Yahoo reported bad earnings Tuesday night.

Here are the ugly numbers, via various analyst reports:

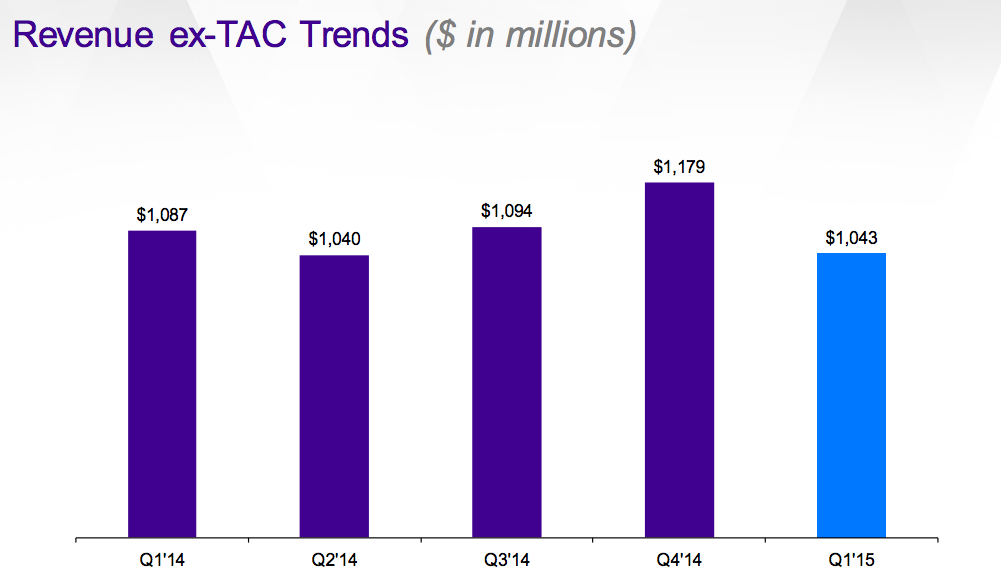

- Revenue was $1.04 billion, down 4% year-over-year, and below analyst expectations of $1.06 billion.

- Non-GAAP EPS was $0.15, down 61% year-over-year, versus $0.18 expected by analysts.

- EBITDA (which is basically a quick measure of profitability) was $231 million, down 25% year-over-year, versus analyst expectations of $236 million.

- Net search revenue was $432 million, down 2.8% year-over-year. This was the first time since 2011 Yahoo had a drop in search revenue.

- Display ad revenue minus traffic acquisition cost was $381 million, which is down 7%, but beat expectations of $379 million.

- It guided to $1.03 billion in ex-TAC revenue in Q2, versus analyst expectations of $1.04 billion.

- It guided to $250 million EBITDA in Q2, versus analyst expectations of $252 million.

Related: Yahoo Joins the 3-Ring Circus of Original Web Video

Yahoo is only down 1% today because it threw investors two bones on the call.

CEO Marissa Mayer said Yahoo has "retained advisors to determine the most promising opportunities to maximize value" for its Yahoo Japan stake. Yahoo still owns a piece of Yahoo Japan, which is an independent, successful company in Japan. Yahoo will figure out a tax-efficient way to sell that stake, which is good for Yahoo shareholders since Mayer is likely to return the proceeds to shareholders either as a buyback or dividend.

Mayer also dangled the possibility of Yahoo selling patents to make more money:

As one of the internet industry's pioneering companies, Yahoo! and its innovative employees have developed a valuable intellectual property portfolio. We have been and will continue to look for sensible ways to realize the value of those assets.

Related: Yahoo's profit, revenue miss Street forecasts as costs rise

For example, within the past two years we've secured patent sales or licenses worth nearly $600 million, all without litigation. We're proud of our efforts to date and we'll continue to look for ways to realize the value of our intellectual property investment.

If there's one thing Mayer has done masterfully, it's manage a restless shareholder base. She is smartly playing out these opportunities, keeping investors satisfied despite a weak core business. The promise of a Yahoo Japan sale, plus selling intellectual property, gives Mayer even more time to work on her turnaround plan for Yahoo.

Clearly she needs it. The numbers don't lie.

Part of the problem is that Yahoo's core business of selling display advertising — those banner ads you see on the web — is dying. As users go mobile, advertisers are focused on apps like Facebook. Display ads for mobile are limited, so they generate less revenue overall than desktop-display advertising:

Ben Schachter at Macquarie Research put it best in a report this morning (our emphasis added):

Related: 'Community’: Why Yahoo Was Smart to Join the Study Group

The 1Q results focused on YHOO’s core fundamentals. In our view, a potential turnaround is still far from certain, but there were positive signs. The MaVeNS [Mayer's acronym for Mobile, Video, Native, and Social advertising] businesses are growing nicely (up 58% y/y) with mobile up 61% y/y. However, net display is still down 7% y/y and net search fell 3% y/y. The premium ad business is evaporating on YHOO, as it fell 40% y/y. Advertisers are clearly moving away from YHOO’s traditional strengths in premium display. In our view, YHOO is focusing on the right areas, but it is going to be an uphill battle. For example, Marissa gave more detail on how YHOO plans to compete on search (more focus on contextual/personalized answers, not Web crawling), but we need to see execution on this vision before we will give YHOO credit.

It's true that Mayer is dealing with a challenging environment. But she hasn't done herself many favors.

She's shifted her attention repeatedly. When Mayer joined Yahoo, her focus was mobile-mobile-mobile. Then, it shifted to media, with investment in video and content sites. She spent $1 billion on Tumblr, which has failed to deliver much in terms of revenue. Now, she's turning her eye to search, plotting to take on Google. She's also preparing some new apps.

Arguably, this is exactly what she had to do. She couldn't afford to load up on one bet. She had to try a few different things to see what works.

But none of her bets have yet to pay off. They don't even really show signs of paying off. Sure, the MAVENS are up 61%, but how good is that, really? They're coming off a very small base. The world is going mobile, so it's not surprising revenue is up 61%.

Mayer has also failed to rein in Yahoo's expenses. Headcount remains high. Yahoo has more employees than Facebook despite being a much smaller business.

Eventually, Mayer going to be judged against how Yahoo's business performs. She is going to run out of ways to satisfy the shareholders that have nothing to do with the business. When that moment comes, it's unclear she's going be ready.

This article orignally appeared in Business Insider:

Read more from Business Insider.

Google' new cellphone sercive has the best data plan anyone has ever offered

A staggering number of American black men are now 'missing'

The biggest difference between being a singel wonan and a single man in 2015