How IRS Protects ID Thieves

Millions of Americans have fallen victim to ID theft during tax season, when fraudsters file false returns in an attempt to steal other people’s refunds.

Victims face delays in getting their real refunds, and paperwork nightmares that can drag on for months. In an attempt to survey the damage, some have asked the IRS for a copy of the fake returns, but Bloomberg reports that the agency has denied such requests, despite consumer-protection regulations intended to help victims in these situations.

The rules protecting consumers apparently conflict with tax laws that prevent its agents from sharing bogus returns and impose a penalty of up to five years in prison and a $250,000 fine for IRS workers who violate that law. “Employees face the specter of felony charges for giving out private details — including, possibly, those of the identity thieves — to those who aren’t authorized,” according to Bloomberg.

Related: 3 Costly and Common Tax Scams to Avoid

Tax refund fraud has ballooned in recent years. While electronic filing has made the tedious process of filing taxes more bearable for consumers, it has also made it easier for criminals to scam the system by filing phony returns using stolen Social Security numbers. Scammers bilked the IRS out of $5.8 billion in fraudulent tax refunds in 2013, a number auditors expected would climb much higher in the most recent tax season. (Numbers haven’t yet been released for 2014 returns).

Electronic fraud became such a problem this year that TurboTax briefly suspended state returns for customers in February to deal with ID theft issues.

If the IRS is of limited help to victims, that’s all the more reason to make sure your information is protected. You can find some tips to reduce your risk of ID theft here.

Top Reads From The Fiscal Times:

- Found! 6,400 New Lois Lerner Emails on the IRS Targeting Scandal

- The Liberal Solution to America’s Big Spending Problem

- The Flawed F-35: Why the Pentagon Will Never Shoot It Down

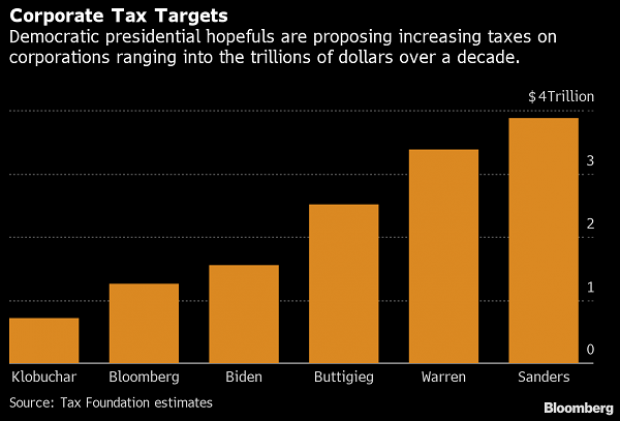

Chart of the Day: Boosting Corporate Tax Revenues

The leading candidates for the Democratic presidential nomination have all proposed increasing taxes on corporations, including raising income tax rates to levels ranging from 25% to 35%, up from the current 21% imposed by the Republican tax cuts in 2017. With Bernie Sanders leading the way at $3.9 trillion, here’s how much revenue the higher proposed corporate taxes, along with additional proposed surtaxes and reduced tax breaks, would generate over a decade, according to calculations by the right-leaning Tax Foundation, highlighted Wednesday by Bloomberg News.

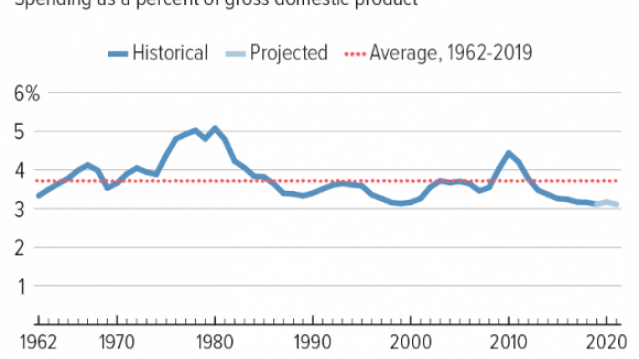

Chart of the Day: Discretionary Spending Droops

The federal government’s total non-defense discretionary spending – which covers everything from education and national parks to veterans’ medical care and low-income housing assistance – equals 3.2% of GDP in 2020, near historic lows going back to 1962, according to an analysis this week from the Center on Budget and Policy Priorities.

