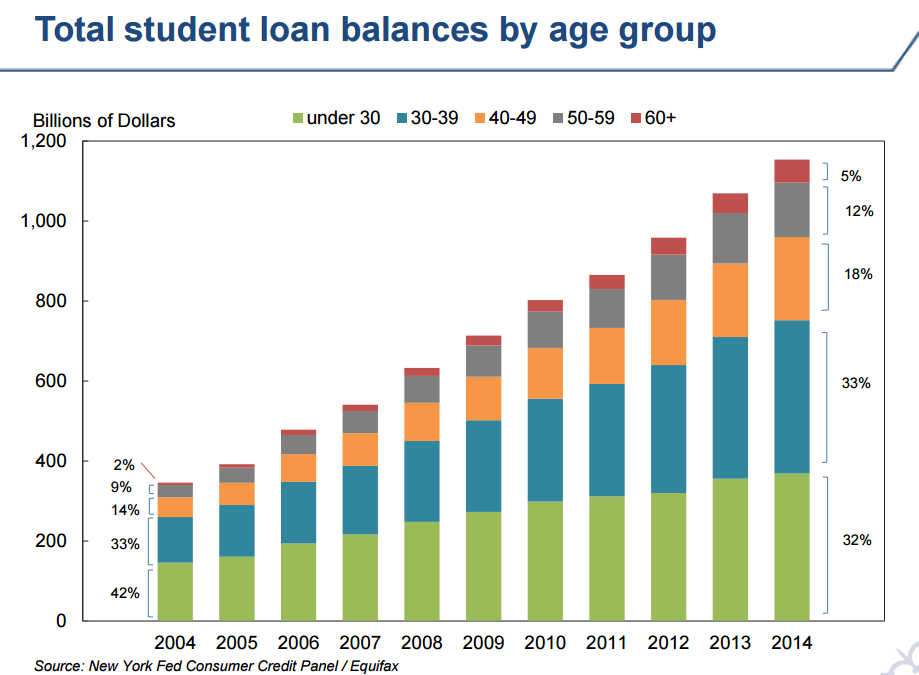

Those worries are well founded: An analysis of student loan borrowing and repayment trends released last week by the Federal Reserve Bank of New York found that student debt loads have continued to increase steadily, even as the balances for other forms of debt have fallen in recent years. The number of defaults on student loans climbed from about half a million 10 years ago to 1.2 million a year at its peak in 2011 and 2012. The default rate has risen from 2.4 percent in 2004 to 3.1 percent in 2014.

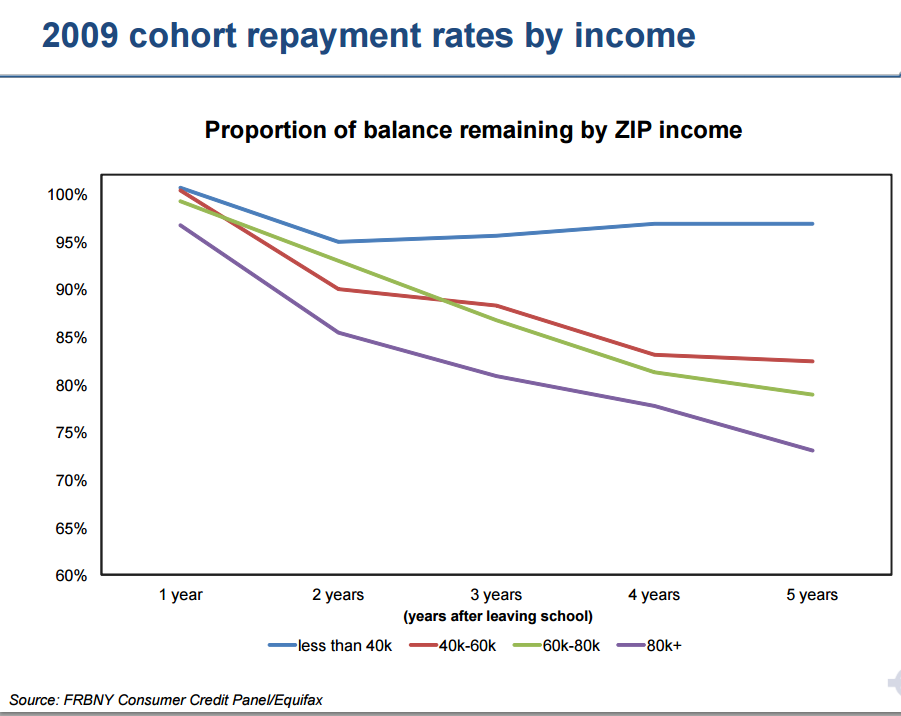

The Fed analysis also found that borrowers from Zip codes with lower average income have had a harder time repaying their loans than those from other neighborhoods, with 70 percent of borrowers in the low-income group who left school in 2009 having had problems repaying their loans.

Related: The Hidden Reason for the Student Loan Crisis

But if parents are increasingly concerned about the mounting cost of college tuition, the group shouldering most of the student debt seems to be more growing more optimistic about their financial futures, according to a new survey by Bankrate.com.

That survey found that 33 percent of millennials said their financial situation is better than it was a year ago, compared to just 19 percent of people over 50. Three in 10 millennials said that their savings are in better shape now compared to last year, and 32 percent said they have more job security than they did last year. Only 4 percent they have less job security now.

That optimism belies some ongoing weakness in parts of the job market. Earlier this month, the Labor Department reported that the unemployment for twentysomething Americans with four-year degrees or higher levels of education rose to 12.4 percent in 2014 from 10.9 percent in 2013. And many millennials who have landed work in recent years have settled for lower-paying positions. A report by Harvard's Joint Center for Housing Studies found that the number of young adults making less than $25,000 climbed by 6 million from 2003 to 2013, while the number of young adults making more than $25,000 has dropped by almost 2 million over that same time period.

Related: How to Really Fix Our Student Debt Crisis

Still, economists are hopeful that the jobless rate for young adults will trend downward this year and in the coming years as the recovery continues and more baby boomers retire. A survey of employers by Michigan State University's Collegiate Employment Research Institute predicts that hiring will jump by 16 percent this year for graduates with four-year degrees.

Top Reads from The Fiscal Times: