How Safe Is that Flight? Auditors Question Airport Security

A government spat between Congress and the Transportation Safety Administration yesterday raised a question: Is the TSA trying to stonewall a congressional committee looking into reports suggesting the agency may be failing in its $7 billion-a-year mission to safeguard airports and air travel from terrorist threats?

At the start of Wednesday’s TSA: Are Airports Safe? hearing, House Oversight Committee Chairman Jason Chaffetz (R-UT ) immediately pointed out a glaring absence from the witness panel—the TSA.

Related: Poor Maintenance Could Make that Airport Scanner a Dud

Chaffetz said the committee had invited TSA acting administrator Melvin Carraway, but the agency offered a lower-level official in his place.

“The Department of Homeland Security objected to [Carraway’s] presence on the panel because they felt it was demeaning to have the acting director sit on the same panel as a private sector witness,” he said, referring to Raffi Fron, president of New Age Security Solutions, a company that provides security systems such as video surveillance.

The hearing was prompted by two separate but equally scathing watchdog reports that question the TSA’s ability to effectively screen passengers.

“Our audits have repeatedly found that human error— often a simple failure to follow protocol—poses significant vulnerabilities,” DHS’s IG John Roth said—adding that despite offering hundreds of recommendations the TSA has failed to assure that its mission is succeeding.

Related: Report Says TSA Wasted $1 Billion on Screening Program

DHS stood by its decision not to send its acting administrator. An agency official told The Fiscal Times that the department only participates in congressional hearing panels with other government agencies—not with private-sector witnesses in order to avoid conflicts of interest.

A spokesperson for the committee said that “witness invitations are not transferable” and that the “DHS does not dictate how we run our hearings.”

This isn’t the only roadblock the Oversight Committee has run into with the TSA. During the hearing, Chairman Chaffetz showed off a heavily redacted document he had requested from the agency—saying even members of Congress had “exceptional” difficulties getting information from them.

The committee spokesperson said House Oversight is currently looking into other ways the TSA has frustrated congressional inquiries—and what kinds of action can be taken.

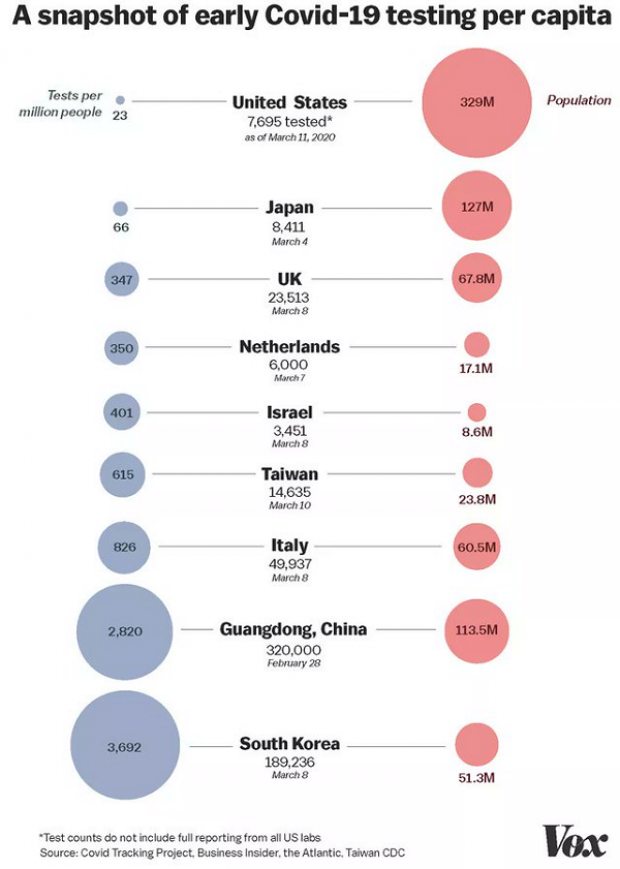

Chart of the Day: Long Way to Go on Coronavirus Testing

The White House on Friday unveiled plans for a new effort to ramp up testing for Covid-19, which experts say is an essential part of limiting the spread of the virus. This chart from Vox gives a sense of just how far the U.S. has to go to catch up to other countries that are dealing with the pandemic, including South Korea, the leading virus screener with 3,692 tests per million people. The U.S., by comparison, has done about 23 tests per million people as of March 12.

After Spending $2 Billion, Air Force Bails Out on Planned Upgrades of B-2 Bombers

The Air Force has scrapped a planned upgrade of its B-2 stealth bomber fleet — even after spending $2 billion on the effort — because defense contractor Northrup Grumman didn’t have the necessary software expertise to complete the project on time and on budget, Bloomberg’s Anthony Capaccio reports, citing the Pentagon’s chief weapons buyer.

Ellen Lord, the undersecretary of defense for acquisition and sustainment, told reporters that the nearly $2 billion that had already been spent on the program wasn’t wasted because “we are still going to get upgraded electronic displays.”

Big Hurdle for Sanders’ Plan to Cancel Student Debt

Bernie Sanders wants to eliminate $1.6 trillion in student debt, to be paid for by a tax on financial transactions, but doing so won’t be easy, says Josh Mitchell of The Wall Street Journal.

The main problem for Sanders is that most Americans don’t support the plan, with 57% of respondents in a poll last fall saying they oppose the idea of canceling all student debt. And the politics are particularly thorny for Sanders as he prepares for a likely general election run, Mitchell says: “Among the strongest opponents are groups Democrats hope to peel away from President Trump: Rust Belt voters, independents, whites, men and voters in rural areas.”

Number of the Day: $7 Million

That’s how much Michael Bloomberg is spending per day in his pursuit of the Democratic presidential nomination, according to new monthly filings with the Federal Election Commission. “In January alone, Bloomberg dropped more than $220 million on his free-spending presidential campaign,” The Hill says. “That breaks down to about $7.1 million a day, $300,000 an hour or $5,000 per minute.”