Tequila’s Stunning Rise: How It Shot Up in U.S. Popularity

Americans are drinking more and better-quality tequila, and not only in margaritas on Cinco de Mayo.

Tequila sales have been growing at an average rate of 5.6 percent a year since 2002, according to February figures from the Distilled Spirits Council of the United States. In 2014 alone, 13.8 million nine-liter cases were sold.

Related: U.S. Surpasses France As Biggest Wine Market

The U.S. represents tequila’s largest market, with about 52 percent of global sales. America’s renewed thirst for mixed cocktails has been a boon for spirits overall, but especially for tequila. Meanwhile, sales in Mexico have remained flat largely because the market there is mature, with little room for growth.

The Distilled Spirits Council said that one of the keys to tequila’s U.S. growth has been distillers’ ability to offer a product for every budget and occasion, but the fastest growth has been in high-end and super-premium brands.

“High-end brands have grown 189 percent in volume since 2002,” it noted. “Virtually unknown in 2002, super-premium tequila volumes have skyrocketed 568 percent and today account for 2.4 million 9-liter cases.”

Celebrity endorsements may have also raised the status of tequila. George Clooney, Sean Combs and Justin Timberlake have all promoted tequila brands.

In addition, distillers are trying to boost the popularity of high-end tequilas further by offering tastings and tours — at least one of which is aimed at the super-wealthy.

Tequila Avion, an ultra-premium tequila maker, is offering a $500,000, three-day trip for 10 to Jalisco, Mexico, to taste its spirits and partake of luxury accommodations, butler service and a private dinner among other amenities.

Related: Kentucky’s McConnell and Paul Offer Tax Breaks for Bourbon

If that seems a tad pricey, Experience Tequila in Portland, Ore., offers four-day tours to Mexico for just under $1,500, and you can find tequila-tasting classes in many cities for about $100.

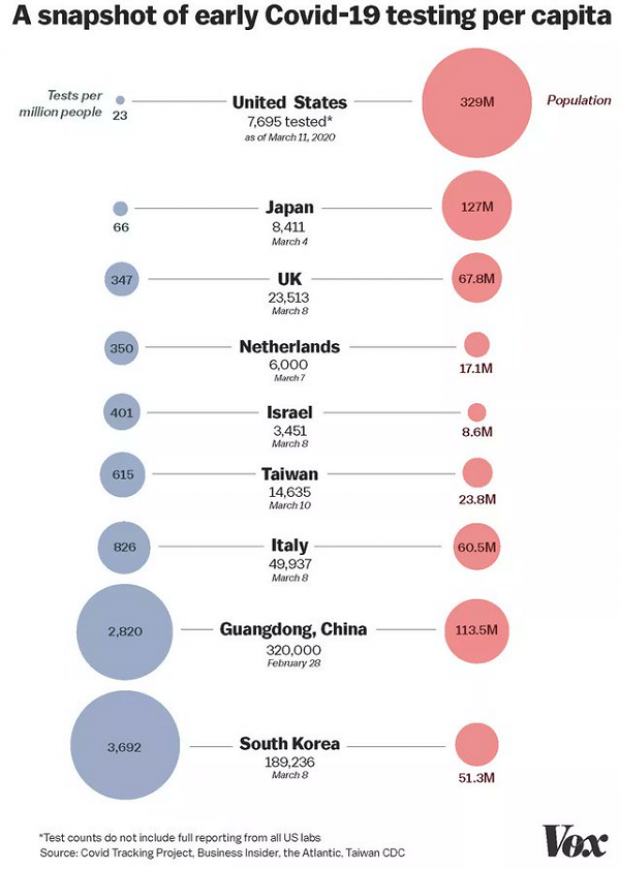

Chart of the Day: Long Way to Go on Coronavirus Testing

The White House on Friday unveiled plans for a new effort to ramp up testing for Covid-19, which experts say is an essential part of limiting the spread of the virus. This chart from Vox gives a sense of just how far the U.S. has to go to catch up to other countries that are dealing with the pandemic, including South Korea, the leading virus screener with 3,692 tests per million people. The U.S., by comparison, has done about 23 tests per million people as of March 12.

After Spending $2 Billion, Air Force Bails Out on Planned Upgrades of B-2 Bombers

The Air Force has scrapped a planned upgrade of its B-2 stealth bomber fleet — even after spending $2 billion on the effort — because defense contractor Northrup Grumman didn’t have the necessary software expertise to complete the project on time and on budget, Bloomberg’s Anthony Capaccio reports, citing the Pentagon’s chief weapons buyer.

Ellen Lord, the undersecretary of defense for acquisition and sustainment, told reporters that the nearly $2 billion that had already been spent on the program wasn’t wasted because “we are still going to get upgraded electronic displays.”

Big Hurdle for Sanders’ Plan to Cancel Student Debt

Bernie Sanders wants to eliminate $1.6 trillion in student debt, to be paid for by a tax on financial transactions, but doing so won’t be easy, says Josh Mitchell of The Wall Street Journal.

The main problem for Sanders is that most Americans don’t support the plan, with 57% of respondents in a poll last fall saying they oppose the idea of canceling all student debt. And the politics are particularly thorny for Sanders as he prepares for a likely general election run, Mitchell says: “Among the strongest opponents are groups Democrats hope to peel away from President Trump: Rust Belt voters, independents, whites, men and voters in rural areas.”

Number of the Day: $7 Million

That’s how much Michael Bloomberg is spending per day in his pursuit of the Democratic presidential nomination, according to new monthly filings with the Federal Election Commission. “In January alone, Bloomberg dropped more than $220 million on his free-spending presidential campaign,” The Hill says. “That breaks down to about $7.1 million a day, $300,000 an hour or $5,000 per minute.”