Tequila’s Stunning Rise: How It Shot Up in U.S. Popularity

Americans are drinking more and better-quality tequila, and not only in margaritas on Cinco de Mayo.

Tequila sales have been growing at an average rate of 5.6 percent a year since 2002, according to February figures from the Distilled Spirits Council of the United States. In 2014 alone, 13.8 million nine-liter cases were sold.

Related: U.S. Surpasses France As Biggest Wine Market

The U.S. represents tequila’s largest market, with about 52 percent of global sales. America’s renewed thirst for mixed cocktails has been a boon for spirits overall, but especially for tequila. Meanwhile, sales in Mexico have remained flat largely because the market there is mature, with little room for growth.

The Distilled Spirits Council said that one of the keys to tequila’s U.S. growth has been distillers’ ability to offer a product for every budget and occasion, but the fastest growth has been in high-end and super-premium brands.

“High-end brands have grown 189 percent in volume since 2002,” it noted. “Virtually unknown in 2002, super-premium tequila volumes have skyrocketed 568 percent and today account for 2.4 million 9-liter cases.”

Celebrity endorsements may have also raised the status of tequila. George Clooney, Sean Combs and Justin Timberlake have all promoted tequila brands.

In addition, distillers are trying to boost the popularity of high-end tequilas further by offering tastings and tours — at least one of which is aimed at the super-wealthy.

Tequila Avion, an ultra-premium tequila maker, is offering a $500,000, three-day trip for 10 to Jalisco, Mexico, to taste its spirits and partake of luxury accommodations, butler service and a private dinner among other amenities.

Related: Kentucky’s McConnell and Paul Offer Tax Breaks for Bourbon

If that seems a tad pricey, Experience Tequila in Portland, Ore., offers four-day tours to Mexico for just under $1,500, and you can find tequila-tasting classes in many cities for about $100.

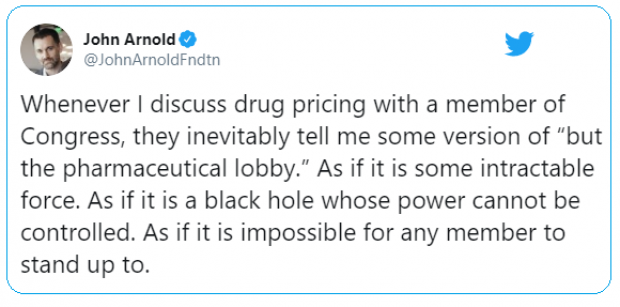

Tweet of the Day: The Black Hole of Big Pharma

Billionaire John D. Arnold, a former energy trader and hedge fund manager turned philanthropist with a focus on health care, says Big Pharma appears to have a powerful hold on members of Congress.

Arnold pointed out that PhRMA, the main pharmaceutical industry lobbying group, had revenues of $459 million in 2018, and that total lobbying on behalf of the sector probably came to about $1 billion last year. “I guess $1 bil each year is an intractable force in our political system,” he concluded.

Warren’s Taxes Could Add Up to More Than 100%

The Wall Street Journal’s Richard Rubin says Elizabeth Warren’s proposed taxes could claim more than 100% of income for some wealthy investors. Here’s an example Rubin discussed Friday:

“Consider a billionaire with a $1,000 investment who earns a 6% return, or $60, received as a capital gain, dividend or interest. If all of Ms. Warren’s taxes are implemented, he could owe 58.2% of that, or $35 in federal tax. Plus, his entire investment would incur a 6% wealth tax, i.e., at least $60. The result: taxes as high as $95 on income of $60 for a combined tax rate of 158%.”

In Rubin’s back-of-the-envelope analysis, an investor worth $2 billion would need to achieve a return of more than 10% in order to see any net gain after taxes. Rubin notes that actual tax bills would likely vary considerably depending on things like location, rates of return, and as-yet-undefined policy details. But tax rates exceeding 100% would not be unusual, especially for billionaires.

Biden Proposes $1.3 Trillion Infrastructure Plan

Joe Biden on Thursday put out a $1.3 trillion infrastructure proposal. The 10-year “Plan to Invest in Middle Class Competitiveness” calls for investments to revitalize the nation’s roads, highways and bridges, speed the adoption of electric vehicles, launch a “second great railroad revolution” and make U.S. airports the best in the world.

“The infrastructure plan Joe Biden released Thursday morning is heavy on high-speed rail, transit, biking and other items that Barack Obama championed during his presidency — along with a complete lack of specifics on how he plans to pay for it all,” Politico’s Tanya Snyder wrote. Biden’s campaign site says that every cent of the $1.3 trillion would be paid for by reversing the 2017 corporate tax cuts, closing tax loopholes, cracking down on tax evasion and ending fossil-fuel subsidies.

Read more about Biden’s plan at Politico.

Number of the Day: 18 Million

There were 18 million military veterans in the United States in 2018, according to the Census Bureau. That figure includes 485,000 World War II vets, 1.3 million who served in the Korean War, 6.4 million from the Vietnam War era, 3.8 million from the first Gulf War and another 3.8 million since 9/11. We join with the rest of the country today in thanking them for their service.

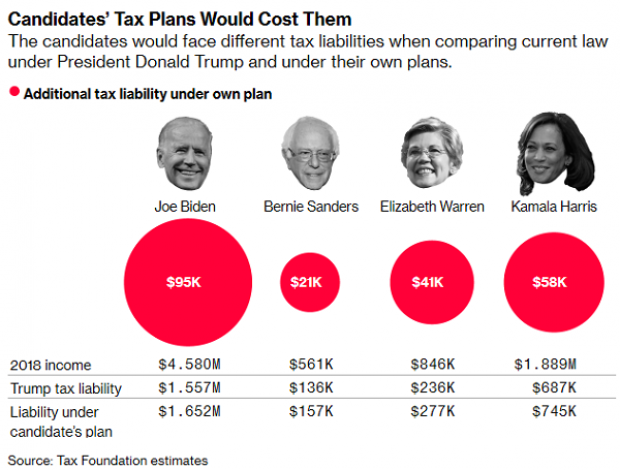

Chart of the Day: Dem Candidates Face Their Own Tax Plans

Democratic presidential candidates are proposing a variety of new taxes to pay for their preferred social programs. Bloomberg’s Laura Davison and Misyrlena Egkolfopoulou took a look at how the top four candidates would fare under their own tax proposals.