Undertrained US Drone Pilots Put War Effort at Risk

The U.S. military is allowing pilots who haven’t fully completed their training to fly predator drones over Yemen and Pakistan—potentially putting innocent people on the ground at risk if something goes wrong.

An alarming new report by the Government Accountability Office found that drone pilots in the Army and Air Force have been skimping on their training sessions in order to get assigned to missions faster.

Related: Who Knew the Navy Could Launch 30 Drones in 60 Seconds?

The GAO said that because there is a shortage of drone pilots, the Air Force and Army have been routinely speeding up the process by cutting training time.

“As a result, the Army does not know the full extent to which pilots have been trained and are therefore ready to be deployed,” the report said.

The GAO reviewed Air Force records and found that only 35 percent of pilots operating drones had completed their required training.

Some pilots told the auditors that training wasn’t completed because there was a lack of funding or gaps in knowledge about the unmanned aerial systems (UAS) commonly called drones.

“Army UAS pilots stated that leadership of larger non-aviation units that oversee their UAS units do not understand UAS pilot training,” the report said.

The GAO had previously reported that there weren’t enough drone pilots compared with the number the Air Force said it needed. At New Mexico’s Holloman Air Force Base, for example, drone pilot staffing was at only 63 percent of full staffing level, the report said.

The latest findings from the GAO seem to confirm that this is still an issue.

Related: The Duck Drone That Could Change the Navy

The U.S. military says it is taking action to increase the number of instructors in order to get more pilots through the complete training process. However, the GAO said that the Army hasn’t fully addressed “the risks associated with using less experienced instructors.”

The Army waived course prerequisites for nearly 40 percent of its drone pilots who were working toward becoming instructors.

“As a result, the Army risks that its UAS pilots may not be receiving the highest caliber of training needed to prepare them to successfully perform UAS missions,” the auditors said.

Meanwhile the Air Force faces instructor shortages as well.

The report calls into question whether a lack of training could hamper drone pilots’ ability to successfully and safely complete their missions. It comes amid intense scrutiny of the government’s drone program after a botched mission in January killed two Western hostages during an attack on al Qaeda in Pakistan.

Scrutiny of the program is nothing new. Human rights activists have long called on the administration to cease using drones in its ongoing war on terror because of civilian casualties.

A 2013 report by Human Rights Watch said that between 2009 and 2013, U.S. drone strikes killed 57 civilians in six different strikes in Yemen. Last year the Yemeni government paid $1 million to families of victims of one of those strikes, which targeted a wedding and killed 11 people.

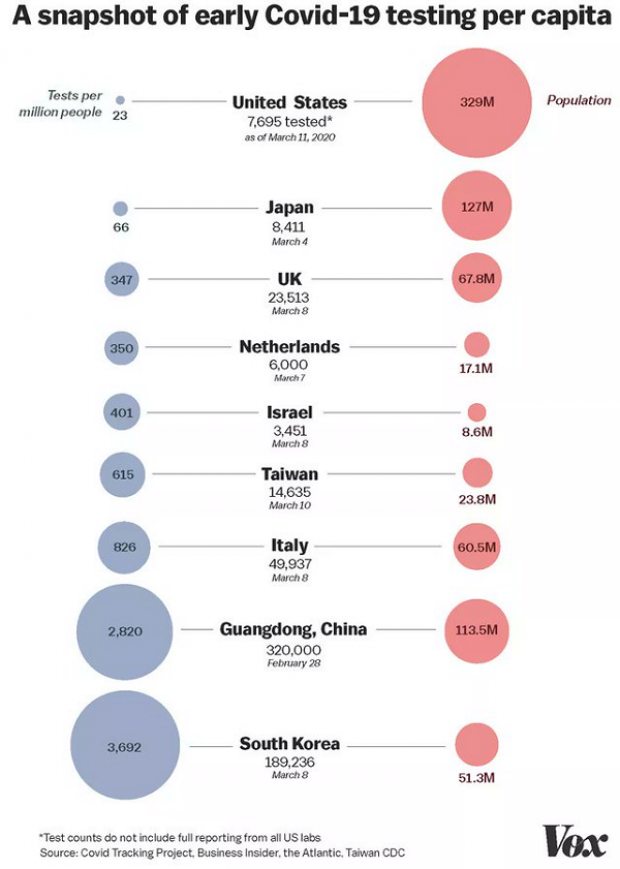

Chart of the Day: Long Way to Go on Coronavirus Testing

The White House on Friday unveiled plans for a new effort to ramp up testing for Covid-19, which experts say is an essential part of limiting the spread of the virus. This chart from Vox gives a sense of just how far the U.S. has to go to catch up to other countries that are dealing with the pandemic, including South Korea, the leading virus screener with 3,692 tests per million people. The U.S., by comparison, has done about 23 tests per million people as of March 12.

After Spending $2 Billion, Air Force Bails Out on Planned Upgrades of B-2 Bombers

The Air Force has scrapped a planned upgrade of its B-2 stealth bomber fleet — even after spending $2 billion on the effort — because defense contractor Northrup Grumman didn’t have the necessary software expertise to complete the project on time and on budget, Bloomberg’s Anthony Capaccio reports, citing the Pentagon’s chief weapons buyer.

Ellen Lord, the undersecretary of defense for acquisition and sustainment, told reporters that the nearly $2 billion that had already been spent on the program wasn’t wasted because “we are still going to get upgraded electronic displays.”

Big Hurdle for Sanders’ Plan to Cancel Student Debt

Bernie Sanders wants to eliminate $1.6 trillion in student debt, to be paid for by a tax on financial transactions, but doing so won’t be easy, says Josh Mitchell of The Wall Street Journal.

The main problem for Sanders is that most Americans don’t support the plan, with 57% of respondents in a poll last fall saying they oppose the idea of canceling all student debt. And the politics are particularly thorny for Sanders as he prepares for a likely general election run, Mitchell says: “Among the strongest opponents are groups Democrats hope to peel away from President Trump: Rust Belt voters, independents, whites, men and voters in rural areas.”

Number of the Day: $7 Million

That’s how much Michael Bloomberg is spending per day in his pursuit of the Democratic presidential nomination, according to new monthly filings with the Federal Election Commission. “In January alone, Bloomberg dropped more than $220 million on his free-spending presidential campaign,” The Hill says. “That breaks down to about $7.1 million a day, $300,000 an hour or $5,000 per minute.”