Cancer Charities Exec Stole $187 Million for Personal Use

Donors who have given money to four of the largest cancer charities in the United States may have unknowingly been financing the lavish lifestyle of the C.E.O. who runs them—paying for luxury cruises, elite gym memberships instead of treatment for cancer patients.

That’s according to a suit filed Tuesday by the Federal Trade Commission as well as attorneys general in all 50 states, which alleges that James Reynolds deceived and defrauded donors out of more than $187 million between four of his charities—including the Cancer Fund of America, Cancer Support Services, Children’s Cancer Fund of America and the Breast Cancer Society.

Related: Medicare Recovers Nearly $28 Billion in Fraud Since 1997

The complaint says that the scheme started in the 1980’s. The charities told donors via telemarketing calls that their money would go toward medicine and transportation for cancer patients. However, most of the money actually went toward Reynolds’ personal indulges.

The complaint says that between 2008 and 2012, only three percent of donations actually went to cancer patients.

The FTC also accuses the organizations of cooking their books and reporting inflated revenues as well as “gifts in kind” that they said they distributed internationally.

The FTC said two of the charities—the Children’s Cancer Fund of America and the Breast Cancer Society plan to settle the charges out of court. The Associated Press reported that the Breast Cancer Society, posted a statement on its website Tuesday blaming increased government scrutiny for the charity's downfall.

"While the organization, its officers and directors have not been found guilty of any allegations of wrongdoing, and the government has not proven otherwise, our board of directors has decided that it does not help those who we seek to serve, and those who remain in need, for us to engage in a highly publicized, expensive, and distracting legal battle around our fundraising practices," the statement said.

Several executives who were also involved in the sccheme, including Reynolds’ son, have agreed to a settlement, which bans them from working in fundraising or charities. The two charities that settled, Breast Cancer Society and the Children’ Cancer Fund of America will be dissolved.

The settlement also orders a $65,664,360 judgment, which is the amount consumers donated between 2008 and 2012. Reynolds junior’s judgment will be for suspended once he pays $75,000. Meanwhile the legal proceedings for Reynolds’ senior and the two remaining charities are ongoing.

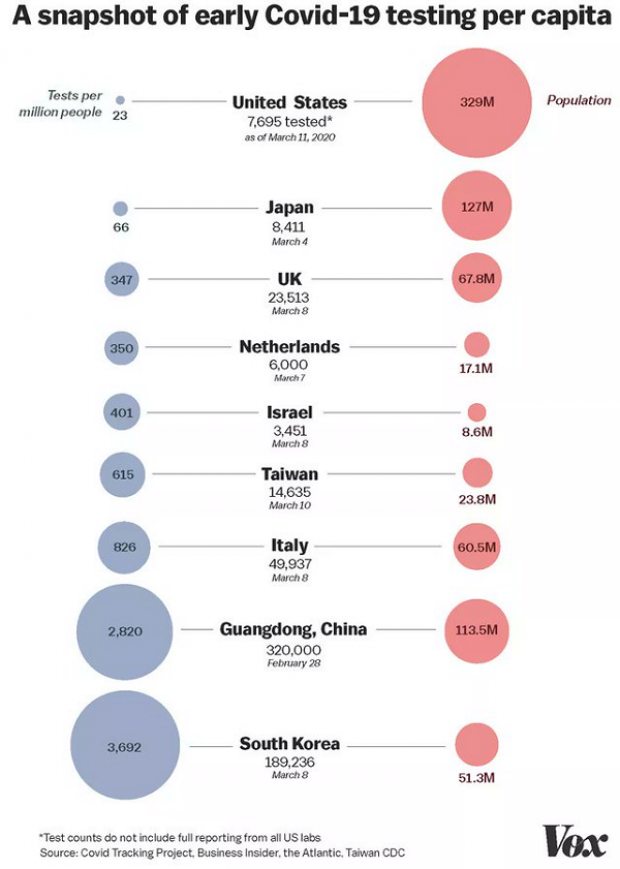

Chart of the Day: Long Way to Go on Coronavirus Testing

The White House on Friday unveiled plans for a new effort to ramp up testing for Covid-19, which experts say is an essential part of limiting the spread of the virus. This chart from Vox gives a sense of just how far the U.S. has to go to catch up to other countries that are dealing with the pandemic, including South Korea, the leading virus screener with 3,692 tests per million people. The U.S., by comparison, has done about 23 tests per million people as of March 12.

After Spending $2 Billion, Air Force Bails Out on Planned Upgrades of B-2 Bombers

The Air Force has scrapped a planned upgrade of its B-2 stealth bomber fleet — even after spending $2 billion on the effort — because defense contractor Northrup Grumman didn’t have the necessary software expertise to complete the project on time and on budget, Bloomberg’s Anthony Capaccio reports, citing the Pentagon’s chief weapons buyer.

Ellen Lord, the undersecretary of defense for acquisition and sustainment, told reporters that the nearly $2 billion that had already been spent on the program wasn’t wasted because “we are still going to get upgraded electronic displays.”

Big Hurdle for Sanders’ Plan to Cancel Student Debt

Bernie Sanders wants to eliminate $1.6 trillion in student debt, to be paid for by a tax on financial transactions, but doing so won’t be easy, says Josh Mitchell of The Wall Street Journal.

The main problem for Sanders is that most Americans don’t support the plan, with 57% of respondents in a poll last fall saying they oppose the idea of canceling all student debt. And the politics are particularly thorny for Sanders as he prepares for a likely general election run, Mitchell says: “Among the strongest opponents are groups Democrats hope to peel away from President Trump: Rust Belt voters, independents, whites, men and voters in rural areas.”

Number of the Day: $7 Million

That’s how much Michael Bloomberg is spending per day in his pursuit of the Democratic presidential nomination, according to new monthly filings with the Federal Election Commission. “In January alone, Bloomberg dropped more than $220 million on his free-spending presidential campaign,” The Hill says. “That breaks down to about $7.1 million a day, $300,000 an hour or $5,000 per minute.”