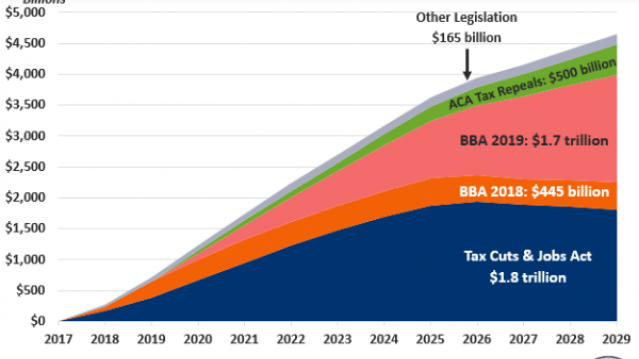

Chart of the Week: Trump Adds $4.7 Trillion in Debt

The Committee for a Responsible Federal Budget estimated this week that President Trump has now signed legislation that will add a total of $4.7 trillion to the national debt between 2017 and 2029. Tax cuts and spending increases account for similar portions of the projected increase, though if the individual tax cuts in the 2017 Republican overhaul are extended beyond their current expiration date at the end of 2025, they would add another $1 trillion in debt through 2029.

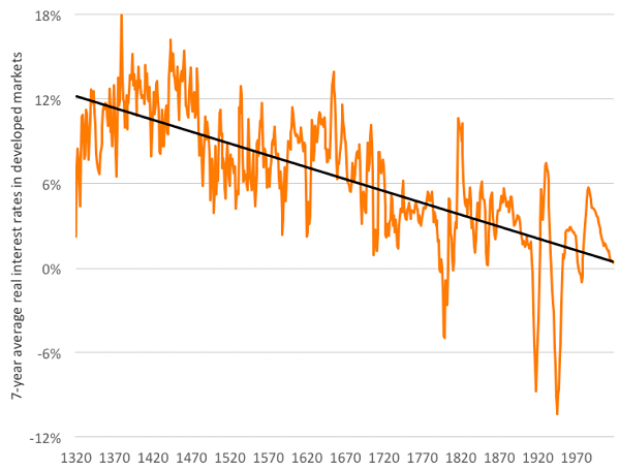

Chart of the Day: The Long Decline in Interest Rates

Are interest rates destined to move higher, increasing the cost of private and public debt? While many experts believe that higher rates are all but inevitable, historian Paul Schmelzing argues that today’s low-interest environment is consistent with a long-term trend stretching back 600 years.

The chart “shows a clear historical downtrend, with rates falling about 1% every 60 years to near zero today,” says Bloomberg’s Aaron Brown. “Rates do tend to revert to a mean, but that mean seems to be declining.”

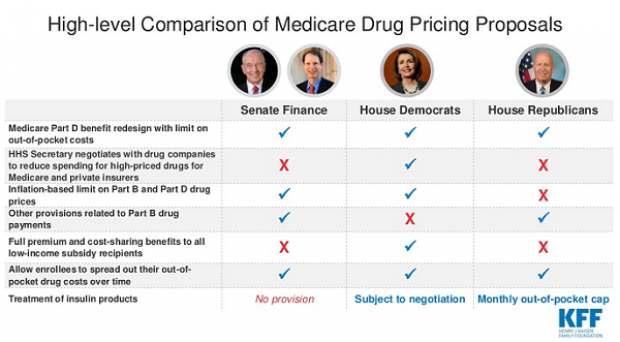

Chart of the Day: Drug Price Plans Compared

Lawmakers are considering three separate bills that are intended to reduce the cost of prescription drugs. Here’s an overview of the proposals, from a series of charts produced by the Kaiser Family Foundation this week. An interesting detail highlighted in another chart: 88% of voters – including 92% of Democrats and 85% of Republicans – want to give the government the power to negotiate prices with drug companies.