The Lucrative Business of SAT Test Prep Is About to Get Disrupted

For years, critics of the SAT have claimed that wealthy students who can afford expensive, private test prep courses have a leg up on poorer students without access to such classes.

That just changed. Starting yesterday, all students can access free, high-quality online test prep via a new partnership between the College Board, which administers the test, and online course powerhouse Khan Academy, a nonprofit supported by the Bill and Melinda Gates Foundation and Ann and John Doerr among others. The online program will include quizzes, video lessons and personalized lessons.

The Official SAT Practice will focus on the recently redesigned SAT, with questions created by the tests’ authors.

Related: SAT Tests: Another Drain on the Family Budget

College test preparation is a $4.5 billion business. Private SAT tutors charge in excess of $100 per hour and classes from companies like Kaplan or Princeton Review run about $1,000. And those classes may help. Students from the wealthiest families have average test scores that are more than 300 points higher than students from the poorest families on average, according to the College Board.

In recent years, more colleges have moved away from the SAT and its competitor, the ACT, as a backlash against the tests have grown.

More than 850 schools have made the tests optional for admission, according to advocacy group FairTest, choosing instead to focus on class grades and other factors. A study released last year of undergrads at those schools found no difference in either the GPAs or the graduation rates of students who took the SATs versus those that skipped it.

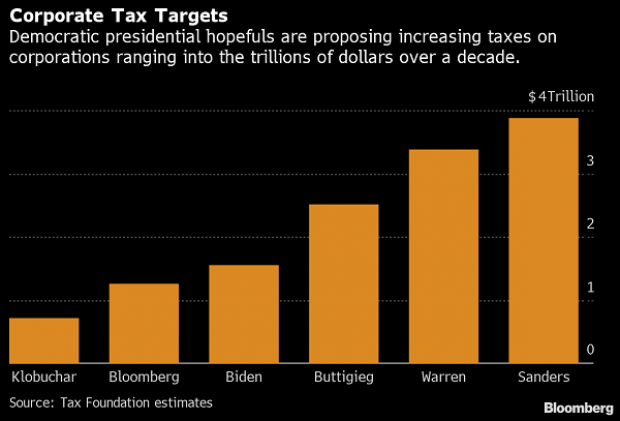

Chart of the Day: Boosting Corporate Tax Revenues

The leading candidates for the Democratic presidential nomination have all proposed increasing taxes on corporations, including raising income tax rates to levels ranging from 25% to 35%, up from the current 21% imposed by the Republican tax cuts in 2017. With Bernie Sanders leading the way at $3.9 trillion, here’s how much revenue the higher proposed corporate taxes, along with additional proposed surtaxes and reduced tax breaks, would generate over a decade, according to calculations by the right-leaning Tax Foundation, highlighted Wednesday by Bloomberg News.

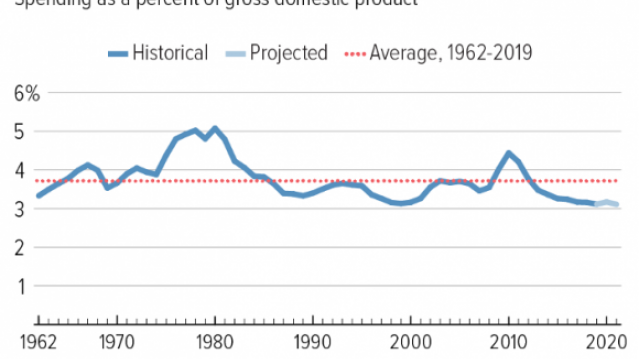

Chart of the Day: Discretionary Spending Droops

The federal government’s total non-defense discretionary spending – which covers everything from education and national parks to veterans’ medical care and low-income housing assistance – equals 3.2% of GDP in 2020, near historic lows going back to 1962, according to an analysis this week from the Center on Budget and Policy Priorities.

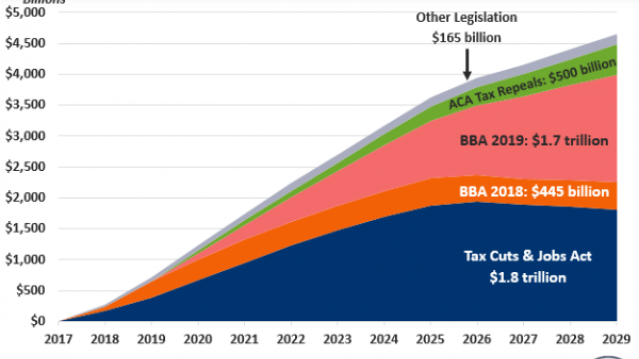

Chart of the Week: Trump Adds $4.7 Trillion in Debt

The Committee for a Responsible Federal Budget estimated this week that President Trump has now signed legislation that will add a total of $4.7 trillion to the national debt between 2017 and 2029. Tax cuts and spending increases account for similar portions of the projected increase, though if the individual tax cuts in the 2017 Republican overhaul are extended beyond their current expiration date at the end of 2025, they would add another $1 trillion in debt through 2029.

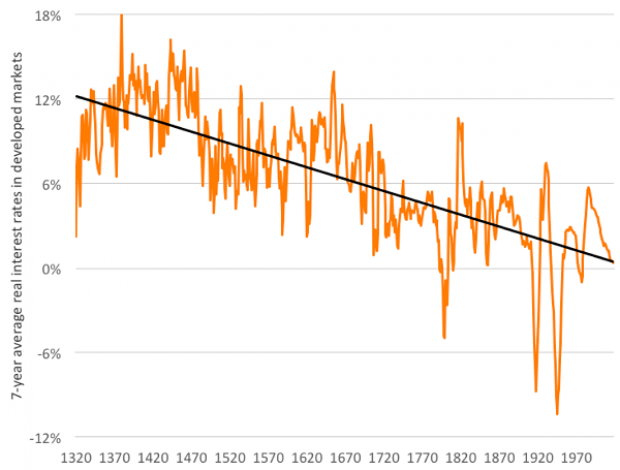

Chart of the Day: The Long Decline in Interest Rates

Are interest rates destined to move higher, increasing the cost of private and public debt? While many experts believe that higher rates are all but inevitable, historian Paul Schmelzing argues that today’s low-interest environment is consistent with a long-term trend stretching back 600 years.

The chart “shows a clear historical downtrend, with rates falling about 1% every 60 years to near zero today,” says Bloomberg’s Aaron Brown. “Rates do tend to revert to a mean, but that mean seems to be declining.”

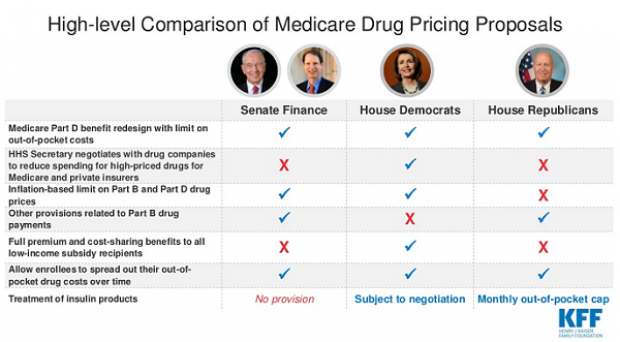

Chart of the Day: Drug Price Plans Compared

Lawmakers are considering three separate bills that are intended to reduce the cost of prescription drugs. Here’s an overview of the proposals, from a series of charts produced by the Kaiser Family Foundation this week. An interesting detail highlighted in another chart: 88% of voters – including 92% of Democrats and 85% of Republicans – want to give the government the power to negotiate prices with drug companies.